|

市场调查报告书

商品编码

1939097

亚太地区热感成像系统:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Asia-Pacific Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

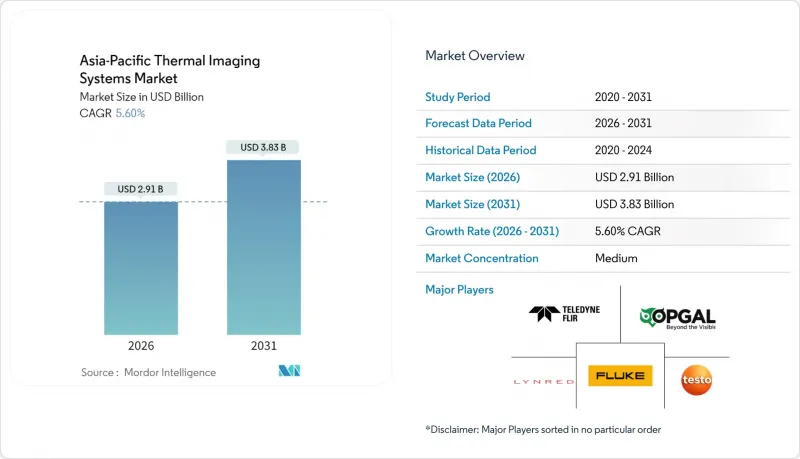

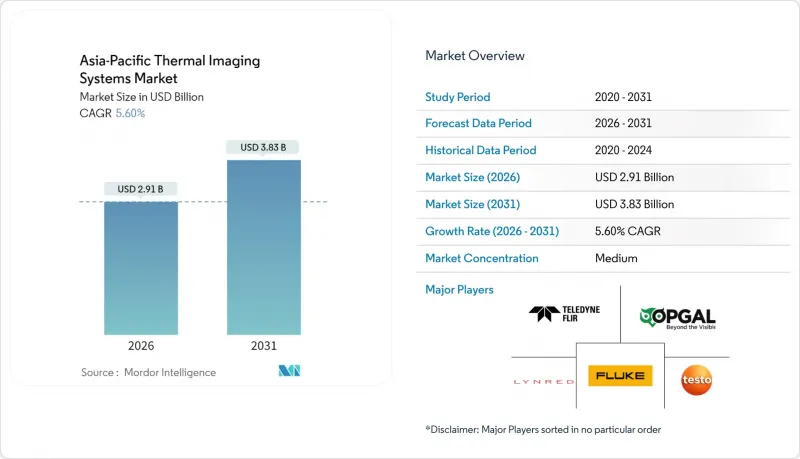

亚太地区热感成像系统市场预计将从 2025 年的 27.6 亿美元成长到 2026 年的 29.1 亿美元,到 2031 年达到 38.3 亿美元,2026 年至 2031 年的复合年增长率为 5.60%。

随着国防部资助边境监控系统升级、工业企业实施预测性维护计画以及消费性电子设备整合紧凑型热成像技术的应用正在加速普及。非冷冻微测辐射热计的价格平均每年下降15-20%,为建筑检测和智慧型手机配件等中价位市场创造了机会。中国、日本和韩国政府的畜牧生物安全法规以及工厂自动化程度的提高,正在将潜在基本客群扩展到传统安防买家之外。製冷型中波红外线摄影机的许可限制以及晶圆级VOx元件的供应不稳定仍然是成本和进度方面的主要风险。为了确保亚太地区热感成像系统市场的未来成长,开发商正优先考虑采用频谱短波红外线解决方案、硫系光学元件和边缘人工智慧分析技术。

亚太地区热感成像系统市场趋势与洞察

降低非製冷微测辐射热计感测器的成本

中国晶圆厂快速扩大量产规模,使得VOx微测辐射热计的价格每年下降15-20%,携带式热成像设备的零售价跌破500美元。这使得建筑商和住宅检查员能够负担得起智慧型手机的热成像附加元件,从而扩大了其在中等收入市场的用户群体。工业电工也开始使用手持式热成像仪来侦测开关设备中的热点,避免发生代价高昂的故障,从而享受更低的整体拥有成本带来的好处。销售量的成长正在拉低利润率,促使供应商专注于增值云端软体和分析订阅服务。感测技术的普及正在推动亚太地区热感成像系统市场的持续成长。

亚太地区国防和边防安全支出不断成长

随着南海和喜马拉雅山脉地区领土紧张局势加剧,各国国防预算都在增加。自2016年以来,美国已累计4.75亿美元用于亚太地区的海上态势感知(MDA)建设。热成像设备正安装在海岸雷达、车载情报监视侦察(ISR)吊舱以及反无人机系统(UAS)电池上,能够昼夜追踪小型无人机。澳洲正在采购配备红外线设备的P-8「海神」反潜巡逻机,新加坡则在其港口监控网路中部署多层热成像摄影机。采购週期强调采用开放式架构,以便整合人工智慧分类工具,从而加快操作员的回应速度。这种长期的采购计划确保了多年交付,并支撑了亚太地区的热感成像系统市场。

