|

市场调查报告书

商品编码

1631566

北美自动化需量反应管理系统:市场占有率分析、产业趋势与成长预测(2025-2030)North America Automated Demand Response Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

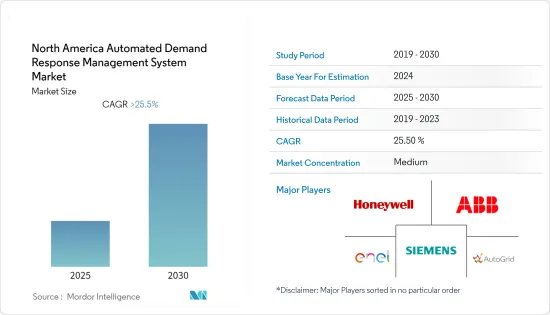

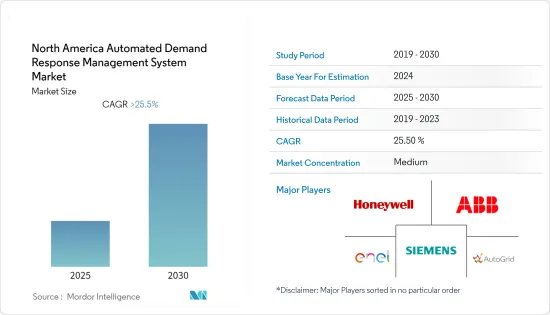

北美自动化需量反应管理系统市场预计在预测期内复合年增长率将超过 25.5%。

儘管COVID-19对市场产生了负面影响,但市场目前已恢復至疫情前的水准。

主要亮点

- 预计该市场将受到能源管理系统良好运作的需求等因素的推动。预计可再生能源的不断普及也将在预测期内推动市场发展。

- 然而,对隐私的担忧以及某些行业无法在需要时减少需求可能会成为限制因素。

- 综合需求面管理(IDSM)预计将为所研究的市场提供重要机会。使用紧密协调多个需求方资源的IDSM,为建筑能源管理提供了更先进、更智慧的方法,帮助客户最大限度地提高成本效益的节省和控制机会。

- 由于对可再生能源发电的需求不断增长以及管理发电组合的有效方法,美国预计将主导整个全部区域的市场。

北美自动化需量反应管理系统市场趋势

可再生能源的普及正在推动市场

- 可再生能源是间歇性的,并且会随着时间的推移而波动。例如,太阳能发电、风力发电受天气影响较大。

- 实施需量反应管理系统可以帮助确保在发生此类中断时减少需求并满足供需平衡。与旨在高需求时期直接供应的能源储存相反,DRMS 旨在在需求和供应缺口扩大期间直接需求,从而解决这两个问题。

- 需量反应控制与利用地热、太阳能、风能、生物质或来自垃圾掩埋场的天然气的自备发电相结合,可以提供保持设施运作所需的离网电力,同时减少电网的能源使用。需量反应有潜力成为大容量电力系统服务的重要来源,有助于整合可变的可再生能源发电。

- 另外,一些公用事业公司正在透过向消费者提供动态电价来扩大其需求响应系统的范围,其中不仅包括消费量,还包括向电网的销售量。例如,在高峰时段,消费者可以透过将电力卖回电网来获得更高的价格。随着需求响应系统范围的扩大,预计不仅是公用事业规模的可再生能源,而且小型住宅可再生能源也将纳入发电系统。

- 此外,由于政府支持、能源安全和成本下降,可再生能源产业预计将在预测期内显着成长并推动北美需量反应管理系统市场。

美国引领市场

- 需量反应计划通常透过在指定时间内减少能源使用或允许公用事业公司在需要时循环空调系统来为客户提供折扣或能源成本节省。

- 高级电錶是美国各地部署的最受欢迎的电錶类型,占美国安装和运作的所有电錶的 50% 以上。除此之外,参与美国需量反应计画的客户总数达到约1,020万人(包括住宅、商业、工业和交通),比2013年成长6.1%。 2020年,在参与需量反应计画的所有客户中,住宅客户占93%以上,其余份额由工业和交通客户分配。

- 2022 年 5 月,NJR Clean Energy Ventures (CEV) 开始在新泽西州米尔本建造一座 8.9 兆瓦浮体式太阳能发电设施。该计划将使用浮体式支架系统在新泽西州美国水务公司卡诺布鲁克水质净化厂的水库上安装 16,510 个太阳能电池板。

- 需量反应(DR) 在美国已存在多年。 DR 系统使消费者能够以可靠、快速、经济高效且自动化的方式暂时关闭、降低或转移不必要的电力。

- 此外,2021年,美国公用事业公司安装的先进(智慧)计量基础设施(AMI)数量约为1.11亿个,与前一年同期比较增长约10%。大约 88% 的 AMI 安装是住宅。全国超过 11 个州采用的智慧电錶安装计划和要求似乎正在发挥作用,电錶普及率正在显着提高。

- 因此,该国智慧/AMI 电錶安装的成长趋势预计将促进智慧电网基础设施的发展,从而增加未来几年对 ADRMS 的需求。

北美自动化需量反应管理系统产业概况

北美需量反应管理系统市场适度细分。主要参与企业(排名不分先后)包括 ABB Ltd、Siemens AG、Honeywell International Inc.、Enel SpA 和 AutoGrid Systems Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章区域市场细分

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- ABB Ltd.

- Siemens AG

- Honeywell International Inc.

- Enel SpA

- AutoGrid Systems Inc.

- General Electric Company

- Centrica PLC

- Itron Inc.

- Lockheed Martin Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 71620

The North America Automated Demand Response Management System Market is expected to register a CAGR of greater than 25.5% during the forecast period.

COVID-19 had a detrimental effect on the market.However, the market has currently rebounded to pre-pandemic levels.

Key Highlights

- The market is likely to be driven by things like the need for an energy management system that works well.Also, increased penetration of renewable energy is expected to drive the market during the forecast period.

- However, the privacy concern and the inability of some industries to comply with the reduction in demand at the need of the hour are likely to act as restraints for the market.

- Integrated demand-side management (IDSM) is expected to provide a great opportunity for the studied market. The use of IDSM, closely coordinating multiple demand-side resources, offers a more forward-thinking and smarter approach to building energy management and helps customers maximize cost-effective savings and control opportunities.

- The United States is expected to dominate the market across the region due to the growing demand for renewable energy and efficient ways to manage the electricity generation mix.

North America Automated Demand Response Management System Market Trends

Increased Penetration of Renewable Energy to Drive the Market

- Renewable energy power sources are intermittent, and they fluctuate over time. For instance, solar power and wind power plants are heavily dependent on weather conditions.

- Implementation of demand response management system can help by ensuring that when such disruptions happen, demand can be reduced, in order to meet the supply demand balance. In contrast to energy storage, which aims to reallocate supply to times of greater demand, DRMS aims to reallocate demand to times of increased supply-demand gap, hence, addressing the problems on the both sides.

- Demand response controls coupled with on-site generation using geothermal, solar, wind, biomass, or landfill-gas-to-energy provide the off-grid power needed to keep facilities running, while reducing energy use from the grid. Demand response present potentially important sources of bulk power system services that can aid in integrating variable renewable generation.

- Apart from that, some utility companies have expanded the scope of demand-response system, by proving the dynamic electricity prices for their consumers for not only consumption but also for selling electricity back to the grid. For example, during peak hours, the consumers can get higher prices for selling the electricity back to the grid system. The enhanced scope of the demand-response system is expected to help integrating not only the utility-scale but also small, residential renewable sources in the power generation system.

- Moreover, with government assistance, energy security, and declining costs, the renewable energy sector is expected to register significant growth, in turn driving the North America demand response management systems market during the forecast period.

United States To Drive the Market

- Demand response programs typically offer customers a rebate or lower energy costs for reducing energy use during specified hours or allowing the utility to cycle their air-conditioning systems when needed.

- Advanced meters are the most prevalent type of metering deployed throughout the United States, accounting for more than 50% of all meters installed and operational in the country. Adding to this, the total number of customers enrolled under the demand response programs in the United States reached around 10.2 million (including residential, commercial, industrial, and transportation), representing an increase of 6.1% from 2013's value. Of all the customers enrolled in the demand response program, residential customers accounted for more than 93% in 2020 and the remaining share was distributed among the industrial and transportation customers.

- In May 2022, NJR Clean Energy Ventures (CEV) started construction on an 8.9-MW floating solar installation in Millburn, New Jersey, which is expected to be the largest floating array in the United States. The project uses a floating racking system, with 16,510 solar panels that are likely to be installed on a reservoir located at the New Jersey American Water Canoe Brook Water Treatment Plant.

- Demand Response (DR) has been in existence in the United States for many years. DR system allows and encourages consumers to temporarily switch off, turn down or shift the nonessential electricity in a reliable, fast, cost-effective, and automated fashion.

- Moreover, in 2021, electric utilities in the United States had about 111 million advanced (smart) metering infrastructure (AMI) installations, representing an increase of around 10% over the previous year's value. About 88% of the AMI installations were residential customer installations. Plans and requirements for the installation of smart meters adopted in more than 11 states across the country appear to be paying off significant increases in meter penetration rates.

- This, increasing trend in the smart/ AMI meter installations in the country is expected to boost the smart grid infrastructure, thereby, increasing the demand for ADRMS in the coming years.

North America Automated Demand Response Management System Industry Overview

The North America demand response management system market is moderately fragmented. Some of the key players (in no particular order) are ABB Ltd, Siemens AG, Honeywell International Inc., Enel SpA, AutoGrid Systems Inc., etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION BY GEOGRAPHY

- 5.1 United States

- 5.2 Canada

- 5.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Siemens AG

- 6.3.3 Honeywell International Inc.

- 6.3.4 Enel SpA

- 6.3.5 AutoGrid Systems Inc.

- 6.3.6 General Electric Company

- 6.3.7 Centrica PLC

- 6.3.8 Itron Inc.

- 6.3.9 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219