|

市场调查报告书

商品编码

1628777

欧洲热可塑性橡胶(TPE):市场占有率分析、产业趋势、成长预测(2025-2030 年)Europe Thermoplastic Elastomer (TPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

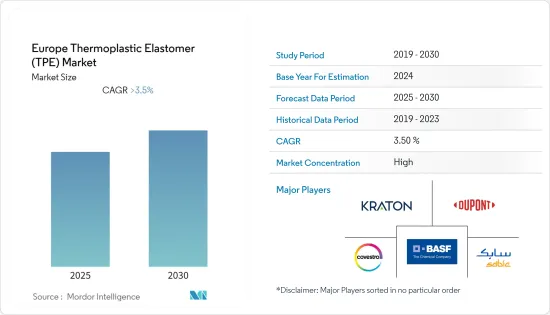

预计欧洲热可塑性橡胶市场在预测期内将维持3.5%以上的复合年增长率。

2020 年,COVID-19 影响了市场。由于汽车工业衰退以及政府封锁导致建设业和汽车製造停止,欧洲热可塑性橡胶市场遭受重创。热可塑性橡胶用于製造垫圈、塑胶、管道、涂层、皮带和软管。然而,由于对基于热可塑性橡胶的罩衣、手术单、手套和其他医疗用品的需求,市场在 2021 年復苏。

主要亮点

- 短期内,橡胶基工具手柄、管道、塑胶和垫圈等建筑业材料对热可塑性橡胶的需求不断增加,预计将推动市场成长。

- 然而,热可塑性橡胶应用的市场饱和预计将阻碍未来的市场成长。

- 对生物基热可塑性橡胶不断增长的需求可能会在未来几年创造市场机会。

- 德国在市场上占据主导地位,预计在预测期内仍将保持最高的复合年增长率。

欧洲热可塑性橡胶市场趋势

增加在汽车和运输应用中的使用

- 热可塑性橡胶(TPE) 用于汽车和电动车领域。这是因为热可塑性橡胶结合了热塑性塑胶的製造便利性和合成橡胶的弹性和耐用性。 TPE 具有低温柔韧性、耐化学性、韧性,并且能够成型为复杂形状。

- TPE 可用于多种应用,包括密封件、软管和管子、电缆以及内部和外部零件。 TPE 因其重量轻、柔韧且在恶劣气候条件下耐用而被用于电动车的电缆、电线、软管、管道、密封件、垫圈以及内部和外部部件。

- 汽车业对所用材料有非常严格的标准。材料必须在极端负载下保持尺寸稳定,并且在暴露于大温差时不得变形。

- TPE 是一种比金属更便宜的塑料,可透过减轻重量来提高车辆能源效率,以较低的成本提供耐用性、耐腐蚀性、韧性、设计灵活性、弹性和卓越的性能。 TPE 的重量更轻,使得製造燃油效率更高的汽车成为可能。车重每减轻10%,消费量预计会降低5-7%。

- 汽车产业对轻质高性能聚合物的需求不断增加,以实现更好的经济性和设计灵活性,这推动了 TPE 市场的成长。高性能热可塑性橡胶为製造商提供了设计优势,并且坚固如钢,有助于减轻重量并减少温室气体排放。

- 欧洲汽车工业是全球汽车工业的主要部门,也是欧洲经济的主要贡献者。该行业的特点是悠久的工程和发明历史、高技能的劳动力以及庞大的汽车市场。 2021年,欧洲汽车产业市场规模超过750亿美元。

- 近年来,欧洲一直是全球电动车市场的主要企业,德国、法国和挪威等国家在电动车的采用和生产方面处于领先地位。根据欧盟统计局数据,2021年欧洲电动车出口额达125.3亿美元,与前一年同期比较成长45%。

- 预计这些因素将在未来几年推动该地区对热可塑性橡胶的需求。

德国主导市场

- TPE(热可塑性橡胶)是一种用于航太工业的聚合物材料,具有弹性、耐用性、柔韧性以及耐温、耐化学品和耐紫外线的性能。 TPE 用于各种飞机应用,包括密封和缓衝、软管和管道以及电气和发动机零件。

- TPE 是一种高度通用的材料,兼具物理特性和易于加工性,使其适合在飞机上的各个区域使用。德国生产了全球超过 6% 的汽车和 12% 的飞机製造,增强了该地区的 TPE 市场。

