|

市场调查报告书

商品编码

1637863

欧洲智慧办公室:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Smart Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

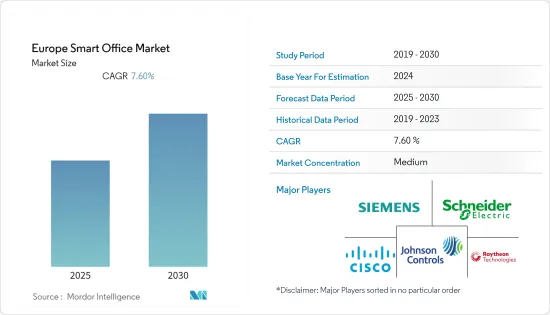

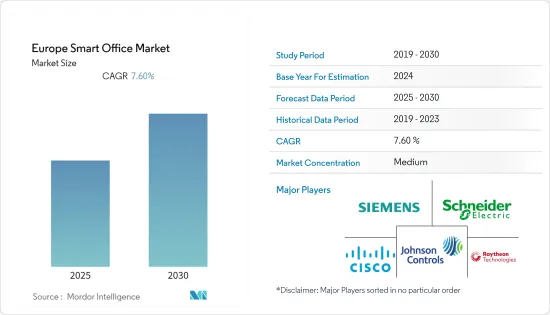

预计预测期内欧洲智慧办公市场复合年增长率将达到 7.6%。

主要亮点

- 智慧建筑可自动化控制基础设施、照明、安全系统、暖气、通风和空调系统等的过程。智慧建筑利用技术并将其与基本建筑基础设施和其他结构和服务组件结合,使建筑更加高效、永续和安全。智慧建筑解决方案是物联网和连接感测器不断发展的生态系统的一部分。

- 智慧办公室正在采用能源管理系统、智慧暖通空调系统以及安全和门禁系统等解决方案。 EMS 是一种整合的电脑系统,用于监控和控制与能源相关的基础设施服务工厂和设施,例如 HVAC 系统和照明。

- 开发绿色 HVAC 系统是为了提高能源效率并降低成本。例如,总部位于加州格伦代尔的知名能源储存公司Ice Energy推出了一款名为「Ice Bear」的冰动力来源空调,它可以为建筑物降温,并且在大多数情况下可以降低净消费量。

- 公司正在这些地区投资并设立办公空间。这些地区房地产行业的不断改善也支持了新建房屋的成长。许多公司都致力于在办公室采用智慧技术,因为许多公司都在这一领域投入了大量资金。这正在推动新兴市场智慧办公市场的成长。许多进入市场的公司正在建造新的基础设施。

- 新冠肺炎疫情将影响全球大部分地区的建筑和其他办公空间的建设,因此智慧办公室设备的生产很可能在短期内受到影响。不过,企业并未对生产能力做出任何重大改变。例如,思科的供应链目前没有出现製造地关闭的情况。此外,随着越来越多的企业采用在家工作的文化,智慧家庭供应商将利用语音和其他智慧家庭实现来改善日常家庭业务,并确保安全和自动化的宅配。

欧洲智慧办公室市场趋势

能源管理系统电力与能源大幅成长

- 欧洲在排放和能源消耗方面的法律和政策比其他国家更为严格。这些法规给建设产业带来了压力,迫使其建造新建筑并维修旧建筑以符合这些规范。

- 英国政府要求能源供应商在 2,600 万户家庭安装智慧电錶,目标是到 2020 年让英格兰、威尔斯和苏格兰的每个家庭都配备智慧电錶。此外,到2025年,英国将有约70万户家庭实现升级,到2050年,英国所有建筑都将实现低碳供暖。

- 智慧电錶的加速普及、能源危机意识的不断增强以及欧洲要求到 2050 年将碳排放减少 80% 的要求被认为是影响英国家庭能源管理系统成长的关键因素。

- 根据德国智慧电錶部署策略,到2032年所有电錶必须智慧化,或至少具备数位化介面。塔尔马辛镇位于 E.ON 子公司 BayernWerk 的服务区内,是该公司声称将安装 10 万个智慧电錶的第一个地点。迄今为止,E.ON 已在英国安装了四百万台智慧电錶。

德国对智慧暖通空调控制系统的需求不断成长

- 预计预测期内德国将占据主要市场占有率。 HVAC 控制系统的采用是由于室内温度控制的需要。该国年平均气温约摄氏10度左右,商业建筑对空调的需求很大。

- 随着近年来气温升高,预计未来几年空调需求将稳定成长。这是技术先进的国家在家庭和商业场所中采用智慧控制恆温器和暖通空调设备背后的驱动力。

- 除此之外,政府能源和环境法规(如法规 842/2006/EC)要求在全国范围内进行洩漏测试,以消除冷媒洩漏。可以透过使用控制系统监控空调设备的使用情况来防止这种情况。

- 政府为 2050 年建造气候适应型建筑所采取的措施还不够。德国住宅协会 (GdW) 和基督教民主联盟经济委员会正在考虑推行分散供热。预计在预测期内,对能源效率的重视将对 HVAC 控制市场产生正面影响。

- 2022 年 10 月—德国经济和气候行动部发布了一份研究和先导计画的提案征求书,以加快热泵和其他气候中性供暖和製冷系统的转变。该倡议将获得每年 6 亿欧元能源研究预算的支持,金额尚未确定。该活动将持续到 2023 年 2 月 28 日。重点将放在热泵发展、环保建筑材料、工业规模热泵、季节性热储存和创新控制范式。

欧洲智慧办公产业概况

欧洲智慧办公市场竞争激烈,由几位大型参与者组成。这些公司正在利用策略合作措施来增加市场占有率和盈利。主要企业包括江森自控国际有限公司、Cisco公司和联合技术公司。

- 2022 年 2 月-德国联邦经济与能源部启动「智慧能源展示-能源转型数位议程」资助计画。该计划旨在引入和测试尖端能源解决方案,同时吸引价值链各个环节的市场相关人员。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 市场限制

- COVID-19 产业影响评估

第六章 市场细分

- 按产品

- 安全和门禁系统

- 能源管理系统

- 智慧暖通空调控制系统

- 音讯/视讯会议系统

- 消防和安全控制系统

- 其他产品

- 依建筑类型

- 改装

- 新大楼

- 按国家

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Koninklijke Philips NV

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric SA

- Siemens AG

- United Technologies Corporation

- Johnson Controls Inc.

- Cisco Systems Inc.

- Crestron Electronics Inc.

- Lutron Electronics Co. Inc.

- Raytheon Technologies

第八章 企业市场占有率

第九章投资分析

第十章:欧洲智慧办公市场的未来

简介目录

Product Code: 48001

The Europe Smart Office Market is expected to register a CAGR of 7.6% during the forecast period.

Key Highlights

- A smart building automates its processes to control its infrastructure, lighting, security systems, heating, ventilation, air conditioning systems, and more. A smart building uses technology and assimilates it with the basic building infrastructure and other structural and equipment components to make buildings more efficient, sustainable, and safe. Smart building solutions are a part of the growing IoT and connected sensor ecosystem.

- Solutions, such as the Energy Management System, Smart HVAC System, and Security and Access System, are adopted for smart offices. EMS is an integrated computerized system for monitoring and controlling energy-related infrastructure services plants and equipment, such as HVAC systems and lighting.

- Green HVAC systems are developed to improve energy efficiency and reduce costs. For instance, Ice Energy, a prominent energy storage company based in Glendale, California, released an ice-powered air-conditioning unit, Ice Bear, to cool buildings and, in most cases, reduce a building's net energy consumption.

- Companies are investing in these regions to establish office spaces. The improving real estate industry in these regions also supports the growth of new buildings. With many companies investing heavily in this segment, many companies are focusing on adopting smart technologies for their offices. This is driving the growth of the smart offices market in developing nations. Many companies entering the market are establishing new infrastructure.

- With the outbreak of COVID-19, the production of smart office equipment will be impacted in the short run as the construction of buildings and other office spaces are affected in significant areas across the world. However, companies have not made any significant changes to their production capacities. For instance, there are currently no manufacturing sites closed in Cisco's supply chain. Also, with more companies adopting work from home culture, smart home vendors can leverage voice and other smart home implementations to improve the day-to-day routines within a home and secure and automate home deliveries.

