|

市场调查报告书

商品编码

1628741

北美服务机器人:市场占有率分析、产业趋势与成长预测(2025-2030)North America Service Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

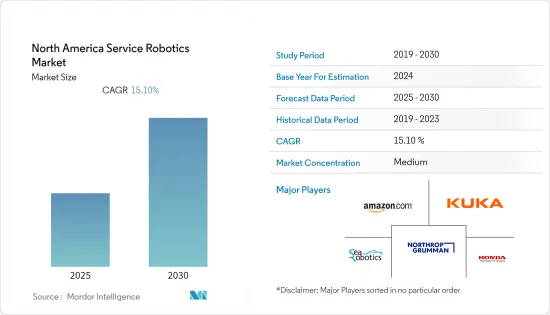

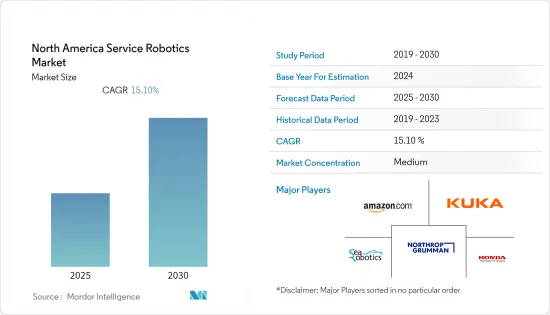

北美服务机器人市场预计在预测期内复合年增长率为15.1%

主要亮点

- 美国是北美地区现场机器人、物流、建筑等服务机器人市场的领导者。机器人在该地区的应用多种多样,也用于专业清洁。

- 在服务机器人的专业用途中,军事用途最受欢迎。在国防方面,有人和无人两种类型的机器人都被使用。对于无人用途,无人机非常常见。多年来,战场上无人机使用的投资一直在增加。无人机用于情报、监视和侦察任务,帮助地面或远处的士兵规划下一步。

- 用于復健和非侵入性治疗的机器人数量呈指数级增长,使该应用成为数量最多的医疗机器人。根据IFR统计,约75%的医疗机器人供应商位于北美和欧洲,27%的服务机器人供应商位于北美。

- 此外,该地区的劳动力短缺是 COVID-19 大流行期间服务机器人使用的驱动因素之一。例如,丹麦紫外线消毒机器人製造商UVD Robotics已向中国和欧洲的医院运送了数百台机器人。

北美服务机器人市场趋势

医疗保健领域对服务机器人的需求不断增长支持市场成长

- 北美服务市场正在快速成长。服务机器人越来越多地应用于医疗保健领域。它在医疗保健领域有多种用途,特别是支援患者护理业务。

- 该地区的医疗保健行业因国家而异。美国的大多数医疗保健提供者都属于私营部门。根据AHA医院统计,2021年,超过57%的医院是非营利的,只有约18%是政府所有的,其余都是营利性的。 2019年美国医疗保健支出成长4.6%,达到3.8兆美元,即人均11,582美元。医疗费用占国内生产总值的比例为17.7%。

- 在加拿大,医疗保健部门主要由公共资助,帮助公民获得基本和高级医疗保健。这个巨大的医疗保健市场正在扩大,未来对机器人的需求可能会增加。在该地区,美国市场的需求比例高于加拿大市场。

- 此外,社会老化和护理人员短缺也增加了老年人照护的需求。随着技术的进步,临床医生和科学家正在转向机器人和其他基于感测器的技术来帮助看护者为老年人提供适当的护理服务。

美国越来越多地引入服务机器人

- 急于引进机器人是北美公司为满足强劲需求而增加投资的一部分。

- 同时,许多公司正在努力让因疫情而失业的工人重返岗位,并将机器人视为在组装上增加人力的替代方案。

- 美国的研发投资正在为所有工业领域的服务机器人市场的发明做出贡献。新兴国家的服务机器人产业极大地受益于先进的感测器网路以及人工智慧和机器学习能力。

北美服务机器人产业概况

北美服务机器人市场随着需求增加而稳定发展,市场集中度适中。

- 根据产业组织自动化推进协会2021年11月编製的资料,工厂等工业用户的机器人订单数量较去年同期成长37%,达到2.9万台,金额14.8亿美元。这表明该地区对服务机器人的需求正在增加。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场趋势

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业政策

- 市场驱动因素

- 市场限制因素

- COVID-19 市场影响评估

第五章市场区隔

- 按类型

- 个人机器人

- 家庭机器人

- 调查

- 娱乐

- 其他的

- 商务用机器人

- 田间机器人(农林/其他)

- 国防/安全(消防)

- 医疗(辅助机器人、诊断/检修系统)

- 无人机无人机

- 其他的

- 个人机器人

- 按领域

- 航空

- 土地

- 水下

- 按成分

- 感应器

- 致动器

- 控制系统

- 软体

- 其他的

- 按最终用户产业

- 军事/国防

- 农业、建筑、采矿

- 运输/物流

- 卫生保健

- 政府机构

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Amazon Inc.

- KUKA AG

- Northrop Grumman Corporation

- Robobuilder Co. Ltd.