冷却相机的初始成本高,且出口许可证受到限制。

ITAR 和 EAR 法规要求中波红外线 (MWIR) 系统获得美国核准,这导致数月的繁琐审批流程,并限制了中国和俄罗斯的买家。此外,低温冷却设备增加了生命週期成本,限制了其在国防和监视领域以外的市场竞争力。因此,儘管探测范围较小,但各机构往往不得不选择非冷却替代方案,这限制了亚太地区热感成像系统的市场规模。

细分市场分析

预计2025年,热成像技术将占据亚太地区热感成像系统市场最大份额,市场规模将达10.2亿美元。这主要得益于日本、韩国以及中国沿海地区的工厂检测和建筑评估需求。反无人机系统(Counter-UAS)专案目前规模较小,但预计到2031年将以5.93%的复合年增长率成长。衝突地区无人机的激增预计将提升亚太地区热感成像系统在国防分析领域的市场份额。

由于预测性维护带来的即时投资回报以及越来越多的建筑规范强制要求进行红外线审核,热成像技术持续保持主导地位。消防机构正在使用能够穿透烟雾识别热源的坚固耐用型成像器,从而缩短工业火灾的反应时间。海上和沿海监视系统将热成像迭加到雷达影像上,提供全天候情境察觉,帮助海军打击非法捕鱼和走私活动。 NEC 的森林火灾侦测网展示了热成像技术在颱风频繁的日本灾害应变中的价值。医疗和搜救队正在采用无人机搭载的系统在能见度低的情况下定位倖存者,这进一步拓展了热成像技术的应用场景,并推动了亚太地区热感成像系统市场的成长。

儘管到2025年热感摄影机仍将占总收入的54.10%,但模组出货量预计将在2031年之前以6.22%的最高复合年增长率增长,这表明原始设备製造商(OEM)正在亚太地区热感成像系统市场中转向更大的模组份额。智慧型手机配件套件和汽车夜视套件更倾向于使用无需额外光学组件即可整合到现有基板的模组,从而提供更大的设计柔软性。

对于工业和公共计划,配备坚固机壳、整合分析功能和网路功能的全组装摄影机仍然是标准配备。然而,Teledyne FLIR 的 Hadron X 热成像仪相容于重量低于 250 克的无人机机架,展现了小型化如何吸引大规模生产客户。模组供应商正在捆绑 SDK 和 AI 加速功能,以缩短不熟悉热成像技术的整合商的上市时间。因此,模组的日益普及将使收入来源多元化,并加强与亚太地区热感成像系统市场 OEM 厂商的合作。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 降低非製冷微测辐射热计感测器的成本

- 亚太地区国防和边防安全支出不断成长

- 工业预测性维护的采用情况

- 热感核心整合到智慧型手机、无人机和ADAS中

- 利用人工智慧热分析技术进行强制性畜牧生物安全检查

- 硫系光学元件可降低锗供应风险

- 市场限制

- 冷却相机的初始成本高,且出口许可证受到限制。

- 认证热成像服务提供者短缺

- 半导体级VOx/InSb晶圆供应的脆弱性

- 智慧城市隐私法规限制热监测

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 热成像

- 海上/沿海监视

- 边境监控

- 反无人机/无人飞行器措施

- 关键基础设施安全

- 其他(消防局、智慧型手机、医疗、PVS)

- 副产品

- 热感像仪

- 热感成像瞄准镜/瞄准器

- 热感模组/核心

- 透过技术

- 非製冷长波红外线(VOx/a-Si)

- 冷却式中波红外线和长波红外线(InSb,MCT)

- 短波红外线和频谱

- 按最终用户行业划分

- 航太/国防

- 执法机关与公共

- 医学和兽医学

- 汽车与出行

- 石油天然气和加工工业

- 製造业和公共产业

- 其他终端使用者区域

- 按国家/地区

- 中国

- 日本

- 印度

- 东南亚

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Teledyne FLIR LLC

- Wuhan Guide Infrared Co., Ltd.

- Lynred

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Fluke Corporation

- Opgal Optronic Industries Ltd.

- Testo SE and Co. KGaA

- Trijicon, Inc.

- Dongguan Xintai Instrument Co., Ltd.

- Thermoteknix Systems Ltd.

- Raytron Technology Co., Ltd.

- Zhejiang Dali Technology Co., Ltd.

- Meridian Innovation Ltd.

- Nippon Avionics Co., Ltd.

- NEC Avio Infrared Technologies Co., Ltd.

- Shenzhen SAT Infrared Technology Co., Ltd.

