|

市场调查报告书

商品编码

1628726

北美智慧办公室:市场占有率分析、产业趋势与成长预测(2025-2030)NA Smart Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

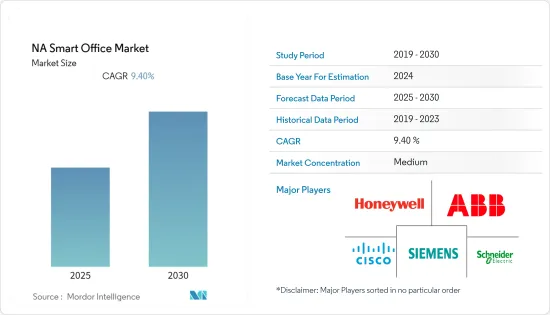

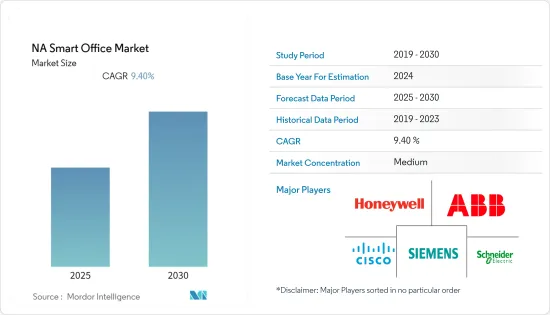

北美智慧办公室市场预计在预测期内复合年增长率为 9.4%

主要亮点

- 受访市场主要受到对智慧办公室解决方案不断增长的需求、智慧办公室中物联网的市场发展以及对职场安全和安保系统不断增长的需求的影响。

- 职场中的物联网使用各种硬体和技术,包括智慧设备、机器人和人工智慧,来提高生产力并发现机会。凭藉这些优势,Amazon Alexa for Business 允许企业在办公室环境中使用 Alexa 数位助理。 Amazon Echo 智慧音箱还可以在办公室中使用,提供不需要近距离的会议室等信息,并允许员工订购设备。

- 对能源效率的日益关注也是推动智慧办公市场成长的关键因素。日益增长的环境问题促使该地区的企业提高业务能源效率并减少环境足迹。

- 智慧型设备的增加是该地区采用互联办公室的主要原因。更多的设备和对新云端运算技术的更多依赖将大大提高公司产品和服务的品质。此外,该公司已经在日常业务中采用混合实境、物联网 (IoT) 和人工智慧 (AI) 等创新技术。

北美智慧办公室市场趋势

安全和存取控制将经历显着增长

- 该地区越来越多地实施网路监控,许多供应商透过网路监控和安全资讯提供安全和存取控制系统。根据 CompTIA 的数据,2021 年,54% 的美国受访者将网路监控作为网路安全策略的一部分。

- 此外,2021 年 3 月,CyberArk 宣布推出新的订阅、计画和工具,旨在加速组织的身分安全工作。这是该公司影响业务策略的一部分,这些新产品补充了 CyberArk 专注于特权存取管理的身份安全产品组合。 CyberArk 继续投资并执行其身分安全愿景。

- 预计在预测期内,对安全存取服务边际(SASE) 的需求和企业兴趣将会增加。该技术支援快速、安全的云端采用,允许用户和装置随时随地存取资料、应用程式和服务。

- 此外,在未来几年中,我们预计采用零信任安全性来确保企业网路资料安全的企业比例将大幅增加。随着公司投资确保大量远距员工的安全,在疫情后的情况下,这一数字预计会增加。例如,2020 年 4 月,Google发布了 Beyond Corp 远端存取产品,该产品基于零信任方法。

美国预计将获得大量市场占有率

- 随着 5G 在美国的广泛采用以及 Wi-Fi 6 等 Wi-Fi 技术的改进,智慧办公室解决方案将与更快、更强大的网路连接,从而更好地存取云端的处理和资料资源。 5G 技术也正在彻底改变物联网服务的交付,包括智慧办公室技术。因为5G技术使设备摆脱了电线和电缆的束缚,并最大限度地降低了功耗。

