|

市场调查报告书

商品编码

1628740

南美洲的黏合剂和密封剂:市场占有率分析、产业趋势、成长预测(2025-2030)South America Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

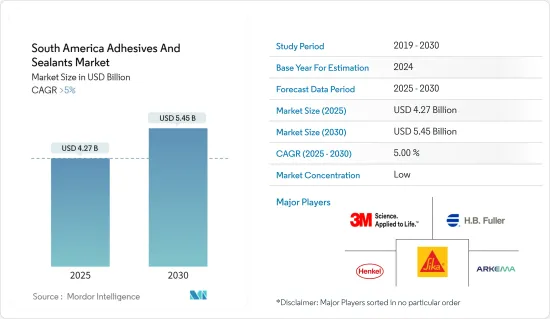

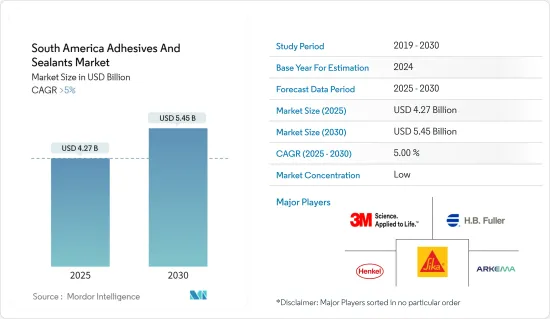

南美洲黏合剂和密封剂市场规模预计到2025年为42.7亿美元,预测期内(2025-2030年)复合年增长率超过5%,预计到2030年将达到54.5亿美元。

南美洲黏合剂和密封剂市场受到COVID-19大流行的严重影响,既带来了挑战,也带来了机会。建设业和製造业等行业最初因停工和中断而出现需求下降。然而,疫情也增加了医疗用品、个人防护设备和卫生产品生产中对黏合剂和密封剂的需求。儘管最初遭遇挫折,但市场预计将復苏并呈现长期成长。

对黏合剂和密封剂的需求主要是由建筑业需求的成长和医疗基础设施的增加所推动的。

然而,与黏合剂和密封剂相关的严格挥发性有机化合物排放法规可能会阻碍市场成长。

生物基黏合剂的创新和发展以及向复合黏合的转变预计将为该地区的黏合剂和密封剂市场提供机会。

巴西是该地区最大的黏合剂和密封剂市场,建筑、航太和汽车等最终用户产业是消费的主要驱动力。

南美洲黏合剂和密封剂的市场趋势

建筑业主导市场

- 黏合剂和密封剂因其特性和物理特性而广泛应用于建筑业。这些性能包括良好的附着力和弹性、内聚力、高内聚强度、柔韧性、基材的高弹性模量、抗热膨胀性以及对紫外线、腐蚀、盐水、雨水和其他气候条件的耐环境性。等

- 2022年,南美地区的建设活动将大幅增加。原因是从大流行年政府关闭和限制的影响中恢復过来。

- 根据智利建筑商会(CChC)的数据,2023年1月至3月期间建筑材料供应价格指数(IPMIC)与去年同期相比成长了5.9%。

- 巴西是该地区主要且最重要的建筑和房地产市场。然而,该国的景气衰退和脆弱的经济状况预计将阻碍该地区建筑业的成长。

- 巴西政府启动了一项基础设施特许经营计划,旨在发展港口、公路、铁路、电力线和卫生基础设施。根据该计划,政府计划透过官民合作关係(PPP)模式投资 450 亿雷亚尔(141 亿美元)。此外,Minha Casa Minha Vida (MCMV)、Plano Decenal de Expansao de Energia 2026 和国家教育计划等政府计划预计将在预测期内支持该行业的成长。

- 此外,2022年巴西工业建设将大幅成长。农产品综合企业连锁公司 BBSios 计划在巴西建造小麦乙醇工厂。领先的投资公司 Nordic Impact Corporation (NIC) 正在巴西投资建造六座容量为 18 兆瓦的太阳能发电厂。

- 上述针对薄巴西的所有因素预计将在预测期内增加该地区对黏合剂和密封剂的需求。

巴西主导南美洲需求

- 巴西是南美洲黏合剂消费量最高的国家。包装、汽车、建筑等行业都严重依赖黏合剂。

- 巴西的成长主要是由住宅和商业建筑行业的快速扩张以及该国的经济扩张所推动的。

- 根据巴西政府介绍,为了提升巴西旅游城市的地位,最大限度地发挥该行业的潜力,吸引更多游客并为他们提供更舒适的住宿,巴西基础设施计划投资762美元8.66亿美元。