- Leonardo SpA

- L3Harris Technologies, Inc.

- BAE Systems plc

- Axis Communications AB

- Seek Thermal, Inc.

- InfraTec GmbH

- Infrared Cameras Inc.

- Tien-Yuan Technology Co., Ltd.

第七章 市场机会与未来展望

The Asia-Pacific thermal imaging systems market is expected to grow from USD 2.76 billion in 2025 to USD 2.91 billion in 2026 and is forecast to reach USD 3.83 billion by 2031 at 5.60% CAGR over 2026-2031.

Adoption accelerates as defense ministries fund border-surveillance upgrades, industrial firms deploy predictive-maintenance programs, and consumer devices integrate compact thermal cores. Declining uncooled micro-bolometer prices, averaging 15-20% annual reductions, open mid-tier opportunities in building inspection and smartphone accessories. Government livestock bio-security mandates and rising factory automation in China, Japan, and South Korea broaden the addressable base beyond traditional security buyers. Export-licensing friction for cooled MWIR cameras and wafer-grade VOx supply fragility remain primary cost and schedule risks. Developers are therefore prioritizing multispectral SWIR solutions, chalcogenide optics, and edge-AI analytics to safeguard future growth paths in the Asia-Pacific thermal imaging systems market.

Asia-Pacific Thermal Imaging Systems Market Trends and Insights

Declining Cost of Uncooled Micro-Bolometer Sensors

Rapid scale-up at Chinese fabs brought 15-20% annual price declines in VOx micro-bolometers, pulling portable thermal devices below USD 500 retail. Builders and home inspectors can now justify thermal add-ons for smartphones, expanding user counts in middle-income markets. Industrial electricians adopt handheld viewers to spot hot spots in switchgear before costly failures, benefiting from lower total cost of ownership. Volume gains widen though margins compress, pushing vendors toward value-added cloud software and analytics subscriptions. The democratization of sensing thus underpins a durable upswing in the Asia-Pacific thermal imaging systems market.

Rising Defense and Border-Security Spending in APAC

Territorial tensions in the South China Sea and along the Himalayas keep defense budgets rising, with USD 475 million earmarked by the U.S. for APAC maritime domain awareness since 2016. Thermal imagers equip coastal radars, vehicle-mounted ISR pods, and counter-UAS batteries capable of tracking small drones day and night. Australia procures thermal-equipped P-8 Poseidon aircraft, while Singapore layers heat-sensing cameras onto harbor surveillance grids. Procurement cycles emphasize open architectures to insert AI classification tools that accelerate operator response. Long-lead acquisition pipelines thus assure multi-year deliveries that buoy the Asia-Pacific thermal imaging systems market.

High Upfront Cost and Export-Licence Constraints for Cooled Cameras

ITAR and EAR regulations mandate U.S. sign-off for MWIR systems, adding months of paperwork and constraining Chinese and Russian buyers. Cryogenic coolers also lift lifetime costs, limiting marketability outside defense and research. Consequently, agencies often settle for uncooled alternatives despite reduced range, trimming the ceiling of the Asia-Pacific thermal imaging systems market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Predictive-Maintenance Adoption

- Smartphone, Drone and ADAS Integration of Thermal Cores

- Semiconductor-Grade VOx / InSb Wafer Supply Fragility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermography generated USD 1.02 billion in 2025, the single largest slice of the Asia-Pacific thermal imaging systems market size, anchored by factory inspection and building diagnostics in Japan, South Korea, and coastal China. Counter-UAS programs, though smaller today, are projected to log a 5.93% CAGR to 2031, expanding the Asia-Pacific thermal imaging systems market share for defense analytics as drones proliferate across contested borders.

Thermography retains leadership because predictive-maintenance ROI is immediate, and building codes increasingly specify infrared audits. Firefighting agencies employ rugged imagers that penetrate smoke and pinpoint hot spots, reducing response times during industrial blazes. Maritime and coastal surveillance packages layer thermal onto radars for 24/7 situational awareness, helping navies deter illegal fishing and smuggling. NEC's forest-fire detection grids illustrate thermal's value in disaster preparedness across typhoon-prone Japan. Medical and search-and-rescue teams adopt drone-mounted systems to locate survivors in low-visibility conditions, further broadening use cases and supporting growth within the Asia-Pacific thermal imaging systems market.

Thermal cameras continued to capture 54.10% of revenue in 2025, yet module shipments are on track for the strongest 6.22% CAGR through 2031, highlighting an OEM pivot that elevates module share of the Asia-Pacific thermal imaging systems market size. Smartphone attach-kits and automotive night-vision packages prefer modules that slot into existing boards without adding optical assemblies, boosting design flexibility.

