|

市场调查报告书

商品编码

1628839

美国饮料包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)US Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

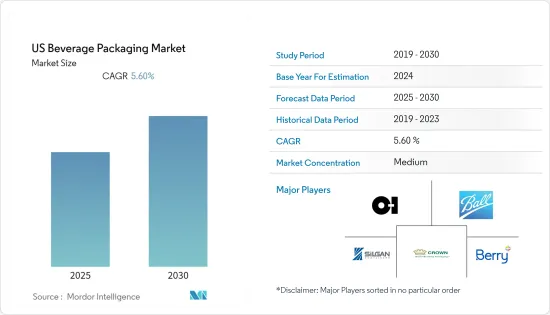

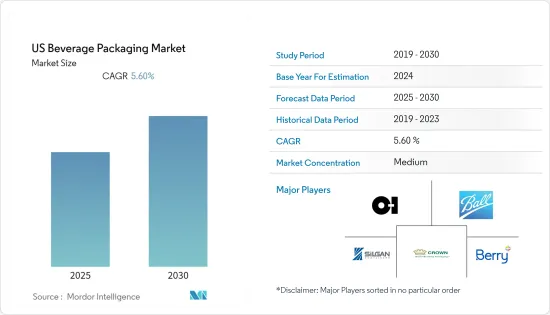

美国饮料包装市场预计在预测期内复合年增长率为 5.6%

主要亮点

- 由于碳酸饮料、能量饮料、果汁等的需求不断增长, 宝特瓶和金属罐是首选材料。另一方面,具有可回收特性的玻璃面临着生产和回收成本增加的挑战。最近,饮料包装的永续性趋势越来越青睐玻璃。

- 此外,由于塑胶因其降低的製造、耐用性和物流成本而长期以来一直是全球饮料製造商的首选包装选择,因此向永续包装的过渡将鼓励这些包装製造商和装瓶公司做出承诺和承诺。到使用更新的资料。

- 我们宣布,美国饮料协会是该地区多家软性饮料製造商共同投资 1 亿美元以促进美国宝特瓶回收并减少该行业对原生塑胶的使用。多个地区和国家的类似趋势表明,装瓶商和包装製造商正被迫改变其产品开发策略。

- 例如,截至 2020 年 2 月,波尔公司计划在 2021 年扩大其美国金属罐产量。该公司的特种饮料罐计划在亚利桑那州和美国东北部开始运营,这符合该公司先前承诺的到2021年终新增至少80亿罐产能的承诺。

- 由于 COVID-19 对回收的影响,我们看到多家废弃物处理公司暂停或减少了回收和收集流程。在美国,废弃物管理部门已暂停一些资源回收设施 (MRF) 的运作。

美国饮料包装市场趋势

酒精饮料占据很大的市场占有率

酒精饮料类别包括葡萄酒、啤酒、烈酒等,包装形式有瓶子、桶子、纸盒、罐子等。

- 就酒精饮料而言,随着全球无气泡葡萄酒消费放缓,葡萄酒产业在包装形式方面发生了重大转变。因此,美国酿酒厂正在推动包装创新,以降低成本并吸引年轻消费者。

- 另一方面,啤酒包装多种多样,包装形式因地区而异,受到当地法律法规、偏好、文化等因素的影响。

- 在美国,由于新型冠状病毒感染疾病 ( COVID-19) 导致现场关闭,生啤酒销售已停止。因此,精酿啤酒製造商转而采用可按需填充和密封的 32 盎司罐装啤酒,以便在桶装啤酒氧化之前将其出售。这导致当前手工生产对包装的需求增加。在封锁的情况下,包装製造商本身也报告说,他们的营运人员减少了,从而带来了供应主导的挑战。

- 包装材料、较小尺寸和永续性的变化都对包装发展的变化做出了重大贡献。烈酒罐头和盒子仍在开发中,因为新形式的酒精饮料面临消费者接受度、保质期限制以及缺乏罐头製造合作伙伴等挑战。

- 在创造碳足迹方面,二氧化碳的最大贡献是小瓶的生产和运输,因此酒精公司采用环保的生产方法。事实上,供应链的这两个要素占葡萄酒产品碳足迹的 51% 至 68%。

金属包装在饮料中的高需求

与餐厅相比,家庭消费饮料和食品的需求正在增加。许多知名市场相关人员已宣布投资建立新的製造基础设施,以满足不断增长的需求。

- 金属包装的最大优点之一是其高度可回收。金属包装可以在其生命週期结束时进行回收,而不会劣化其质量,这就是为什么金属包装领先于塑料和瓶子等其他材料,成为各个饮料公司品牌的首选包装类型。罐头中使用的铝几乎 100% 都可以熔化并再次使用。

- 此外,美国正在建造几座新的铝罐製造设施,以满足国家的各种饮料需求。例如,2021年9月,罐头製造商Canpack开始在印第安纳州东部建造一座新的铝罐工厂,预计每年生产约36亿罐。 Canpac是波兰Giorgi Global的子公司,该工厂预计长期僱用约340名员工。

- 华盛顿州铝业协会表示,回收流中的塑胶污染主要是由于塑胶标籤、收缩套管和类似产品的使用增加所造成的,这可能会给回收商带来营运甚至安全问题。 2020年9月,铝协会发布了《铝容器设计指南》,以进一步应对这些挑战并向饮料公司推荐解决方案。解决这些问题的解决方案以及替代塑胶和玻璃的案例正在推动市场对铝罐的需求。

- 此外,美国生产的铝罐平均含有约 73% 的回收成分,而玻璃瓶的回收成分为 23%,塑胶瓶的回收成分不到 6%。此外,铝罐废料比玻璃或塑胶更有利可图,这使得铝罐成为美国回收系统财务可行性的重要驱动力。

- 然而,随着人们越来越意识到塑胶对环境的影响,越来越多的人选择罐装饮料而不是宝特瓶。此外,美国啤酒公司百威啤酒已开始包装 Icon,以展示其对永续性的承诺。百威啤酒包装上新的 100%可再生能源标誌是该品牌向消费者传达其啤酒是由可再生能源动力来源的啤酒厂生产的方式。

美国饮料包装产业概况

美国饮料包装市场是细分的,包括 Owens-Illinois Inc.、Ball Corporation、Cronw Holdings Inc.、Berry Global Inc. 和 Sonoco Products Compnay 等主要企业。这些公司在美国投资研发以开发新的包装产品。

- 2021 年 3 月 - Owens-illinois Inc. 宣布扩张安第斯市场,为玻璃包装的永续市场提供服务。该公司已投资约 7,500 万美元扩建其位于哥伦比亚的Zipaquira 工厂。该计划预计于 2022年终完工后,将使该公司美洲部门的产能增加约 2%,每年生产约 5 亿瓶。

- 2021 年 9 月 - 波尔公司宣布计划在内华达州北拉斯维加斯建造一座新的美国铝製饮料包装工厂。该多线工厂计划于 2022 年下半年开始生产,全面运作后预计将创造近 180 个製造业就业机会。

- 2021 年 10 月 - Crown Holdings, Inc. 宣布与 Velox Ltd. 建立合作关係。 Crown 和 Velox 正在结合各自的专业知识,为希望扩大产品范围的知名品牌和希望利用完全可回收饮料罐 Cut it open 优势的小型生产商带来新的可能性。该技术和解决方案是市场首创,运行速度比现有数位解决方案快五倍以上,创造了更多的品牌设计选择。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 市场限制因素

第六章 市场细分

- 按材质

- 塑胶

- 金属

- 玻璃

- 纸板

- 依产品类型

- 瓶子

- 能

- 小袋

- 纸盒

- 啤酒桶

- 按用途

- 酒精饮料

- 牛奶

- 能量饮料

- 其他的

第七章 竞争格局

- 公司简介

- Owens-illinois Inc.

- Ball Corporation

- Crown Holdings Inc.

- Silgan Containers Inc.

- Berry Global Inc.

- Sonoco Products Company

- CCL Containers Inc

- Ardagh Group

- Amcor Limited

- Berlin Packaging

- Westrock

第八章投资分析

第9章市场的未来

The US Beverage Packaging Market is expected to register a CAGR of 5.6% during the forecast period.

Key Highlights

- The growing demand for carbonated drinks, energy drinks, and juices, among others, is indicative of rising PET bottles and metal cans as preferred materials for the same. Glass, on the other hand, with its recyclable properties, has been challenged by increased costs of production and recycling. The preference for the same has been growing recently concerning sustainability trends across beverage packaging.

- Moreover, as plastic has been a long-standing and preferred packaging option by global beverage manufacturers, due to the reduced manufacturing, durability, and logistics costs, the transition towards sustainable packaging has driven these packaging manufacturers and bottling companies to pledge and commit usage of newer materials for the same.

- The American Beverage Association, amongst multiple soft drink producers in the region, announced a USD 100 million joint investment to drive PET bottle recycling in the United States and reduce the industry's use of virgin plastic. Similar trends across multiple regions and countries have been suggestive of a landscape influencing bottlers and packaging manufacturers to pivot product development strategies.

- For instance, as of February 2020, Ball Corporation is expected to expand the United States Metal Can production by 2021. Its specialty beverage can would commence operations in Arizona and the northeastern US, in line with the company's previous commitment to add at least 8 billion units of capacity by the end of 2021.

- Due to COVID-19 impact on the recycling front, multiple waste companies have been observed to have stopped or reduced recycling and collection processes. In the United States, Waste Management suspended operations at some of its materials recovery facilities (MRFs).

US Beverage Packaging Market Trends

Alcohol Beverages to hold significant market share

The categorization of alcoholic beverages includes wine, beer, spirits, etc., being packaged using formats such as bottles, kegs, cartons, and cans, to name a few.

- When it comes to Alcoholic beverages, there has been a significant transitioning of the wine industry concerning packaging format has been observed, as the global consumption across still wine has been slowing down. This has led the Unites States-based wineries to drive packaging innovations to cut costs and appeal to younger consumers.

