|

市场调查报告书

商品编码

1628779

欧洲玻璃瓶和容器:市场占有率分析、行业趋势和成长预测(2025-2030)Europe Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

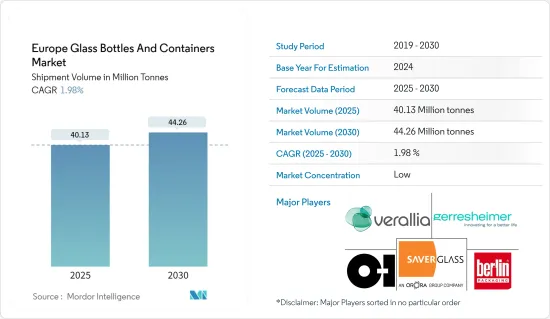

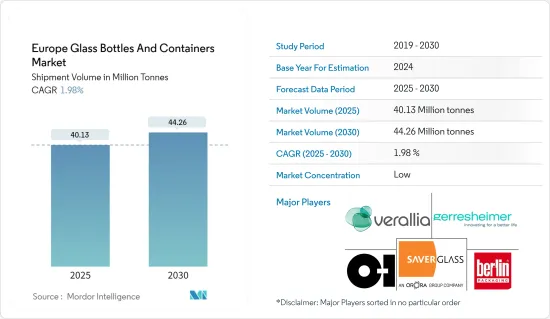

以出货量为准,欧洲玻璃瓶及容器市场规模预计将从2025年的4013万吨扩大到2030年的4,426万吨,预测期间(2025-2030年)复合年增长率为1.98%。

欧洲玻璃瓶和容器市场是包装产业的重要组成部分。这是由永续性趋势、消费者对优质包装的需求以及针对减少塑胶废弃物的法规所推动的。欧洲玻璃製造业发达,德国、义大利、法国、西班牙是玻璃生产和消费中心。

主要亮点

- 欧洲玻璃包装市场价值数十亿欧元,近年来稳步成长。食品和饮料、药品和化妆品等关键行业的需求正在推动这一成长。该市场预计将温和成长,尤其是在酒精饮料、化妆品和美食等高端包装领域。葡萄酒、啤酒和烈酒等酒精饮料占据了大部分市场,果汁和碳酸饮料等其他饮料也做出了巨大贡献。

- 玻璃是一种高度永续性的包装材料,因为它是可回收的。欧洲制定了强有力的回收政策,导致玻璃包装的回收率很高,许多国家通常超过 70%。随着人们对塑胶废弃物的日益关注,玻璃越来越被视为一种环保的替代品。

- 欧洲消费者更喜欢玻璃包装,理由是品质优良、产品完整性和可回收性。玻璃包装通常用于奢侈品和有机产品。欧盟循环经济行动计画等欧盟措施推动了回收率的提高和废弃物的减少。玻璃作为可回收材料满足了这些目标,进一步增加了包装行业的需求。

- 最大的行业是饮料,主要是酒精饮料(葡萄酒、啤酒、烈酒)和软性饮料。优选玻璃瓶和罐子以保持风味和品质。由于玻璃具有惰性和无菌性,玻璃容器在製药工业中广泛用于包装药品,特别是液体药品、疫苗和糖浆。在化妆品行业,玻璃因其豪华的外观和气密性而被用于护肤品、香水、化妆品的豪华包装。

- 该地区也参与玻璃瓶和容器产品的贸易。根据国际贸易中心统计,欧洲各国玻璃容器产能差异较大。德国以每年5,493,250吨位居第一,其次是义大利,为4,897,205吨,法国为4,580,750吨。

- 欧洲包装产业正在经历重大变革,有利于传统玻璃包装的替代品。包装材料的永续性问题、成本效益和技术进步正在推动这一趋势。因此,现有的玻璃包装市场面临来自生质塑胶、软包装和先进聚合材料等创新替代品的新挑战和竞争。这种转变正在改变消费者的偏好,并迫使玻璃包装製造商调整策略,以在不断变化的市场环境中保持市场占有率。

欧洲玻璃瓶及容器市场趋势

饮料业占据主要市场占有率

- 欧洲拥有法国、义大利、西班牙、德国等一些世界领先的葡萄酒生产国,玻璃瓶是葡萄酒的主流包装。玻璃被广泛认为是保存葡萄酒风味、香气和品质的最佳材料,与奢侈品有着密切的联繫。葡萄酒产业仍然是欧洲玻璃包装需求的主要动力,在一些国家,玻璃容器占葡萄酒包装的80%以上。

