|

市场调查报告书

商品编码

1628715

欧洲气雾罐:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

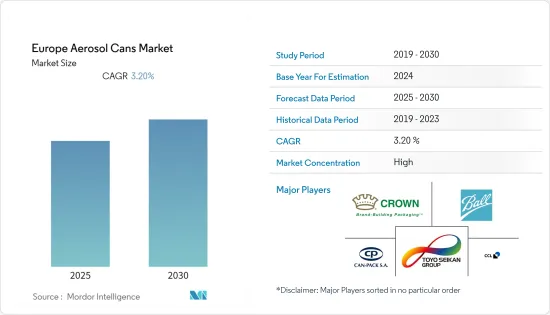

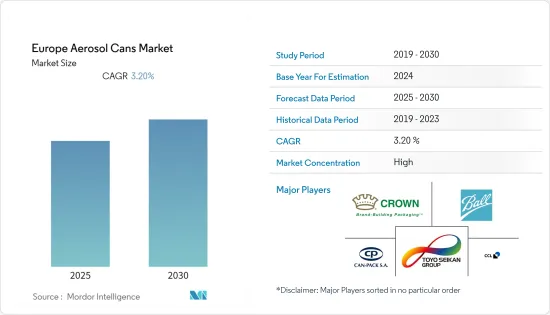

欧洲气雾罐市场预计在预测期内复合年增长率为 3.2%

主要亮点

- 气雾剂产品范围从家用产品和化妆品等消费品到工业和医疗用途的特殊气雾剂类型。气雾罐用于被覆剂、清洗产品、香水、个人保养用品、杀虫剂和许多其他产品。 1990 年代初,喷雾技术的创新和环保推进剂的使用使得气雾罐在多个行业中得到快速采用,儘管由于对碳氟化合物气体的日益担忧而面临挑战。

- 由于欧洲主要经济体个人护理和食品领域的需求不断增长,欧洲在所研究的市场中占据很大份额。

- 此外,由于铝气雾罐的安全性高且操作方便,製药业对铝气雾罐的兴趣与日俱增。预计这些因素将刺激该地区的需求。政府对永续性的推动以及产业对其的接受度对该地区铝气雾罐的需求产生了重大的积极影响。

- 德国、法国和俄罗斯的人均气雾剂消费量预计将在预测期内推动需求增加。除了个人护理领域外,製药领域也呈现成长趋势,因为气雾剂系统专为卫生、安全和准确的产品应用而客製化。此外,随着许多工业和汽车领域寻求创新的包装解决方案,这些领域的气雾剂产品的消费量正在迅速增加,各种产品都采用气雾剂罐包装。

- 此外,基础设施发展投资的增加和积极的经济趋势预计将在预测期内进一步提振工业需求。此外,由于气雾剂包装提供的便利性和强度,气雾剂罐已成为许多行业使用的标准包装。此外,市场参与者对封装技术的不断创新和开发预计将推动市场成长。

- 此外,到2020 年9 月,来自整个包装价值链的超过85 家公司和组织,包括拜尔斯道夫、宝洁、联合利华、欧莱雅、ALPLA 和enkel,将使用数位技术来实现更好的分拣。我们也致力于提高欧盟的包装回收率,以促进循环经济。

- Ball 最近在巴黎举行的 ADF & PCD 展会上展示了其最新的罐头技术,即 360 度自订成型。这项新技术为罐头轮廓设计带来了新的维度,采用的工艺可以在罐头的整个圆週上进行对称或不对称的自订,这对品牌所有者和最终消费者都有利。此外,法律、指令和法规中规定的法规也在业界提出了要求指南,例如FEA(欧洲气溶胶联合会)标准。

欧洲气雾罐市场趋势

铝占最大的市场占有率

- 铝是气雾罐包装解决方案中最受欢迎的金属之一。其金属帆布印有广告,可快速冷却,100%可回收,并惰性,有助于减轻货运重量,从而降低运输成本和碳排放。对除臭剂的偏好和消费者可支配收入的增加正在推动欧洲对铝製气雾罐的需求。