- On the other hand, Beer's packaging is highly diverse; the formats packaging type preference has been driven by different regions where local laws, regulations, tastes, culture, and other drivers influence the packaging landscape.

- The draft beer sales stopped flowing in the United States due to on-premise shutdowns caused by efforts in the wake of novel coronavirus disease COVID-19. Therefore, allied craft brewers turned to 32 oz. Cans filled and sealed on demand to sell out leftover beer in kegs before oxidization. This has led to an increased demand for packaging towards current production in hand. Amidst the lockdown scenarios, packaging manufacturers have themselves reported operability with a reduced workforce, creating a supply-driven challenge.

- Changes in packaging materials, smaller sizes, and sustainability have all contributed significantly to changes in packaging development. Canned and boxed spirits are still in development as new forms of alcoholic beverages face challenges such as consumer acceptance, shelf life constraints, and lack of canning partners.

- Alcohol companies are adopting green production methods as when it comes to carbon footprint creation, the largest contribution of CO2 actually comes from the production and transportation of vials. In fact, these two components of the supply chain can account for 51% to 68% of a wine product's carbon footprint.

Metal Packaging holds high demand in beverages

Beverages demand home consumption, and grocery is increased compared to restaurants. Many prominent market players have announced investments to set up new manufacturing infrastructures to fulfill the increased demand.

- One of the biggest benefits of metal packaging is that they are highly recyclable. Metal packaging can be recycled at the end of their lifecycle without its quality degradation, and which makes metal packaging the preferred packaging type for brands across various beverage companies, ahead of other materials, such as plastic and bottle. Nearly 100% of the aluminum used in the cans can be melted down and used again.

- Further, the United States is witnessing several new aluminum can production facilities catering to various beverage needs in the country. For instance, in September 2021, Canpack, a can manufacturer, began constructing a new aluminum can factory in eastern Indiana and is expected to produce approximately 3.6 billion cans per year. The Canpack is a subsidiary of the Polish company Giorgi Global and the factory is expected to employ approximately 340 people in the long run.

- The Aluminum Association, Washington stated that plastic contamination in the recycling stream is driven mainly by increased use of plastic labels, shrink sleeves, and similar products, which can cause operational and even safety issues for recyclers. In September 2020, the Aluminum Association released an aluminum container design guide to further address some of these challenges and recommend solutions to beverage companies. Such solutions to address the challenges and instances of replacing plastic and glass drive the demand for aluminum cans in the market.

- Further, the average aluminum can produced in the United States contains approximately 73% recycled content, compared to 23% for glass bottles and less than 6% for plastic. Furthermore, aluminum can scrap more beneficial than glass or plastic, making aluminum a vital driver of the financial viability of the United States' recycling system.

- However, as people become more aware of the environmental impact of plastic, they are increasingly opting to buy beverages in cans rather than bottles. Additionally, Budweiser -an American beer company, started packaging icons to showcase its commitment to sustainability. The new 100% Renewable Energy logo on Budweiser packaging is a way for the brand to tell consumers the beer is made in breweries powered by renewable energy.

US Beverage Packaging Industry Overview

The United States Beverage Packaging Market is fragmented with the presence of key players such as Owens-Illinois Inc, Ball Corporation, Cronw Holdings Inc, Berry Global Inc., and Sonoco Products Compnay. These players are investing in R&D for new product innovations of packaging in the United States.

- March 2021 - Owens-illinois Inc announced an expansion in Andean Market to serve a sustainable market in glass packaging. The company invested approximately USD 75 million in an expansion at its Zipaquira, Colombia facility. Upon completion by the end of 2022, the project is expected to add nearly 2 percent of capacity to the company's Americas segment and produce about 500 million bottles annually.

- September 2021 - Ball Corporation announced plans to build a new U.S. aluminum beverage packaging plant in North Las Vegas, Nevada. The multi-line plant is scheduled to begin production in late 2022 and is expected to create nearly 180 manufacturing jobs when fully operational.

- October 2021 - Crown Holdings, Inc. announced a collaboration with Velox Ltd. Crown and Velox brought together their expertise to unlock new possibilities for major brands wishing to increase product offerings, as well as smaller producers are taking advantage of the benefits of fully recyclable beverage cans. The technology and solution deliver market firsts and create greater brand design options with running speeds over five times faster than existing digital solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Metal

- 6.1.3 Glass

- 6.1.4 Paperboard

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Pouches

- 6.2.4 Cartons

- 6.2.5 Beer kegs

- 6.3 By Application

- 6.3.1 Alcoholic Beverages

- 6.3.2 Milk

- 6.3.3 Energy Drinks

- 6.3.4 Other applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens-illinois Inc.

- 7.1.2 Ball Corporation

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Containers Inc.

- 7.1.5 Berry Global Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 CCL Containers Inc

- 7.1.8 Ardagh Group

- 7.1.9 Amcor Limited

- 7.1.10 Berlin Packaging

- 7.1.11 Westrock