|

市场调查报告书

商品编码

1851537

热可塑性橡胶(TPE):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Thermoplastic Elastomer (TPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

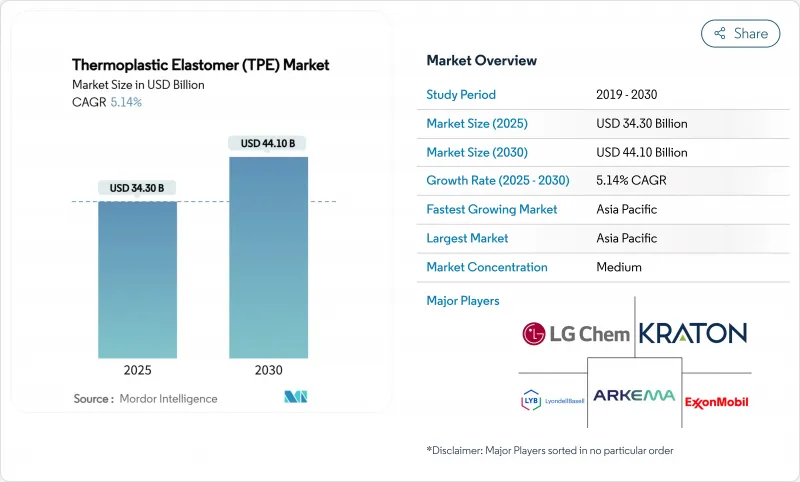

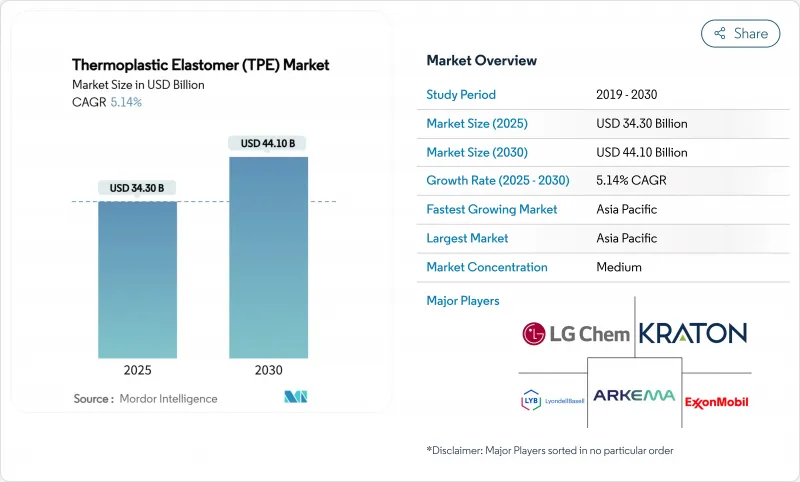

预计到 2025 年热可塑性橡胶市场规模为 343 亿美元,到 2030 年将达到 441 亿美元,预测期(2025-2030 年)复合年增长率为 5.14%。

这项进展凸显了该材料兼具橡胶般的柔韧性和热塑性塑胶的加工效率,对于汽车电气化、下一代医疗设备以及循环製造的要求至关重要。生产商正在扩大区域产能,并推出低碳、高回收成分等级的产品,以满足永续性法规和企业净零排放目标。亚太地区仍然是生产和消费中心,这得益于其庞大的汽车和电子供应链、医疗保健投资以及对电动车的政策支持。医疗保健现代化以及用更俱生物相容性的替代品取代PVC和乳胶的趋势正在加速发展,而电池电动车中轻量化线束和充电硬体的需求进一步推动了对高利润化合物的需求。儘管己二酸价格波动且机器成本不断上涨,但热可塑性橡胶市场仍保持稳健成长,因为各行业都在寻求更轻、可回收且更易于设计的材料。