- SeaRobotics Corporation

- Honda Motors Co. Ltd.

- iRobot Corporation

- Hanool Robotics Corporation

- Iberobtoics SL

- Gecko Systems Corporation

- RedZone Robotics

第七章 市场机会及未来趋势

简介目录

Product Code: 52717

The North America Service Robotics Market is expected to register a CAGR of 15.1% during the forecast period.

Key Highlights

- The United States is a leader in the service robotics market for field robotics, logistics, and construction within North America. The usage of robotics in this region is varied and is also used in professional cleaning.

- The military application of service robotics is high in the professional use of service robotics. In defense, both manned and unmanned types of robots are used. In unmanned use, drones are very common. Investment in the use of drones has increased in the battlegrounds for a few years. They are being used for intelligence, surveillance, and reconnaissance missions and have helped the soldiers on the ground and sitting far away to plan their next move.

- A tremendously growing number of robots for rehabilitation and non-invasive therapy make this application the largest medical one in terms of units. About 75% of medical robot suppliers are from North America and Europe, while 27% of total service robot suppliers are from North America as per IFR.

- Moreover, the labor shortage in the region is one of the driving factors for the use of service robots during the COVID-19 pandemic. For instance, UVD Robots, Danish manufacture of ultraviolet-light-disinfection robots, shipped hundreds of its machines to hospitals in China and Europe.

North America Service Robotics Market Trends

The Growing Demand of Service Robots in Healthcare Sector Aids in Market Growth

- The North America Service market is growing at a fast pace. Service robotics is increasingly in use in the healthcare sector. They are used for a variety of reasons in healthcare, especially to assist in the operations of taking care of patients.

- The healthcare sector in this region varies in different countries. The majority of the healthcare providers in the USA belong to the private sector. According to AHA Hospital Statistics, 2021 edition, more than 57% of the hospitals are non-profit, and only around 18% are government-owned, and the rest is for profit. U.S. health care spending grew 4.6 % in 2019, reaching USD 3.8 trillion or USD 11,582 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 17.7 %.

- In Canada, the majority of the healthcare sector is publicly funded, which is helpful for the citizens to get access to basic and advanced healthcare. This huge healthcare market is increasing, and the demand for robotics will increase in the period to come. The USA market has a higher percentage of demand compared to the Canadian market in this region.

- Moreover, the growth in the aging population and nursing staff shortage is driving the need for the provision of care for the elderly. As technology advances, clinicians and scientists are looking to robotics and other sensor-based technologies to aid caregivers in providing decent care services for older adults.

United States to Witness High Adoption of Service Robots

- The rush to add robots is part of a larger upswing in investment as companies in North America seek to keep up with strong demand, which in some cases has contributed to shortages of key goods.

- At the same time, many firms have struggled to lure back workers displaced by the pandemic and view robots as an alternative to adding human muscle to their assembly lines.

- Investment in research and development in the United States is aiding the invention of the service robot market amongst all sectors of industries. The service robot industry in the country is largely benefited by the developed sensor network and AI and machine learning capabilities of industries.

North America Service Robotics Industry Overview

The North America Service Robot market has a medium market concentration as the market is in developing steadily with rising demand.

- November 2021: According to data compiled by the industry group the Association for Advancing Automation, the factories, and other industrial users ordered 29,000 robots, 37% more than during the same period last year, valued at USD 1.48 billion. This points to an increase in the demand for service robots in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

- 4.5 Market Drivers

- 4.6 Market Restraints

- 4.7 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Personal Robots

- 5.1.1.1 Domestic Robots

- 5.1.1.2 Research

- 5.1.1.3 Entertainment

- 5.1.1.4 Others

- 5.1.2 Professional Robots

- 5.1.2.1 Field Robots (Agriculture, Forestry and Others)

- 5.1.2.2 Defense and Security (Fire Fighting)

- 5.1.2.3 Medical (Assistive robots, diagnostic and overhauling systems)

- 5.1.2.4 UAV Drones

- 5.1.2.5 Others

- 5.1.1 Personal Robots

- 5.2 By Areas

- 5.2.1 Aerial

- 5.2.2 Land

- 5.2.3 Underwater

- 5.3 By Components

- 5.3.1 Sensors

- 5.3.2 Actuators

- 5.3.3 Control Systems

- 5.3.4 Software

- 5.3.5 Others

- 5.4 By End-User industries

- 5.4.1 Military and Defense

- 5.4.2 Agriculture, Construction and Mining

- 5.4.3 Transportation & Logistics

- 5.4.4 Healthcare

- 5.4.5 Government

- 5.4.6 Others

- 5.5 By Countries

- 5.5.1 United States

- 5.5.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Inc.

- 6.1.2 KUKA AG

- 6.1.3 Northrop Grumman Corporation

- 6.1.4 Robobuilder Co. Ltd.

- 6.1.5 SeaRobotics Corporation

- 6.1.6 Honda Motors Co. Ltd.

- 6.1.7 iRobot Corporation

- 6.1.8 Hanool Robotics Corporation

- 6.1.9 Iberobtoics S.L

- 6.1.10 Gecko Systems Corporation

- 6.1.11 RedZone Robotics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219