|

市场调查报告书

商品编码

1851365

红外线成像系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

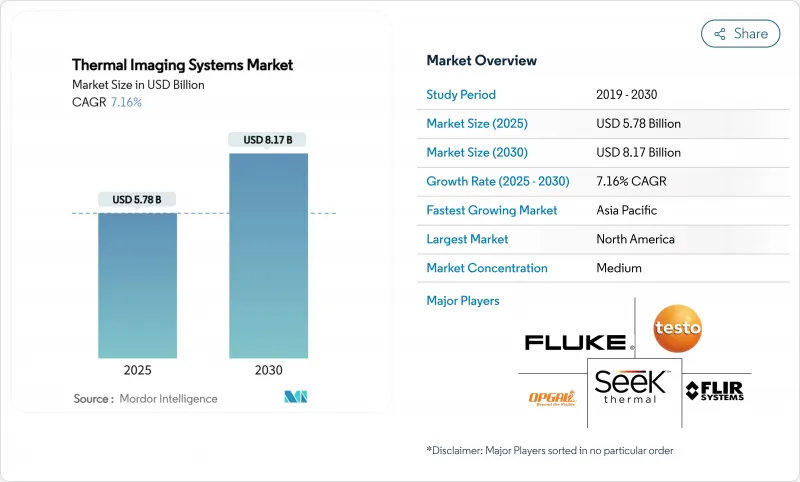

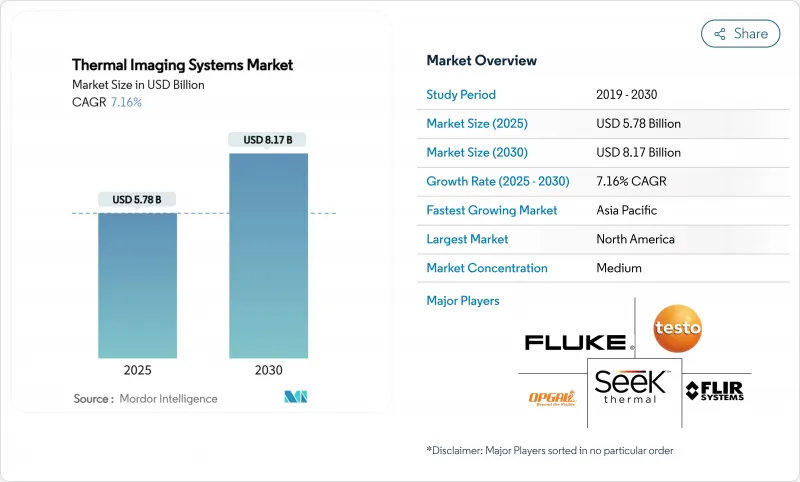

预计到 2025 年,红外线成像系统市场规模将达到 57.8 亿美元,到 2030 年将达到 81.7 亿美元,年复合成长率为 7.16%。

国防现代化进程的加速、工业自动化的扩展以及强制性汽车安全功能的实施,正在推动热成像设备需求的成长。 NFPA-70B热成像标准的实施,促进了製造业和公共产业领域的稳定采购週期,同时,非製冷长波红外线(LWIR)热成像设备价格的下降也扩大了其应用范围。同时,汽车製造商正在将夜视摄影机整合到高级驾驶辅助系统(ADAS)中,以符合行人保护法规。印太地区的情报、监视与侦察(ISR)预算,包括美国和澳洲军方为下一代前视红外线(FLIR)感测器下达的多年期订单,进一步推动了这一增长势头。

全球红外线成像系统市场趋势与洞察

非製冷微测辐射热计价格下降

非製冷检测器的成本曲线持续下降,使其应用范围从国防和重工业扩展到更广泛的领域。规模经济、简化的製造流程以及LightPath等公司提供的替代性硫系光学元件正在缓解长期以来锗探测器的瓶颈问题。智慧型手机OEM厂商正在试用热感附加元件,车队营运商也在其环境、安全、治理(ESG)计画中指定使用热成像检测。这种商业性的普及提高了将原始影像转化为可执行洞察的分析软体的定价权。

增加印太地区的国防情报、监视与侦察预算

区域安全竞争正在推动远距侦察机的采购。美国「太平洋威慑倡议」拨款99亿美元用于先进感测器,澳洲「国防蓝图」则拨款500亿澳元(约347亿美元)用于频谱成像平台。加上小型企业创新研究津贴(SBIR)对双波段前视红外线(FLIR)阵列的支持,这套系统为检测器代工厂和光学元件供应商提供了多年的供应保障。

出口管制制度(ITAR 和 EAR)