全球热可塑性橡胶(TPE)市场趋势与洞察

促进电动车电线电缆的轻量化

电动车革命正在从根本上改变电线电缆的规格,热可塑性橡胶)正成为减轻重量和优化性能的关键推动因素。塞拉尼斯公司的Hytrel TPC-LCF耐温范围为-40 度C至130 度C,同时碳排放量减少50%,充分展现了聚合物护套如何帮助减轻电动车线束的重量。交联聚烯正在高压线路中取代硅橡胶,提供耐磨性,缩短布线路径,并减少铜的使用。亚太地区,尤其是中国汽车製造商,占据了电动车生产的大部分份额,这使得当地的复合材料生产商在成长轨道上占据领先地位。 TPE护套也被应用于车载充电垫片和冷却液管,提高了每辆车的平均聚合物含量,并推动了热可塑性橡胶市场的收入成长。

在暖气、通风和空调(HVAC)行业中不断扩展的应用

热泵和新型冷媒的普及应用提高了密封和减振方面的要求。 TE Connectivity 将使用寿命可靠性作为采购标准之一,推动了以耐高温 TPE 取代 EPDM 用于垫圈和软管内衬。 DSM 的 Arnitel HT 可实现一体式热风管道,重量减轻 40%,组件成本降低 50%。数位化控制的压缩机也需要柔性安装支架来容纳感测器并降低噪音,而热可塑性橡胶市场上的特殊 TPE 化合物恰好能满足这一需求。

己二酸供应导致热塑性聚氨酯(TPU)价格波动

原料成本上涨正给热塑性聚氨酯 (TPU) 价值链带来巨大的利润压力,其中己二酸供应受限已成为影响价格稳定和生产计画的关键瓶颈。BASF提高了丁二醇衍生物的价格,加剧了 TPU 生产商的成本波动。科腾聚合物在 SIS 展会上将价格提高了 330 吨,显示嵌段共聚物的价格也出现了类似的上涨。石油原料价格上涨和物流中断导致加工商面临价差收窄的困境,并促使一些目标商标产品製造商 (OEM) 推迟热可塑性橡胶市场中非关键的 TPU 相关计划。

细分市场分析

热塑性烯烃预计将在热可塑性橡胶市场细分领域占据最大份额,2024年营收占比将达到25.59%,并预计到2030年将以7.39%的复合年增长率持续增长。汽车製造商正将TPE-O应用于保险桿饰板、气坝密封件和底盘护板等领域,因为它易于与聚丙烯基材黏合,并具有优异的耐候性。建筑型材和消费品领域的销售量也在成长,这主要得益于聚丙烯基合金的成本优势。

TPU因其在运动鞋、输送机和导管护套等对耐磨性要求极高的应用领域备受青睐,在以金额为准位居第二。儘管己二酸价格波动仍限制其成长势头,但高价值细分市场仍能维持净利率。 TPV紧跟在后,主要用于引擎室空气管理零件,这些零件必须承受高达140°C的峰值温度。苯乙烯嵌段共聚物在黏合剂和抛弃式刮鬍刀领域保持着一定的市场份额,而TPC和TPA则在传动带、气动管路和增压空气管等领域不断扩大应用。像Teknor Apex公司用于电动车电池密封件的Sarlink TPV这样的特种化合物,充分展现了配方技术如何在热可塑性橡胶市场中带来溢价优势。

区域分析

亚太地区将占据热可塑性橡胶市场最大的区域份额,2024销售额将达到46.84%,预计到2030年将维持6.45%的复合年增长率。中国生产全球近三分之一的汽车,也是智慧型手机和消费性电子产品丛集的中心。英威达(INVISTA)将其上海尼龙66产能翻倍至每年40万吨,凸显了原料的自给自足,这为复合材料生产商的成长提供了支持。韩国供应显示器和电池组件,而印度则扩大了可再生能源电线电缆的生产,从而促进了区域内贸易。