Europe Smart Office Market Trends

Power and Energy in Energy Management Systems to Show Significant Growth

- Europe, concerning emissions and energy consumption, has stringent laws and policies compared to others. These regulations pressure the construction industry to make new buildings and refurbish the old ones that adhere to these norms.

- The UK government mandate states that energy suppliers need to install smart meters in 26 million homes, aiming for every household in England, Wales, and Scotland, to have a smart meter by 2020. Additionally, approximately 700,000 households will be upgraded by 2025, and all buildings in the UK will have low-carbon heating by 2050.

- The accelerating smart meter roll-out, growing awareness of the energy crisis, and the European directive to reduce 80% of carbon emissions by 2050 have been identified as the significant factors influencing the growth of home energy management systems in the United Kingdom.

- By 2032, according to Germany's smart meter implementation strategy, every meter must be intelligent or, at the very least, have a digital interface. The municipality of Thalmassing in the service area of E.ON subsidiary Bayernwerk is where the firm claims to be the first to install 100,000 smart meters. E.ON has installed four million smart meters in the UK thus far.

Demand for smart HVAC Control Systems to Increase in Germany

- Germany is expected to hold a significant market share in the studied market over the forecast period. The adoption of HVAC control systems is driven by the need to control the temperature indoors. The country's annual temperature hovers around 10 degrees Celsius, creating a demand for air conditioning in commercial buildings.

- With the growing temperatures in recent years, the demand for air conditioners is expected to increase steadily over the coming years. This has further driven the technologically advanced country to adopt smart controlling thermostats in homes and commercial settings alongside the HVAC equipment.

- Combined with this, government energy regulations and environmental regulations such as Regulation 842/2006/EC stipulate that refrigerant leaks are to be eliminated by carrying out leak inspections in the country. Such occurrences can be controlled by monitored usage of the HVAC equipment with the control systems.

- The government's measures to create a climate-neutral building stock by 2050 are insufficient. The country's German Housing Association (GdW) and the CDU Economic Council are looking to shift to decentral heating. The focus on energy efficiency is expected to positively impact the HVAC controls market over the forecast period.

- In October 2022 - A request for proposals for research and pilot projects was made by the German Ministry for Economic Affairs and Climate Action to hasten the switch to heat pumps and other climate-neutral heating and cooling systems. The initiative will be supported by its annual EUR 600 million budget for energy research, but there is no set amount for it. It will operate through February 28, 2023. The development of heat pumps, environmentally acceptable construction materials, industrial-scale heat pumps, seasonal heat storage, and innovative control paradigms will all be emphasized.

Europe Smart Office Industry Overview

The Europe smart office market is highly competitive and consists of several major players. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. Significant players include Johnson Controls International PLC, Cisco Systems Inc., and United Technologies Corp., among others.

- February 2022 - The funding programme "Smart Energy Showcases - Digital Agenda for the Energy Transition" was established by the German Federal Ministry of Economic Affairs and Energy. This effort aims to install and test cutting-edge energy solutions while also involving market actors from all points along the value chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Assessment of the Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Security and Access Control System

- 6.1.2 Energy Management System

- 6.1.3 Smart HVAC Control System

- 6.1.4 Audio-Video Conferencing System

- 6.1.5 Fire and Safety Control System

- 6.1.6 Other Products

- 6.2 By Building Type

- 6.2.1 Retrofits

- 6.2.2 New Buildings

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips N.V

- 7.1.2 Honeywell International Inc.

- 7.1.3 ABB Ltd.

- 7.1.4 Schneider Electric SA

- 7.1.5 Siemens AG

- 7.1.6 United Technologies Corporation

- 7.1.7 Johnson Controls Inc.

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Crestron Electronics Inc.

- 7.1.10 Lutron Electronics Co. Inc.

- 7.1.11 Raytheon Technologies

8 COMPANY MARKET SHARE

9 INVESTMENT ANALYSIS

10 FUTURE OF EUROPE SMART OFFICE MARKET

02-2729-4219

+886-2-2729-4219