- AT&T、Verizon、T-Mobile 和 Sprint 于 2020年终推出了 5G 无线网路。因此,目前5G已经在美国部分城市推出。然而,预计需要数年时间才能在美国实现全面、成熟、全速的 5G 覆盖范围(例如 4G LTE)。 T-Mobile也宣布将于2024年推出基于5G的家庭网路。目标是将覆盖范围扩大到美国以前服务不足的农村地区。 T-Mobile 目前正在其 4G LTE 网路上向一些 T-Mobile 客户提供其服务的试用版。

- 数位转型和不断变化的相关人员需求正在加速对智慧办公室的需求。其中之一是疫情对未来工作的影响以及混合工作模式的日益采用。然而,一些现有的驱动因素在该国变得越来越重要,导致针对各种使用案例的专用智慧物联网解决方案的出现。

- 市场供应商正在结合多种资料驱动和数位化的服务和解决方案,以提高工作专业知识和效率,实现成本和能源节约,并透过各种相关人员应用程式将办公室带入办公室,从而增加价值。

北美智慧办公产业概况

北美的智慧办公室竞争力中等。该地区公司为维持强劲竞争而采取的主要成长策略是产品发布、高额研发支出、联盟和收购。

- 2021 年 5 月Honeywell为建筑物业主和管理者推出云端基础的解决方案。简化和整合营运和业务资料,以帮助资料更好的决策、提高效率并实现永续性目标。

- 2020 年 7 月-西门子推出智慧办公室应用 Comfy,协助员工在疫情期间安全返回职场。西门子也表示,此次部署针对约600个企业地点,为面向未来的数位工作场所和麵向未来的工作环境奠定了基础。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对节能解决方案的需求不断增长

- 安全系统自动化的需求不断增加

- 市场挑战

- 安装更换成本高、隐私问题

第六章 市场细分

- 依产品类型

- 智慧办公室照明

- 安全/进入/退出控制系统

- 能源管理系统

- 智慧暖通空调控制系统

- 视讯会议系统

- 消防/安全控制系统

- 依建筑类型

- 维修

- 新大楼

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Koninklijke Philips NV

- Honeywell International Inc.

- ABB Ltd

- Schneider Electric SE

- Siemens AG

- United Technologies Corporation

- Johnson Controls International PLC

- Cisco Systems Inc.

- Crestron Electronics Inc.

- Lutron Electronics Co. Inc.

- FogHorn Systems Inc.

- Enlighted Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 52340

The NA Smart Office Market is expected to register a CAGR of 9.4% during the forecast period.

Key Highlights

- The market being studied is primarily influenced by the rising demand for smart office solutions, the development of IoT in smart office offerings, and the increasing need for workplace safety and security systems.

- IoT in the workplace uses a variety of hardware and technologies, such as smart devices, robots, and artificial intelligence, to improve productivity and identify opportunities. Owing to these benefits, Amazon Alexa for Business allows companies to use its Alexa digital assistant in an office setting. Organizations can also use Amazon Echo smart speakers in the office to provide information, such as the proximity-free meeting room or allow employees to order supplies.

- The increasing focus on energy efficiency is another key factor driving the growth of the smart office market. The rising environmental concerns are pushing the companies in the region to improve the energy efficiency of operations and reduce their environmental footprint.

- The rising number of smart devices has been the primary reason behind the implementation of connected offices in the region. More devices and a heavy dependence on emerging cloud computing technologies will exponentially improve the firms' quality of products and services. Further, businesses are already adapting to innovations, such as mixed reality, the internet of things (IoT), and artificial intelligence (AI), in their daily operations.