北美依然是创新的温床。总部位于底特律的原始设备製造商 (OEM) 指定使用生物基热塑性聚苯乙烯 (TPV) 窗密封件,而波士顿地区的医疗设备新兴企业则在试点新型导管涂层,巩固了其盈利的细分市场。塞拉尼斯公司在华创国际塑胶橡胶展 (Chinaplas) 上推出的 Hytrel TPC-LCF 涂层在德克萨斯研发,符合美国《通货膨胀削减法案》的奖励,可减少 50% 的二氧化碳排放。自 2025 年起生效的石化产品进口关税可能会使树脂成本增加 12% 至 20%,这将促使复合材料生产商重新掌控中间体生产并扩大国内 TPU 生产线产能。

欧洲环境指令将加速采用含60%再生材料的热塑性弹性体(TPE),例如Avient公司的reSound REC GP 7820。德国一级供应商正在测试符合欧盟7冷启动要求的热塑性聚苯乙烯(TPV)散热器软管。同时,西班牙和义大利正在推广使用Arnitel HT管道的热泵维修,以实现其脱碳目标。儘管南美洲、中东和非洲目前的市场规模较小,但随着基础设施的扩展,它们具有长期的成长潜力。墨西哥现在是全球第四大聚氨酯市场,这反映了美国汽车供应链的近岸外包以及TPU射出成型製造商向原始设备製造商(OEM)靠拢的趋势。波湾合作理事会国家正在投资建造特种弹性体产业中心,以实现经济多元化,摆脱对原油出口的依赖,这预示着热可塑性橡胶需求的下游区域化趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 促进电动车电线电缆的轻量化

- 在暖气、通风和空调(HVAC)行业中日益增长的应用

- 家用电器中的应用日益广泛

- 来自医疗保健行业的需求增加

- 鞋类和体育用品需求

- 市场限制

- 己二酸供应导致热塑性聚氨酯(TPU)价格波动

- 高昂的製造成本和设备成本

- 软热塑性塑胶3D列印面临的挑战

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 苯乙烯嵌段共聚物(TPE-S)

- 热塑性烯烃(TPE-O)

- 热塑性硫化橡胶(TPV)

- 热塑性聚氨酯(TPU)

- 热塑性共聚酯(TPC)

- 热塑性聚酰胺(TPA)

- 透过使用

- 汽车与运输

- 建筑/施工

- 鞋类

- 电气和电子

- 医疗的

- 其他用途(家用产品、黏合剂和密封剂、暖通空调)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Arkema

- Asahi Kasei Corporation.

- Avient Corporation

- BASF

- Celanese

- Covestro AG

- Group Dynasol

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Huntsman International LLC

- Kraton Corporation

- Lanxess

- LCY

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Group Corporation.

- SABIC

- Teknor Apex

- Sumitomo Chemical Co., Ltd.

- APAR Industries Ltd.

- The Lubrizol Corporation

第七章 市场机会与未来展望

The Thermoplastic Elastomer Market size is estimated at USD 34.30 billion in 2025, and is expected to reach USD 44.10 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

This advance highlights the material's ability to combine rubber-like flexibility with thermoplastic processing efficiency, a combination now integral to vehicle electrification, next-generation medical devices, and circular manufacturing mandates. Producers are expanding regional capacity and introducing low-carbon, recycled-content grades to satisfy sustainability regulations and corporate net-zero targets. Asia-Pacific continues to anchor production and consumption thanks to its extensive automotive and electronics supply chains, healthcare investment, and policy support for electric vehicles. Healthcare modernization and the ongoing replacement of PVC and latex with biocompatible alternatives add another layer of momentum, while lighter wire harnesses and charging hardware in battery-electric cars further pull demand into high-margin formulations. Despite adipic-acid volatility and elevated machinery costs acting as brakes, the thermoplastic elastomers market retains a resilient growth profile as industries seek lighter, recyclable, and more design-flexible materials.