- 此外,欧洲家庭对油漆和髮胶喷雾的消费量创历史新高。由于 2020 年与 COVID-19 大流行相关的聚集限制,很少有欧洲人在沙龙中使用髮胶。对家用喷雾剂的需求增加也导致英国罐头片材进口增加。该国依赖混合国产和进口的铝製髮胶喷雾罐板,这些板由 Ball 和 Crown 等公司製成罐头。

- 总体而言,许多因素正在促使消费者远离金属罐,包括成本、环境足迹、便利性以及不同包装解决方案提供的灵活性。例如,铝使用矾土,而开采矾土是非常能源密集的。这个过程需要大量的能量,并且必须将其转化为铝并成型以製成罐头。

- 此外,铝罐可回收且易于列印。此外,铝罐重量轻,可以很好地阻隔气体。这些因素使得铝罐在个人护理行业中比其他金属罐或塑胶或玻璃等其他材料更普遍。

- 此外,除臭剂罐的铝基主要由铝组成,但含有少量其他金属,包括0.4%铁、0.2%硅、1%镁、1%锰和0.15%铜。除臭罐产业使用的大部分铝来自回收材料。欧洲铝供应总量的约 25% 来自回收废料,个人护理罐产业是回收材料的使用者。一些製造商表示,铝罐行业回收了超过 65% 的旧罐。

英国占最大市场占有率

- 包括英国在内的许多欧洲国家都有严格的回收法,鼓励公司使用铝而不是钢。铝製气雾罐高度灵活,可实现明亮的包装,这使其对个人护理行业极为重要。此外,可回收材料的可用性提高了使用的便利性并推动了需求。

- 2020年9月,英国莱斯特市与铝包装回收组织(Alupro)和Metal Matters合作,推动金属包装的回收。由莱斯特市议会发起的「让金属变得重要」宣传活动将呼吁该市超过 14 万个家庭回收所有金属包装废弃物。

- 此外,据估计,莱斯特每年使用超过 1.68 亿个罐头、铝箔托盘和气雾剂容器,而且它们的金属可以无限回收。据莱斯特市议会称,如果该市家庭使用的所有金属包装都被回收进行回收,每年将产生 4,500 吨二氧化碳,相当于当地道路上的 950 辆汽车的排放量。

- 英国气雾剂製造商协会(BAMA)表示,虽然许多用户受到国家封锁和非必需零售店关闭的影响,但气雾剂行业已迅速适应不断变化的情况,并创造新的产品来应对市场需求2020年整体产量仍超过15亿台,相比2019年仅下降1.3%。

- 此外,2020 年 9 月,英国品牌管理、数位印刷和互动媒体提供商 Springfield Solutions 推出了一项新的气雾剂数位装饰服务。到目前为止,为气雾剂添加优质效果,例如点清漆、金、银、多色箔、触感饰面和压花效果,一直是一个成本高昂、不灵活且耗时的过程。但随着斯普林菲尔德独特的数位标籤装饰服务的出现,这一切都改变了。

欧洲气雾罐产业概况

欧洲气雾罐市场高度整合,有几个主要参与企业,因为它是一个价格敏感的市场。此外,市场供应商正在致力于永续性和产品增强,以获得市场占有率和盈利。近期市场发展趋势如下。

- 2021 年 3 月 - LINDAL 在德国推出线上 3D 气雾剂配置器,改变了传统的包装设计流程。新的 3D 气溶胶配置器专门託管在该公司的网站上。客户可以使用一套复杂的编辑和设计工具来快速轻鬆地创建 3D 气雾剂包装。

- 2020 年 9 月 - 瑞典铝製成罐製造商 Nussbaum Matzingen AG 推出了一款由 100% 消费后回收 (PCR) 铝製成的气雾罐。该产品是同类产品中首款不含原生铝的气雾罐。努斯鲍姆的目标是利用回收罐生产气雾罐,以实现循环经济物质流。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 化妆品产业需求不断扩大

- 气雾罐的可回收性

- 市场问题

- 替代包装的竞争加剧

- 市场机会

- 新兴国家具有高成长潜力

第五章 COVID-19 对欧洲气雾槽产业的影响

第六章 市场细分

- 按材质

- 铝

- 钢罐

- 其他的

- 按最终用户产业

- 化妆品和个人护理(除臭剂、止汗剂、髮胶喷雾、造型慕丝等)

- 家庭使用

- 药品/动物用药品

- 油漆/清漆

- 汽车/工业

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Crown Holdings inc.

- Ball Corporation

- Toyo Seikan Group Holdings

- CCL Industries

- Can-Pack SA

- Ardagh Group

- Nampak Ltd

- Mauser Packaging Solutions

- Nussbaum Matzingen AG

- Tecnocap SpA

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 51784

The Europe Aerosol Cans Market is expected to register a CAGR of 3.2% during the forecast period.

Key Highlights

- Aerosol offers a wide range of products, from mass-market goods, such as household and cosmetic products, to specific aerosol types dedicated for industrial or medical purposes. The aerosol cans are used for coatings, cleaning agents, air fresheners, personal care items, insecticides, and a host of other products. While the market faced challenges in the early 1990s due to increased concerns about CFC propellants, innovations in spray technologies and the use of eco-friendly propellants have enabled rapid adoption of aerosol cans in multiple industries.

- Europe accounts for a significant share in the market studied due to the increasing demand from the leading European economy's personal care and food segment.

- Moreover, the pharmaceutical sector has been observed to have shown a growing interest in aluminum aerosol cans owing to the can's high level of security, further complemented by its convenient handling. Such factors are expected to add to the demand in the region. The government's push for sustainability and industrial acceptance of the same has been a huge positive impact on aluminum aerosol cans demand in the region.

- The per capita consumption of aerosols in Germany, France, and Russia, is expected to provide more demand during the forecast period. Besides the personal care sector, the pharmaceutical segment is witnessing growth as the aerosol system is tailor-made for a hygienic, safe and precise application of products. Moreover, with many industrial and automotive segments looking for innovative packaging solutions, the consumption of aerosol products from these sectors has increased rapidly, with a wide range of products being packaging in aerosol cans.

- Additionally, increasing investments in infrastructure development and positive economic trends are expected further to support the industrial demand over the forecast period. Moreover, owing to the convenience and strength offered by aerosol packaging, aerosol cans have become the standard packaging used in many industries. Besides, constant innovations by the companies in the market and technological developments in packaging are expected to drive market growth.

- Further, In September 2020, over 85 companies and organizations from the complete packaging value chain, including Beiersdorf, Procter & Gamble, Unilever, L'Oreal, ALPLA, and Henkel, have joined forces to assess whether digital technology can enable better sorting. They also focus on improved recycling rates for packaging in the European Union to drive a circular economy.

- Recently, Ball Corporation unveiled its latest can technology, 360-degree custom shaping, at the ADF & PCD exhibition in Paris. The new technology brought another dimension can contouring, using a process that allows custom shaping, symmetrically or asymmetrically, up to the entire circumference of the can, benefiting both brand owners and end consumers. Furthermore, with regulations specified in laws, directives, or rules, the guidelines of the requirements are also placed in industry, e.g., FEA (European Aerosol Federation) standards.

Europe Aerosol Cans Market Trends

Aluminum Accounts For the Largest Market Share

- Aluminum is one of the most popular metals for aerosol can packaging solutions. Its metal canvas for ad printing, fast cooling, 100% recyclability, and inertness is helping for the reduction in freight weight, resulting in low transportation costs and reduced carbon emission. Its increased preference for deodorants and rise in customers' disposable income drive the demand for aluminum aerosol cans in Europe.

- Also, there was an unprecedented spike in at-home consumption of paints and hair spray in Europe. Few Europeans are using hairsprays at saloons because of gathering restrictions related to the COVID-19 pandemic in 2020. The increase in take-home sprays demand also necessitated higher UK imports of can sheets. The country relies on a mixture of domestic and imported aluminum hair sprays can sheet formed into cans by companies such as Ball and Crown.

- Overall, many factors, such as costs, environmental footprint, convenience, and flexibility offered by different packaging solutions, are driving consumers away from metal cans. For instance, Aluminum uses bauxite, and bauxite mining is very energy-intensive. The process requires a lot of energy and the conversion to Aluminum and molding to make the cans.

- Moreover, Aluminum cans offer the advantages of recyclability and ease of printing. Additionally, they are lightweight and act as excellent barriers to gases. Such factors allow a higher penetration of aluminum variants in the personal care industry than other metal cans and other materials such as plastic or glass.