- 法国仍然是欧洲国家中最大的葡萄酒消费国之一,预计 2023 年消费量将达到约 2,440 万百升。这种高消费水平反映了法国根深蒂固的葡萄酒文化以及葡萄酒在日常生活和社交场合的重要性。根据国际葡萄与葡萄酒组织的数据,英国的消费量为 1,280 万百升。受消费者偏好变化和对葡萄酒鑑赏力不断提高的影响,英国的葡萄酒消费量正在稳步增长。

- 欧洲各地的这些葡萄酒消费趋势表明,对玻璃瓶作为包装材料的需求持续成长。玻璃瓶仍然是葡萄酒的首选包装选择,因为它们可以保存风味,延长保质期,并为消费者提供优质的美学吸引力。这些重要的欧洲市场葡萄酒消费的持续成长标誌着饮料产业对高品质玻璃包装解决方案的需求同步成长。

- 玻璃饮料市场在精酿啤酒、有机果汁和优质烈酒等高端和利基市场中表现出强劲的势头。对高品质、环保包装解决方案的需求正在推动玻璃容器在这些类别中的使用增加。精酿啤酒和小批量饮料是玻璃包装市场的主要贡献者。许多精酿啤酒商和小型饮料製造商选择玻璃瓶来向客户传达品质、传统和环境责任。

- 儘管塑胶和铝罐占据主导地位,但玻璃瓶仍然占据软性饮料市场的利基市场,包括优质苏打水、有机饮料和工艺软性饮料。天然、有机和健康意识饮料品牌的日益普及也促进了玻璃作为永续包装选择的使用。新鲜果汁,尤其是冷压和有机果汁,通常采用玻璃包装,因为它可以保持产品的品质和风味。

- 在欧洲,消费者对塑胶污染的认识不断增强,以及对一次性塑胶的监管更加严格,正在推动人们对环保包装的偏好。玻璃具有高度可回收性,并且能够无限期地重复使用而不会降低质量,因此在饮料包装领域吸引了具有环保意识的消费者。

- 这种向永续选择的转变正在影响製造商和零售商对包括饮料在内的各种产品采用玻璃包装。玻璃的可回收性和再生性符合循环经济原则,进一步增加了对欧洲市场的吸引力。此外,玻璃包装维持产品品质和延长保质期的特性也是其在该地区消费者和生产商中日益受欢迎的因素。

德国占有很大的市场占有率

- 德国是欧洲玻璃容器的重要市场。强劲的工业部门、包装商品的高消费量以及对永续性的重视支撑着这个市场。在德国,玻璃容器的需求主要由食品饮料、化妆品和製药业推动。

- 在非酒精饮料领域,特别是在优质和有机饮料领域,果汁和健康饮料等产品正在采用玻璃容器。德国有着深厚的啤酒传统,玻璃容器在多种饮料品类中都受到青睐,许多消费者更喜欢安全且惰性的包装材料,导致该国饮料行业对玻璃容器的需求强劲。

- 根据德国联邦统计局的数据,2021 年至 2023 年,德国消费者在酒精饮料上的支出稳定成长。 2021年达293亿美元,2022年小幅成长至295亿美元。到2023年,这一数字将增加至307亿美元,反映出过去三年酒精饮料支出的持续上升趋势。

- 德国也是世界上玻璃回收率最高的国家之一,超过 90% 的玻璃瓶被回收。日益增强的环保意识促使德国消费者和企业选择玻璃作为永续包装材料。玻璃被广泛认为是一种环保材料,因为它可以 100% 可回收且不会损失品质。这就是为什么人们越来越偏好玻璃包装,特别是考虑到德国的包装废弃物立法和提倡可回收材料的生产者延伸责任 (EPR) 法规。

- 德国参与玻璃瓶及容器产品的出口。根据国际贸易中心统计,德国出口量从2021年的1,094,706吨大幅增加至2022年的1,494,488吨,增幅达36.4%。这一增长表明国际上对德国产品的需求不断增长。这一增长可能是由于大流行后的经济復苏、全球贸易的成长或汽车、化学、机械和消费品等某些行业的繁荣。