Global Thermoplastic Elastomer (TPE) Market Trends and Insights

EV Light Weighting Push in Automotive Wire and Cable

The electric vehicle revolution is fundamentally reshaping wire and cable specifications, with thermoplastic elastomers emerging as critical enablers of weight reduction and performance optimization. Celanese's Hytrel TPC-LCF delivers a 50% carbon-footprint cut while enduring -40 °C to 130 °C, illustrating how polymeric jacketing helps reduce harness weight in electric vehicles. Cross-linked polyolefins now displace silicone in high-voltage lines, providing abrasion resistance that shortens routing paths and trims copper usage. Asia-Pacific, led by Chinese OEMs, dominates EV output, so local compounders secure volume growth first. TPE jacketing is also moving into onboard charging pads and coolant tubes, lifting average polymer content per vehicle and magnifying revenue inside the thermoplastic elastomers market.

Growing Application in the Heating, Ventilation, and Air Conditioning (HVAC) Industry

Heat-pump adoption and new refrigerants intensify sealing and vibration requirements. TE Connectivity cites lifetime reliability as a procurement benchmark, spurring substitution of EPDM with higher-temperature TPEs in gaskets and hose liners. DSM's Arnitel HT permits single-piece hot-air ducts, cutting weight 40% and part cost 50%, a direct gain for installers targeting energy-efficient retrofits. Digitally controlled compressors also need flexible mounts that dampen noise while hosting sensors, a niche well served by specialty TPE compounds in the thermoplastic elastomers market.

Thermoplastic Polyurethane (TPU) Price Volatility Due to Adipic Acid Supply

Raw material cost inflation is creating significant margin pressure across the Thermoplastic Polyurethane (TPU) value chain, with adipic acid supply constraints representing a critical bottleneck that affects pricing stability and production planning. BASF raised butanediol derivative prices, amplifying cost swings for TPU makers . Kraton implemented a USD 330 t increase on SIS, signifying parallel inflation across block copolymers. When petroleum feedstocks spike and logistics falter, converters face slimmer spreads, prompting some Original Equipment Manufacturers (OEMs) to defer non-critical projects that rely on TPU inside the thermoplastic elastomers market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Utilization in Consumer Electronics

- Increasing Demand from Healthcare Industry

- High Manufacturing and Equipment Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermoplastic olefins led with 25.59% 2024 revenue and are forecast to post the segment-best 7.39% CAGR through 2030, sustaining the largest slice of the thermoplastic elastomers market size at segment level. Automakers rely on TPE-O for bumper fascia, air-dam seals, and under-body panels because the blends bond readily with polypropylene substrates and resist weathering. Construction profiles and consumer goods add volume, especially where cost targets favor PP-based alloys.

TPU holds the number-two spot by value, favored for abrasion-critical uses in athletic shoes, conveyor belts, and catheter jacketing. Growth momentum remains tempered by adipic-acid price instability, yet high value-added niches preserve margins. TPV follows closely in under-hood air-management parts that must tolerate 140 °C peaks. Styrenic block copolymers keep share in adhesives and disposable razors, while TPC and TPA extend reach into drive belts, pneumatic tubing, and charge-air ducts. Specialty compounding, such as Teknor Apex's Sarlink TPV for EV battery seals, demonstrates how formulation know-how unlocks premium pricing within the thermoplastic elastomers market.

The Thermoplastic Elastomers Market Report is Segmented by Product Type (Styrenic Block Copolymers (TPE-S), Thermoplastic Olefins (TPE-O), Thermoplastic Vulcanizates (TPV), and More), Application (Automotive and Transportation, Building and Construction, Footwear, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific claimed 46.84% of 2024 value, the highest thermoplastic elastomers market share among regions, and is on course for a 6.45% CAGR to 2030. China represents the fulcrum, producing nearly one in three vehicles globally and hosting expansive smartphone and appliance clusters. INVISTA's move to double Nylon 6,6 capacity to 400,000 t/y in Shanghai underscores raw-material self-sufficiency that underpins compounder growth. South Korea supplies display and battery components, while India escalates wire-and-cable builds for renewable energy, sustaining intra-regional trade.