美国不断变化的出口法规要求许多两用焦面阵列和光学套件必须获得许可,这延长了销售週期并限制了国际收入。最近的提案将把先前不受监管的商用成像器纳入许可范畴,鼓励原始设备製造商 (OEM) 加快将其供应链本地化到美国以外的地区。政策的不确定性造成了沉重的合规成本,尤其对于小批量、小众的创新企业而言更是如此。

细分市场分析

到2024年,安防监控将占总收入的38.2%,这进一步巩固了边境保护在热成像系统市场的基础性地位。边境管控支出的增加和关键基础设施的加强将推动固定式和云台变焦摄影机的采购,而人工智慧主导的分析技术将减轻操作员的工作负担。汽车高级驾驶辅助系统(ADAS)将成为成长最快的细分市场,复合年增长率(CAGR)将达到7.8%,这得益于监管机构对行人安全和自动紧急煞车系统的推动。过去将红外线功能作为选配的原始设备製造商(OEM)现在正在调整其设计流程,将更小的模组整合到更高销量的车型中,从而扩大其年度出基准。

随着工厂逐步符合 NFPA-70B 标准并获得类似年金的检测收入,对热成像服务的需求也日益多元化。消防部门正在为第一线人员配备热成像单筒望远镜,并利用卫星热点警报进行快速部署。智慧型手机和夹式微测辐射热计配套的行动应用程式的出现,标誌着热成像系统市场消费阶段的开始。

手持式热成像仪预计在2024年将占总收入的46.4%,这主要得益于其在预防性保养、执法和紧急应变等领域的广泛应用。电池供电设备的便利性将显着提升其更换需求,尤其是在检测器解析度不断提高的情况下。然而,整合式OEM模组的成长速度将超过手持式热成像仪,年复合成长率将达到7.2%,从而推动汽车、无人机和智慧家电等领域热成像系统市场的扩张。固定式解决方案对于周界安防和製程监控仍然至关重要,因为这些领域需要全天候监控。

军方采购重点关注尺寸、重量、功耗和成本(SWaP-C),这推动了专有的百叶窗校准和边缘人工智慧技术的发展,以缩小有效载荷的体积。正在研发中的柔性红外线感测器有望应用于未来的可穿戴设备,但距离实用化仍需数代技术的发展。

区域分析

2024年,北美将占全球支出的41.5%,这主要得益于国防相关领域的拨款,例如美国斥资1.175亿美元订购的第三代FLIR感测器。 NFPA-70B标准的实施将进一步推动工业领域的应用,而一级汽车製造商正在试行2027年车型的夜视系统。 CISA网路安全指令将带动对强化韧体的高端需求,从而使美国供应商能够保持价格竞争力。

亚太地区预计将实现最高的复合年增长率(CAGR),达到8.3%,这主要得益于日本、韩国、印度和澳洲对其情报、监视和侦察(ISR)装备的多元化以及车辆出口的扩大。中国的热成像技术市占率将从2019年的15%成长到2020年的63%。儘管国内感测器生态系统日趋成熟,但出口限制使得中国难以获得美国尖端最尖端科技,刺激了该地区的研发投入。

受国防光电订单和汽车安全法规的推动,欧洲市场呈现强劲成长态势。 HENSOLDT光电部门营收飙升34%,凸显了强劲的采购需求。中东和非洲市场对周界监控的需求旺盛,包括向沙乌地阿拉伯订单多感测器模组。南美市场虽仍处于新兴阶段,但其工业维护和公共预算正在不断增长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 非製冷微测辐射热计价格下降

- 增加印太地区的国防情报、监视与侦察预算

- NFPA-70B 电气安全热成像强制要求

- 汽车製造商寻求经济高效的ADAS夜视技术

- 智慧工厂中基于人工智慧的预测性维护

- 气候相关的野火监测需求

- 市场限制

- 出口管制(ITAR 和 EAR)

- 冷却式中波红外线摄影机需要高额资本投入。

- 锗光学元件供应链瓶颈

- 网路摄影机的网路安全风险

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 价格分析(按应用和技术划分)

第五章 市场规模与成长预测

- 透过使用

- 安全与监控

- 军事/国防

- 热成像/检测

- 消防部门

- 个人视觉系统

- 智慧型手机和平板电脑

- 汽车高级驾驶辅助系统(ADAS)

- 海事与航太

- 按外形规格

- 手持式成像设备

- 固定类型(旋转/非旋转)

- 整合式OEM模组

- 透过技术

- 非製冷长波红外线

- 中波红外线冷却

- 短波红外线和频谱

- 按组件

- 检测器/核心

- 相机

- 光学元件和透镜组

- 软体和分析

- 按最终用户行业划分

- 国防与国防安全保障

- 工业的

- 商业的

- 医疗的

- 公共

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 东协(分裂)

