|

市场调查报告书

商品编码

1628828

亚太地区饮料包装:市场占有率分析、产业趋势、成长预测(2025-2030)Asia Pacific Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

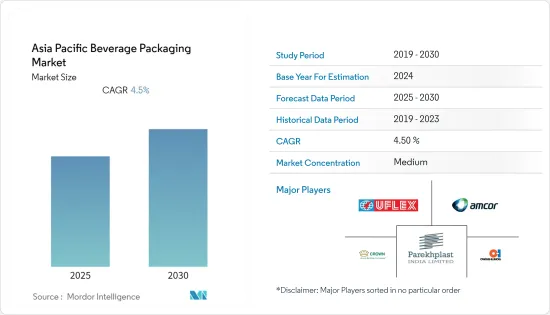

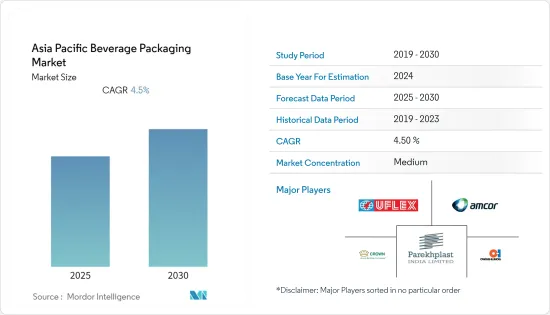

亚太饮料包装市场预计在预测期内复合年增长率为4.5%

主要亮点

- 该地区的饮料市场对果肉、果汁和其他浓缩物以及酱汁和番茄酱瓶的需求不断增加。此外,各种保健饮料、乳製品、啤酒和酒精饮料主要推动了该地区饮料需求的增加,并推动了市场的成长。

- 此外,印度领先的饮料製造商每年都会向海外市场出口茶和咖啡等各种产品。根据统计和计划实施部 (MOSPI) 的一项研究,2019 年印度饮料製造收入为 109.4 亿美元。预计2023年将达116.9亿美元。例如,印度最重要的跨国软包装材料和解决方案公司 UFlex Limited 为饮料领域推出了名为「Asepto Eye」的包装解决方案。 Asepto 的最新产品以其卓越的包装为无菌包装带来了现代復兴,遵循 Asepto 品牌所宣称的创新之路。

- 最近关于禁止使用一次性塑胶的法规预计将促进塑胶包装的成长,并将在与所有相关人员的讨论结束后实施。这些法规预计将对饮料最终用户行业的塑胶使用产生重大影响,其中塑胶广泛以宝特瓶、吸管和容器的形式使用。

- 随着酒精和非酒精饮料市场的成长,全部区域对金属罐包装的需求预计将大幅增加。此外,饮料包装的兴起正在推动该地区的金属瓶盖和瓶盖市场。该地区有许多参与企业为饮料业提供 ROPP 和铝製瓶盖和瓶盖。例如,Oricon Enterprises Ltd 每年供应 92.16 亿个铝冠盖和 18 亿个 ROPP 盖。

- 此外,2020年2月,可口可乐日本在东京、神奈川、千叶和埼玉推出了350毫升和700毫升两种饮料PET包装。

亚太地区饮料包装市场趋势

啤酒可望占据较大市场占有率

- 近年来,啤酒消费量快速成长。印度仍然是最大的啤酒市场之一,每年有超过 2000 万人达到饮酒年龄。印度最着名的啤酒製造商联合啤酒厂也生产着名的翠鸟品牌,推出了最新的翠鸟即溶啤酒。本产品以两袋一盒出售。

- 该地区啤酒使用的传统包装是带有皇冠密封的玻璃瓶。由于玻璃在该地区广泛用于酒精包装,预计在预测期内需求将会增加。玻璃价格也对酒精公司的利润率产生重大影响,利润率随石油价格趋势而波动。

- 不确定的利润迫使製造商逐渐将其他包装材料纳入其生产线。最近的趋势是宝特瓶被用来包装含酒精和不含酒精的啤酒。使用的宝特瓶包括非隧道巴斯德消毒瓶、单向隧道巴斯德消毒瓶和可回收/可再填充瓶。

- 与碳酸软性饮料 (CSD) 中使用的 PET 相比,啤酒需要更高的 CO2 和 O2 阻隔性能。所需的水平取决于啤酒类型、容器尺寸、分销管道和环境条件(储存时间、温度、湿度水平)。

- 此外,该地区的消费者正在转向无麸质啤酒。此外,中国、印度和越南的啤酒消费量每年以超过6%的速度成长。因此,口味和配方的不断创新可能会推动啤酒需求并促进罐装啤酒的成长。例如,总部位于阿姆斯特丹的喜力公司增持了总部位于班加罗尔的印度最大啤酒製造商联合啤酒厂的股份。

- 此外,日本公司正在透过产品创新扩大在东南亚的业务,以抓住该地区的成长。例如,2021年3月,日本东洋油墨集团旗下聚合物和涂料子公司Toyochem推出了一种新型不含双酚A(BPA-NI)的金属啤酒瓶和罐内被覆剂。新型 BPA-NI 内部喷涂和固定式 (SOT) 端线圈涂布基于丙烯酸乳液和聚酯树脂,其配方可实现所需的性能。我们也解决监管机构和消费者对 BPA 相关健康和食品安全的担忧。此外,Toyochem将以新品牌Lionova销售其BPA-NI解决方案,旨在扩大其在海外市场的地位。

印度预计将实现显着渗透

- 玻璃和硬质塑胶在印度饮料包装中占据很大份额。 PET 是用于水包装的材料,约占印度包装水资源部门的 55%。

- 印度包装市场的成长主要由食品和饮料产业推动。据IBEF称,印度的食品和杂货市场是全球第六大市场,其中零售业占销售额的70%。

- 中等收入群体消费能力的增强、有组织零售的快速扩张以及出口正在进一步推动市场成长。这就需要标准化的包装,以延长保质期,保持生产速度,同时确保品质。

- 因此,采用先进的包装手法来保证品质对于印度食品饮料产业变得非常重要。根据印度工业联合会2020年1月举行的全国包装会议显示,食品饮料产业和电子商务占包装产业的50%。

- 此外,2020年7月,Fabonest Food在印度推出了一系列采用永续且可无限回收的铝罐装的泉水饮料,以支持印度的永续发展目标。

- 据印度包装研究所(IIP)称,过去十年,印度的包装消费量增加了200%,从每人每年4.3公斤增加到8.6公斤。然而,儘管有这种成长,印度的人均消费量却是世界大型经济体中最低的。这进一步凸显了市场未来的成长潜力。

- 此外,2021 年 6 月,FieldFresh Foods 的优质包装食品品牌 Del Monte 宣布推出包装王椰子水,以其卓越的健康和口味优势而闻名。 Del Monte 是印度第一个提供 King Coconut Water 的品牌。随着消费者越来越多地采用更健康的生活方式,为快速成长的椰子水包装领域注入了新的活力。

亚太地区饮料包装产业概况

亚太地区饮料包装市场本质上是细分的。拥有大量市场份额的领先公司正在扩大其在各个地区的基本客群。此外,许多公司正在与多家公司进行策略和合作计划,以提高市场占有率和盈利。最近的市场趋势包括:

- 2020 年 11 月 - 日本饮料製造商 Sangaria 九年来一直依赖西得乐作为主要合作伙伴。该公司再次求助于其值得信赖的供应商,透过安装多功能西得乐无菌 Combi Predis 对碳酸饮料和宝特瓶饮料进行无菌加工来提高生产灵活性。这项投资也将帮助Sangaria未来扩大其产品系列。

- 2020 年 5 月 - Piramal Glass Limited 与 Microsoft 合作,透过将数位技术融入其製造流程来转变业务流程。利用新兴的新时代技术来改变您的玻璃业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 包装器材进口加速,饮料包装产业快速扩张。

- 消费者对便利包装的需求不断成长

- 市场限制因素

- 缺乏最佳管理和製造实务的接触

- COVID-19 市场影响评估

第五章市场区隔

- 按材质

- 塑胶

- 纸板

- 金属

- 玻璃

- 依产品类型

- 瓶子

- 能

- 袋和纸箱

- 盖子与封口装置

- 其他的

- 按用途

- 碳酸饮料/果汁饮料

- 啤酒

- 葡萄酒/蒸馏酒

- 瓶装水

- 牛奶

- 能量/运动饮料

- 其他的

- 原产地

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争状况

- 公司简介

- Parekhplast India Limited

- Crown Holdings, Inc.

