|

市场调查报告书

商品编码

1629760

增黏剂:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Tackifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

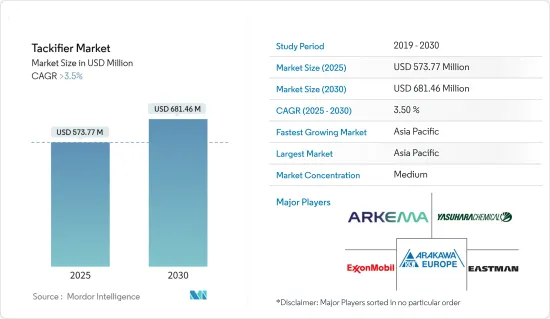

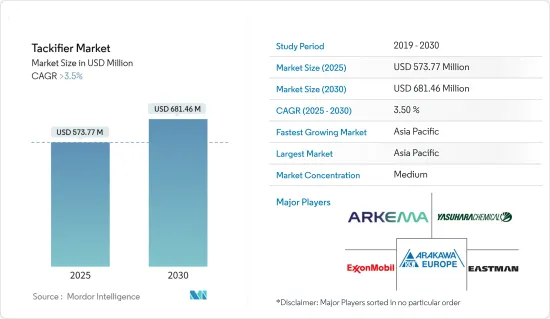

增黏剂市场规模预计到2025年为5.7377亿美元,预计到2030年将达到6.8146亿美元,预测期内(2025-2030年)复合年增长率将超过3.5%。

主要亮点

- COVID-19 大流行对 2020 年的市场产生了负面影响,导致世界各地的营运关闭、製造活动和供应链中断以及生产停顿。此后,市场已从大流行中恢復过来。预计2022年市场将达到疫情前水准并持续稳定成长。

- 推动市场的关键因素之一是新兴国家城市基础设施的成长。然而,新兴的无增黏剂黏合剂市场正在阻碍所研究市场的成长。

- 向生物基黏合剂的转变预计将为市场提供重大成长机会。亚太地区在市场中占有最高份额,并且可能在预测期内继续主导市场。

增粘剂市场趋势

建筑业主导市场

- 在最终用户产业中,建筑业目前在全球增黏剂市场中占有很大份额。

- 建筑业的各种应用对压敏黏着剂合剂和水基黏合剂的需求量很大,包括暖气、通风、空调、混凝土、接缝水泥、活动住宅和弹性地板材料。

- 这些黏合剂使用很大比例的增黏剂来改善表面黏性、脱模性和黏合性。世界各地的建筑业都在成长,这可能会导致黏合剂市场对增黏剂的需求增加。

- 这段时期快速的都市化促进了建设活动。根据中国国家统计局的数据,中国的建筑产值将于 2022 年达到峰值,达到约 31.2 兆元(4.61 兆美元)。因此,市场需求预计将增加。

- 此外,根据美国人口普查局的数据,2023 年 9 月的建筑支出经季节已调整的的年增长率预计为 19,965 亿美元,比 8 月修正后的 19,883 亿美元增长 0.4%。

- 欧盟统计机构欧盟统计局的初步估计显示,与2023年6月相比,2023年7月建筑业经季节已调整的产量,欧元区将成长0.8%,欧盟将成长0.7%。相反,2023年6月欧元区建设业生产将下降1.2%,欧盟将下降1.0%。

- 因此,由于上述因素,预计建筑业将在预测期内主导研究市场。

亚太地区主导市场

- 亚太地区经济状况的持续改善为消费者带来了更好的经济状况,从而导致该地区对电子、建筑、汽车和纺织产品的需求增加。

- 此外,中国是黏合剂製造和向多个国家出口的主要国家之一,在亚太增粘剂市场中占有很大份额。

- 主要黏合剂製造公司如Henkel AG & Company、KGaA、HB Fuller Company、Ashland和Evonik Industries AG均在该地区设有製造工厂,併计划建造更多製造工厂,使得黏合剂产量有望增加。黏合剂产量及其产量的增加预计将推动增黏剂的消费。

- 2023年6月,汉高宣布在中国增设一座新的黏合剂製造工厂。汉高黏合剂技术公司的新製造工厂位于中国山东省烟台化学工业。新工厂「鲯鹏」的建设成本约为8.7亿元人民币(1.19亿美元)。新厂增加了汉高在中国高抗衝胶黏剂产品的产能,并进一步优化其供应链,以满足国内外市场不断增长的需求。

- 此外,2023年3月,Pidilite宣布在印度生产Jowat热熔胶。该黏合剂是在 Pidilite 位于古吉拉突邦皮的製造工厂生产的。

- 在日本,国土交通省宣布,2022年将开发约859,500住宅,与前一年同期比较增加0.4%。

- 此外,印度正在扩大其商业部门。印度正在进行多个计划。例如,2022年第一季,价值9亿美元的CommerzIII商业办公综合体开工。本计划位于孟买戈尔冈,兴建一栋43层商业办公大楼,占地面积2,60,128平方公尺。该计划预计将于 2027 年第四季完成,为预测期内的市场成长做出贡献。

- 因此,预计亚太地区将在预测期内主导增粘剂市场。

增粘剂产业概况

增粘剂市场已部分整合。研究市场的主要企业包括(排名不分先后)荒川化学工业株式会社、伊士曼化学公司、埃克森美孚公司、阿科玛、安原化学等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 新兴国家城市基础建设的成长

- 亚太地区热熔胶需求不断扩大

- 其他司机

- 抑制因素

- 无增黏剂黏合剂市场的兴起

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 原料

- 松香树脂

- 石油树脂

- 松节油树脂

- 形式

- 固体的

- 液体

- 树脂分散体

- 种类

- 合成

- 自然的

- 目的

- 胶带、标籤

- 组装

- 书籍装订

- 鞋类、皮革和橡胶製品

- 其他用途(型材包裹等)

- 最终用户产业

- 车

- 建筑/施工

- 不织布

- 包装

- 鞋类

- 其他最终用户产业(纸浆和造纸等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arakawa Chemical Industries,Ltd.

- KRATON CORPORATION

- Arkema

- DRT(Les Derives Resiniques et Terpeniques)

- Eastman Chemical Company

- Exxon Mobil Corporation

- Lawter, A Harima Chemicals, Inc. Company

- Neville Chemicals Company

- Natrochem, Inc.

- TECKREZ, INC.

- TWC Group

第七章 市场机会及未来趋势

- 转向生物基黏合剂

- 其他机会

简介目录

Product Code: 56041

The Tackifier Market size is estimated at USD 573.77 million in 2025, and is expected to reach USD 681.46 million by 2030, at a CAGR of greater than 3.5% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 outbreak caused nationwide lockdowns around the world, disruptions in manufacturing activities and supply chains, and production halts, all of which had a negative impact on the market in 2020. Subsequently, the market recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- One of the major factors driving the market is the growing urban infrastructure in developing countries. However, the emerging tackifier-free adhesives market is hindering the growth of the market studied.

- Shifting focus towards bio-based tackifiers is expected to provide a major growth opportunity for the market studied. Asia-Pacific accounted for the highest share of the market and is likely to continue dominating the market during the forecast period.

Tackifier Market Trends

Building and Construction Industry to Dominate the Market

- Among the end-user industries, building and construction accounts for a significant share of the global tackifiers market currently.

- Pressure-sensitive and water-borne adhesives are in significant demand for various purposes in the building and construction industry for heating, ventilation, air conditioning, concrete, joint cement, manufactured housing, resilient flooring, etc.

- These adhesives use a significant percentage of tackifiers to improve the tack, peel, and bonding of the surface. The growing construction industry across the world is providing growth prospects to the market studied, which is likely to lead to an increasing demand for tackifiers in the adhesive market.

- Rapid urbanization during this time has boosted the construction activities. According to the National Bureau of Statistics of China, China's construction output peaked in 2022 at about CNY 31.20 (USD 4.61 trillion). Thus, it is expected to increase the market demand.

- Further, according to the United States Census Bureau, construction spending in September 2023 was estimated at a seasonally adjusted annual rate of USD 1,996.5 billion, registering a growth of 0.4 % from the revised August estimate of USD 1,988.3 billion.

- In July 2023, compared with June 2023, seasonally adjusted production in the construction sector increased by 0.8% in the euro area and by 0.7% in the EU, according to the initial estimates from Eurostat, the statistical office of the European Union. Conversely, in June 2023, production in construction declined by 1.2% in the euro area and by 1.0% in the EU.

- Hence, owing to the factors mentioned above, the building and construction industry is expected to dominate the market studied during the forecast period.

Asia-Pacific to Dominate the Market

- Continuous improvement in the economic conditions of the Asia-Pacific region has enhanced the financial status of the consumers, which, in turn, has increased the demand for electronic appliances, buildings, automobiles, and textiles in the region.

- China is also one of the largest manufacturers and exporters of adhesives to many countries and occupies a significant share of the Asia-Pacific tackifier market.

- The major adhesive manufacturing companies, such as Henkel AG & Company, KGaA, H B Fuller Company, Ashland, and Evonik Industries AG, have their manufacturing plants in this region, and they are planning to build more manufacturing plants, which likely will increase the production of adhesives. The increase in the production of adhesives and their outputs is expected to drive the consumption of tackifiers.

- In June 2023, Henkel Announced the addition of a New adhesive Manufacturing Facility in China. The new manufacturing facility of Henkel Adhesive Technologies in the Yantai chemical industry park in Shandong province, China. The new plant, 'Kunpeng,' will cost approximately CNY 870 million (USD 119 million). The new plant will increase Henkel's production capacity of high-impact adhesive products in China and further optimize the supply chain to meet the increasing demand from domestic and foreign markets.

- Further, in March 2023, Pidilite announced the manufacture of Jowat's hot melt adhesive in India. The adhesives will be produced at Pidilite's manufacturing plant in Vapi, Gujarat.

- In Japan, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing developments were initiated, which represented an increase of 0.4% compared to the previous year.

- Furthermore, India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 square meters in Goregaon, Mumbai. The project is expected to be completed in Q4 2027, thus benefitting the market growth during the forecast period.

- Thus, the Asia-Pacific region is expected to dominate the tackifier market during the forecast period.

Tackifier Industry Overview

The tackifier market is partially consolidated in nature. The major players in the studied market (not in any particular order) include Arakawa Chemical Industries, Ltd., Eastman Chemical Company, Exxon Mobil Corporation, Arkema, and Yasuhara Chemical Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Urban Infrastructure in Developing Countries

- 4.1.2 Growing Demand for Hot-melt Adhesives in Asia-Pacific

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Emerging Tackifier Free Adhesives Market

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Feedstock

- 5.1.1 Rosin Resins

- 5.1.2 Petroleum Resins

- 5.1.3 Terepene Resins

- 5.2 Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.2.3 Resin Dispersion

- 5.3 Type

- 5.3.1 Synthetic

- 5.3.2 Natural

- 5.4 Application

- 5.4.1 Tapes and Labels

- 5.4.2 Assembly

- 5.4.3 Bookbinding

- 5.4.4 Footwear, Leather, and Rubber Articles

- 5.4.5 Other Applications (Profile Wrapping, Etc.)

- 5.5 End-user Industry

- 5.5.1 Automotive

- 5.5.2 Building and Construction

- 5.5.3 Non-Wovens

- 5.5.4 Packaging

- 5.5.5 Footwear

- 5.5.6 Other End-user Industries (Pulp and Paper, Etc.)

- 5.6 Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arakawa Chemical Industries,Ltd.

- 6.4.2 KRATON CORPORATION

- 6.4.3 Arkema

- 6.4.4 DRT (Les Derives Resiniques et Terpeniques)

- 6.4.5 Eastman Chemical Company

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Lawter, A Harima Chemicals, Inc. Company

- 6.4.8 Neville Chemicals Company

- 6.4.9 Natrochem, Inc.

- 6.4.10 TECKREZ, INC.

- 6.4.11 TWC Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus towards Bio-based Tackifiers

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219