|

市场调查报告书

商品编码

1629777

海底帮浦:市场占有率分析、产业趋势、成长预测(2025-2030)Subsea Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

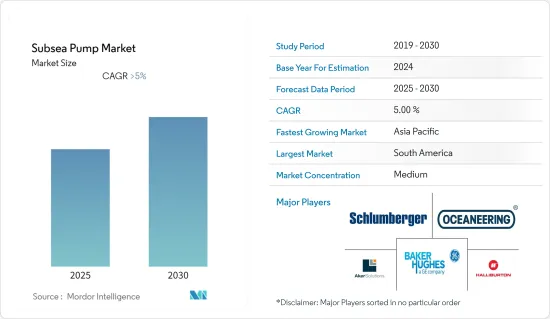

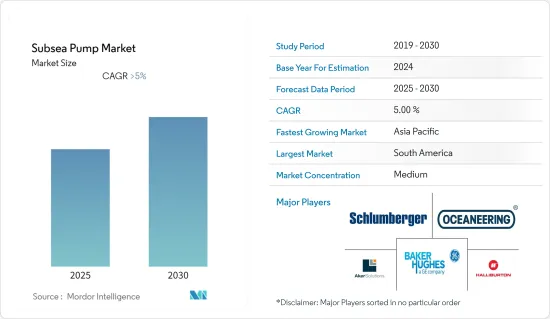

海底泵市场预计在预测期内复合年增长率将超过 5%。

2020年,COVID-19对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 中期来看,随着更多陆上油田成熟,勘探和生产活动预计将转向更深的海上区域,从而导致海上深水和超深水计划的增加。预计这将在预测期内推动市场。

- 另一方面,由于供需缺口、地缘政治和其他几个因素,近年来原油价格高度波动,预计将在预测期内阻碍研究市场的成长。

- 主要企业正在投资持续的研发计划以促进技术进步,以降低海洋支出的整体成本。海底泵主要用于成熟的海上油田,透过降低油藏背压来提高采收率并减少生产支出。降低海底泵成本的能力已成为推动即将到来的市场的机会。

- 2018年,南美洲主导了全球整体市场,大部分需求来自巴西。成长最快的地区是亚太地区,其次是欧洲。

海底帮浦市场趋势

深海领域主导市场

- 石油和天然气行业越来越多地寻找新技术,以帮助最大限度地提高现有棕地和新资产的收益,并活性化产量。

- 2021年,全球原油产量达到约42亿吨。不同深度的勘探和生产活动为海上工业带来了挑战。随着潜舰研发进一步向近海、深海推进,技术难度不断上升。深水开发采用与钻井、油井开发和油井作业相关的整体流程和设备相关的各种海底布局和生产系统。

- 近年来,随着成熟油田的增加,海上探勘和生产(E&P)活动不断扩大。例如,在目前最重要的石油生产盆地二迭纪盆地,老油井的产量已开始下降,这些地区的发现空间已所剩无几。因此,石油和天然气产业正在转向更深的海上石油和天然气探勘,以满足不断增长的需求。

- 海上计划的前置作业时间长且成本高。在投资生产基础设施之前,营运商建造了其他需要高资本支出的基础设施。因此,已经完成最终投资决定并开始开发的计划很可能继续透过石油和天然气生产收入收回投资。预计这些计划将成为预测期内上半年的重要推手。

- 截至2021年,海上石油和天然气产业约占全球原油产量的30%。中东、北海、巴西、墨西哥湾、裏海是海上石油主要产区。除此之外,丰富的资源以及深海和超深海地区石油和天然气开采潜力的增加预示着市场研究的巨大机会。

- 此外,在油价稳定的环境下,深水和超深水计划收益大幅成长,因低油价而无法实施的计划启动,资本支出增加。

- 因此,由于海上探勘投资和新开发油田的石油产量增加,深水领域预计将在预测期内主导市场。

南美洲正在经历显着的成长

- 近年来,该地区海上石油和天然气开发活跃。这是由于与世界各地的海上石油和天然气计划相比,其盈亏平衡价格较低,投资回收期也具有竞争力,这使得它们在当前的动盪时期更加强大。

- 截至2021年,巴西是南美洲石油和天然气支出领先的国家。该国海上盐层下油田产量约占石油总产量的50%,2020年终将增加至75%左右。产量的增加和对海上天然气田的依赖增加是由于钻井技术的改进、海上石油和天然气行业专业知识的增加以及基础设施的改善导致生产成本稳步下降。

- 此外,阿根廷国家石油公司YPF 2021年的资本投资约27.1亿美元,较2020年增加约74%(2020年资本投资:15.5亿美元)。该公司计划在预测期内进一步增加该国石油和天然气产业的资本支出,特别是上游产业。

- 哥伦比亚石油和天然气产业显示出发展迹象。哥伦比亚国家石油公司 Ecopetrol 设定 2021 年资本支出目标为 50 亿美元。与 2021 年的预测值(35 亿美元)相比,增加了约 30%。这一增长是预期的,因为勘探和生产计划在国内外都变得更加活跃。深水领域的最新投资和即将开展的计划预计将在预测期内推动南美洲地区海底泵市场的成长。

- 考虑到上述几点和最近的趋势,预计南美洲海底帮浦市场在预测期内将出现显着成长。

海底泵行业概况

海底帮浦市场适度细分。该市场的主要企业包括(排名不分先后)Aker Solutions ASA、Baker Hughes A GE Co、Halliburton Company、Schlumberger Limited、Weatherford International PLC 和 Oceaneering International。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按发展

- 浅水区

- 深海

- 按用途

- 提升

- 分离

- 注射

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 印度

- 澳洲

- 印尼

- 欧洲

- 英国

- 法国

- 德国

- 欧洲其他地区

- 南美洲

- 巴西

- 哥伦比亚

- 智利

- 阿根廷

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Aker Solutions ASA

- Baker Hughes Co

- Halliburton Company

- Schlumberger Limited

- Oceaneering International Inc.

- TechnipFMC PLC

- Weatherford International PLC

- Drill-Quip Inc.

- National-Oilwell Varco Inc

- Subsea 7 SA

- Saipem SpA

第七章 市场机会及未来趋势

简介目录

Product Code: 56492

The Subsea Pump Market is expected to register a CAGR of greater than 5% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, with the increasing number of onshore fields reaching maturity, exploration and production activity is expected to make a shift toward deeper offshore regions, which is expected to result in an increase in offshore deep-ultra deepwater projects. This, in turn, is expected to drive the market during the forecast period.

- On the other hand, a highly volatile crude oil price scenario in recent years, owing to the supply-demand gap, geopolitics, and several other factors, is expected to hinder the growth of the market studied during the forecast period.

- Nevertheless, the major companies are investing in ongoing R&D projects for the advancement of technology to reduce the overall cost of offshore expenditures. Subsea pumps are employed primarily in mature offshore fields to improve the recovery rate by reducing back-pressure on the reservoir, thereby lowering the production expenditure. The ability to reduce the cost of a subsea pump is providing the opportunity to propel the market in the coming future.

- South America dominated the market across the globe in 2018, with the majority of the demand coming from Brazil. The fastest-growing region is Asia-Pacific, then Europe.

Subsea Pumps Market Trends

Deepwater Sector to Dominate the Market

- The oil and gas industry is engaged in a rising movement to identify new techniques and technologies that can help them maximize revenues from existing brownfields and new assets by enhancing their outputs.

- In 2021, global crude oil production amounted to approximately 4.2 billion metric tons. Exploration and production activities in various water depths have become a challenge for the offshore industry. As the subsea developments have further moved offshore and into deeper waters, the technical difficulty has continuously increased. A wide range of subsea layouts and production systems are used for deepwater developments, associated with the overall process and the equipment involved in drilling, field development, and field operation.

- With the rising number of maturing oilfields in recent years, there has been growth in offshore exploration and production (E&P) activities. For instance, in the Permian Basin, currently the most important basin in terms of crude oil production, the production from old wells has started to decline, and there is little scope for discovery in these areas. As a result, the oil and gas industry is shifting toward deeper offshore regions to search for oil and gas to meet the increasing demand.

- Also, offshore projects have a high lead time and are expensive. Before the operators invested in the production infrastructure, they built other infrastructure that required high CAPEX. Hence, the development of the projects, for which the FIDs have already been taken and development has begun, is likely to continue to recover the investment through oil and gas production revenues. These projects are expected to be significant drivers during the first half of the forecast period.

- As of 2021, the offshore oil and gas industry accounted for about 30% of global crude oil production. The Middle East, North Sea, Brazil, the Gulf of Mexico, and the Caspian Sea are the major offshore oil and gas producing regions. In addition to this, the availability of abundant resources, coupled with increased potential to recover oil and gas from deepwater and ultra-deepwater areas, is expected to provide a great opportunity for the market to be studied.

- Furthermore, during the stable oil price environment, the deepwater and ultra-deepwater projects witnessed a spike in revenue as the projects, which were not viable due to low crude oil prices, got started and increased the CAPEX.

- Therefore, with increasing offshore exploration investment and oil production from newly developed fields, the deepwater sector is expected to dominate the market in the forecast period.

South America to Witness Significant Growth

- The region has witnessed significant offshore oil and gas activity in the last few years. This can be attributed to the lower breakeven prices and competitive payback times compared to offshore oil and gas projects worldwide, making them more resilient in the current turbulent times.

- As of 2021, Brazil was the major country in South America regarding oil and gas spending. The country's offshore pre-salt oil fields pumped around 50% of the total oil output, which increased to approximately 75% by the end of 2020. This increasing production and dependency on offshore oil and gas fields can be attributed to steadily decreasing production expenses due to improved drilling technology, growing expertise in the offshore oil and gas industry, and increased infrastructure.

- Furthermore, Argentina's state-owned oil company YPF's CAPEX in 2021 stood at around USD 2.71 billion, representing an increase of almost 74% when compared to the value in 2020 (CAPEX in 2020: USD 1.55 billion); the company is planning to further increase the CAPEX in the country's oil and gas sector, especially in the upstream activities, during the forecast period.

- Colombia is showing signs of development in the country's oil and gas sector. In 2021, Colombia's state-owned oil company Ecopetrol set a CAPEX target of USD 5 billion, i.e., an increase of about 30% compared to the expected value (USD 3.5 billion) in 2021. This anticipated increase is because exploration and production projects at home and abroad are ramping up. The latest investment and upcoming projects in deepwater are likely to drive the growth of the subsea pump market during the forecast period in the South America region.

- Owing to the above points and recent developments, South America is expected to witness significant growth in the subsea pump market during the forecast period.

Subsea Pumps Industry Overview

The subsea pump market is moderately fragmented. Some of the major players in the market (in no particular order) include Aker Solutions ASA, Baker Hughes A GE Co., Halliburton Company, Schlumberger Limited, Weatherford International PLC, and Oceaneering International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies & Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Shallow water

- 5.1.2 Deep Water

- 5.2 By Application

- 5.2.1 Boosting

- 5.2.2 Separation

- 5.2.3 Injection

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Australia

- 5.3.2.4 Indonesia

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 France

- 5.3.3.3 Germany

- 5.3.3.4 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Colombia

- 5.3.4.3 Chile

- 5.3.4.4 Argentina

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aker Solutions ASA

- 6.3.2 Baker Hughes Co

- 6.3.3 Halliburton Company

- 6.3.4 Schlumberger Limited

- 6.3.5 Oceaneering International Inc.

- 6.3.6 TechnipFMC PLC

- 6.3.7 Weatherford International PLC

- 6.3.8 Drill-Quip Inc.

- 6.3.9 National-Oilwell Varco Inc

- 6.3.10 Subsea 7 SA

- 6.3.11 Saipem SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219