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Teledyne FLIR

- Opgal Optronic Industries

- Fluke Corporation

- Seek Thermal

- Axis Communications

- Leonardo DRS

- Raytheon Technologies

- L3Harris Technologies

- Lockheed Martin

- Testo SE and Co. KGaA

- Bullard

- Hikmicro(Hikvision)

- Guide Sensmart

- Excelitas(Xenics)

- BAE Systems

- HT Italia

- Trijicon

- Zhejiang Dali

- Pelco

- Yantai IRay

第七章 市场机会与未来展望

The thermal imaging systems market size is valued at USD 5.78 billion in 2025 and is forecast to reach USD 8.17 billion by 2030, expanding at a 7.16% CAGR.

Accelerating defense modernization, expanding industrial automation, and mandated automotive safety features are converging to keep demand elevated. Standardization around NFPA-70B thermography is stimulating steady procurement cycles in manufacturing and utilities, while uncooled long-wave infrared (LWIR) price declines are widening accessibility. In parallel, vehicle makers are integrating night-vision cameras into Advanced Driver-Assistance Systems (ADAS) to comply with pending pedestrian-protection rules. The momentum is reinforced by Indo-Pacific ISR budgets, with military programs in the United States and Australia placing multi-year orders for next-generation FLIR sensors.

Global Thermal Imaging Systems Market Trends and Insights

Falling Price of Uncooled Micro-Bolometers

Cost curves for uncooled detectors continue to decline, enlarging addressable opportunities beyond defense and heavy industry. Scale economies, simplified fabrication, and alternative chalcogenide optics from firms such as LightPath are mitigating historic germanium bottlenecks. Smartphone OEMs are piloting thermal add-ons, and fleet operators are specifying thermographic inspections under corporate ESG programs. The broader commercial reach strengthens pricing power for analytics software that converts raw images into actionable insights.

Growing Defense ISR Budgets in Indo-Pacific

Regional security competition is stimulating long-range surveillance procurements. The United States' Pacific Deterrence Initiative allocates USD 9.9 billion for advanced sensors, while Australia's AUD 50 billion (USD 34.7 billion) defense roadmap earmarks funds for multispectral imaging platforms. Combined with SBIR grants supporting dual-band FLIR arrays, the pipeline sustains multi-year volume visibility for detector foundries and optics suppliers.

Export-Control Regimes (ITAR & EAR)

Evolving US export rules mandate licenses for many dual-use focal-plane arrays and optics kits, elongating sales cycles and limiting addressable international revenue. Recent proposals would pull previously uncontrolled commercial imagers into license categories, prompting OEMs to accelerate non-US supply-chain localization. The policy uncertainty introduces compliance costs that particularly burden small-volume niche innovators.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory NFPA-70B Thermography for Electrical Safety

- Vehicle OEM Push for Cost-Effective ADAS Night-Vision

- High Cap-Ex for Cooled MWIR Cameras

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security and surveillance held 38.2% of 2024 revenue, reinforcing the foundational role of perimeter protection in the thermal imaging systems market. Increasing border-control spending and critical infrastructure hardening sustain procurement of fixed and pan-tilt-zoom cameras, while AI-driven analytics cut operator workload. Automotive ADAS, the fastest-growing application at a 7.8% CAGR, capitalizes on regulatory nudges for pedestrian safety and automated emergency braking. OEM design cycles that once specified infrared as optional are now embedding compact modules into higher-volume trims, broadening annual shipment baselines.

Demand diversification is evident in thermography services as factories comply with NFPA-70B, creating annuity-style inspection revenue. Firefighting agencies are equipping frontline responders with thermal monoculars, leveraging satellite-driven hotspot alerts for rapid deployment. Emerging mobile apps pairing smartphones with clip-on micro-bolometers signal the consumerization phase of the thermal imaging systems market.

Hand-held imagers captured 46.4% of 2024 revenue, favored for versatility across preventive maintenance, law enforcement, and first-responder scenarios. The convenience of battery-operated units sustains significant replacement demand, especially as detector resolution improves. Integrated OEM modules, however, are set to outpace at a 7.2% CAGR, underpinning the expansion of the thermal imaging systems market size inside vehicles, drones, and smart appliances. Fixed-mount solutions remain indispensable in perimeter security and process monitoring where 24/7 coverage is mandatory.

Military procurement emphasizes Size, Weight, Power, and Cost (SWaP-C) gains, driving proprietary shutterless calibration and edge AI to compress payload footprints. Flexible infrared sensors in development promise future wearables, although commercialization is still several design iterations away.