- Uflex Ltd

- Haldyn Glass Limited

- Rexam plc

- Owens-Illinois Inc

- Piramal Glass Private Limited

- HSIL Group

- Hindustan Tin Works Ltd

- Amcor plc

- Hindustan National Glass & Industries Ltd(HNGIL)

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 55116

The Asia Pacific Beverage Packaging Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- The demand for fruit pulp, juices, and other concentrates, along with sauces or bottles of ketchup, is increasing in the beverage market in the region. In addition, various health beverages, milk products, beer, and liquors have mainly contributed to the increasing demand for drinks in the area, thus driving the market growth.

- Moreover, the leading beverage manufacturers in India export various products, such as tea and coffee, to foreign markets each year. According to the Ministry of Statistics and Program Implementation (MOSPI) survey, the revenue from manufacturing beverages in India in FY 2019 was USD 10.94 billion. It is expected to reach USD 11.69 billion by 2023. For instance, UFlex Limited, India's most significant multinational flexible packaging materials & solution company, has launched a packaging solution called 'Asepto Eye' for the beverages segment. The newest offering from Asepto gives a modern revival to aseptic packaging due to its packaging excellence, taking forward the innovative trail that the brand Asepto professes.

- The recent regulation on the ban of single-use plastics is expected to grow plastic packaging growth, which is scheduled to be enforced in the future once the discussion with all the stakeholders gets concluded. These regulations are expected to significantly affect the use of plastics in the beverage end-user industry, where plastics are extensively used in the form of bottles, straws, and containers.

- With the growth of the alcoholic and non-alcoholic beverage market, the demand for metal can package is expected to increase significantly across the region. Also, the increase in beverage packaging is driving the metal caps and closure market in the area. The region holds many players that supply ROPP and aluminum caps and closures to the beverage industries. For instance, Oricon Enterprises Ltd has 9,216 million units per annum of aluminum crown caps and 1,800 million units per annum of ROPP caps.

- Further, in February 2020, Coca-Cola Japan has launched two new PET packaging sizes for beverages that include 350ml and 700ml for its drink in Tokyo, Kanagawa, Chiba, and Saitama.

Asia Pacific Beverage Packaging Market Trends

Beer is Expected to Account For Significant Market Share

- The consumption of beer has been increasing exponentially in the recent past. India remains one of the largest beer markets, with more than 20 million people entering the legal age for drinking every year. In addition, United Breweries, India's most prominent beer producer that also makes the famous Kingfisher brand, has announced their latest Kingfisher Instant Beer. The product is sold in a box that contains two sachets.

- The traditional packaging material used for beer in the region is the glass bottle sealed with a crown closure. As glass is extensively used for alcohol packaging in the area, the demand is expected to increase during the forecast period. Also, glass prices have a significant impact on the margin profile of the alcohol companies, which fluctuates based on the crude oil price movement.

- Owing to the uncertain margins, manufacturers are gradually incorporating other packaging materials in their production lines. A recent development is the use of PET bottles for the packaging of both alcoholic and non-alcoholic beer. The PET beer bottles used are non-tunnel pasteurized, one-way tunnel pasteurized and returnable/refillable bottles.

- Beer needs high CO2 and O2 barrier performance compared to PET used in carbonated soft drinks (CSD). The level required depends on the type of beer, container size, distribution channels, and environmental conditions (storage time, temperature, and humidity levels).

- Moreover, in this region, consumers are increasingly shifting toward gluten-free beers. Also, beer consumption grows at over 6 percent per annum in China, India, and Vietnam. Hence, the growing innovation in flavors and preparations is likely to drive the demand for beer, increasing beer cans' growth. For instance, Heineken, an Amsterdam-based company, increased its stake in Bangalore-based United Breweries, India's largest beer manufacturer, thereby offering high growth potential for the beer packaging industry in the country, which will raise the usage of beer cans.

