|

市场调查报告书

商品编码

1628783

亚太地区下一代储存:市场占有率分析、产业趋势和成长预测(2025-2030 年)APAC Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

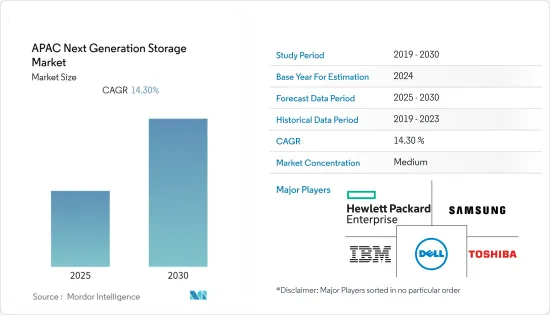

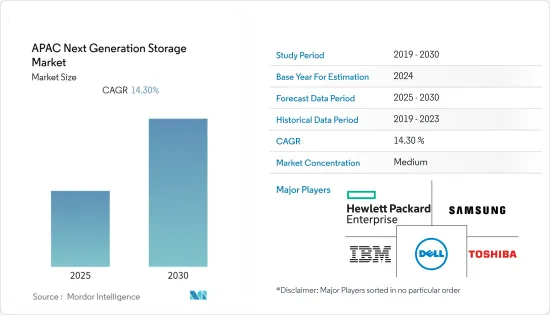

亚太下一代储存市场预计在预测期内复合年增长率为14.3%

主要亮点

- 快速的技术进步和各行业非结构化资料的成长正在推动亚太地区对安全、可靠和经济高效的储存基础设备的需求。在当前情况下,企业面临着资料量、速度和种类不断增加所带来的挑战,导致对高效储存解决方案的需求不断增加。

- 下一代储存解决方案是用于快速且有效率地储存、移植和提取资料檔案和物件的运算设备。此外,企业越来越依赖云端技术进行日常业务。透过云端平台,产生大量资料以供日后参考。因此,企业需要强大而高效的储存解决方案,预计这将在预测期内推动市场成长。

- 电子商务在全球蓬勃发展,亚太地区也不例外。该全部区域电子商务活动的成长也是该地区市场成长的关键因素之一。中国、印度、日本和韩国等国家是该地区电子商务产业成长的主要贡献者。根据世界经济论坛统计,中国电子商务占全球零售电子商务销售额的50%以上。此外,根据东亚论坛预测,2020年中国电子商务销售额将达2.3兆美元。消费者采购中互联网使用的增加正在产生大量关键资料,从而导致下一代资料存储解决方案的采用增加。

- 亚太地区为下一代储存解决方案供应商提供了巨大的机会。 COVID-19大流行的爆发加剧了远距工作和线上工作的趋势。不仅个人而且私人和公共组织对互联网的使用日益增加,也创造了对智慧储存解决方案的需求。考虑到透过网路产生的资料的重要性,企业更有可能投资下一代储存解决方案,这也推动了市场的成长。

- 亚太地区下一代储存市场的发展主要是由政府发展和加速数位化的倡议所推动的。例如,2021年5月,日本政府宣布为企业和地方政府提供财政支持,在当地约五个城市建立资料中心。

- 此外,中小型企业(SME)资料储存需求的增加以及智慧型手机、笔记型电脑和平板电脑在亚太地区的日益普及等因素正在推动对下一代储存解决方案的需求。

亚太地区下一代储存市场趋势

零售终端产业预计将显着成长

- 零售业已广泛采用云端运算,对云端技术的投资正在快速增加。与银行业和製造业一样,零售业也意识到云端运算随着数位世界的发展所发挥的变革作用。

- 零售业数位化的进步也促进了市场成长。此外,各种零售公司也正在采用物联网、人工智慧和机器学习等技术来转变业务营运并为客户提供增强的服务。

- 随着亚太地区智慧型手机用户的增加,零售业的竞争正在加剧。智慧型手机的普及导致电子商务的成长从根本上促进了线上零售的成功。行动零售的成长正在大规模推动电子商务市场。因此,零售商发现自己在一个日益由线上市场主导的市场中竞争。 NASSCOM预计,印度电商市场预计将成长5%,2021年销售额将超过560亿美元。此外,2021年第一季印度智慧型手机出货量达到3,800万部,较去年同期成长约23%。这一增长主要是由于公司推出新产品以及 2020 年以来的需求延迟。

- 零售交易会产生大量资料。组织和其他第三方使用这些资料做出各种明智的业务决策。因此,为了使这些资料可用,公司将资料以结构化或非结构化格式储存在资料仓储中。亚太地区整体零售业的成长也促进了全部区域下一代储存解决方案的成长。

预计中国将占较大份额

- 2020年,中国占据了最大的市场份额,预计在预测期内将保持其主导地位。该国拥有大量中小型组织,需要储存解决方案来满足其业务需求。

- 电子商务在中国变得越来越流行。此外,医疗、教育等各领域的服务数位化正在加速。因此,这些行业也有望为市场公司提供各种成长机会,以扩大基本客群。例如,2021年10月,中国职场应用之一钉钉报告称,用户数量从2021年1月的4亿增加到2021年8月的5亿。