The Thermal Imaging Systems Market Report is Segmented by Application (Security and Surveillance, Military and Defense, and More), Form Factor (Hand-Held Imaging Devices, Fixed-Mount, and More), Technology (Uncooled LWIR, Cooled MWIR, and More), Component (Detectors/Cores, and More), End-User Industry (Defense and Homeland Security, Industrial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 41.5% of 2024 spending, reflecting defense allocations such as the US Army's USD 117.5 million order for third-generation FLIR sensors. NFPA-70B compliance further bolsters industrial uptake, and automotive Tier-1s are piloting night-vision programs for 2027 model years. Cybersecurity directives from CISA drive premium demand for hardened firmware, enabling US-based vendors to maintain pricing discipline.

Asia-Pacific is projected to log the highest 8.3% CAGR as Japan, South Korea, India, and Australia diversify ISR fleets and expand vehicle exports. China's share shift from 15% to 63% in thermography during 2019-2020 illustrates the manufacturing scale at play. Indigenous sensor ecosystems are maturing, yet export controls restrict access to state-of-the-art US technology, fueling regional R&D investment.

Europe posts steady growth, buoyed by defense optronics orders and automotive safety regulations. HENSOLDT's 34% revenue surge in its Optronics segment underscores resilient procurement. Middle East and Africa register firm demand for perimeter surveillance, with Teledyne FLIR shipping multi-sensor pods to Saudi Arabia. South America remains emergent, but industrial maintenance and public-safety budgets point to incremental upside.

- Teledyne FLIR

- Opgal Optronic Industries

- Fluke Corporation

- Seek Thermal

- Axis Communications

- Leonardo DRS

- Raytheon Technologies

- L3Harris Technologies

- Lockheed Martin

- Testo SE and Co. KGaA

- Bullard

- Hikmicro (Hikvision)

- Guide Sensmart

- Excelitas (Xenics)

- BAE Systems

- HT Italia

- Trijicon

- Zhejiang Dali

- Pelco

- Yantai IRay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Falling price of uncooled micro-bolometers

- 4.2.2 Growing defense ISR budgets in Indo-Pacific

- 4.2.3 Mandatory NFPA-70B thermography for electrical safety

- 4.2.4 Vehicle OEM push for cost-effective ADAS night-vision

- 4.2.5 AI-enabled predictive maintenance in smart factories

- 4.2.6 Climate-driven wildfire monitoring demand

- 4.3 Market Restraints

- 4.3.1 Export-control regimes (ITAR and EAR)

- 4.3.2 High cap-ex for cooled MWIR cameras

- 4.3.3 Supply-chain choke points in germanium optics

- 4.3.4 Cyber-security risks in networked cameras

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Pricing Analysis (by Application and Technology)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Security and Surveillance

- 5.1.2 Military and Defense

- 5.1.3 Thermography / Inspection

- 5.1.4 Firefighting

- 5.1.5 Personal Vision Systems

- 5.1.6 Smartphones and Tablets

- 5.1.7 Automotive ADAS

- 5.1.8 Maritime and Aerospace

- 5.2 By Form Factor

- 5.2.1 Hand-held Imaging Devices

- 5.2.2 Fixed-mount (Rotary / Non-rotary)

- 5.2.3 Integrated OEM Modules

- 5.3 By Technology

- 5.3.1 Uncooled LWIR

- 5.3.2 Cooled MWIR

- 5.3.3 SWIR and Multispectral

- 5.4 By Component

- 5.4.1 Detectors / Cores

- 5.4.2 Complete Cameras

- 5.4.3 Optics and Lens Sets

- 5.4.4 Software and Analytics

- 5.5 By End-user Industry

- 5.5.1 Defense and Homeland Security

- 5.5.2 Industrial

- 5.5.3 Commercial

- 5.5.4 Medical

- 5.5.5 Public Safety

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia and NZ

- 5.6.4.6 ASEAN (Break-up)

- 5.6.4.7 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Teledyne FLIR

- 6.4.2 Opgal Optronic Industries

- 6.4.3 Fluke Corporation

- 6.4.4 Seek Thermal

- 6.4.5 Axis Communications

- 6.4.6 Leonardo DRS

- 6.4.7 Raytheon Technologies

- 6.4.8 L3Harris Technologies

- 6.4.9 Lockheed Martin

- 6.4.10 Testo SE and Co. KGaA

- 6.4.11 Bullard

- 6.4.12 Hikmicro (Hikvision)

- 6.4.13 Guide Sensmart

- 6.4.14 Excelitas (Xenics)

- 6.4.15 BAE Systems

- 6.4.16 HT Italia

- 6.4.17 Trijicon

- 6.4.18 Zhejiang Dali

- 6.4.19 Pelco

- 6.4.20 Yantai IRay

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment