|

市场调查报告书

商品编码

1629773

涡轮发电机:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Turbo Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

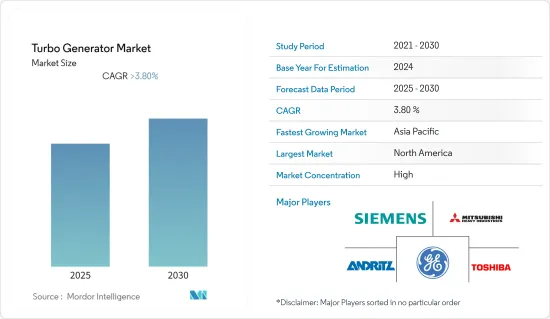

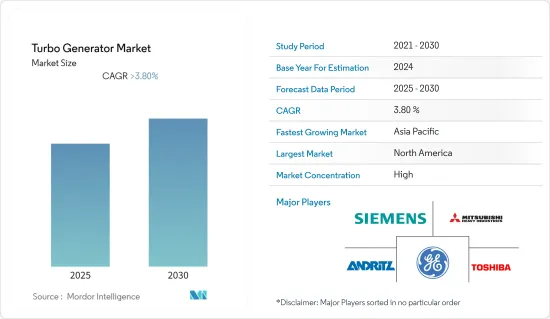

预计涡轮发电机市场在预测期内复合年增长率将超过 3.8%

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,发电厂投资和不断增长的能源需求预计将推动市场成长。

- 另一方面,可再生能源发电设备安装量的增加预计将阻碍预测期内涡轮发电机市场的成长。

- 尼日利亚、安哥拉和加纳等非洲国家能源密集型产业的扩张可能会在预测期内为涡轮发电机市场创造利润丰厚的成长机会。

- 亚太地区在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长归因于印度、中国和日本等该地区国家对电力需求的增加和工业基础设施的扩张。

涡轮发电机市场趋势

燃气发电厂主导市场

- 2021年,以天然气为燃料的发电量较2020年增加2.3%。因此,随着尖峰发电需求的增加,天然气有望成为重要的燃料类型并带动燃气发电厂的数量。

- 2021年,全球化石能源来源发电总合将超过4.4兆瓦。煤炭仍然是世界上最重要的发电来源,其次是天然气。

- 燃气发电厂可在几分钟内与电网同步。因此,它是一个尖峰负载电厂。因此,尖峰时段电力需求的增加预计将导致燃气发电厂的需求增加。这可能会在不久的将来推动涡轮发电机市场的发展。

- 北美天然气生产的主要热点是二迭纪、阿巴拉契亚、马塞勒斯和尤蒂卡蕴藏量。二迭纪和阿巴拉契亚山脉预计将占北美天然气供应的55%。

- 马塞勒斯和尤蒂卡的供应量预计将占北美天然气供应总量的约 40%。因此,增加天然气产量也是推动燃气电厂发展的重要因素之一。

- 由于这些发展,预计该细分市场将在预测期内占据主导地位。

亚太地区实现显着成长

- 由于持续的经济成长、工业化程度的提高和商业潜力的增加,亚太地区是涡轮发电机成长最快的市场之一。

- 中国消耗了世界能源需求的四分之一以上。此外,虽然该国的能源产量不断增加,但消费量预计也会增加。这一增幅远高于全球能源生产和消费预计分别成长 29% 和 31%。由于能源需求的增加,预计该国将长期引领涡轮发电机市场。

- 2022年2月,中国东部沿海的浙江省核准兴建一座耗资11亿美元、装置容量为2吉瓦(GW)的新燃煤发电厂。国家消费电子网路公司预计2021年至2025年期间将新增15万千瓦燃煤发电厂,总合为1,230万千瓦。

- 2022年9月,印度电力部长宣布计画在2030年新增约56吉瓦燃煤发电能力,以满足不断增长的电力需求。预计这将推动所研究市场的成长。

- 据美国能源情报署称,未来两年(2023年)中国将新增超过200万桶/日的新增产能。计划,揭阳计画于2022年终投产,玉龙计划计画于2023年投产。预计这将增加炼油厂对涡轮发电机的需求,并在预测期内进一步扩大涡轮发电机市场。

- 在亚太地区,中国是最具主导地位的国家之一,预计将推动涡轮发电机市场的发展。同时,印度、日本、中国、澳洲和马来西亚等国家预计将跟随这一趋势,在预测期内增加涡轮发电机市场的需求。

汽轮发电机产业概况

涡轮发电机市场适度整合。市场的主要企业(排名不分先后)是西门子公司、东芝公司、通用电气公司、三菱重工有限公司和安德里茨公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 最终用户

- 燃煤发电厂

- 燃气发电厂

- 核能发电厂

- 其他的

- 冷却型

- 风冷

- 氢冷却

- 水氢冷却

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Toshiba Corporation

- General Electric Company

- Siemens AG

- Dongfang Electric Corporation Limited

- Andritz AG

- Bharat Heavy Electricals Limited

- Harbin Electric Company Limited

- Mitsubishi Heavy Industries Ltd

- Ansaldo Energia SpA

- Wartsila Oyj Abp

第七章 市场机会及未来趋势

简介目录

Product Code: 56448

The Turbo Generator Market is expected to register a CAGR of greater than 3.8% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investment in power plants and energy demand is expected to drive the market's growth.

- On the other hand, increased installation of renewable power capacity is expected to hamper the growth of the turbo generator market during the forecast period.

- Nevertheless, the expansion of energy-intensive industries in African countries, such as Nigeria, Angola, and Ghana, is likely to create lucrative growth opportunities for the Turbo Generator Market in the forecast period.

- The Asia-Pacific region dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing demand for power, and the expansion of industrial infrastructure in the countries of this region, including India, China, and Japan.

Turbo Generator Market Trends

Gas-fired Power Plants to Dominate the Market

- In 2021, the electricity generated from natural gas as fuel recorded a growth rate of 2.3% compared to 2020. Thus, with an increase in demand for a peak power source, natural gas is expected to be the significant fuel type and promulgate the number of gas-fired power plants.

- In 2021, electricity generation from fossil-based energy sources worldwide had a combined power capacity of over 4.4 terawatts. Coal is still the most significant source of electricity generation worldwide, followed by natural gas.

- The gas-fired power plants can be synchronized with an electricity grid within minutes. This makes it a peak-load power plant. Therefore, the increasing demand for peak power is expected to pose an increased requirement for gas-fired power plants. This, in turn, is likely to drive the market for turbo generators in the near future.

- The major hotspots for natural gas production in North America include the Permian, Appalachian, Marcellus, and Utica reserves. The Permian and Appalachian are expected to account for 55% of the natural gas supply in North America.

- The supply from Marcellus and Utica is expected to account for around 40% of the total natural gas supply in North America. Therefore, the rising production of natural gas is also one of the significant factors proliferating the development of gas-fired power plants.

- On account of such developments, the segment is expected to dominate in the forecast period.

Asia-Pacific to Witness a Significant Growth

- Asia-Pacific is one of the fastest-growing markets for turbo generators, with consistent economic growth, growing industrialization, and improving business potential.

- China consumes more than a quarter of the world's energy demand. Moreover, it is projected that the country's energy production will rise while consumption is also estimated to grow. The increase is much more than the global forecast energy production and consumption growth of 29% and 31%, respectively. The country is expected to lead the market for turbo generators in the long term due to its growing energy demand.

- In February 2022, Zhejiang's eastern Chinese coastal province approved the construction of a new USD 1.10 billion coal-fired power plant with 2 gigawatts (GW) of generating capacity. The State Grid Corporation expects another 150 GW of new coal-fired power capacity to be built over the 2021-2025 period, bringing the total to 1,230 GW.

- In September 2022, India's Power Minister announced plans to add about 56 GW of coal-fired generation capacity by 2030 in order for the country to meet the growing demand for electricity. This is expected to boost the growth of the market studied.

- According to Energy Information Agency, China will add more than 2.0 million bpd (barrels per day) of new capacity over the next two years (2023). For instance, the Jieyang project is expected to commence operations by end of 2022, and the Yulong project is expected to begin operations in 2023. This, inturn is expected to drive the demand for turbo generators in refineries, and further promulgating the turbo generators market during the forecast period.

- In Asia-Pacific, China is one of the most dominant countries, and it is expected to drive the turbo generator market. Whereas, countries, such as India, Japan, China, Australia, and Malaysia, are expected to follow the trend and augment the demand for turbo generator market, during the forecast period.

Turbo Generator Industry Overview

The Turbo Generator Market is moderately consolidated. Some key players in this market (in no particular order) are Siemens AG, Toshiba Corporation, General Electric Company, Mitsubishi Heavy Industries Ltd, and Andritz AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Coal-fired Power Plant

- 5.1.2 Gas-fired Power Plant

- 5.1.3 Nuclear Power Plant

- 5.1.4 Other End Users

- 5.2 Cooling Type

- 5.2.1 Air Cooled

- 5.2.2 Hydrogen Cooled

- 5.2.3 Water-hydrogen Cooled

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Toshiba Corporation

- 6.3.2 General Electric Company

- 6.3.3 Siemens AG

- 6.3.4 Dongfang Electric Corporation Limited

- 6.3.5 Andritz AG

- 6.3.6 Bharat Heavy Electricals Limited

- 6.3.7 Harbin Electric Company Limited

- 6.3.8 Mitsubishi Heavy Industries Ltd

- 6.3.9 Ansaldo Energia SpA

- 6.3.10 Wartsila Oyj Abp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219