|

市场调查报告书

商品编码

1628720

欧洲汽车网路安全市场 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe for Cyber Security of Cars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

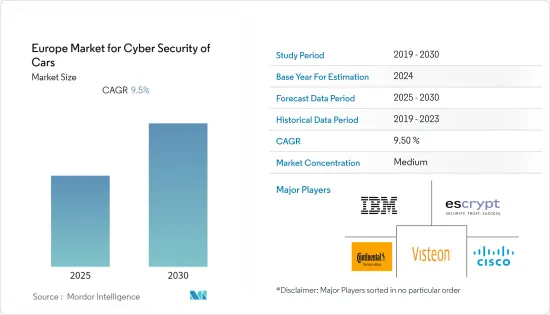

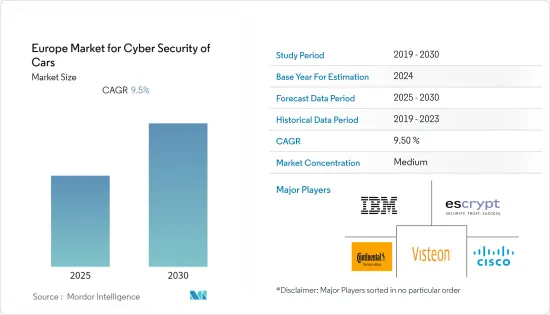

汽车产业网路安全欧洲市场预计在预测期内复合年增长率为 9.5%

主要亮点

- 欧盟法律的执行以及源自国家框架和国家网路安全计画的行动预计将推动该地区的市场成长。作为数位议程的一部分,义大利政府将大力投资数位身分保护,以提高数位交易和安全水平。此类倡议预计将支持市场成长。

- 德国正试图在网路安全方面将自己定位为像美国或中国一样的技术独立国家。 2020年8月,该国宣布成立一个联邦机构,致力于应对网路攻击和加强国家的数位安全。到 2023 年,该机构还将获得总计 4.12 亿美元的资金,以继续针对网路攻击的创新和解决方案。

- 随着物联网的出现和汽车通讯技术的普及,消费者对联网汽车的趋势不断增加,增加了对汽车网路安全的需求。Capgemini SA预计,到 2023 年,全球约四分之一的乘用车将是联网汽车,其中欧洲占据领先份额,且数量增长最快。

- 另外,对 ADAS 系统的需求不断增长预计将影响汽车网路安全需求。 ADAS 系统的大部分核心功能和其他功能预计将透过网路连线执行,从而允许从远端设备进行控制。

欧洲汽车网路安全市场趋势

云端安全预计将获得显着的市场占有率

- 云端运算改变了企业使用、共用和储存资料、应用程式和工作负载的方式。然而,与此同时,许多新的安全威胁、机器学习和挑战正在出现。随着大量资料流入云端和公有云服务,风险甚至更大。在最终用户数位化程度不断提高的推动下,该地区的一些国家目前处于云端采用的前沿。对内容、边缘服务、最后一哩连接的需求不断增长,以及与运输相关的资料量的增加正在提高车辆互连资料的隐私性。

- 在云端安全方面,託管安全供应商预计将获得该地区的巨大需求,领先公司正在专注于投资此类公司,以获得该地区的能力、实力和市场占有率。大多数公司使用多个云端供应商,因此,客户越来越需要确保跨云端提供者的统一安全性。此外,公司正在寻求采用集中方式来应用安全控制和合规措施。

- 此外,国家战略节点旨在支援公共管理的实体基础设施,并由 AGID 指定的评估小组进行认证。有必要进行初步评估,以确保提供政府云端服务的基础设施通用的安全标准。这是义大利政府行政资讯化三年计画(2019-2021)的一部分。这些倡议预计将支持市场成长。

- 然而,北欧公司正在加速资料向云端的迁移,为汽车建立新的数位系统,并增加其网路架构中的端点数量。对第三方供应商和服务供应商的日益依赖为攻击者提供了渗透供应链的新方法。

英国预计将拥有很大的市场占有率

- 英国《2016-2021年国家网路安全战略》是一项五年计划,投资19亿英镑,旨在到2021年使该国对网路威胁更具抵御能力,保护企业和人民,并保护系统和基础设施。该组织充当政府和麵临网路威胁的各个行业之间的联络人,提供有关网路威胁的适当指导和支持。预计这将为网路安全专业人员创造创新并创造更多就业机会。

- 2020 年 6 月,O2 UK 还宣布完成了计划,该项目由英国政府资助的创新机构 Innovate UK 和互联与自动驾驶汽车中心 (CCAV) 资助。在为期 12 週的 CAV 测试平台 (BeARCAT) 网路安全计划中,O2 正在与科技公司 Cisco、Millbrook Inspection Station 和华威大学的工程和製造技术部门 Warwick Manufacturing Group 等合作伙伴合作,以发挥其技术专长。进入我家。

- 网路犯罪的兴起引发了人们对新解决方案开发的关注,也成为了该国投资格局的特征。例如,Bridewell Consulting 是一家拥有託管侦测响应和安全营运中心的保全服务公司,已从私人公司的Growth Capital Partners 获得数百万美元的投资,以扩大其在英国和欧洲其他地区的业务。

- 此外,2021 年 10 月,Trustonic 加入瑞萨 R-Car 联盟,以扩大联网汽车市场中网路安全解决方案的可用性。透过作为该行业论坛的一部分进行合作,Trustonic 和其他 R-Car 联盟成员将创建新的安全解决方案,并为生态系统内的人员创造价值。

欧洲汽车网路安全产业概述

欧洲汽车网路安全市场本质上具有适度的竞争性。产品发布、高研发成本、联盟和收购是该地区公司保持竞争力的关键成长策略。

- 2021 年 3 月 - IBM Security 宣布推出一项服务,旨在管理跨混合云端环境的云端安全策略、计划和控制。 IBM Security Services for Cloud 的扩充套件旨在协助企业在其混合云环境中采用一致的安全策略。该服务还利用人工智慧和自动化来帮助识别风险并确定风险的优先顺序。

- 2020 年 2 月 - 思科和 Oxbotica 合作将 OpenRoaming 引入自动驾驶汽车。透过 OpenRoaming,自动驾驶车辆无需实际输入使用者名称或密码即可连接到可信任的 Wi-Fi 网路。相反,自动驾驶汽车使用 Oxbotica 等製造商颁发的凭证进行身份验证。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对工业生态系的影响

第五章市场动态

- 市场驱动因素

- 由于汽车中安装的技术的增加,安全威胁日益增加

- 政府法规

- 市场问题

- 市场动态

第六章 市场细分

- 按解决方案类型

- 基于软体

- 基于硬体

- 专业服务

- 一体化

- 其他解决方案

- 依设备类型

- 网路安全

- 应用程式安全

- 云端安全

- 其他安全

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Harman International Industries Inc.(Samsung)

- Escrypt GmbH

- Delphi Automotive PLC

- Arilou Technologies

- Infineon Technologies AG

- Visteon Corporation

- Continental AG

- Cisco Systems Inc

- Argus Cybersecurity

- Secunet AG

- NXP Semiconductors NV

- IBM Corporation

- Honeywell International Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 52077

The Europe Market for Cyber Security of Cars Industry is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The implementation of EU legislation and actions stemming from the National Framework and the National Cybersecurity Plan is expected to facilitate the market's growth in the region. As part of its Digital Agenda, the Italian government plans to make considerable investments in digital identity protection to increase digital transactions and security levels. Initiatives like this are expected to boost the market growth.

- Germany is pushing itself as a technologically independent country like the United States and China in terms of cybersecurity. In August 2020, the country announced a federal agency dedicated to handling cyberattacks and strengthening the country's digital security. The agency is also slated to receive total funding of USD 412 million by 2023 to continue innovation and solutions to cyber-attacks.

- The increasing consumer propensity toward connected cars, due to the advent of IoT and the proliferation of communication technologies in vehicles, is augmenting the need for cybersecurity in cars. According to Capgemini, by 2023, about a quarter of all the passenger cars in use worldwide will likely be connected, with Europe holding the major share and showing the fastest growing numbers.

- Apart from this, the increasing demand for the ADAS system is expected to influence the demand for cybersecurity in cars; with ADAS systems, a prominent share of core functions along with other features are expected to run on network connections, which can be controlled from remote devices.

Europe Cyber Security of Cars Market Trends

Cloud Security Expected to Witness Significant Market Share

- Cloud computing has transformed the way enterprises use, share, and store data, applications, and workloads. However, it has also introduced a host of new security threats, machine learning, and challenges. With significant data going into the cloud and public cloud services, it further increases the exposure. Currently, multiple countries in the region are at the forefront of cloud adoption augmented by the end-user drive for digitalization. The growing demand from content, edge services, and last-mile connectivity to transport-led growing data volumes has increased the interconnection data privacy of cars.

- In terms of cloud security, managed security providers are expected to see significant demand from the region, and major players are focusing on investing in such firms to gain a regional foothold and market share along with capabilities. Most organizations use multiple cloud providers, and with it, the demand for a unified way to secure them is increasing among the customers. Also, companies are looking to adopt a centralized way to apply security controls and compliance policies.

- Further, National strategic nodes are designed to support the public administration's physical infrastructure, which will be certified by evaluation groups tasked by AGID. Preliminary evaluations are necessary to ensure a common security standard for infrastructure offering public administration cloud services. This is a part of the 2019-2021 Three-Year Plan for Information Technology in Public Administration undertaken by the Italian Government. Such initiatives are expected to boost market growth.

- However, Nordic companies are accelerating data migration to the cloud, crafting new digital systems catering to cars, and increasing the number of endpoints within their network architecture. Their developing dependence on third-party suppliers and service providers has presented attackers with new avenues into supply chains.

United Kingdom Expected to Witness Significant Market Share

- The National Cyber Security Strategy adopted by the United Kingdom for 2016-2021 is a five-year plan of investing GBP 1.9 billion to defend systems and infrastructure by protecting both companies and its citizens by making the country resilient to cyber threats by 2021. This body functions as a bridge to provide proper guide and support involving cyber threats between various industries exposed to it and the government. This is expected to create innovations and drive more job opportunities for cyber security professionals.

- Also, in June 2020, O2 UK announced the completion of a project to support the development of cybersecurity testing capabilities funded by Innovate UK, the UK Government-funded innovation agency, and the Centre for Connected and Autonomous Vehicles (CCAV). During the 12-week Baselining, Automation, and Response for CAV Testbed (BeARCAT) cybersecurity project, O2 granted access to its technical subject matter experts, working alongside partners such as technology company Cisco, Millbrook Proving Ground, and Warwick Manufacturing Group, the engineering, manufacturing, and technology department at the University of Warwick.

- The increased rate of cybercrimes has driven the focus of developing new solutions and has characterized the country's investment landscape. For instance, Bridewell Consulting, a cyber security services company dealing with Managed Detection Response and Security Operations Centre, acknowledged multi-million dollar investment from Growth Capital Partners, a private equity firm to expand its operations in the UK and in the rest of Europe.

- Further, in October 2021, Trustonic joined the Renesas R-Car Consortium to expand the availability of cybersecurity solutions in the connected vehicle market. Trustonic and other R-Car Consortium members will create new security solutions and generate value for those in the ecosystem by collaborating as part of this industry forum.

Europe Cyber Security of Cars Industry Overview

The Europe Market for Cyber Security of Cars is moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- March 2021 - IBM Security announced services designed to manage cloud security strategy, policies, and controls across hybrid cloud environments. The expanded suite of IBM Security Services for Cloud is designed to assist companies in adopting a consistent security strategy across their hybrid cloud environments. Also, the services leverage AI and automation to help identify and prioritize risks.

- February 2020 - Cisco and Oxbotica partnered to bring OpenRoaming to autonomous cars. With the help of OpenRoaming, Autonomous Vehicles can connect to trusted Wi-Fi networks without the need to physically enter the usernames or passwords. Instead, Autonomous Vehicles authenticate using credentials issued by the manufacturer, like Oxbotica.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Security Threats as More Technologies Get Integrated Into Cars

- 5.1.2 Government Regulations

- 5.2 Market Challenges

- 5.2.1 Dynamic Nature of the Market

6 MARKET SEGMENTATION

- 6.1 By Solution Type

- 6.1.1 Software-based

- 6.1.2 Hardware-based

- 6.1.3 Professional Service

- 6.1.4 Integration

- 6.1.5 Other Types of Solution

- 6.2 By Equipment Type

- 6.2.1 Network Security

- 6.2.2 Application Security

- 6.2.3 Cloud Security

- 6.2.4 Other Types of Security

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Harman International Industries Inc. (Samsung)

- 7.1.2 Escrypt GmbH

- 7.1.3 Delphi Automotive PLC

- 7.1.4 Arilou Technologies

- 7.1.5 Infineon Technologies AG

- 7.1.6 Visteon Corporation

- 7.1.7 Continental AG

- 7.1.8 Cisco Systems Inc

- 7.1.9 Argus Cybersecurity

- 7.1.10 Secunet AG

- 7.1.11 NXP Semiconductors NV

- 7.1.12 IBM Corporation

- 7.1.13 Honeywell International Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219