North America Smart Office Market Trends

Security and Access Control to Witness Significant Growth

- The region is witnessing significant adoption of Network monitoring, and various market vendors are offering security and access control systems through network monitoring and security information. According to CompTIA, In 2021, In 2021, 54% of respondents from the United States witnessed using Network Monitoring as part of their cybersecurity strategy.

- Further, in March 2021, CyberArk announced the availability of new subscriptions, programs, and tools designed to accelerate organizations' Identity Security initiatives. It is part of the company strategy to impact business, and these new offerings complement CyberArk's Identity Security portfolio, which is centered on Privileged Access Management. The company continues to invest and execute its vision for Identity Security.

- Over the forecast period, the demand and enterprise interest in Secure Access Service Edge (SASE) is expected to increase as the technology enables fast and secure cloud adoption and ensures that users and devices have access to data, applications, and services anywhere at any time.

- Also, Over the coming years, a significant share of enterprises are expected to adopt zero trust security to ensure the safety of the data over the company network; the numbers are expected to increase in post-pandemic scenarios where the enterprises invest in securing a large number of remote workers. For instance, in April 2020, Google launched its Beyond Corp Remote Access product based on the Zero Trust approach.

United States Expected to Witness Significant Market Share

- With the significant rollout of 5G in the United States and improved Wi-Fi technology, such as Wi-Fi 6, smart office solutions are witnessing being linked by faster, more powerful networks, meaning better access to processing and data resources in the cloud. 5G technology is also revolutionizing IoT services' delivery, including smart office technology, as it allows devices to work free of wires and cables while consuming a minimal amount of power.

- AT&T, Verizon, T-Mobile, and Sprint launched their 5G wireless networks toward the end of 2020. Hence, 5G is currently available to customers in select cities across the United States. However, it is expected to take a few years before full-fledged, top-speed 5G coverage is available across the country, like 4G LTE. T-Mobile also announced that it would be launching a 5G - based home network by 2024. The aim is to extend coverage to previously underserved rural areas across the United States. It is currently offering a trial version of the service on its 4G LTE network to a select number of T-Mobile customers.

- Several progressions have accelerated smart office demand, driven by digital transformation and changing needs of all stakeholders. One of the drivers is the pandemic's impact on the future of work and the increased adoption of the hybrid work model. However, several existing drivers have grown in importance in the country, with dedicated, intelligent IoT solutions for various use cases.

- The market vendors are combining several data-driven and digitally-enabled services and solutions to improve work expertise and efficiency, realize the cost and energy savings, and add value to the office through apps for various stakeholders.

North America Smart Office Industry Overview

The North America Smart Office is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- May 2021 - Honeywell launched a cloud-based solution for building owners and managers that simplifies and combines operational and business data to back up better decision-making, drive greater efficiencies, and achieve sustainability goals.

- July 2020 - Siemens announced a smart office app, Comfy, to help employees return to work safely during the pandemic. Siemens also stated that the deployment would target approximately 600 company locations and lay the groundwork for future-proof digital workplaces and future-oriented working environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Efficient Solutions

- 5.1.2 Growing Need for Automation of Security Systems

- 5.2 Market Challenges

- 5.2.1 High Installation and Replacement Costs Along With Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Smart Office Lighting

- 6.1.2 Security and Access Control System

- 6.1.3 Energy Management System

- 6.1.4 Smart HVAC Control System

- 6.1.5 Audio-video Conferencing System

- 6.1.6 Fire and Safety Control System

- 6.2 By Building Type

- 6.2.1 Retrofits

- 6.2.2 New Buildings

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips NV

- 7.1.2 Honeywell International Inc.

- 7.1.3 ABB Ltd

- 7.1.4 Schneider Electric SE

- 7.1.5 Siemens AG

- 7.1.6 United Technologies Corporation

- 7.1.7 Johnson Controls International PLC

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Crestron Electronics Inc.

- 7.1.10 Lutron Electronics Co. Inc.

- 7.1.11 FogHorn Systems Inc.

- 7.1.12 Enlighted Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219