- 2023年出口量小幅下降至1,205,642吨,较2022年最高峰下降19.4%。这种下降可归因于供应链中断、全球经济挑战或主要市场需求模式的变化。大宗商品价格波动、国际需求变化和地缘政治紧张局势(包括乌克兰衝突)等因素可能影响了德国2023年的出口表现。

欧洲玻璃瓶及容器产业概况

欧洲玻璃瓶和容器市场较为分散,许多公司争夺市场占有率。这种竞争环境促进了技术创新,并鼓励公司脱颖而出,以满足不同的客户需求。该市场包括大型跨国公司和中小型区域製造商,各自为该行业的活力做出了贡献。 OI Glass, Inc.、SAVERGLASS Group、Berlin Packaging、Verallia Group 和 Gerresheimer AG 等主要企业透过广泛的产品系列、技术进步和策略伙伴关係确立了自己的地位。

这些和其他市场参与企业服务于各个行业,包括食品和饮料、药品、化妆品和个人护理。对永续性和环保包装解决方案的持续关注也对这些主要企业的市场策略和产品开发产生了重大影响。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 玻璃瓶及容器进出口资料

- PESTEL 分析 - 欧洲玻璃瓶和容器产业

- 包装玻璃行业标准及法规

- 包装玻璃的原料分析及材质考虑

- 容器和包装玻璃的永续性趋势

- 欧洲玻璃瓶及容器熔炉及位置

第五章市场动态

- 市场驱动因素

- 对环保产品的需求不断成长

- 食品饮料市场需求快速成长

- 市场挑战

- 由于越来越多采用玻璃替代品,传统市场面临挑战

- 全球玻璃瓶及容器市场的欧洲市场分析

- 贸易情景 - 欧洲玻璃瓶和容器产业进出口范式的历史和现状分析

第六章 市场细分

- 按最终用户产业

- 用于酒精

- 啤酒和苹果酒

- 葡萄酒/烈酒

- 非酒精性

- 碳酸饮料

- 乳类饮料

- 水

- 其他非酒精饮料

- 食物

- 化妆品

- 药品

- 其他最终用户产业

- 用于酒精

- 按国家/地区

- 德国

- 义大利

- 法国

- 波兰

- 英国

- 西班牙

- 俄罗斯

第七章 竞争格局

- 公司简介

- Verallia Group

- BA GLASS GROUP

- OI Glass, Inc.

- Vidrala, SA

- VERESCENCE FRANCE

- Gerresheimer AG

- SAVERGLASS Group

- ALGLASS SA

- Quadpack Industries SA

- Berlin Packaging

- Wiegand-Glas Holding GmbH

- Ardagh Group SA

- HEINZ-GLAS GmbH & Co.

- Zignago Vetro SpA

- Beatson Clark

第八章补充:欧洲主要玻璃容器主要窑炉供应商分析

第九章 市场未来展望

The Europe Glass Bottles And Containers Market size in terms of shipment volume is expected to grow from 40.13 million tonnes in 2025 to 44.26 million tonnes by 2030, at a CAGR of 1.98% during the forecast period (2025-2030).

The European container glass market is a crucial segment of the packaging industry. It is driven by sustainability trends, consumer demand for premium packaging, and regulations targeting plastic waste reduction. Europe boasts a well-developed glass manufacturing sector, with Germany, Italy, France, and Spain serving as central glass production and consumption hubs.

Key Highlights

- The European glass container market, valued in billions of euros, has experienced steady growth in recent years. Demand across critical sectors, including food and beverages, pharmaceuticals, and cosmetics, drives this growth. The market is expected to grow moderately, with a notable increase in the premium packaging segment, particularly for alcoholic beverages, cosmetics, and gourmet food products. Alcoholic beverages, such as wine, beer, and spirits, constitute a large portion of the market, while other beverages, like juices and carbonated drinks, also contribute significantly.

- Due to its recyclability, glass is a highly sustainable packaging material. Europe has implemented robust recycling policies, resulting in high glass packaging recycling rates, often surpassing 70% in numerous countries. As concerns about plastic waste grow, glass is increasingly considered an environmentally friendly alternative.

- European consumers prefer glass packaging, attributing it to premium quality, product integrity preservation, and recyclability. Glass packaging is frequently associated with high-end and organic products. European Union initiatives, such as the EU Circular Economy Action Plan, drive higher recycling rates and waste reduction. Glass aligns well with these objectives as a recyclable material, further increasing its demand in the packaging sector.

- The largest segment is beverages, focusing on alcoholic drinks (wine, beer, spirits) and soft drinks. Glass bottles and jars are preferred to preserve flavour and quality. Due to glass's inert nature and sterility, the pharmaceutical industry widely uses glass containers for packaging medicines, especially liquid medications, vaccines, and syrups. In cosmetics, glass is used for premium packaging of skincare products, perfumes, and cosmetics, owing to its high-end appeal and ability to provide an airtight seal.

- The region also participates in the trade of container glass products. According to the International Trade Center, European countries' glass container production capacity varies significantly. Germany leads with 5,493,250 tons per year, followed by Italy at 4,897,205 tons and France at 4,580,750 tons.

- The European packaging industry is experiencing a significant shift as alternatives to traditional glass packaging gain traction. Sustainability concerns, cost-effectiveness, and technological advancements in packaging materials drive this trend. As a result, established glass packaging markets face new challenges and competition from innovative alternatives like bioplastics, flexible packaging, and advanced polymer materials. This shift reshapes consumer preferences and forces glass packaging manufacturers to adapt their strategies to maintain market share in an evolving landscape.

Europe Glass Bottles And Containers Market Trends

Beverage Industry to Hold a Significant Market Share

- Europe hosts several of the world's leading wine-producing nations, including France, Italy, Spain, and Germany, where glass bottles remain the dominant packaging choice for wine. Glass is widely regarded as the optimal material for maintaining wine's flavour, aroma, and quality, and it is closely associated with premium products. The wine industry continues to be a primary driver of glass container demand in Europe, with glass packaging accounting for over 80% of wine packaging in certain countries.

- France remained one of the leading wine consumers among European countries, with consumption reaching approximately 24.4 million hectoliters in 2023. This high level of consumption reflects France's deep-rooted wine culture and its significance in daily life and social gatherings. According to the International Organisation of Vine and Wine, the United Kingdom consumed about 12.8 million hectoliters. The UK's wine consumption has been steadily growing, influenced by changing consumer preferences and an increasing appreciation for wine.

- This trend in wine consumption across Europe indicates continued demand for glass bottles as packaging materials. Glass bottles remain the preferred packaging option for wine due to their ability to preserve flavour, extend shelf life, and provide a premium aesthetic appeal to consumers. The sustained growth in wine consumption in these critical European markets suggests a parallel increase in the demand for high-quality glass packaging solutions in the beverage industry.

- The glass container beverage market shows strength in premium and niche sectors, such as craft beer, organic juices, and high-end spirits. The demand for high-quality, environmentally friendly packaging solutions drives growth in glass container usage for these categories. Craft beer and small-batch beverages contribute significantly to the market for glass packaging. Many craft brewers and small beverage producers choose glass bottles to communicate quality, tradition, and environmental responsibility to their customers.

- Despite the dominance of plastic and aluminium cans, glass bottles remain in niche segments of the soft drink market, including premium sodas, organic beverages, and craft soft drinks. The increasing popularity of natural, organic, and health-focused beverage brands has contributed to using glass as a sustainable packaging option. Fresh juices, particularly cold-pressed and organic varieties, are frequently packaged in glass due to their ability to preserve product quality and taste.

- Europe shows an increasing preference for environmentally friendly packaging, driven by growing consumer awareness of plastic pollution and stricter regulations on single-use plastics. Being highly recyclable and indefinitely reusable without quality loss, glass appeals to environmentally conscious consumers in beverage packaging.

- This shift towards sustainable options influences manufacturers and retailers to adopt glass packaging for various products, including beverages. Glass's recyclability and reusability align with circular economy principles, further enhancing its appeal in the European market. Additionally, glass packaging's ability to preserve product quality and extend shelf life contributes to its growing popularity among consumers and producers in the region.

Germany to Hold a Significant Market Share

- Germany represents a significant market for glass containers in Europe. Its robust industrial sector, high consumption of packaged goods, and increasing emphasis on sustainability support this market. The food and beverage, cosmetic, and pharmaceutical industries primarily drive the demand for glass containers in Germany.

- The non-alcoholic beverage segment, especially in premium and organic categories, also embraces glass packaging for products like juices and health drinks. Germany's strong beer heritage, preference for glass in various beverage sectors, and consumer inclination towards safe, inert packaging materials collectively contribute to the robust demand for glass containers in the country's beverage industry.