- COVID-19疫情增加了对智慧网路银行服务的需求,传统银行业务面临重大挑战。随着行动烘焙成为零售业务的主要管道,各银行开始建立数位银行模式来获客。根据中国互联网资讯中心统计,中国网路付款用户比例占人口的86.3%。因此,对数位化的日益关注及其在银行业的日益普及也推动了该国下一代储存解决方案的成长。

- 此外,中国是亚太地区资料中心数量最多的国家。据世邦魏理仕称,中国约有 47,000 个资料中心,预计未来几年这一数字将进一步成长。这是由于该国人口众多且技术饱和状态。

亚太地区下一代储存产业概况

亚太地区下一代储存市场竞争激烈,全部区域有多家主要企业,且整合程度适度。市场主要企业包括 Hewlett Packard Enterprise Development LP、Dell Inc.、SAMSUNG、IBM Corporation 和 TOSHIBA CORPORATION。市场开发公司采取多种策略,包括产品开发、併购、联盟与合作。

- 2021 年 2 月 - 东芝公司宣布发表全新 MG09 系列 18TB 硬碟。新型硬碟采用能量辅助磁记录。此外,这些硬碟与许多应用程式和作业系统相容。该公司还透过满足不断增长的资料量驱动的市场需求,帮助储存解决方案架构师和云端规模服务供应商在云端、混合云端和本地机架规模储存中实现更高的储存密度。

- 2021 年 10 月 - DataDirect Networks (DDN) 宣布将在印度本地製造其资料储存解决方案。这项倡议符合该国的 Atmanirbhar Bharat Abhiyaan,随后该公司将向其客户提供「印度製造」的储存产品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 银行业数位化的进步

- 电子商务产业的成长

- 市场限制因素

- 资料安全问题

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按储存系统

- 直接附加储存 (DAS)

- 网路附加储存 (NAS)

- 储存区域网路 (SAN)

- 依储存架构分

- 基于檔案物件的储存 (FOBS)

- 区块储存

- 按最终用户产业

- BFSI

- 零售

- 资讯科技和电讯

- 卫生保健

- 媒体娱乐

- 其他最终用户产业

- 按国家名称

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 亚太地区

第六章 竞争状况

- 公司简介

- Dell Inc.

- HP

- IBM

- NetApp, Inc.

- SanDisk Corporation

- Samsung Electronics

- Toshiba Corporation

- Netgear, Inc.

- Pure storage Inc.

- Hitachi, Ltd

第七章 投资分析

第八章市场展望

The APAC Next Generation Storage Market is expected to register a CAGR of 14.3% during the forecast period.

Key Highlights

- Rapid technological advancements and the increasing volume of unstructured data across different verticals/industries have created the need for secure, reliable, and cost-efficient storage infrastructure in the Asia-Pacific region. In the current scenario, enterprises face challenges posed by the escalating data volumes, velocity, and variety, leading to increased demand for efficient storage solutions.

- Next-generation storage solutions are computing devices used to store, port, and extract data files and objects quickly and efficiently. Moreover, companies are increasingly moving towards using cloud technology for their day-to-day business operations. Humongous amounts of data are generated through the cloud platform that may be required for future reference. Therefore, robust and efficient storage solutions are required by the companies that are anticipated to drive the market growth over the forecast period.

- E-commerce is gaining traction worldwide, and the Asia Pacific region is no expectation to it. The growth in e-commerce activity across the region is also one of the critical factors for the regional market growth. Countries such as China, India, Japan, and South Korea, among others, are the key contributors to the growth of the e-commerce industry across the region. According to the World Economic Forum, e-commerce in China represents more than 50% of the global retail e-commerce sales. Moreover, according to the East Asia Forum, e-commerce sales in China stood at USD 2.3 trillion in 2020. Increasing internet usage for consumer purchases generates large amounts of crucial data, resulting in the increasing adoption of next-generation data storage solutions.

- The Asia-Pacific region presents a significant opportunity for next-generation storage solution vendors. The outbreak of the COVID-19 pandemic has escalated the trend of remote operations and online working. Increased usage of the internet in private and public organizations, as well as by individuals, is creating demand for smart storage solutions. Given the criticality of data generated through the internet, companies are highly inclined to invest in next-generation storage solutions, which is also driving market growth.

- Growth in the Asia-Pacific next-generation storage market is primarily driven by government initiatives to develop and promote digitalization. For instance, in May 2021, the Japanese government announced financial support to companies and municipalities to establish data centers in around five regional cities.

- Further, factors such as the growing demand for data storage in small to medium enterprises (SMEs) and the increasing proliferation of smartphones, laptops, and tablets in the Asia-Pacific region have augmented the demand for a next-generation storage solution.