Complete cameras still anchor industrial and public-safety projects where rugged housings, analytics, and networking come pre-integrated. Nonetheless, Teledyne FLIR's Hadron X aligns with drone frames weighing under 250 g, showing how miniaturization attracts volume customers. Module vendors bundle SDKs and AI acceleration to reduce time-to-market for integrators unfamiliar with thermography. Rising module penetration, therefore, diversifies revenue streams and cements OEM ties inside the Asia-Pacific thermal imaging systems market.

The Asia-Pacific Thermal Imaging Systems Market Report is Segmented by Application (Thermography, Maritime and Coastal Surveillance, and More), Product (Thermal Cameras, Thermal Scopes/Sights, and More), Technology (Uncooled LWIR, and More), End-User Vertical (Aerospace and Defence, Law-Enforcement and Public Safety, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Teledyne FLIR LLC

- Wuhan Guide Infrared Co., Ltd.

- Lynred

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Fluke Corporation

- Opgal Optronic Industries Ltd.

- Testo SE and Co. KGaA

- Trijicon, Inc.

- Dongguan Xintai Instrument Co., Ltd.

- Thermoteknix Systems Ltd.

- Raytron Technology Co., Ltd.

- Zhejiang Dali Technology Co., Ltd.

- Meridian Innovation Ltd.

- Nippon Avionics Co., Ltd.

- NEC Avio Infrared Technologies Co., Ltd.

- Shenzhen SAT Infrared Technology Co., Ltd.

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- BAE Systems plc

- Axis Communications AB

- Seek Thermal, Inc.

- InfraTec GmbH

- Infrared Cameras Inc.

- Tien-Yuan Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining cost of uncooled micro-bolometer sensors

- 4.2.2 Rising defence and border-security spending in Asia-Pacific

- 4.2.3 Industrial predictive-maintenance adoption

- 4.2.4 Smartphone, drone and ADAS integration of thermal cores

- 4.2.5 Livestock bio-security mandates using AI-thermal analytics

- 4.2.6 Chalcogenide optics easing germanium supply risk

- 4.3 Market Restraints

- 4.3.1 High upfront cost and export-licence constraints for cooled cameras

- 4.3.2 Scarcity of certified thermography service providers

- 4.3.3 Semiconductor-grade VOx / InSb wafer supply fragility

- 4.3.4 Smart-city privacy rules limiting thermal surveillance

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Thermography

- 5.1.2 Maritime and Coastal Surveillance

- 5.1.3 Border Surveillance

- 5.1.4 Counter-UAS / Drones

- 5.1.5 Critical Infrastructure Security

- 5.1.6 Others (Fire-fighting, Smartphones, Medical, PVS)

- 5.2 By Product

- 5.2.1 Thermal Cameras

- 5.2.2 Thermal Scopes / Sights

- 5.2.3 Thermal Modules / Cores

- 5.3 By Technology

- 5.3.1 Uncooled LWIR (VOx / a-Si)

- 5.3.2 Cooled MWIR and LWIR (InSb, MCT)

- 5.3.3 SWIR and Multispectral

- 5.4 By End-User Vertical

- 5.4.1 Aerospace and Defence

- 5.4.2 Law-Enforcement and Public Safety

- 5.4.3 Healthcare and Veterinary

- 5.4.4 Automotive and Mobility

- 5.4.5 Oil and Gas and Process Industries

- 5.4.6 Manufacturing and Utilities

- 5.4.7 Other End-User Verticals

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Southeast Asia

- 5.5.5 South Korea

- 5.5.6 Australia and New Zealand

- 5.5.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Teledyne FLIR LLC

- 6.4.2 Wuhan Guide Infrared Co., Ltd.

- 6.4.3 Lynred

- 6.4.4 Hangzhou Hikvision Digital Technology Co., Ltd.

- 6.4.5 Fluke Corporation

- 6.4.6 Opgal Optronic Industries Ltd.

- 6.4.7 Testo SE and Co. KGaA

- 6.4.8 Trijicon, Inc.

- 6.4.9 Dongguan Xintai Instrument Co., Ltd.

- 6.4.10 Thermoteknix Systems Ltd.

- 6.4.11 Raytron Technology Co., Ltd.

- 6.4.12 Zhejiang Dali Technology Co., Ltd.

- 6.4.13 Meridian Innovation Ltd.

- 6.4.14 Nippon Avionics Co., Ltd.

- 6.4.15 NEC Avio Infrared Technologies Co., Ltd.

- 6.4.16 Shenzhen SAT Infrared Technology Co., Ltd.

- 6.4.17 Leonardo S.p.A.

- 6.4.18 L3Harris Technologies, Inc.

- 6.4.19 BAE Systems plc

- 6.4.20 Axis Communications AB

- 6.4.21 Seek Thermal, Inc.

- 6.4.22 InfraTec GmbH

- 6.4.23 Infrared Cameras Inc.

- 6.4.24 Tien-Yuan Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment