|

市场调查报告书

商品编码

1628811

赌场管理系统 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Casino Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

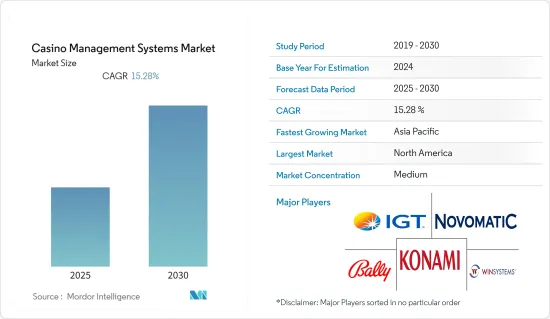

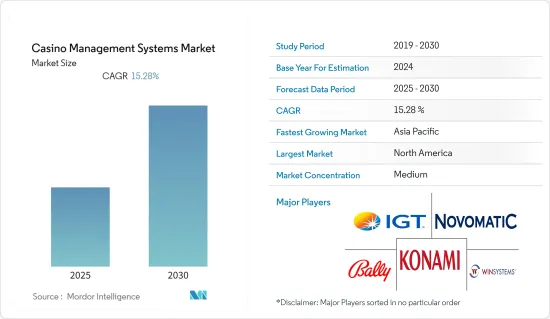

赌场管理系统 (CMS) 市场预计在预测期内复合年增长率为 15.28%

主要亮点

- 用于管理赌场的系统由用于监控玩家、分析玩家活动、处理资金和会计、管理安全和监视或这些的混合的硬体和软体组成。赌场需要复杂的软体和硬体基础设施,不仅可以追踪运营,还可以在整个工作过程中保持顺畅的流程。主要目的是玩家追踪、活动分析以及持续的安全和监控。这些是赌场执行的一些最重要的业务,也是市场成长机会的主要驱动力。

- 此外,新兴经济体的大部分经济依赖旅游业,这鼓励了赌场的出现。这是因为政府现在允许赌场开设商店,以吸引更多跨境人群,赌场和政府都可以享受到相互接受的好处,这可以是一个乐观的场景。基于区块链成熟度模型(BMM),政府区块链协会(GBA)独立审查了AXES.ai 的实体赌场管理平台,并于2023 年4 月将其认可为1 级可信任区块链解决方案。

- 赌场管理系统监控金融活动,确保遵守赌博规则,并向监管机构提供准确的报告。因此,这些系统整合了多种技术,包括脸部辨识、车牌盘式分析仪和其他分析,以帮助营运商阻止游戏俱乐部楼层的诈骗、窃盗和诈欺行为。提供赌场管理系统的公司一直在寻找融入新技术和改进的方法。预计这将为市场进一步成长提供各种有利可图的机会。

- 然而,线上赌场的兴起和日益严格的法规环境可能会成为限制整个预测期内整体市场成长的问题。

- COVID-19 大流行对赌场业产生了负面影响。 COVID-19 大流行对实体赌场业产生了负面影响,许多国家政府实施的旅行限制导致赌场、彩票和其他赌博设施关闭。然而,在后COVID-19市场场景中,由于人工智慧(AI)、机器学习和生物识别等技术的发展,市场预计将出现巨大的成长机会。

赌场管理系统市场趋势

游戏产业的成长推动市场成长

- 随着赌博业对各种先进技术的需求激增,对赌场管理系统的需求也预计会增加。很快,合法性的提高和博彩设施数量的增加预计将成为行业成长的主要推动力。此外,由于世界各地游戏俱乐部的增加,赌场管理系统市场正在扩大。

- 无线技术和线上赌博的发展也为赌场产业带来了进一步的前景。简而言之,赌场度假村需要各种零售商为其提供管理和营运设施所需的软体。

- 这就是为什么需要一个中央管理系统来与现代赌场单元中常见的最佳作业系统互动并收集重要资料。网路游戏、广告亭、体育和赛马书籍、RFID 桌子监控、老虎机票务、无现金游戏和宾果游戏只是可能与赌场管理软体整合的一些应用程式。

- 例如,2022 年 10 月,International Game Technology PLC 宣布其子公司 IGT Global Solutions Corporation 与乔治亚彩票公司签订了为期七年的协议,主要目的是部署世界一流的彩票和 iLottery 产品和技术。续约合约。作为合约延期的一部分,IGT 将在 10,000 多个 POS 零售终端上安装无现金功能,允许玩家使用签帐金融卡购买彩票。

- 此外,随着博彩业和赌场度假村的发展,赌场和游戏开发商有更多机会,从而扩大了其国内和国际分销管道。

北美市场实现压倒性成长

- 线上赌博业正在北美迅速扩张。许多玩家被线上赌场所吸引,因为它们的可访问性和易用性。为了利用这个不断扩大的行业,许多传统赌场也推出了线上平台。北美历来允许多种赌博选择,对非法赌博也有相当大的容忍度。

- 在美国获得许可和管理的赌场必须制定适当的系统和程序,以确保玩家和赌徒在出现赌博相关问题(无论是线下还是线上)时得到治疗和支持。儘管美国有许多离线或实体赌场,但它们是唯一在特定州获得许可并经营的赌场,因此能够向消费者提供合法的线上赌博服务。

- 赌场越来越重视分析,以相互竞争并吸引更多客户,因为竞争比以往任何时候都更加激烈,机壳也越来越多。对资料库仓储技术的投资增加和忠诚卡的大量使用现在记录了大多数客户交易。大量美国公民经常去赌场购买彩票、玩拉霸机和赌桌游戏。

- 2023 年 4 月,International Game Technology PLC 宣布最近在威斯康辛州瓦贝诺的 Potawatomi Casino Hotel Carter 完成了 IGT Advantage 赌场管理系统 (CMS) 的安装。 CMS 将使 Potawatomi Casino Hotel Carter 的客人能够享受前瞻性的游戏体验,并受益于与姊妹酒店 Potawatomi Casino Hotel 相关的忠诚度奖励计划。

赌场管理系统产业概况

在赌场管理系统市场,来自世界各地和区域市场的玩家正在争夺客户的注意力。该行业适度分散,随着本地 CMS 参与者的发展以及弹性价格设定模式的使用加剧了市场竞争。市场主要企业包括 International Game Technology PLC、Novomatic AG、Bally Technologies Inc.、Konami Gaming Inc. 等。

- 2022 年 11 月 - International Game Technology PLC 宣布其子公司 IGT Canada Solutions ULC 已与 Loto-Quebec 签署了一份为期五年的延期合同,主要提供智能视频彩票中央系统软体,包括改进的网络诊断和资料分析。它还支援游戏标准协会的游戏到系统(G2S)标准通讯协定,具有增强的玩家用户介面、令人兴奋的多级神秘大奖(Vault Breaker)、改进的负责任游戏功能、无现金、为玩家中心提供附加功能。

- 2022 年 10 月 - International Game Technology PLC 宣布在拉斯维加斯 OYO 酒店及赌场开设「财富之轮老虎机区」。该区域的特色游戏包括动画「财富之轮 4D 珍藏版」和「财富之轮 Cash Link 2」视讯老虎机。该区域还拥有 IGT 最大的橱柜——命运之轮巨型塔。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

- 市场驱动因素

- 国际观光蓬勃发展

- 游戏产业的成长

- 市场挑战

- 线上赌场的兴起

- 严格的法规环境

第五章市场区隔

- 目的

- 会计处理

- 安全和监视

- 饭店管理

- 分析

- 玩家追踪

- 媒体管理

- 行销和推广

- 按最终用户

- 中小型赌场

- 大型赌场

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争状况

- 公司简介

- International Game Technology PLC

- Novomatic AG

- Bally Technologies Inc.

- Konami Gaming Inc.

- Winsystems Inc.

- TCS John Huxley

- Aristocrat Leisure Limited

- Apex Gaming Technology

- MICROS Systems Inc.(变更为 Oracle Hospitality)

- Agilysys

- Amatic Industries GmbH

- Bluberi Gaming Technologies Inc.

- Decart Ltd.

第七章 投资分析

第八章 市场机会及未来趋势

The Casino Management Systems Market is expected to register a CAGR of 15.28% during the forecast period.

Key Highlights

- Systems for managing casinos may comprise hardware and software to monitor players, analyze player activity, handle money and accounting, manage security and surveillance, or a mix of these. Casinos need sophisticated software and hardware infrastructure to keep track of operations as well as to maintain a smooth flow throughout the entire working method. The main goals are tracking players, analyzing activity, and ongoing security and surveillance. These are some of the duties that casinos perform that are of the utmost importance, driving the market's growth opportunities significantly.

- Moreover, in developing countries, the reliance on tourism for a significant chunk of the economy has boosted the emergence of casinos. This is because governments now permit casinos to set up shops to attract a large crowd from across borders, which can result in an optimistic scenario for both the casinos and the government as they reap the benefits of mutual acceptance. In accordance with the Blockchain Maturity Model (BMM), the Government Blockchain Association (GBA) independently examined and classified AXES.ai's land-based casino management platform as a Level One Trusted Blockchain Solution in April 2023, making it the first blockchain solution.

- Casino management systems monitor financial activities, assure adherence to gambling rules, and offer precise reporting to regulatory organizations. Hence, to help operators stop fraud, theft, and cheating on the gaming club floor, these systems integrate numerous technologies, including facial recognition, license plate readers, and other analytics. Companies that provide casino management systems always look for ways to improve and incorporate new technology. This is expected to bring various lucrative opportunities for the market to grow further.

- However, the rise of online casinos as well as the rise in the stringent regulatory environment could be a matter of concern that could limit the market's overall growth throughout the forecast period.

- The COVID-19 pandemic has negatively impacted the casino industry. It had harmed the land-based casino industry; the stay-at-home restrictions imposed by governments across many countries led to closing of casinos, lottery, and other gambling venues. However, in the post-COVID-19 market scenario, the market is expected to witness significant growth opportunities due to the rising developments in technologies like artificial intelligence (AI), machine learning, and biometrics.