- According to Statistisches Bundesamt, consumer spending on alcoholic beverages in Germany has steadily increased from 2021 to 2023. In 2021, spending reached USD 29.3 billion, followed by a slight rise to USD 29.5 billion in 2022. By 2023, this figure grew to USD 30.7 billion, reflecting a consistent upward trend in the country's expenditure on alcoholic drinks over the past three years.

- Germany also maintains one of the world's highest glass recycling rates, with over 90% of glass bottles being recycled. As environmental awareness grows, German consumers and companies increasingly choose glass as a sustainable packaging material. Glass is widely recognized as eco-friendly due to its 100% recyclability without quality loss. This has led to a rising preference for glass containers, particularly in light of German packaging waste laws and Extended Producer Responsibility (EPR) regulations promoting recyclable materials.

- The country participates in the export of container glass products. According to the International Trade Center, Germany's export volume increased significantly from 1,094,706 tons in 2021 to 1,494,488 tons in 2022, a 36.4% rise. This increase suggests heightened international demand for German products. Factors contributing to this growth may include post-pandemic economic recovery, increased global trade, or specific industry booms in sectors like automotive, chemicals, machinery, or consumer goods.

- In 2023, export volume decreased slightly to 1,205,642 tons, a 19.4% reduction from the 2022 peak. This decline may be attributed to supply chain disruptions, global economic challenges, or changing demand patterns in critical markets. Factors such as commodity price fluctuations, shifts in international demand, or geopolitical tensions, including the Ukraine conflict, could have influenced Germany's export performance in 2023.

Europe Glass Bottles And Containers Industry Overview

The European container glass market is fragmented, with numerous players competing for market share. This competitive environment fosters innovation and drives companies to differentiate their offerings to meet diverse customer needs. The market includes large multinational corporations and smaller regional manufacturers, each contributing to the industry's dynamism. Key players in this market, such as O-I Glass, Inc., SAVERGLASS Group, Berlin Packaging, Verallia Group, and Gerresheimer AG, have established strong positions through their extensive product portfolios, technological advancements, and strategic partnerships.

These companies and other market participants cater to various sectors, including food and beverage, pharmaceuticals, cosmetics, and personal care. The ongoing focus on sustainability and eco-friendly packaging solutions has also significantly influenced market strategies and product development among these key players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in Europe

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace and Location in Europe

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Eco-friendly Products

- 5.1.2 Surging Demand from the Food and Beverage Market

- 5.2 Market Challenge

- 5.2.1 Increasing Adoption of Glass Alternatives Challenges Traditional Markets

- 5.3 Analysis of the Current Positioning of Europe in the Global Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Europe

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.1.1 Beer and Cider

- 6.1.1.2 Wine and Spirits

- 6.1.2 Non-alcoholic (Qualitative Analysis For Segment Analysis)

- 6.1.2.1 Carbonated Soft Drinks

- 6.1.2.2 Dairy-based

- 6.1.2.3 Water

- 6.1.2.4 Other Non-alcoholic Beverages

- 6.1.3 Food

- 6.1.4 Cosmetics

- 6.1.5 Pharmaceutical

- 6.1.6 Other End-user Verticals

- 6.1.1 Alcoholic (Qualitative Analysis For Segment Analysis)

- 6.2 By Country

- 6.2.1 Germany

- 6.2.2 Italy

- 6.2.3 France

- 6.2.4 Poland

- 6.2.5 United Kingdom

- 6.2.6 Spain

- 6.2.7 Russia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verallia Group

- 7.1.2 BA GLASS GROUP

- 7.1.3 O-I Glass, Inc.

- 7.1.4 Vidrala, S.A.

- 7.1.5 VERESCENCE FRANCE

- 7.1.6 Gerresheimer AG

- 7.1.7 SAVERGLASS Group

- 7.1.8 ALGLASS SA

- 7.1.9 Quadpack Industries SA

- 7.1.10 Berlin Packaging

- 7.1.11 Wiegand-Glas Holding GmbH

- 7.1.12 Ardagh Group S.A.

- 7.1.13 HEINZ-GLAS GmbH & Co.

- 7.1.14 Zignago Vetro S.p.A.

- 7.1.15 Beatson Clark