|

市场调查报告书

商品编码

1628824

北美工厂自动化和工业控制:市场占有率分析、行业趋势和成长预测(2025-2030)North America Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

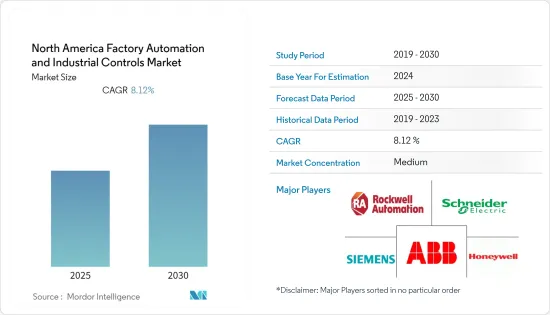

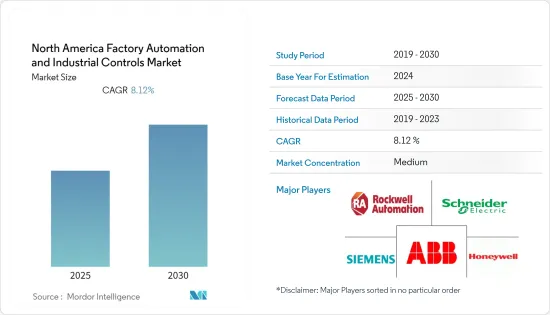

北美工厂自动化和工业控制市场预计在预测期内复合年增长率为 8.12%

主要亮点

- >为了节省能源和提高成本效益,该地区的工厂自动化和工业控制系统呈现日益增长的趋势。根据牛津经济研究院 2019 年的报告,预计未来 10 年美国将有超过 150 万个工作因自动化而流失。该地区的汽车工业始终处于将机器人融入製造流程的前沿。约翰迪尔等行业领先製造商正在进行大量投资,将自动化技术整合到其产品和流程中。

- 有

- 。

- 例如,2020年3月,美国知名SCARA机器人製造商爱普生机器人宣布与Air 解决方案供应商 Engineering(AAE)合作

- 。近日,加拿大皇家银行(RBC)与微软合作推出Go Digital计划,主要协助加拿大企业投资智慧自动化技术和云端解决方案。

- 诸如先进製造伙伴关係(AMP) 之类的倡议越来越多地被采取,以促使当地工业、各大学和联邦政府投资于新兴的自动化技术。加拿大政府创建了一个名为「Automate Canada」的计划,这是一个专门从事製造自动化解决方案的全球公司丛集。

- 然而,建立新的自动化製造工厂需要引进新的自动化技术,包括SCADA、DCS、RTU、PLC和HMI。建立这样的製造工厂需要在设备、软体和培训方面进行大量资本投资。如此大的投资对于新参与企业来说很难建立他们的第一家工厂。

北美工厂自动化和工业控制市场趋势

感测器和发射器现场设备推动市场成长

- 随着工业操作中速度处理和物料输送的进步和改进,在整个处理和处理阶段提供相同程度的效率改进对于工业来说变得非常重要。这已成为产业避免和减少生产线及其他瓶颈、推动需求的关键方面。例如,汽车产业提供了快速回应市场需求、减少製造停机时间、提高供应链效率和扩大生产力的机会。

- 接近感测器用于智慧工厂的各种应用。随着高速输送机系统和自动化机器人的使用越来越多,这些感测器变得越来越重要。电容式感测器还具有高灵敏度,适用于涉及相对定位的任务。

- 光学接近感测器由于其尺寸小且能够在恶劣条件下工作而得到了广泛的应用。然而,其一般用途需要暗房应用,并且与其他类型的感测器相比其价格分布较高。

- 智慧工厂涉及的流程高度依赖机器能否保持所需的输入和输出速度。这使您能够确保最短的理想时间和最大的产量,并避免过度拥挤。由于这些特点,位置和速度感测器市场预计在研究期间将显着增长。随着工厂管理越来越多地采用计算机,预计该行业也将向数位系统转变。

美国占较大市场占有率

- 美国一直以来都是采用重大技术创新的先驱。这些趋势一直持续到今天。最近,福特在位于科隆的涂装车间引入了协作机器人。六台协作机器人在 35 秒内打磨了嘉年华的车身,进一步改进了製造流程。此外,该国越来越多的公司正在采用自动化来优化业务。

- 美国石油和天然气产业是自动化工作 PLC 系统的主要需求驱动力。自动化不仅使该国能够生产大量石油和天然气,而且还促进了石油产品在国内的顺利分配。此外,丰田物料搬运北美公司 (TMHNA) 还选择了两项大学研究提案,透过 TMHNA 大学研究计画获得资助。

- 此外,该国是最大的原油生产国之一,也是石油和天然气产业的重要参与企业。例如,根据EIA的数据,该国2019年原油产量为24.94兆英热单位,至2030年,产量预计将达到30.01兆英热单位。此外,德克萨斯州(美国)生产全国大部分原油,对生产设备的需求也很大。

- 其中许多外国公司正在采取联盟和收购策略,预计将在全球范围内取得长足进步。例如,2021年5月,帝国石油宣布收购埃克森美孚美国石油和天然气资产,以加强在美国的影响力。该资产由约 700 口油气井和注入井组成,占地约 40,000 英亩二迭纪租赁土地。

北美工厂自动化和工业控制产业概况

由于参与企业众多,北美工厂自动化和工业控制市场竞争非常激烈。参与企业从事产品开发、伙伴关係、併购和收购等策略活动。市场的主要发展包括:

- 2021 年 2 月 - ABB 宣布推出新的 GoFa 和 SWIFTI 协作机器人系列,扩大其协作机器人产品组合。这些机器人提供更高的承重能力和速度,补充了 ABB 的 YuMi 和单臂 YuMi 协作机器人系列。它们专为电子、医疗、消费品、物流以及食品和饮料等行业而设计。

- 2020年3月-欧姆龙公司在美国设立新的机器人安全自动化业务总部。该公司已在新工厂投资 1000 万美元,用于设计、开发、测试和製造机器人和安全自动化解决方案。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 启动严格的节能标准并促进本地生产

- 市场问题

- 贸易紧张局势和金融措施收紧

第五章市场区隔

- 按类型

- 工业控制系统

- 集散控制系统(DCS)

- PLC(可程式逻辑控制器)

- 监控/资料采集(SCADA)

- 产品生命週期管理 (PLM)

- 人机介面 (HMI)

- 製造执行系统(MES)

- 现场设备

- 机器视觉系统

- 机器人(工业)

- 感测器和发射器

- 马达和驱动器

- 其他现场设备

- 工业控制系统

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 电力/公共产业

- 饮食

- 车

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Yasakawa Electric Corporation

- KUKA AG(Midea Group)

- Fanuc Corporation

- Regal Beloit Corporation

- Nidec Motor Corporation

- Basler AG

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 55074

The North America Factory Automation and Industrial Controls Market is expected to register a CAGR of 8.12% during the forecast period.

Key Highlights

- >

- Therefore, to save energy and to gain cost-benefit, the trend of factory automation and industrial control systems is gaining traction in the region. According to a 2019 report from Oxford Economics, the United States is projected to lose more than 1.5 million jobs to automation over the next decade.The regional automotive sector has always led the way in implementing robotics in their manufacturing processes. Key industry manufacturers, like John Deere, are making significant investments to integrate automated technology both into their products and processes.

- The region is witnessing increasing robotic technologies adoption. For instance, in March 2020, globally renowned SCARA robot manufacturer, Epson Robots, collaborated with the US-based automation solutions provider, Air Automation Engineering (AAE), as part of an initiative to increase its technical support in the Midwest United States.

- The adoption of factory automation solutions can help these manufacturers in cost savings, enhance productivity, and improve quality. Recently, Royal Bank of Canada (RBC) collaborated with Microsoft and launched the Go Digital program, mainly to help the Canadian businesses in investing in smart automation technologies and cloud solutions. Presently, the program is available to Canadian food manufacturers and will continue to expand to other industries over time.

- Initiatives, like 'Advanced Manufacturing Partnership (AMP)', are increasingly undertaken to make the regional industry, various universities, and the federal government to invest in the emerging automation technologies. The government in Canada created a program, Automate Canada, a global cluster of companies, specializing in manufacturing automation solutions. In the past, it also invested USD 230 million to help automate Ontario's manufacturing sector.

- However, establishment of new automated manufacturing plant mandates the deployment of emerging automation technologies Including SCADA, DCS, RTU, PLC, and HMI. The setting up of these manufacturing plants requires large capital investments for equipment, software, and training. Investing such a large amount is difficult for new entrants who are setting up their first plant.

North America Factory Automation and Industrial Controls Market Trends

Sensors and Transmitters Field Devices to Drive the Market Growth

- With the advancement and improvement in the processing of speed and material handling in the industrial operations, it has become important for the industries to bring similar level of efficiency improvement across the processing and handling stages. It has been an important aspect in the industry to avoid and reduce bottlenecks across the production line and beyond and has driven the demand. For instance, these offer opportunities to the automotive industry to react faster to market requirements, reduce manufacturing downtimes, enhance the efficiency of supply chains, and expand productivity.

- Proximity sensors are used in smart factory for varied applications. These sensors are becoming more important with the growing use of fast conveyer systems and automated robots. Capacitive sensors also have high sensitivity, making them a favorable choice for tasks related to relative positioning.

- Optical proximity sensors are finding an extensive use, owing to their small-size and ability to work in extreme conditions. However, their general use requires a dark room application, and they also come at a higher price point compared to other type of sensors.

- The processes involved in a smart factory are heavily dependent on the ability of machines to maintain desired rate of input and output. This ensures minimum ideal time and maximum output and avoids overcrowding. Due to these functions, the market for position and velocity sensors is expected to witness a significant growth during the study period. This industry is also projected to witness a shift toward digital systems, owing to increasing incorporation of computers for factory management.

United States Holds Significant Market Share

- The United States has traditionally been a forerunner in terms of adoption of key technological innovations. A continuation of these trends have been observed. Recently, Ford deployed cobots in its Cologne paint shop. The six cobots sand Fiesta bodies in 35 seconds, further improving the manufacturing process. Additionally, the country is home to various enterprises that are increasingly adopting automation to optimize operations.

- The US oil and gas industry has been a primary demand driver for PLC systems for automation tasks. Automation has not only enabled the high production of oil and gas in the country but also been responsible for the smooth distribution of oil products within the country. Further, Toyota Material Handling North America (TMHNA) selected two universities' research proposals to receive funding through the TMHNA University Research Program.

- Moreover, the country is one of the largest producers of crude oil and a prominent player in the oil and gas industry. For instance, according to EIA, the country produced 24.94 quadrillion Btu of Crude Oil in 2019, and by 2030, the production number is expected to reach 30.01 quadrillions Btu. Additionally, Texas (United States) produces the major share of crude oil in the country, and it is expected to hold a significant demand for production equipment.

- Most of these foreign players are adopting partnership and acquisition strategy, which is also bringing advancement at a global level. For instance, in May 2021, Empire Petroleum announced the acquisition of ExxonMobil's oil and gas assets in US to strengthen its presence in the United States. The assets comprise of about 700 oil, gas, and injector wells and accounts for 40,000 net acres of Permian leasehold, approximately.

North America Factory Automation and Industrial Controls Industry Overview

The North America factory automation and industrial controls market is competitive due to several players in the market. Players are involved in product development and strategic activities such as partnerships, mergers, and acquisitions. Some of the key developments in the market are:

- February 2021- ABB announced the expansion of its collaborative robot portfolio with the launch of its new GoFa and SWIFTI cobot families. These robots offer higher payloads and speeds, to complement YuMi and Single Arm YuMi in ABB's cobot line-up. These are designed to serve industries such as electronics, healthcare, consumer goods, logistics, food and beverage and others.

- March 2020 - Omron Corporation opened a new robotics and safety automation business headquarters in the United States. The company invested USD 10 million in the new facility, where it would design, develop, test, and manufacture robotic and safety automation solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing

- 4.6 Market Challenges

- 4.6.1 Trade Tensions and Monetary Policy Tightening

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Industrial Control Systems

- 5.1.1.1 Distributed Control System (DCS)

- 5.1.1.2 PLC (Programmable Logic Controller)

- 5.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4 Product Lifecycle Management (PLM)

- 5.1.1.5 Human Machine Interface (HMI)

- 5.1.1.6 Manufacturing Execution System (MES)

- 5.1.2 Field Devices

- 5.1.2.1 Machine Vision Systems

- 5.1.2.2 Robotics (Industrial)

- 5.1.2.3 Sensors and Transmitters

- 5.1.2.4 Motors and Drives

- 5.1.2.5 Other Field Devices

- 5.1.1 Industrial Control Systems

- 5.2 By End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Power and Utilities

- 5.2.4 Food and Beverages

- 5.2.5 Automotive

- 5.2.6 Other End-user Industries

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Schneider Electric SE

- 6.1.2 Rockwell Automation Inc.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Emerson Electric Company

- 6.1.5 ABB Ltd.

- 6.1.6 Mitsubishi Electric Corporation

- 6.1.7 Siemens AG

- 6.1.8 Omron Corporation

- 6.1.9 Yokogawa Electric Corporation

- 6.1.10 Yasakawa Electric Corporation

- 6.1.11 KUKA AG (Midea Group)

- 6.1.12 Fanuc Corporation

- 6.1.13 Regal Beloit Corporation

- 6.1.14 Nidec Motor Corporation

- 6.1.15 Basler AG

7 Investment Analysis

8 Future of the Market

02-2729-4219

+886-2-2729-4219