- Further, The aluminum base for deodorant cans consists primarily of Aluminum, but it contains small amounts of other metals, including 0.4% iron, 0.2% silicon, 1% magnesium, 1% manganese, and 0.15% copper. A significant portion of the Aluminum used in the deodorant can industry is derived from recycled material. Approximately 25% of the total European aluminum supply comes from recycled scrap, and the personal care can industry is the user of recycled material. Some of the manufacturers stated that the aluminum can industry reclaims (recycles) more than 65% of used cans.

United Kingdom Accounts for the Largest Market Share

- Many countries in Europe, including the United Kingdom, have strict recycling laws encouraging companies to adopt aluminum over steel. Aluminum aerosol cans offer high flexibility and bright packaging, crucial aspects of the personal care industry. Moreover, the eased recyclable material availability adds to its usability, thus, driving the demand.

- In September 2020, the UK city of Leicester had partnered with the Aluminum Packaging Recycling Organisation (Alupro) and MetalMatters to promote metal packaging recycling. The Make Metals Matter campaign, launched by Leicester City Council, is likely to target over 140,000 homes in the city to remind people to recycle all of their household metal packaging waste.

- Further, it is estimated that over 168 million cans, foil trays, and aerosol containers are used in Leicester every year, and the metal they are made of is endlessly recyclable. According to Leicester City Council, if all the metal packaging used in the city's homes was collected for recycling, it may help save 4,500 metric tons in carbon emissions, equivalent to taking 950 cars off local roads for a year.

- According to British Aerosol Manufacturers' Association (BAMA), many users impacted due to the national lockdowns and the closure of non-essential retail, the aerosol industry was quick to adjust to the changing circumstances and respond to new market needs, with overall production still above 1.5 billion units in 2020, just 1.3% down on 2019.

- Further, in September 2020, UK-based brand management, digital print, and interactive media provider Springfield Solutions have launched a new digital embellishment service for aerosols. Until now, adding premium effects to aerosols, such as spot varnishes, gold, silver, and multi-colored foils, tactile finishes, and emboss effects, has been a costly, inflexible, and lengthy process. However, this is all set to change because of Springfield's unique digital label embellishment offerings.

Europe Aerosol Cans Industry Overview

The European aerosol cans market is highly consolidated with a few significant players as the market is price sensitive; hence sustaining in the market is demanding. Further, vendors in the market are driven by sustainability and product enhancements to capture the market share and profitability. Some of the recent developments in the market are:

- March 2021 - LINDAL has launched an online 3D Aerosol Configurator in Germany to transform traditional packaging design processes. The new 3D Aerosol Configurator is hosted exclusively on the company's website. Customers can gain access to a suite of sophisticated editing and design tools to instantly and easily create 3D aerosol packaging.

- September 2020 - Nussbaum Matzingen AG, a Swedish manufacturer of aluminum monobloc cans, has launched an aerosol can made from 100% postconsumer recycled (PCR) aluminum. The product is the first of its kind of aerosol can containing no primary aluminum at all. The goal for Nussbaum is to produce an aerosol can made from recycled cans, implementing a circular economy material flow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Demand from the Cosmetic Industry

- 4.4.2 Recyclability of aerosol cans

- 4.5 Market Challenges

- 4.5.1 Increasing Competition from Substitute Packaging

- 4.6 Market Opportunities

- 4.6.1 Emerging economies offer high growth potential

5 IMPACT OF COVID-19 ON THE EUROPE AEROSOL CAN INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.1.3 Other Materials

- 6.2 By End-User Industry

- 6.2.1 Cosmetic and Personal Care (Deodorants/Antiperspirants, Hairsprays, Hair Mousse, and Others)

- 6.2.2 Household

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive/Industrial

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings inc.

- 7.1.2 Ball Corporation

- 7.1.3 Toyo Seikan Group Holdings

- 7.1.4 CCL Industries

- 7.1.5 Can-Pack SA

- 7.1.6 Ardagh Group

- 7.1.7 Nampak Ltd

- 7.1.8 Mauser Packaging Solutions

- 7.1.9 Nussbaum Matzingen AG

- 7.1.10 Tecnocap SpA

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219