|

市场调查报告书

商品编码

1628796

欧洲涡轮发电机:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Turbo Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

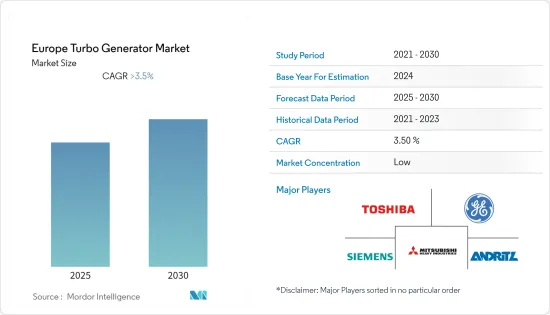

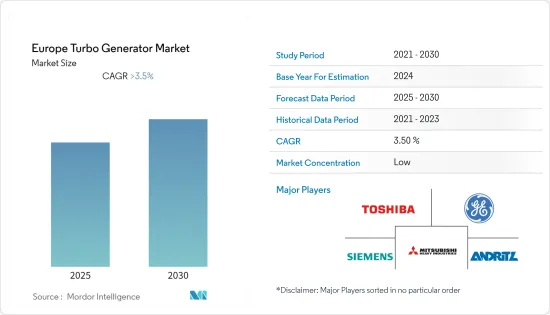

预计欧洲涡轮发电机市场在预测期内将维持3.5%以上的复合年增长率

COVID-19 对 2020 年市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,欧洲能源需求的增加以及发电厂数量的增加预计将在预测期内推动涡轮发电机市场的发展。此外,推动涡轮发电机市场的关键因素是涡轮发电机提供的固有优势、直接连接到发电机的能力以及由此带来的较低营业成本。

- 同时,挑战在于德国和法国等国家正在增加可再生电力的装机并转向清洁能源,以实现社会、经济和环境方面的突破,这预计将抑制所研究市场的成长。

- 儘管如此,西班牙和德国能源密集型产业的扩张预计将为涡轮发电机市场提供重大机会,因为西班牙和德国更喜欢天然气作为燃料而不是煤炭和其他能源。

- 由于工业化的快速发展以及预测期内燃气电厂计划的大幅增加,预计德国将在 2021 年成为欧洲涡轮发电机的领先市场。

欧洲涡轮发电机市场趋势

燃气发电厂主导市场成长

- 2021年,该地区天然气发电量成长4.7%。因此,随着尖峰发电需求的增加,天然气有望成为重要的燃料类型,增加欧洲燃气发电厂的数量。

- 燃气发电厂可以在几分钟内与电网同步。因此,它是一个尖峰负载电厂。因此,尖峰时段电力需求的增加预计将导致燃气发电厂的需求增加。这可能会推动未来涡轮发电机市场的发展。

- 2021年,欧洲天然气发电量达到799太瓦时,比煤炭发电量高出约4.1%。在西班牙,天然气几乎取代煤炭成为能源来源。德国主要消费煤炭和褐煤,大量使用天然气作为能源。

- 此外,英国、德国和法国等国家由于快速工业化而大幅扩张,增加了欧洲燃气发电厂的安装。

- 预计这些发展将在预测期内推动燃气发电厂的发展。

德国引领市场需求

- 德国是涡轮发电机最大的市场之一,经济持续成长,工业化程度不断提高,商业潜力不断增加。此外,德国正在投资燃气发电厂,以减少核能发电厂和燃煤发电厂的发电量。

- 该国是欧洲最大的精製之一,并有多个计划和投资正在建设中,以提高其精製能力。因此,预计德国将在预测期内推动炼油厂对涡轮发电机的需求,并进一步推动涡轮发电机市场。

- 此外,俄乌衝突爆发、俄罗斯天然气供应中断后,俄罗斯重启了多座燃煤电厂,以维护能源安全。

- 2022年10月,德国总理奥拉夫‧萧兹宣布将重启5座褐煤电厂,同时延长3座核能发电厂的寿命。

- 另一方面,可再生能源发电比例的不断增加是成长抑制因素。截至2021年,太阳能装置容量约为5,800万千瓦,风力发电约6,370万千瓦。

- 因此,由于投资增加和即将开展的计划增加了对涡轮发电机的需求,预计德国将在预测期内成为最大的市场。

欧洲涡轮发电机产业概况

欧洲涡轮发电机市场部分分散。主要公司包括西门子公司、东芝公司、通用电气公司、三菱重工有限公司和安德里茨公司(排名不分先后)。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 研究假设和市场定义