Casino Management Systems Market Trends

Growth of Gaming Industry drives the market growth

- The demand for casino management systems is anticipated to increase as the gambling industry's need for various advanced technologies soars. Shortly, it is expected that growing legality and an increase in gaming establishments will be significant drivers of industry growth. Additionally, the market for casino management systems is expanding because of the rise in gaming clubs worldwide.

- The development of wireless technology and online gambling has also given the casino sector additional prospects. In essence, a casino resort needs a variety of retailers to supply the required software for the management and operation of the facilities.

- Therefore, a single central management system is necessary to interface with and gather vital data from the best operational systems often found in contemporary casino units. Internet gaming, advertising kiosks, sports and racebooks, RFID table monitoring, slot ticketing, cashless gaming, and bingo are just a few applications that are likely to be integrated with casino administration software.

- For Instance, in October 2022, International Game Technology PLC announced its subsidiary, IGT Global Solutions Corporation, signed a seven-year contract extension agreement with the Georgia Lottery Corporation mainly to deploy its world-class lottery and iLottery products and technology. As part of the contract extension, IGT would install cashless functionality on more than 10,000 point-of-sale retail terminals, allowing players to purchase lottery with a debit card.

- Moreover, with the growth of the gaming industry and casino resorts, casino, and game developers are achieving more opportunities and thus expanding the prevailing channels domestically and internationally.

North America to Witness the Dominant Market Growth

- In North America, the industry of online gambling has been expanding rapidly. A significant amount of gamers have been attracted to online casinos by their accessibility and ease. To take advantage of this expanding industry, many conventional casinos have also launched online platforms. Numerous gambling options were historically permitted in North America, and there was a fair amount of tolerance for illegal gaming.

- All U.S.-licensed and controlled casinos, both offline and online, must have systems and procedures that can and will aid players and gamblers in receiving treatment and support if they have gambling-related difficulties. There are a lot of offline or land-based casinos in the United States, but only those will be allowed to provide their consumers with legal online gambling services since they are licensed and run in specific states.

- Casinos are putting a significant emphasis on analytics to compete with one another and make sure they attract more customers in light of the increased competition and more housing than previously. Most customer transactions are recorded owing to growing investments in database warehousing technologies and the mass usage of loyalty cards. Numerous U.S. citizens frequently purchase lottery tickets and go to casinos to play slot machines and table games.

- In April 2023, International Game Technology PLC declared that it recently had completed an installment of the IGT ADVANTAGE casino management system (CMS) at Potawatomi Casino Hotel Carter in Wabeno, Wisc. The CMS would allow Potawatomi Casino Hotel Carter guests to enjoy future-forward gaming experiences and reap the benefits of a loyalty rewards program linked with the sister property Potawatomi Casino Hotel.

Casino Management Systems Industry Overview

Players from around the world and regional markets compete for customer's attention in the casino management systems market. The industry is moderately fragmented, and the development of local CMS players and the use of flexible pricing models have increased market rivalry. The major players in the market are International Game Technology PLC, Novomatic AG, Bally Technologies Inc., and Konami Gaming Inc., among others.

- November 2022 - International Game Technology PLC has declared subsidiary, IGT Canada Solutions ULC, has signed a five-year contract extension with Loto-Quebec mainly to deliver an enhanced version of its INTELLIGENT video lottery central system software and related components, which includes improved network diagnostics and data analytics. It also supports the Gaming Standards Association's Game to System (G2S) standard protocol, which allows an enhanced player user interface, exciting multi-level mystery jackpots (Vault Breaker), improved responsible gaming features, cashless and additional player-centric functionality.

- October 2022 - International Game Technology PLC has declared the Wheel of Fortune Slots Zone launch at the OYO Hotel & Casino Las Vegas, where Standout game titles include the animated Wheel of Fortune 4D Collector's Edition and Wheel of Fortune Cash Link 2 video slots. The zone also features the IGT's largest cabinet, the Wheel of Fortune Megatower.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Booming International Tourism

- 4.5.2 Growth of the Gaming Industry

- 4.6 Market Challenges

- 4.6.1 Rise of Online Casinos

- 4.6.2 Stringent Regulatory Environment

5 MARKET SEGMENTATION

- 5.1 Purpose

- 5.1.1 Accounting and Handling

- 5.1.2 Security and Surveillance

- 5.1.3 Hotel Management

- 5.1.4 Analytics

- 5.1.5 Player Tracking

- 5.1.6 Media Management

- 5.1.7 Marketing and Promotions

- 5.2 By End-user

- 5.2.1 Small and Medium Casinos

- 5.2.2 Large Casinos

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 International Game Technology PLC

- 6.1.2 Novomatic AG

- 6.1.3 Bally Technologies Inc.

- 6.1.4 Konami Gaming Inc.

- 6.1.5 Winsystems Inc.

- 6.1.6 TCS John Huxley

- 6.1.7 Aristocrat Leisure Limited

- 6.1.8 Apex Gaming Technology

- 6.1.9 MICROS Systems Inc. (Renamed Oracle Hospitality)

- 6.1.10 Agilysys

- 6.1.11 Amatic Industries GmbH

- 6.1.12 Bluberi Gaming Technologies Inc.

- 6.1.13 Decart Ltd.