|

市场调查报告书

商品编码

1628810

资料中心自动化:市场占有率分析、产业趋势、成长预测(2025-2030)Data Center Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

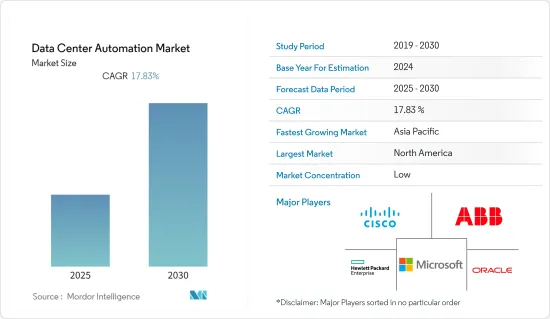

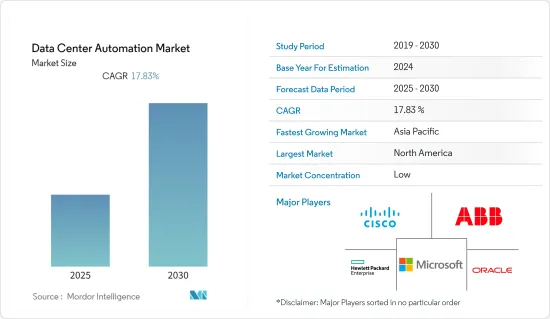

资料中心自动化市场预计在预测期内复合年增长率为17.83%

主要亮点

- 社交网路、分析、云端运算和行动运算的蓬勃发展预计将对资料中心自动化需求产生积极影响。产生的资料中约 80% 是非结构化资料,包括来自部落格和社交媒体平台等各种来源的原始音讯、文件和文字。

- 分析巨量资料需要简单性。然而,手动处理大量资料会导致很高的错误机率。因此,自动化在资料中心中发挥关键作用,预计将在预测期内推动市场成长。

- 拥有和经营资料中心的公司聘请第三方来接管资料中心的管理。同时,我们将尽可能多的流程保留在内部。作为託管服务的替代方案,自动化可以透过优化流程来消除错误、节省时间并降低成本。

- 根据经济合作暨发展组织(OECD) 和各种资讯来源的数据,在 COVID-19 大流行期间,互联网使用量增加了 60%,由于物联网 (IoT) 和视频,资料中心需求不断增加据说串流媒体服务的需求增加。

资料中心自动化市场趋势

云端运算和线上应用程式的成长

- 数位化显着增加了资料生成的数量和速度。资料中心自动化的关键驱动因素是大型和小型企业越来越多地采用云,面对加速创新和竞争颠覆,需要敏捷性和灵活性。

- 资料流量的增加是支撑云端资料储存需求的主要因素。随着物联网在全球的传播,设备的连接性也不断增强。因此,累积了大量的资料。

- 根据思科估计,全球有超过 500 亿台智慧连网设备。分析从此类设备收集的资料可以产生客户交易模式并帮助企业了解消费者趋势。

- 近年来,云端的采用显着成长,最近的 COVID-19 大流行进一步加速了这一趋势,加速了全球数位技术的采用。根据 IBM 报告,单一生产车间每月产生超过 2,200 Terabyte的资料,单一生产线每天产生超过 70 Terabyte的资料。然而,大多数资料仍未被分析和保护。因此,企业正在转向云端储存来保护和利用这些资料。

- 此外,IBM 报告称,大约 90% 的资料是在过去两年中产生的。海量资料的产生正在推动企业对低成本资料备份和储存的需求。根据分析,在预测期内,资料中心自动化市场将出现庞大的商机。

- 自动化资料中心管理提供了集中管理方法。自动化资料中心管理可以建立日誌储存库、追踪变更并审核使用者活动。因此,您将收到诈欺的活动的即时通知。资料中心自动化可让企业自动建立报告、图形、图表和其他视觉效果。报告、图表和图形中的自动资料显示可实现更快、更轻鬆的解释和更准确的见解。

北美市场领先

- 北美地区预计将占据很大的市场占有率,因为该地区有多家主要企业,无论最终用户的行业如何,先进技术都在快速引入。预计北美将在整个预测期内保持其主导地位。此外,新技术的早期采用、云端基础方案研发的大量投资以及IT基础设施的增强也有望进一步推动市场成长。