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按最终用户

- 燃煤发电厂

- 燃气发电厂

- 核能发电厂

- 其他最终用户

- 按地区

- 德国

- 英国

- 法国

- 其他欧洲国家

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Toshiba Corporation

- General Electric Company

- Siemens AG

- Andritz AG

- Mitsubishi Heavy Industries Ltd

- Ansaldo Energia SpA

- Kawasaki Heavy Industries Ltd

- Centrax Gas Turbines Limited

- MAN Energy Solutions

- Doosan Power Systems

第七章 市场机会及未来趋势

简介目录

Product Code: 54420

The Europe Turbo Generator Market is expected to register a CAGR of greater than 3.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing energy demand in Europe which increased the number of power plants, is expected to drive the turbo generator market during the forecast period. Moreover, the major factors driving the turbo generator market are the inherent advantages that turbo generators provide, the ability to be connected directly to the electrical generator, and the resulting lower operating costs.

- On the other hand, the challenges are that countries such as Germany and France are moving toward clean energy, with the increased installation of renewable power capacity to achieve social, economic, and environmental development, which, in turn, is expected to restrain the growth of the market studied.

- Nevertheless, the expansion of energy-intensive industries preferring gas as a fuel over coal and other energy resources in Spain and Germany is expected to provide a significant opportunity for the turbo generator market.

- Germany was expected to be the leading market for turbo generators in the European region in 2021, owing to rapid industrialization and a significant increase in gas-fired power plant projects during the forecast period.

Europe Turbo Generator Market Trends

Gas-fired Power Plants to Dominate the Market Growth

- In 2021, the electricity generation from natural gas as fuel recorded a growth rate of 4.7% in the region. Thus, with an increase in the demand for a peak power source, natural gas is expected to be the significant fuel type, thereby promulgating the number of gas-fired power plants in Europe.

- The gas-fired power plants can be synchronized with the electricity grid within minutes. This makes it a peak-load power plant. Therefore, increasing demand for peak power is expected to pose an increased requirement for gas-fired power plants. This, in turn, is likely to drive the market for turbo generators in the future.

- In 2021, Europe's electricity from natural gas amounted to 799 TWh, which was about 4.1% more than coal. In Spain, gas has almost overtaken coal as an energy source. Germany, primarily a coal and lignite consumer, has significantly used gas as a power source.

- Moreover, in countries such as the United Kingdom, Germany, and France, there has been a significant expansion due to rapid industrialization, which has increased the installation of gas-fired power plants in Europe.

- These development are expected to drive the gas-fired power plants during the forecast period.

Germany to Drive the Market Demand

- Germany is one of the largest markets for turbo generators, with consistent economic growth, growing industrialization, and improving business potential. Moreover, Germany has been investing in gas-fired power plants, in order to reduce power production from nuclear and coal-fired power plants.

- The country is one of the biggest crude oil refiners in Europe, with several upcoming projects and investments to increase refining capacity. Therefore, Germany is expected to drive the demand for turbo generators in refineries, and further promulgate the turbo generators market during the forecast period.

- Additionally, after the outbreak of the Russia-Ukraine conflict leading to a supply disruption of Russian gas, the country has reopened several coal power plants in order to maintain energy security.

- In October 2022, German Chancellor Olaf Scholz announced that Germany was reopening five power plants that burn lignite, while extending the lives of three of its nuclear power plants.

- On the other hand, increasing share of renewable energy in the electricity generation mix is epxetcd to restraint the market growth in the country. As of 2021, solar energy installed capacity stood at around 58 GW and wind energy stood at around 63.7 GW.

- Therefore, with the increased investments and upcoming projects that increase the demand of turbo-generators, Germany is expected to be the largest market during the forecast period.

Europe Turbo Generator Industry Overview

The European turbo generator market is partially fragmented. Some of the key players are (in no particular order) Siemens AG, Toshiba Corporation, General Electric Company, Mitsubishi Heavy Industries Ltd, and Andritz AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Coal-fired Power Plant

- 5.1.2 Gas-fired Power Plant

- 5.1.3 Nuclear Power Plant

- 5.1.4 Other End Users

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Toshiba Corporation

- 6.3.2 General Electric Company

- 6.3.3 Siemens AG

- 6.3.4 Andritz AG

- 6.3.5 Mitsubishi Heavy Industries Ltd

- 6.3.6 Ansaldo Energia SpA

- 6.3.7 Kawasaki Heavy Industries Ltd

- 6.3.8 Centrax Gas Turbines Limited

- 6.3.9 MAN Energy Solutions

- 6.3.10 Doosan Power Systems

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219