North America remains innovation-heavy. Detroit OEMs specify bio-based TPV window seals, and Boston-area medical device startups pilot new catheter coatings, locking in profitable niches. Celanese's Hytrel TPC-LCF, launched at Chinaplas yet developed in Texas, achieves a 50% carbon-footprint cut, aligning with US Inflation Reduction Act incentives. Tariffs on petrochemical imports, effective 2025, could add 12-20% to resin costs, nudging compounders to reshore intermediate production and potentially opening capacity for domestic TPU lines.

Europe's environmental directives accelerate uptake of recycled-content TPEs such as Avient's reSound REC GP 7820, which contains 60% post-consumer feedstock . German Tier 1s test TPV radiator hoses that meet Euro 7 cold-start requirements. Meanwhile, Spain and Italy deploy heat-pump retrofits that use Arnitel HT ducting to meet decarbonization targets. South America and the Middle East & Africa are smaller today yet offer long-run upside as infrastructure expands. Mexico is now the world's fourth-largest polyurethane market, reflecting near-shoring of US automotive supply chains and drawing TPU injection molders closer to OEMs. Gulf Cooperation Council countries invest in specialty elastomer hubs to diversify away from crude exports, hinting at localized downstream demand within the thermoplastic elastomers market.

- Arkema

- Asahi Kasei Corporation.

- Avient Corporation

- BASF

- Celanese

- Covestro AG

- Group Dynasol

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- Huntsman International LLC

- Kraton Corporation

- Lanxess

- LCY

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation.

- SABIC

- Teknor Apex

- Sumitomo Chemical Co., Ltd.

- APAR Industries Ltd.

- The Lubrizol Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV Light Weighting Push in Automotive Wire and Cable

- 4.2.2 Growing Application in the Heating, Ventilation, and Air Conditioning (HVAC) Industry

- 4.2.3 Increasing Utilization in Consumer Electronics

- 4.2.4 Increasing Demand from Healthcare Industry

- 4.2.5 Subtantial Demand from Footwear and Sports Equipment

- 4.3 Market Restraints

- 4.3.1 TPU (Thermoplastic Polyurethane) Price Volatility Due to Adipic Acid Supply

- 4.3.2 High Manufacturing and Equipment Cost

- 4.3.3 Challenges of 3D Printing with Soft Thermoplastics

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Styrenic Block Copolymers (TPE-S)

- 5.1.2 Thermoplastic Olefins (TPE-O)

- 5.1.3 Thermoplastic Vulcanizates (TPV)

- 5.1.4 Thermoplastic Polyurethane (TPU)

- 5.1.5 Thermoplastic Copolyester (TPC)

- 5.1.6 Thermoplastic Polyamide (TPA)

- 5.2 By Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Footwear

- 5.2.4 Electrical and Electronics

- 5.2.5 Medical

- 5.2.6 Other Applications (Household Goods, Adhesive and Sealants, HVAC)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Arkema

- 6.4.2 Asahi Kasei Corporation.

- 6.4.3 Avient Corporation

- 6.4.4 BASF

- 6.4.5 Celanese

- 6.4.6 Covestro AG

- 6.4.7 Group Dynasol

- 6.4.8 dsm-firmenich

- 6.4.9 DuPont

- 6.4.10 Evonik Industries AG

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 Huntsman International LLC

- 6.4.13 Kraton Corporation

- 6.4.14 Lanxess

- 6.4.15 LCY

- 6.4.16 LG Chem

- 6.4.17 LyondellBasell Industries Holdings B.V.

- 6.4.18 Mitsubishi Chemical Group Corporation.

- 6.4.19 SABIC

- 6.4.20 Teknor Apex

- 6.4.21 Sumitomo Chemical Co., Ltd.

- 6.4.22 APAR Industries Ltd.

- 6.4.23 The Lubrizol Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Bio-Based Thermoplastic Elastomers