APAC Next Generation Storage Market Trends

Retail end-use industry is expected to register significant growth

- The retail industry is widely adopting cloud computing, with its investment in cloud technologies increasing rapidly. Like the banking and manufacturing industries, retailers recognize the transformative role of cloud computing in the prevailing digital world.

- Increasing digitalization in the retail industry is also contributing to the growth of the market. Moreover, technologies such as IoT, AI, and ML, are also increasingly adopted by various retailers to transform their business operations and provide enhanced services to their customers.

- The retail industry is witnessing increased competition, with the increased smartphone users prevailing in the Asia Pacific region. The growth of e-commerce due to the rising popularity of smartphones is essentially contributing to online retail sales success. This increase in retail sales via mobiles is driving the e-commerce market on a large scale. As such, the retailers are finding themselves competing in a marketplace that is increasingly dominated by online marketplaces. According to NASSCOM, the e-commerce market in India is expected to register a growth of 5%, with a sales value of more than USD 56 billion in 2021. Moreover, smartphone shipments in India reached 38 million units in Q1 2021, increasing approximately 23% YoY. This growth is primarily driven by new product launches by the companies and delayed demand from 2020.

- A large amount of data is generated from retail transactions. Organizations and other third parties utilize this data to make various informed business decisions. Therefore, to make this data available, companies store the data in the structured or unstructured format in data warehouses. The growth of the overall retail industry in the Asia Pacific region is also contributing to the growth of next-generation storage solutions across the region.

China is expected to hold the major share

- China held the largest share in the market in 2020 and is expected to continue its dominance over the forecast period. The country has a large number of small and medium-sized organizations that require storage solutions for their business needs.

- China has a widespread e-commerce adoption. Also, the digitization of services is accelerating across a variety of sectors that include healthcare and education. Therefore, these industries are also expected to offer various growth opportunities for the market players to expand their customer base. For instance, in October 2021, DingTalk, one of the workplace apps in China, reported that its number of users has increased to 500 million in August 2021 from 400 million in January 2021.

- The COVID-19 pandemic increased demand for intelligent online banking services, and the traditional banking business witnessed significant challenges. With mobile baking being the primary channel for retail businesses, various banks began building digital banking models for customer acquisition. According to the China Internet Network Information Center, the percentage of online payment users accounted for 86.3% of the country's population. Therefore, the increased focus on digitalization in the banking industry and its growing adoption is also supporting the growth of next-generation storage solutions in the country.

- Furthermore, China also houses the most significant number of data centers in the Asia Pacific region. According to CBRE, there are around 47,000 data centers in China, and the number is expected to grow further over the coming years. This is because of the country's massive population and its saturation towards technology.

APAC Next Generation Storage Industry Overview

The Asia Pacific Next Generation Storage market, is competitive and moderately consolidated with several key players across the region. Some of the prominent players in the market include Hewlett Packard Enterprise Development LP, Dell Inc., SAMSUNG, IBM Corporation, and TOSHIBA CORPORATION. The market players are undertaking various strategies such as product development, merger and acquisition, and partnership and collaboration, among others.

- February 2021 - Toshiba Corporation announced the launch of a new MG09 Series of 18TB HDD. The new HDD is equipped with energy-assisted magnetic recording. Moreover, these HDDs are compatible with a large number of applications and operating systems. The company also aims to suffice the market demand due to increased data volumes, thereby helping storage solution designers and cloud-scale service providers achieve higher storage densities for cloud, hybrid-cloud, and on-premises rack-scale storage.

- October 2021 - DataDirect Networks (DDN) announced that the company would be locally manufacturing its data storage solutions in India. This initiative is in line with the nation's Atmanirbhar Bharat Abhiyaan; following which, the company will be delivering "Make in India" storage products to the customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing digitalization across the banking industry

- 4.2.2 Rising e-commerce industry

- 4.3 Market Restraints

- 4.3.1 Data security concerns

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Storage System

- 5.1.1 Direct Attached Storage (DAS)

- 5.1.2 Network Attached Storage (NAS)

- 5.1.3 Storage Area Network (SAN)

- 5.2 Storage Architecture

- 5.2.1 File and Object-based Storage (FOBS)

- 5.2.2 Block Storage

- 5.3 End-User Industry

- 5.3.1 BFSI

- 5.3.2 Retail

- 5.3.3 IT and Telecom

- 5.3.4 Healthcare

- 5.3.5 Media and Entertainment

- 5.3.6 Other End-User Industries

- 5.4 Country

- 5.4.1 Asia Pacific

- 5.4.1.1 India

- 5.4.1.2 China

- 5.4.1.3 Japan

- 5.4.1.4 Rest of Asia Pacific

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dell Inc.

- 6.1.2 HP

- 6.1.3 IBM

- 6.1.4 NetApp, Inc.

- 6.1.5 SanDisk Corporation

- 6.1.6 Samsung Electronics

- 6.1.7 Toshiba Corporation

- 6.1.8 Netgear, Inc.

- 6.1.9 Pure storage Inc.

- 6.1.10 Hitachi, Ltd