- 巴西的纸浆和造纸业是巴西最成功的农产品出口之一,在生产此类产品的国家中排名靠前。纸箱由多种材料製成,包括纸板、双摺纸、白色牛皮纸、再生材料和复合材料。 Combistyle 纸盒包装由 SIG 与巴西最大的牛奶生产商之一 Frimesa 于 2022 年 5 月推出。这些纸盒包装在巴西圣保罗举行的美洲最大的餐饮展览会2022 年 APAS 展会上进行了展示。

- 巴西是南美洲最大的纸板市场之一。根据巴西区域统计实验室的估计,巴西的板材和瓦楞包装产量预计将从 2018 年的 28.9 亿美元增加到 2023 年的 31.8 亿美元。

- 巴西电商市场在 2021 年上半年成长了 31%,2020 年已经成长了 40%。在当今竞争激烈的快消品市场中,企业要想在竞争中脱颖而出,维护自己的市场品牌形象,就必须采用精美的包装,并在包装上进行创新。

- 汽车工业是该国广泛使用黏合剂和密封剂的另一个主要产业。根据OICA统计,2022年包括乘用车和商用车在内的汽车总产量为236万辆,较2021年成长5%。预计2021年汽车总产量约224万辆。

- 该国是该地区成熟的医药市场。在国内大型供应商的推动下,该国市场见证了各种产品创新,主要是医药包装产品。

- 此外,根据巴西医院联合会、巴西国家卫生联合会和巴西卫生署的数据,到 2022 年,巴西的医院数量将达到 7,191 家。医院的成长将为全国各地的药品包装供应商增加机会,以满足对复方药物日益增长的需求。

- 上述因素均对国内黏合剂和密封剂的需求产生重大影响。

南美洲胶黏剂和密封剂产业概况

南美洲黏合剂和密封剂市场按其性质划分。主要企业(排名不分先后)包括 Henkel AG &Co.KGaA、3M、HB Fuller Company、Arkema 和 Sika AG。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 巴西建筑业需求增加

- 扩大在包装行业的应用

- 其他司机

- 抑制因素

- 关于VOC排放的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 黏合树脂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 氰基丙烯酸酯

- VAE・EVA

- 其他树脂(聚酯、橡胶等)

- 黏合技术

- 溶剂型

- 反应性

- 热熔胶

- UV固化胶

- 密封树脂

- 硅胶

- 聚氨酯

- 丙烯酸纤维

- 环氧树脂

- 其他树脂(沥青、聚硫化物UV固化等)

- 最终用户产业

- 航太

- 车

- 建筑/施工

- 鞋类/皮革

- 医疗保健

- 包装

- 木工/细木工

- 其他最终用户产业(电子、消费/DIY 等)

- 地区

- 阿根廷

- 巴西

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema Group

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- DuPont

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hexion

- Huntsman International LLC

- ITW Performance Polymers(Illinois Tool Works Inc.)

- Jowat AG

- Mapei Inc.

- Tesa SE(A Beiersdorf Company)

- Pidilite Industries Ltd

- RPM International Inc.

- Sika AG

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 生物基胶黏剂的创新与发展

- 转向复合黏合

The South America Adhesives And Sealants Market size is estimated at USD 4.27 billion in 2025, and is expected to reach USD 5.45 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The South American adhesives and sealants market was significantly affected by the COVID-19 pandemic, bringing both challenges and opportunities. Lockdowns and disruptions in industries like construction and manufacturing initially reduced demand. However, the pandemic simultaneously increased the need for adhesives and sealants in manufacturing medical supplies, personal protective equipment, and hygiene products. Despite the initial setbacks, the market is anticipated to recover and exhibit long-term growth.

The demand for adhesives and sealants is extensively driven by the growing demand from the construction industry and increasing healthcare infrastructure.

However, the market growth is likely to be hindered by the stringent VOC emissions regulations related to adhesives and sealants.

The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to offer opportunities for the adhesives and sealants market in the region.

Brazil stands to be the largest market for adhesives and sealants in the region, where the end-user industries, such as construction, aerospace, and automotive, majorly drive consumption.

South America Adhesives and Sealants Market Trends

The Building and Construction Industry to Dominate the Market

- Adhesives and sealants have been extensively used in the building and construction industry owing to their characteristics and physical properties. These properties include good adhesion and elasticity, cohesion, high cohesive strength, flexibility, the high elastic modulus of the substrate, resistance from thermal expansion, and environmental resistance from UV light, corrosion, salt water, rain, and other weathering conditions.

- In 2022, the South American region will see a tremendous increase in construction activities. The reason for this is the rebounding from the impact of lockdowns and restrictions imposed by the government during the pandemic year.

- According to the Chilean Chamber of Construction (CChC), the Construction Materials and Supplies Price Index (IPMIC) rose by 5.9% YoY in the first three months of 2023.

- Brazil is the primary and most significant construction and real estate market in the region. However, the country's recession and weak economic conditions are expected to hamper the growth of the region's construction industry.