- 德国拥有最大的汽车工业。据OICA称,到2021年终,该国将生产33,086,692辆汽车。德国引领欧洲汽车市场,拥有约 40 个组装和引擎生产厂,占欧洲汽车总产量的三分之一。

- TPE(热可塑性橡胶)因其耐温、耐化学品和耐紫外线而被用于住宅行业。 TPE广泛用于地板材料、屋顶、门窗、浴室设备等。它耐用、灵活且易于护理,适合住宅使用。根据联邦统计局的数据,2021 年德国建筑许可数量增加了 7%,达到 248,688 个(Destatis)。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

欧洲热可塑性橡胶产业概况

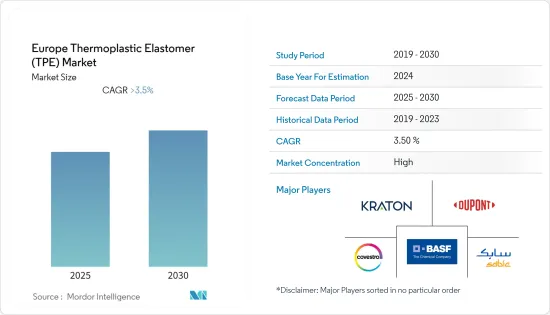

欧洲热可塑性橡胶市场因其性质而部分一体化。该市场的主要企业包括杜邦、BASF、科思创、科腾公司和沙乌地阿拉伯基础工业公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建设产业的需求不断增加

- 扩大暖通空调产业的应用

- 抑制因素

- 应用市场饱和

- 由于 COVID-19 的影响,情况不利

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 依产品类型

- 苯乙烯嵌段共聚物 (TPE-S)

- 热塑性烯烃 (TPE-O)

- 合成橡胶合金(TPE-V 或 TPV)

- 热塑性聚氨酯(TPU)

- 热塑性共聚酯

- 热塑性聚酰胺

- 按用途

- 汽车和交通

- 建筑/施工

- 鞋类

- 电力/电子

- 医疗保健

- 家电

- 空调

- 黏合剂、密封剂、被覆剂

- 其他用途

- 按地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Apar Industries Ltd

- Arkema

- Asahi Kasei Corporation

- BASF SE

- Covestro AG

- DSM

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Grupo Dynasol

- Huntsman International LLC

- KRATON CORPORATION

- KURARAY CO. LTD

- LANXESS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- SABIC

- Sirmax SpA

- Sumitomo Chemicals Co. Ltd

- The Lubrizol Corporation

第七章 市场机会及未来趋势

- 对生物基热可塑性橡胶的需求不断成长

- 医疗产业应用不断增加

The Europe Thermoplastic Elastomer Market is expected to register a CAGR of greater than 3.5% during the forecast period.

In 2020, COVID-19 affected the market. The European thermoplastic elastomer market suffered from declining automotive industries and the government-imposed lockdown, which halted construction and automotive manufacturing. Thermoplastic elastomers make gaskets, plastics, pipes, coatings, belts, and hoses. However, the market recovered in 2021 with the demand for gowns, drapes, gloves, and other thermoplastic elastomer-based medical items.

Key Highlights

- Over the short term, the increasing demand for thermoplastic elastomers in the construction industry materials, like rubber-based tool grips, pipes, plastics, and gaskets, is expected to drive the market's growth.

- However, market saturation in the applications of thermoplastic elastomers is expected to hinder the market's growth in the future.

- The growing demand for bio-based thermoplastic elastomers will likely create opportunities for the market in the coming years.

- Germany is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Europe Thermoplastic Elastomers Market Trends

Increasing Usage in the Automotive and Transportation Applications

- The automotive and electric vehicle sectors utilize thermoplastic elastomers (TPEs) because they combine the manufacturing convenience of thermoplastics with the elasticity and durability of elastomers. Due to their low-temperature flexibility, chemical resistance, toughness, and ability to be molded into complex shapes,

- TPEs are used for sealing, hoses and tubing, cables, interior and exterior components, and many more applications. TPEs are used in EVs for cables, wiring, hoses, tubing, seals, gaskets, and interior and exterior components due to their lightweight, flexibility, and durability in extreme climatic conditions.

- The automotive sector includes very rigorous standards for the materials utilized. Even when subjected to extreme loads, the materials must be dimensionally stable and not distort, even when subjected to wide temperature differences.

- TPEs are plastics that are less expensive than metals and help make automobiles more energy-efficient by lowering weight and providing durability, corrosion resistance, toughness, design flexibility, resiliency, and good performance at a low cost. TPE's reduced weight allows for more fuel-efficient automobiles. It is anticipated that every 10% reduction in vehicle weight results in a 5-7% reduction in fuel consumption.

- The growing demand for lightweight and high-performance polymers in the automotive industry to give better economy and design flexibility is driving the TPE market's rise. High-performance thermoplastic elastomers provide manufacturers with design advantages and equivalent strength to steel, which aids in weight reduction and greenhouse gas emissions control.

- The European automotive sector is a key segment of the worldwide automotive industry and a substantial contributor to the European economy. The sector is distinguished by a long history of engineering and invention, a highly skilled workforce, and a big automotive market. In 2021, Europe's automobile sector was worth more than USD 75 billion.

- In recent years, Europe is a major player in the global electric vehicle market, with nations such as Germany, France, and Norway leading the way in EV adoption and production. According to Eurostat, Europe's electric car exports in 2021 reached USD 12.53 billion, a 45% increase over the previous year.

- All the abovementioned factors are expected to augment the demand for thermoplastic elastomers in the region over the coming years.

Germany to Dominate the Market

- TPE (thermoplastic elastomer) is a type of polymer material utilized in the aerospace industry due to its elasticity, durability, flexibility, and resistance to temperature, chemicals, and UV light. TPEs are used in various airplane applications, such as sealing and cushioning, hoses and tubing, and electrical and engine components.

- TPE offers a versatile material with a combination of physical qualities and processing simplicity, making it suitable for usage in various regions of an airplane. Germany produces more than 6% of the world's automobiles and 12% of the world's aircraft manufacturing, bolstering the region's TPE market.

- Germany includes the largest automobile industry. According to OICA, the country produced 33,08,692 vehicles by the end of 2021. Germany leads the European automotive market, with around 40 assembly and engine production plants contributing to one-third of Europe's total automobile production.

- TPE (thermoplastic elastomer) is employed in the housing industry because of its resilience to temperature, chemicals, and UV radiation. TPEs are widely utilized in flooring, roofing, windows & doors, and bathroom fixtures. They are suitable for house use because they combine durability, flexibility, and ease of upkeep. According to the Federal Statistical Office, building permits in Germany increased by 7% in 2021 to 248,688 permits (Destatis).

- Therefore, the above factors are expected to significantly impact the market in the coming years.

Europe Thermoplastic Elastomers Industry Overview

The European thermoplastic elastomer market is partially consolidated in nature. The key players in the market include DuPont, BASF SE, Covestro AG, KRATON CORPORATION, and SABIC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Industry

- 4.1.2 Growing Applications in the HVAC Industry

- 4.2 Restraints

- 4.2.1 Market Saturation in Applications

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Styrenic Block Copolymer (TPE-S)

- 5.1.2 Thermoplastic Olefin (TPE-O)

- 5.1.3 Elastomeric Alloy (TPE-V or TPV)

- 5.1.4 Thermoplastic Polyurethane (TPU)

- 5.1.5 Thermoplastic Copolyester

- 5.1.6 Thermoplastic Polyamide

- 5.2 Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Footwear

- 5.2.4 Electrical and Electronics

- 5.2.5 Medical

- 5.2.6 Household Appliances

- 5.2.7 HVAC

- 5.2.8 Adhesives, Sealants, and Coatings

- 5.2.9 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apar Industries Ltd

- 6.4.2 Arkema

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 BASF SE

- 6.4.5 Covestro AG

- 6.4.6 DSM

- 6.4.7 DuPont

- 6.4.8 Evonik Industries AG

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Grupo Dynasol

- 6.4.11 Huntsman International LLC

- 6.4.12 KRATON CORPORATION

- 6.4.13 KURARAY CO. LTD

- 6.4.14 LANXESS

- 6.4.15 LG Chem

- 6.4.16 LyondellBasell Industries Holdings BV

- 6.4.17 Mitsubishi Chemical Corporation

- 6.4.18 Mitsui Chemicals Inc.

- 6.4.19 SABIC

- 6.4.20 Sirmax SpA

- 6.4.21 Sumitomo Chemicals Co. Ltd

- 6.4.22 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Bio-based Thermoplastic Elastomers

- 7.2 Increasing Applications in the Medical Industry