- Further, Japanese companies are striding up their business by product innovation in Southeast Asia to cash in on the region's growth. For instance, in March 2021, Toyochem Co., Ltd., the polymers and coatings subsidiary of Japan's Toyo Ink Group, launched a new Bisphenol A non-intent (BPA-NI) internal coatings for metal beer bottles and cans. The new BPA-NI interior sprays and coil coatings for stay-on tab (SOT) ends are formulated to achieve the required performance based on acrylic emulsion and polyester resins. It is also addressing BPA-related health and food safety concerns from regulators and consumers alike. In addition, Toyochem will be marketing its BPA-NI solutions under the new brand name Lionova, as the company also seeks to expand its position in markets overseas.

India to Expected to Witness Significant Rate of Adoption

- In terms of India's beverage packaging, glass and rigid plastic hold a prominent share of the market. PET is the material that is used for packaging water, which accounts for around 55% of India's packaged water sector.

- The growth of the packaging market in India is primarily driven by the food and beverage industries. According to IBEF, the Indian food and grocery market is the world's sixth-largest, with retail contributing to 70% of the sales.

- The increase in the spending capacity of the middle-income group, the rapid expansion of organized retail and exports further facilitate the growth of the market. This has led to the need for standardized packaging, which can improve shelf-life, maintain production speed, and simultaneously ensure quality.

- Thus, adopting advanced packaging methods to ensure quality has become critical for India's food and beverage industry. According to the National Packaging Conference held by the Confederation of Indian Industries in January 2020, the food and beverage industries and e-commerce accounted for 50% of the packaging industry.

- Further, in July 2020, Fabonest Food and Beverages has launched spring water beverages in sustainable and endlessly recyclable aluminum cans in India to keep up India's sustainable development goals.

- According to the Indian Institute of Packaging (IIP), packaging consumption in India increased by 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa. However, despite this growth, the per capita consumption of India is the lowest among the large economies of the world. This further emphasizes the future growth potential of the market.

- Further, in June 2021, Del Monte, the premium packaged foods brand from FieldFresh Foods, has announced its packaged King Coconut Water launch, renowned for its superior health and taste benefits. Del Monte is the first brand in India to offer King Coconut Water. It raises the bar in the fast-growing packaged coconut water segment as consumers increasingly adopt healthier lifestyles.

Asia Pacific Beverage Packaging Industry Overview

The Asia Pacific beverage packaging market is fragmented in nature. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- November 2020 - The Japanese beverage company Sangaria has been counting on Sidel as a vital partner for more than nine years. The company once again turned to its reliable supplier to increase its production flexibility by acquiring the Versatile Sidel Aseptic Combi Predis to handle aseptically carbonated and still drinks in PET bottles. This investment will also support Sangaria to widen its product portfolio in the future.

- May 2020 - Piramal Glass Limited partnered with Microsoft to transform its operational procedures to include digital technology in the manufacturing process. It will leverage some of the emerging or new-age technologies to transform its glass business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Acceleration in Packaging Machinery Imports, leading to proliferation of Beverage Packaging Industry

- 4.4.2 Increased demand for convenience packaging from consumers

- 4.5 Market Restraints

- 4.5.1 Lack of Exposure to Best Management and Manufacturing Practices

- 4.6 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Type of Product

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Pouches and Cartons

- 5.2.4 Caps and Closures

- 5.2.5 Other Types of Product

- 5.3 By Application

- 5.3.1 Carbonated Soft Drinks and Fruit Beverages

- 5.3.2 Beer

- 5.3.3 Wine and Distilled Spirits

- 5.3.4 Bottled Water

- 5.3.5 Milk

- 5.3.6 Energy and Sports Drinks

- 5.3.7 Other Applications

- 5.4 Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parekhplast India Limited

- 6.1.2 Crown Holdings, Inc.

- 6.1.3 Uflex Ltd

- 6.1.4 Haldyn Glass Limited

- 6.1.5 Rexam plc

- 6.1.6 Owens-Illinois Inc

- 6.1.7 Piramal Glass Private Limited

- 6.1.8 HSIL Group

- 6.1.9 Hindustan Tin Works Ltd

- 6.1.10 Amcor plc

- 6.1.11 Hindustan National Glass & Industries Ltd (HNGIL)

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219