|

市场调查报告书

商品编码

1628778

中东和非洲的需量反应管理系统 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Middle-East and Africa Demand Response Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

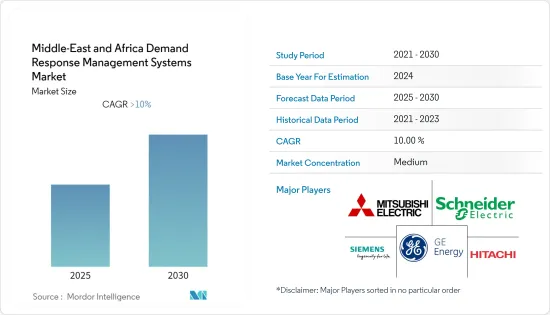

中东和非洲的需量反应管理系统(DRMS)市场预计在预测期内复合年增长率将超过10%。

2020 年市场受到 COVID-19 的负面影响。但它已经达到了大流行前的水平。

主要亮点

- 当今的需求响应行动大部分发生在商业和工业领域。此外,该地区的科技巨头主导着市场空间,而中小企业则以不断创新和更智慧的软体产品为其提供支援。这种情况是公用事业和客户的需求响应管理系统实施背后的驱动力。

- 另一方面,由于骇客攻击而对消费者资料造成威胁的隐私担忧预计将阻碍市场成长。

- 将智慧技术融入现有电网结构预计将在未来几年为市场参与企业创造充足的机会。

- 由于许多即将实施的可再生能源和智慧电网计划将减少石化燃料在发电中的份额,预计阿拉伯联合大公国将成为该地区最大的市场。此外,可再生能源发电的不确定性可能会推动该国对 DRMS 的需求。

中东和非洲需量反应管理系统市场趋势

自动需量反应系统成长最快

- 工业需量反应是一项动态能源基础设施管理计划,旨在支持电网稳定并满足不断增长的全球能源需求。会转向关闭某些生产流程或减少某些电力负载。

- 需求面管理是各电网的时代要求。随着智慧电网技术和自动需量反应系统的兴起,DRMS已成为领先的需求面管理策略,为传统供应面解决方案提供经济高效的替代方案,以解决尖峰负载期间不断增长的电力需求和价格上涨预计将提供多种选择。

- 此外,随着可再生能源发电的电网整合不断加速,智慧电网预计将成为强制性的,提供电网固定容量,同时整合风能和太阳能等可变能源的发电。

- 根据国际可再生能源机构统计,截至2021年,中东可再生能源装置容量已从2012年的1,360千万瓦增至近2,400万千瓦,而非洲可再生能源装置容量已从2012年的2,845万千瓦增加。

- 可再生能源产能预计将进一步增加。可再生能源容量的显着增加正在推动对新自动化系统的需求,以稳定电网运作。

- 因此,中东和非洲的需量反应管理系统市场预计将成长,因为自动需量反应系统控制电力消耗的能力将使客户能够在尖峰时段自动管理其能源消耗。

阿联酋主导市场

- 中东和非洲的需量反应管理系统市场预计在预测期内将出现显着成长,特别是在阿拉伯联合大公国。

- 阿拉伯联合大公国持有全球已探明石油蕴藏量的 7%,约 1,050 亿桶和 73 兆立方英尺的传统天然气。

- 截至2021年,全国总发电量约为139.4TWh。天然气发电厂是主要的电力源。 2021年,约98%的电力由天然气发电厂生产。而且,当年石油、天然气占初级能源消耗的比重达到惊人的98.87%。然而,该国承诺到 2030 年产量至少达到 25%。

- 由于高可支配收入、炎热的夏季和电器产品的普及,尖峰时段用电需求不断增加。该国曾经因经济快速成长而遭受电力短缺的困扰,但近年来情况有所缓解。为了解决电力供需不匹配的问题,我们指导大需求者以行政发行的方式实施无偿减负荷,减少尖峰用电。

- 此外,我们也致力于发展世界级的电力基础设施,以成为其他海湾合作委员会国家的电力出口国。 DRMS 可以帮助阿联酋优化消费并提高未使用能源出口分配效率。

- 阿联酋正致力于透过发展核能发电厂和太阳能发电厂来提高电力部门的产能。阿联酋很可能成为中东和北非地区第一个大规模太阳能发电的国家。在产能增加和可再生能源融入能源结构的支持下,预计未来几年 DRMS 的市场前景将十分光明。

- 2022年11月,阿布达比经济发展部(ADDED)宣布将根据经济影响、酋长国化率和能源管理效率等合格标准,向工业部门提供优惠的天然气和电力关税,从而提供优惠的能源关税。计划(ETIP 2.0)已扩展。预计这些措施将推动工业参与企业投资更好的需量反应管理系统,以在预测期内提高能源效率。

- 因此,加大力度、投资和政府采取措施实现全国电力产业现代化等因素预计将推动预测期内的市场研究。

中东和非洲需量反应管理系统产业概况

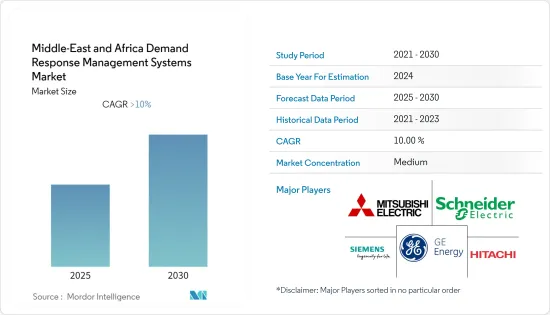

中东和非洲需量反应管理系统市场适度细分,因为该行业有许多公司营运。该市场的主要企业(排名不分先后)包括施耐德电气、西门子、日立有限公司、三菱电机公司、GE Energy 和 ABB (Ventyx)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 传统需量反应

- 自动需量反应

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schneider Electric

- Siemens AG

- Alstom SA

- Eaton Corporation PLC

- Enel SpA

- ABB Ltd

- General Electric Company

- Mitsubishi Electric Corporation

- Saudi Electricity Company

第七章 市场机会及未来趋势

The Middle-East and Africa Demand Response Management Systems Market is expected to register a CAGR of greater than 10% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. However, it has reached pre-pandemic levels.

Key Highlights

- Most of the demand response action today is in the commercial and industrial sectors. Moreover, technology giants of the region are leading the market space, with smaller companies supporting them with constant innovations and smarter software products. This scenario acts as a driver for the adoption of demand response management systems for utilities and customers.

- On the other note, privacy concerns regarding the threat to consumers' data through hacking are expected to hinder the market's growth.

- The integration of smart technologies in the existing grid structure is expected to create an ample amount of opportunities for the market players in the coming years.

- The United Arab Emirates is expected to be the largest market in the region, owing to many upcoming renewable and smart grid projects to decrease the share of fossil fuel in power generation. Furthermore, the uncertainty in power generation through renewables may propel the demand for DRMS in the country.

MEA Demand Response Management Systems Market Trends

Automated Demand Response System to Grow at the Fastest Rate

- Industrial demand response is a dynamic energy infrastructure management program designed to support the stability of the electricity grid, as well as meet the globally growing demand for energy with the assistance of large and very large energy users in both the industrial and commercial sectors who agree to switch off certain production processes or turn down certain electrical loads during periods of peak demand.

- Demand-side management is the need of the hour for any grid. With a rise in smart grid technologies and automated demand response systems, DRMS is a key demand-side management strategy that is expected to provide a cost-effective alternative to traditional supply-side solutions to address the growing electricity demand during peak load or when prices are high.

- Additionally, as grid integration of renewable energy is growing rapidly, it is expected to mandate smart grids to provide grid-firming capacity while integrating energy generation from variable sources such as wind and solar.

- As of 2021, according to International Renewable Energy Agency, the Middle East had a total installed renewable capacity of nearly 24 GW, up from 13.6 GW in 2012, and Africa had a total installed renewable capacity of 55.7 GW from 28.45 GW in 2012.

- Renewable energy capacities are expected to grow even further. Such large-scale increase in renewable energy capacity has facilitated the requirement for new automated systems to stabilize grid operation.

- Therefore, the Middle-East and African demand response management systems market is expected to grow due to the ability of the automated demand response system to control electricity consumption, allowing customers to manage energy consumption at times of peak demand automatically.

United Arab Emirates to Dominate the Market

- The market for demand response management systems in the Middle-East and African region is expected to witness significant growth, majorly in the United Arab Emirates, during the forecast period.

- The United Arab Emirates has 7% of the global proven oil reserves, i.e., about 105 billion barrels and 73 trillion cubic feet of conventional gas.

- As of 2021, the total electricity generation in the country was about 139.4 TWh. Natural gas-fired power plants majorly power the country. In 2021, about 98% of electricity was generated by natural gas-fired plants. Moreover, the share of oil and natural gas in primary energy consumption in the same year was staggering at 98.87%. However, the country has committed to producing at least 25% by 2030.

- The peak electricity demand has been increasing on account of high disposable incomes, hot summers, and the widespread use of electrical appliances in the country. The country has experienced shortages in power availability due to rapid economic growth, a situation that has ebbed in recent years. To manage this mismatch in electricity demand and supply, large customers were instructed to undertake administratively rationed, uncompensated load reductions to reduce peak demand.

- In addition, the country has focused on developing world-class power infrastructure to become a power exporter to other GCC nations. DRMS has the potential to aid the United Arab Emirates in optimizing its consumption and improving the efficiency of allocating unused energy to export.

- The country has focused on massive capacity addition in the power sector by developing nuclear and solar power plants. It is likely to become the first MENA country to produce solar power on such a large scale. Supported by an increase in capacity and the integration of renewable in the energy mix, the market outlook for DRMS is estimated to be positive over the coming years.

- In November 2022, the Abu Dhabi Department of Economic Development (ADDED) expanded the Energy Tariff Incentive Programme (ETIP 2.0) by offering preferential rates for gas and electricity to the industrial sector based on eligibility criteria that include economic impact, Emiratisation rate, and energy management efficiency. Such measures are expected to spur industry players into investing in better demand response management systems to improve energy efficiency during the forecast period.

- Therefore, factors such as increasing efforts to modernize the power sector across the country, investments, and government policies, are expected to drive the market studied during the forecast period.

MEA Demand Response Management Systems Industry Overview

The Middle-East and Africa demand response management systems market is moderately fragmented due to many companies operating in the industry. The key players in this market (in no particular order) include Schneider Electric Inc., Siemens, Hitachi Ltd, Mitsubishi Electric Corporation, GE Energy, and ABB (Ventyx).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional Demand Response

- 5.1.2 Automated Demand Response

- 5.2 Geography

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabian

- 5.2.3 South Africa

- 5.2.4 Res of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schneider Electric

- 6.3.2 Siemens AG

- 6.3.3 Alstom SA

- 6.3.4 Eaton Corporation PLC

- 6.3.5 Enel SpA

- 6.3.6 ABB Ltd

- 6.3.7 General Electric Company

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 Saudi Electricity Company