- In Brazil, the government launched an infrastructure concessions program with an aim to develop the country's port, road, railway, power transmission lines, and sanitation infrastructure. Under this plan, the government aims to invest BRL 45.0 billion (USD 14.1 billion) through the public-private partnership (PPP) model. Furthermore, government programs such as Minha Casa Minha Vida (MCMV), Plano Decenal de Expansao de Energia 2026, and the National Education Plan are expected to support industry growth over the forecast period.

- Furthermore, in 2022, there will be a tremendous rise in industrial construction in Brazil. BSBios, an agribusiness chain company, is planning to construct a wheat ethanol plant in Brazil. Nordic Impact Cooperation (NIC), a major investment company, has invested in the construction of six solar PV plants with a capacity of 18MW in Brazil.

- All of the above thin Brazil factors are likely to increase the demand for adhesives and sealants in the region during the forecast period.

Brazil to Dominate the Demand in South American Region

- Brazil is the country with the highest consumption of adhesives in South America. Packaging, automotive, construction, and other sectors rely heavily on adhesives.

- Brazil's growth is fueled mainly by rapid expansion in the residential and commercial building sectors and the country's expanding economy.

- According to the Brazilian government, USD 866 million was invested in 762 infrastructure projects in 2022 to upgrade the state of Brazilian tourist cities and maximize the potential of the industry, drawing more tourists and providing them with a more comfortable stay.

- Brazil's paper and pulp sector is one of the country's most successful agricultural exports, ranking high on the list of nations that generate this kind of product. Cartons can be made from various materials such as paperboard, duplex, white kraft, recycled materials, or composite. Combistyle carton packaging was introduced in May 2022 by SIG, along with Frimesa, one of the largest milk producers in Brazil. These carton packs were showcased at APAS Show 2022, the biggest F&B trade show in the Americas, held in So Paulo, Brazil.

- Brazil is one of South America's largest markets for corrugated cardboard. According to estimates from the Brazilian Institute of Geography and Statistics, Brazil's production of sheets and corrugated cardboard packaging is expected to rise from USD 2.89 billion in 2018 to USD 3.18 billion in 2023.

- The Brazil e-commerce market grew by 31% in the first half of 2021, and in 2020, it had already grown by 40%. In today's competitive FMCG market, it has become inevitable for companies to use attractive packaging and bring innovation to their packaging to stand out from their competitors and maintain their brand image in the market.

- The automotive industry is another primary sector that uses adhesives and sealants extensively in the country. According to OICA, the total production of automotive, including passenger cars and commercial vehicles, in 2022 was 2.36 million units, registering a 5% growth in production compared to 2021. In 2021, the total automotive production was estimated to be around 2.24 million units.

- The country is a mature pharmaceutical market in the region. The market in the country witnessed various product innovations, especially pharmaceutical packaging products, owing to significant vendors across the country.

- Furthermore, according to the Brazilian Federation of Hospitals, National Health Confederation (Brazil), and Ministry of Health (Brazil), the number of hospitals in Brazil reached 7,191 in 2022. Such growth in hospitals would increase the opportunities for pharmaceutical packaging vendors nationwide to serve the growing need for prescribed pharmaceuticals.

- All the factors above have a significant impact on the demand for adhesives and sealants in the country.

South America Adhesives and Sealants Industry Overview

The South American adhesives and sealants market is fragmented in nature. The major players (not in any particular order) include Henkel AG & Co. KGaA, 3M, H.B. Fuller Company., Arkema and Sika AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Brazil

- 4.1.2 Growing Usage in the Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins (Polyester, Rubber, etc.)

- 5.2 Adhesives Technology

- 5.2.1 Solvent-borne

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-Cured Adhesives

- 5.3 Sealant Resin

- 5.3.1 Silicone

- 5.3.2 Polyurethane

- 5.3.3 Acrylic

- 5.3.4 Epoxy

- 5.3.5 Other Resins (Bituminous, Polysulfide UV-Curable, etc.)

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries (Electronics, Consumer/DIY, etc.)

- 5.5 Geography

- 5.5.1 Argentina

- 5.5.2 Brazil

- 5.5.3 Colombia

- 5.5.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Beardow Adams

- 6.4.6 Dow

- 6.4.7 DuPont

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Hexion

- 6.4.11 Huntsman International LLC

- 6.4.12 ITW Performance Polymers (Illinois Tool Works Inc.)

- 6.4.13 Jowat AG

- 6.4.14 Mapei Inc.

- 6.4.15 Tesa SE (A Beiersdorf Company)

- 6.4.16 Pidilite Industries Ltd

- 6.4.17 RPM International Inc.

- 6.4.18 Sika AG

- 6.4.19 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials