|

市场调查报告书

商品编码

1628758

中东和西非的药用塑胶包装:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East and West Africa Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

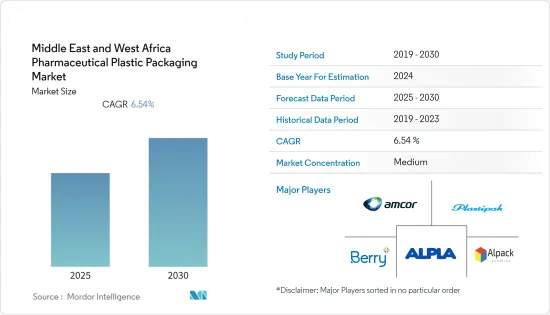

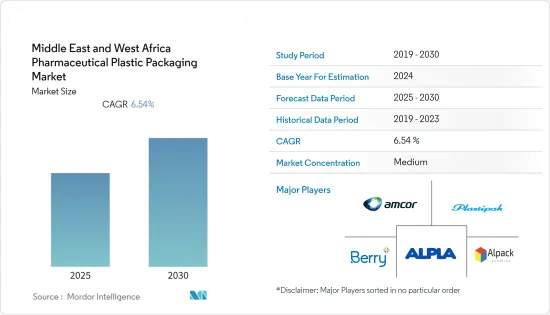

中东和西非医药塑胶包装市场预计在预测期内复合年增长率为6.54%

主要亮点

- 由于慢性病的增加、生技药品市场的成长以及技术的进步,预计医药塑胶包装市场将继续扩大。

- 零售药局预计将在该地区变得更加普遍,药厂预计将更加重视产品差异化和品牌提升。此外,饮食模式、生活方式和睡眠週期的变化正在增加慢性病的盛行率,从而增加对药物的需求。

- 药品包装最常用的材料是塑胶。塑胶由于其防潮阻隔性、高尺寸稳定性、高衝击强度、抗应变性、低吸水性、透明性以及耐热性和阻燃性,在药品包装中变得越来越重要。此外,政府对改善医疗保健系统和保险覆盖范围的关注正在增加对药物的需求并刺激市场扩张。

- 儘管非洲在改善食品生产和加工方面有着巨大的前景,但该地区供应链的缺乏或不足继续减缓了塑胶药品包装需求的成长。

- 在新冠肺炎 (COVID-19) 疫情期间,瓶子和容器等市场持续飙升。此外,对生技药品和疫苗的需求促使包装公司投资无菌形式并提高产能。

中东和西非药用塑胶包装市场趋势

瓶子推动市场成长

- 塑胶瓶预计将显着增长,因为它们重量轻且易于处理,比玻璃瓶更容易运输且不易破碎。此外,塑胶美观且具有优异的空气和湿气阻隔性。塑胶瓶的这些特性预计将刺激跨地区的市场扩张。

- 硬质塑胶包装更容易消毒,并支持製药业的无菌瓶。 PAA(过氧乙酸)已通过化学方法和传统方法用于对宝特瓶进行消毒。它是净化整体细菌(细菌、孢子、霉菌、酵母)的最广泛、最有效的介质,可与强酸性和弱酸性产品一起使用。

- 此外,塑胶非常适合各种成分。由于塑胶容器可能与药物製剂接触,因此它们通常由不含可能影响药品功效或稳定性或引起毒性问题的成分的材料製成。

- 此外,塑胶滴管瓶主要供患有眼睛综合症的人使用。个人生活方式的改变,尤其是长时间使用电脑、电视等电子设备,导致干眼症盛行率急遽上升。 Gerresheimer 等公司提供固态、液体和眼科药物塑胶包装。产品范围包括用于输液和眼用溶液的宝特瓶。

- 例如,2022 年 5 月,Amcor Plc 开发了最新技术 PowerPostTM,使瓶子重量减轻了 30%,并且可以由 100% 回收材料製成。此外,该产品基于真空吸附技术PowerStrap。

沙乌地阿拉伯预计将成长

- 根据卫生署) 的数据,沙乌地阿拉伯的医药市场到 2021 年将达到约 93 亿美元,反映出 2017 年至 2021 年的医药支出为 420 亿美元。由于医疗基础设施的改善和非传染性疾病盛行率的上升,沙乌地阿拉伯市场正在迅速扩张。

- 此外,四个「经济城市」的发展预计将为在该地区建立药品加工和包装业务开闢新的可能性。例如,阿卜杜拉国王的工业城市标誌着製药业的成长。该地区的药品製造和包装设施已获得辉瑞(沙乌地阿拉伯)等公司的投资。

- 医疗保健支出的增加和健康意识的提高可能会推动市场扩张。由于宏观经济因素(例如医疗保险公司渗透率的提高以及医疗改革(例如允许100%直接投资製药业)),该行业预计也会成长。

- 糖尿病、心血管疾病和癌症等非传染性疾病现已成为沙乌地阿拉伯的主要原因。这是由久坐的生活方式、超重、大量吸烟和不良的饮食习惯引起的。世界卫生组织 (WHO) 报告称,沙乌地阿拉伯 68.2% 的人口超重,33.7% 的人口肥胖。

- 该国政府的政策偏向国内生产商,提供无息贷款、公用事业补贴以及原材料和中间产品免进口关税等优惠。因此,由于治疗糖尿病等疾病的药物需求不断增长,预计该国对包装的需求将大幅增加。

中东和西非医药塑胶包装产业概况

中东和西非药品塑胶包装市场是一个适度整合的市场。 Amcor Plc、Plastic Holdings Inc、Berry Global Inc、Alpack Plastic Packaging、Alpla Group等在市场上占据主要份额的领先公司正在扩大基本客群。此外,许多公司正在与多家公司形成策略合作,以提高市场占有率和盈利。

- 2022 年 7 月 - Alpla 集团宣布收购波兰公司 APON,该公司位于 Zyrardow,为製药业生产塑胶包装,扩大和发展了 2019 年成立的 ALPLApharma 部门。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术见解

- COVID-19 对区域药用塑胶包装市场的影响

第五章市场动态

- 市场驱动因素

- 对硬质和软质药用塑胶产品的需求不断增加

- 发展更好、更先进的医疗基础设施

- 市场限制因素

- 限製药用塑胶产品销售和供应的法规

- 由于供应商议价能力而导致原物料成本波动

第六章 市场细分

- 按原料分

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯 (PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他材料

- 副产品

- 固态容器

- 滴管瓶

- 滴鼻剂瓶

- 液体瓶

- 口腔护理

- 小袋

- 管瓶/安瓿

- 墨水匣

- 注射器

- 盖子和封口

- 其他产品

- 按地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 土耳其

- 埃及

- 南非

- 其他中东和非洲

- 中东

第七章 竞争格局

- 公司简介

- Amcor Limited

- Berry Plastics Group, Inc.

- Aptar Pharma

- Berk Company, LLC

- Alpha Packaging

- Graham Packaging Company

- COMAR, LLC

- Alpack Plastic Packaging

- Drug Plastics Group

- Plastipak Holdings, Inc.

- Gulf Pakcaging Industries Limited

第八章投资分析

第9章市场的未来

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is expected to register a CAGR of 6.54% during the forecast period.

Key Highlights

- The market for pharmaceutical plastic packaging is anticipated to continue to rise due to the rising prevalence of chronic diseases, the growth of the biologics market, and technical advancements.

- The penetration of retail pharmacies in the region is expected to increase, while pharmaceutical manufacturers' emphasis on product differentiation and brand improvement is expected to increase. Furthermore, there is a greater demand for drugs due to the rising prevalence of chronic diseases brought on by altered dietary patterns, lifestyles, and sleep cycles.

- Plastics are the most used materials in pharmaceutical packaging. Plastics are gaining increasing importance in the packaging of pharmaceutical goods due to barriers against moisture, high dimensional stability, high impact strength, resistance to strain, low water absorption, transparency, and resistance to heat and flame. Moreover, the government's focus on improving healthcare systems and insurance coverage drives up demand for pharmaceuticals, fueling market expansion.

- Although there are excellent prospects to improve food production and processing in Africa, the region's lack of or inadequate supply chains continue to slow the expansion of the need for plastic pharmaceutical packaging.

- During Covid -19, the market, which includes bottles and containers, has continued to soar. In addition, packaging companies are seen investing in the sterile format while increasing their production capacity due to the need for biologics and vaccines.

Middle East & West Africa Pharmaceutical Plastic Packaging Market Trends

Bottles to Drive the Market Growth

- Due to their small weight and ease of handling, plastic bottles are predicted to experience a significant increase because they are easier to carry and less likely to break than glass bottles. Additionally, plastics are more aesthetically pleasing and provide a superior barrier to air and moisture. These qualities of plastic bottles are anticipated to stimulate market expansion across regions.

- Rigid plastic packaging is more easily sterilized and supports aseptic bottles for the pharmaceutical industry. PAA (peracetic acid) has been chemically and traditionally used for PET bottle sterilization. It is the most efficient medium with the most extensive decontamination spectrum of overall germs (bacteria, spores, molds, and yeasts) and can be used for high and low acid products.

- Additionally, plastics work well with a variety of compositions. Since plastic containers may come into touch with pharmaceutical formulations, they are typically made of materials that don't include any components that could affect the formulation's effectiveness or stability or provide a toxicity concern.

- Furthermore, plastic dropper bottles are predominantly used in people with eye syndrome. The changing lifestyles of individuals, particularly the extended use of electronic gadgets, such as computers and TV, have led to an upsurge in the prevalence of dry eye syndrome. Companies like Gerresheimeroffer pharmaceutical plastic packaging for solid, liquid, and ophthalmic applications. The range of products includes PET bottles for liquid dosage and ophthalmic solutions.

- For instance May 2022, Amcor Plc developed the latest technology, PowerPostTMthat delivers a bottle that is up to 30% lighter and can be made from 100% recycled material. Furthermore, the product is built on vacuum-absorbing technology PowerStrap.

Saudi Arabia is expected to witness the growth

- The Saudi Arabian pharmaceutical market reached a value of roughly USD 9.3 billion in 2021, reflecting 42 billion USD in pharmaceutical spending from 2017 to 2021, according to the Ministry of Health (MoH). Saudi Arabia's market is expanding rapidly due to improving healthcare infrastructure and the rising prevalence of non-communicable illnesses.

- Additionally, it is anticipated that the growth of four "economic cities" will open up new possibilities for establishing pharmaceutical processing and packaging businesses in this area. For instance, the industrial city of King Abdullah suggested that the pharmaceutical industry increase. A pharmaceutical production and packaging facility in the vicinity has received investments from businesses, including Pfizer (Saudi).

- Rising healthcare spending and improved health awareness are likely to propel market expansion. The industry would also be expected to grow due to macroeconomic factors, including increasing health insurance company penetration and healthcare reforms like allowing 100% FDI in the pharmaceutical sector.

- In Saudi Arabia, non-communicable diseases like diabetes, cardiovascular disease, and cancer are now the leading causes of death. This is brought on by living a sedentary lifestyle, being overweight, smoking a lot, and eating poorly. The World Health Organization (WHO) has reported that 68.2% of Saudi Arabia's population is overweight and 33.7% of its population is obese.

- The government policies in the nation are biased in favor of domestic producers, giving them exemptions, including interest-free financing, subsidized utility charges, and no import duties on raw materials and intermediate products. As a result, the country would be expected to experience a significant increase in the demand for packaging due to the rising demand for cures for diseases like diabetes.

Middle East & West Africa Pharmaceutical Plastic Packaging Industry Overview

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is the moderately consolidated market. The major players, such as Amcor Plc, plastic holdings Inc, Berry Global Inc, and Alpack Plastic Packaging, Alpla Group, with a significant share in the market, are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability.

- July 2022 - The ALPLA Group has announced its acquisition of the Polish company APON, which produces plastic packaging for the pharma industry at its site in zyrardow, which will expand and grow the ALPLApharma business division established in 2019.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Insights

- 4.4 Impact of COVID-19 on the Pharmaceutical Plastic Packaging Market in region

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Rigid & Flexible Pharmaceutical Plastic Products

- 5.1.2 Development of Better and More Advanced Healthcare Infrastructure

- 5.2 Market Restraints

- 5.2.1 Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products

- 5.2.2 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polypropylene (PP)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Low Density Polyethylene (LDPE)

- 6.1.4 High Density Polyethylene (HDPE)

- 6.1.5 Other Types of Materials

- 6.2 By Product

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Pouches

- 6.2.7 Vials & Ampoules

- 6.2.8 Cartridges

- 6.2.9 Syringes

- 6.2.10 Caps & Closures

- 6.2.11 Other Product Types

- 6.3 Region

- 6.3.1 Middle East

- 6.3.1.1 UAE

- 6.3.1.2 Saudi Arabia

- 6.3.1.3 Qatar

- 6.3.1.4 Turkey

- 6.3.1.5 Egypt

- 6.3.1.6 South Africa

- 6.3.1.7 Rest of Middle East and Africa

- 6.3.1 Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Berry Plastics Group, Inc.

- 7.1.3 Aptar Pharma

- 7.1.4 Berk Company, LLC

- 7.1.5 Alpha Packaging

- 7.1.6 Graham Packaging Company

- 7.1.7 COMAR, LLC

- 7.1.8 Alpack Plastic Packaging

- 7.1.9 Drug Plastics Group

- 7.1.10 Plastipak Holdings, Inc.

- 7.1.11 Gulf Pakcaging Industries Limited