- 市场投资的主要驱动力是新技术的持续发展和应用,这些技术释放了以前被认为是商业性的容量。随着该国对医疗保健、零售、通讯和製造业的持续投资,云端基础的解决方案市场预计将在预测期内显着成长。

- 该国已采取多项措施来实现基础设施现代化。为了实现这一目标,美国计划斥资高达2.49亿美元部署私有云端运算服务和资料中心。通用动力公司、惠普和诺斯罗普格鲁曼公司是陆军私有云端合约选定的服务供应商之一,它们提供使用安全私有云端整合资料中心的云端运算服务。

- 在美国,云端运算的引进进展迅速,国内资料中心的数量也随之增加。根据瑞士信贷统计,美国目前拥有全球最多的超大规模资料中心,占全国所有超大规模资料中心的三分之一以上。该地区资料中心自动化领域正在出现重大商机。

资料中心自动化产业概况

资料中心自动化市场高度分散,因为有许多公司提供服务。一些主要的云端和人工智慧服务供应商也提供资料自动化作为配套服务,这也导致了市场碎片化。主要企业包括Oracle、富士通、惠普和微软。近期市场主要趋势如下:

- 2022 年 8 月 - ABB 和 ATS Global 签署了一份谅解备忘录 (MoU) 协议,以扩大 ABB 能力资料中心自动化 (DCA) 市场。总部位于荷兰的ATS World已获得全球系统整合商(GIS)称号。我们将与 ABB 合作,共用资源和专业知识,并利用我们的资料中心评估潜在客户合作伙伴关係的效益和效率,以发展双方的业务。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 云端运算和线上应用程式的成长

- 能源和成本效率问题

- 市场限制因素

- 储存限制是市场成长的挑战

第六章 市场细分

- 按解决方案

- 伺服器

- 资料库

- 网路

- 其他解决方案

- 依资料中心类型

- 1层级

- 2层级

- 3层级

- 4层级

- 按发展

- 本地

- 云

- 按最终用户产业

- BFSI

- 卫生保健

- 零售

- 製造业

- 资讯科技/通讯

- 按行业分類的其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- BMC Software Inc.

- EntIT Software LLC

- ABB Limited

- Hewlett Packard Enterprise Company

- Dell Inc.

- Oracle Corporation

- Fujitsu Ltd

- Microsoft Corporation

- VMware Inc.

- Brocade Communications Systems

- Citrix Systems Inc.

- Service Now Inc.

- Chef Software Inc.

第八章 市场机会及未来趋势

第九章投资分析

简介目录

Product Code: 54894

The Data Center Automation Market is expected to register a CAGR of 17.83% during the forecast period.

Key Highlights

- The boom in social networking, analytics, cloud computing, and mobile computing is projected to positively impact the need for data center automation. Approximately 80% of the data generated is unstructured, containing raw audio, file, or text from various sources, such as blogs and social media platforms.

- Big Data needs to be concise to be analyzed. However, manually handling an enormous amount of data would lead to a high probability of error. Thus, automation plays a vital role in data centers by performing looked-for tasks, which is expected to drive market growth during the forecast period.

- The market includes several opportunities as the company that owns and operates a data center hires third parties to take over data center management. At the same time, they keep as many processes in-house as possible. As an alternative to managed services, automation can eliminate errors, save time, and optimize the processes for better cost-savings

- The Organisation for Economic Co-operation and Deployment (OECD) and various sources claim that during the COVID-19 pandemic, internet usage increased by as much as 60% and that demand for data centers increased as a result of the internet of things (IoT) and video streaming services.

Data Center Automation Market Trends

Growth in Cloud Computing and Online Applications

- Digitization significantly increased the volume and speed of data generation. The primary driver for data center automation is the increase in cloud adoption across both big and small businesses, which is the need for agility and flexibility in the face of accelerating innovation and disruptions from competitors.

- Increased data traffic was the main underlying factor responsible for the demand for cloud data storage. With an increase in IoT adoption worldwide, device connectivity is also growing. Hence, there is an accumulation of vast piles of data.

- As per estimates by Cisco, there are over 50 billion smart connected devices in the world. The data collected from such devices can be analyzed to generate customer transaction patterns and help companies understand the propensity of their consumers.

- In recent years, cloud adoption significantly grew, and with the recent COVID-19 pandemic, which accelerated digital technologies adoption globally, the trend was further fueled. According to a report by IBM, a single manufacturing site can generate more than 2,200 terabytes of data in one month, and a single production line can generate more than 70 terabytes per day-yet most data remain unanalyzed and unsecured. Therefore, companies are moving to cloud storage to secure and utilize this data.

- Also, IBM reported that approximately 90% of the data was generated in the last two years. Due to the massive data generation, there is an increasing demand for low-cost data backup/storage across enterprises. It is analyzed to create significant opportunities for the data center automation market during the forecast period.

- A centralized control method is offered by automated data center management. It can build a log repository for tracking modifications and auditing user activity. Thus, real-time notifications are sent out for any unauthorized activity. Businesses can automate the production of reports and visuals like graphs and charts attributable to data center automation. Automatic data display in reports, charts, and graphs allow for quicker, more straightforward interpretation and more precise insights.

North America to Lead the Market

- With multiple prominent players in the region and the early adoption of advanced technologies across several end-user verticals, the North American region is expected to hold a significant market share. It will continue its dominance throughout the forecast period. Moreover, early adoption of newer technologies, significant investments in R&D for cloud-based solutions, and enhanced IT infrastructure are also anticipated to drive market growth further.

- A significant driver behind the investments in the market is the continuous evolution and new technology applications to unlock volumes that were previously considered non-commercial. With an investment series across healthcare, retail, communications, and manufacturing applications in the country, the market for cloud-based solutions is expected to witness significant growth over the forecast period.

- The country made multiple efforts to modernize its infrastructure. To achieve this, the US Army planned to spend up to USD 249 million to deploy private cloud computing services and data centers. General Dynamics, HP, and Northrop Grumman were among the service providers selected for the Army Private Cloud contract, providing cloud computing services to consolidate data centers using a secure private cloud.

- In the United States, cloud-based computing adoption is increasing rapidly, owing to which the data centers in the country are also witnessing an increase. According to Credit Suisse, the United States currently accounts for the highest number of hyperscale data centers worldwide, holding more than one-third of the total hyperscale data centers in the country. It creates significant opportunities for data center automation in the region.

Data Center Automation Industry Overview

The data center automation market is highly fragmented due to many players offering the service. Some major players who offer cloud and AI services also offer data automation as a bundled service, another reason for the fragmentation of the market. Some key companies in the firm include Oracle, Fujitsu, HP, and Microsoft, among others. Some key recent developments in the market include:

- August 2022- ABB and ATS Global have established a Memorandum of Understanding (MoU) agreement to expand the ABB Ability Data Center Automation (DCA) market. With its headquarters in the Netherlands, the business earned the Global System Integrator (GIS) title. It will cooperate with ABB to pool resources and expertise, evaluate the benefits and efficiency of potential customer alliances using data centers, and expand each party's businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Covid-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Cloud Computing and Online Applications

- 5.1.2 Energy and Cost Efficiency Concerns

- 5.2 Market Restraints

- 5.2.1 Limitation in Storage to Challenge the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Server

- 6.1.2 Database

- 6.1.3 Network

- 6.1.4 Other Solutions

- 6.2 By Data Center Type

- 6.2.1 Tier 1

- 6.2.2 Tier 2

- 6.2.3 Tier 3

- 6.2.4 Tier 4

- 6.3 By Deployment Mode

- 6.3.1 On-premise

- 6.3.2 Cloud

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Manufacturing

- 6.4.5 IT and Telecom

- 6.4.6 Other End-user Verticals

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 BMC Software Inc.

- 7.1.3 EntIT Software LLC

- 7.1.4 ABB Limited

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 Dell Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 Fujitsu Ltd

- 7.1.9 Microsoft Corporation

- 7.1.10 VMware Inc.

- 7.1.11 Brocade Communications Systems

- 7.1.12 Citrix Systems Inc.

- 7.1.13 Service Now Inc.

- 7.1.14 Chef Software Inc.

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 INVESTMENT ANALYSIS

02-2729-4219

+886-2-2729-4219