|

市场调查报告书

商品编码

1629781

中东和非洲 SSD 快取:市场占有率分析、产业趋势、统计和成长预测(2025-2030 年)Middle East and Africa SSD Caching - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

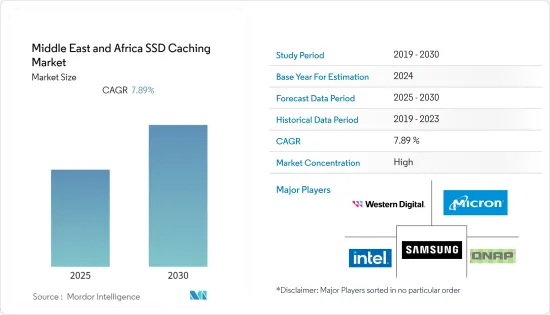

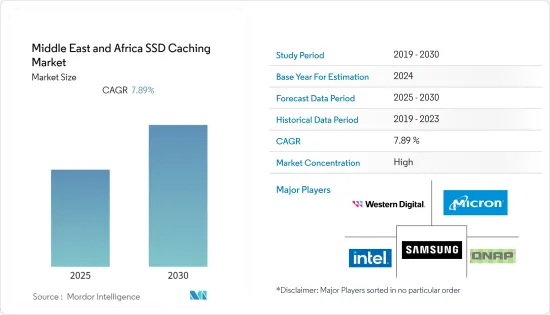

中东和非洲SSD兑现市场预计在预测期内复合年增长率为7.89%

主要亮点

- SSD 快取需要 SSD 硬碟和相关软体的组合才能正常运作。由于SSD硬碟价格昂贵,因此它们与常规硬碟结合使用以提高效能效率。市场不断扩大,企业正在实施这些解决方案以降低成本并提高生产力。组织必须探索来自不同资料来源的大量资料。 SSD 解决方案简化了流程,无需对高功率驱动器或解决方案进行大量投资。

- 基于NAND快闪记忆体的 SSD 提供超快速的储存效能和快速的投资回报,使其成为巨量资料应用的理想选择。 SSD可用作主机快取、网路快取、全SSD储存阵列或混合储存阵列中的SSD层。

- 据经合组织称,流入非洲经济体及其人口的外部资金正在增加。在就业方面,虽然成长有所增加,但就业创造率仍然较低。根据网路世界统计,截至去年12月,非洲网路使用者数为6.0132亿,中东网路使用者数为2.0502亿。

- SSD 硬碟价格昂贵,必须与传统硬碟结合使用才能提高效能效率。市场持续成长,许多公司正在实施这些解决方案以降低成本并提高效率。这些公司必须分析来自各种资料来源的庞大资料集。 SSD 解决方案可简化您的任务,而无需大量投资于高功率驱动器和解决方案。

- COVID-19 的疫情对市场产生了重大影响。原料供应受到影响。因此,价值链被扰乱,为产品带来通膨风险。一旦中国和韩国的电子产品供应链在疫情后恢復,供应链差距预计将缩小。

中东/非洲SSD快取市场趋势

企业级储存预计将占据较大份额

- 伺服器通常由一组硬碟 (HDD) 组成,或连接到由大量硬碟组成的储存区域网路 (SAN)。在商业储存网路中,伺服器技术的改进造成了 I/O 效能的差距。基于 SSD 的快取透过减少 I/O 延迟和提高 IOPS 效能来缩小 I/O 效能差距。基于伺服器的快取无需升级储存阵列或在关键网路资料路径中安装其他设备。伺服器 SSD 快取透过处理网路边缘关键伺服器的大部分 I/O 需求,有效降低储存网路和阵列要求。这种需求的减少可以提高其他关联伺服器的储存效能并延长储存基础设备的使用寿命。

- 在企业环境中,SSD 快取会在资料穿越网路时保存先前要求的资料,以便在需要时快速检索。将先前要求的材料放入临时储存中可以减少对公司频宽的需求并加快对最新资讯的存取。企业级 SSD 将资料永久或暂时快取并储存在非挥发性半导体记忆体中。这些 SSD 使用NAND快闪记忆体,声称比旋转 HDD 具有更好的性能和更低的功耗。随着中东和非洲各产业对运算速度的需求不断增加,SSD 快取变得越来越重要。于是,不少企业纷纷进入SSD快取市场。因此,SSD快取的成本有所下降。

- 各种企业的资料中心应用程式正在处理不断增长的资料集。页快取的快取有效性因其容量低而受到限制。与硬碟和 DRAM 相比,新兴的基于快闪记忆体的 SSD 具有更低的延迟和成本。因此,基于SSD的快取在资料中心中普遍使用。根据世界云端指数,资料中心流量正在增加资料储存需求。由于SSD的高效能,高流量资料中心对SSD快取的需求可能会增加。 SSD 快取允许资料中心和云端运算环境以更快的输入/输出操作 (IOP) 和更低的延迟来容纳更多使用者并每秒处理更多交易。

- 另一方面,维持投资是最困难的挑战。由于大流行,企业和客户的工作负载急剧增加,他们必须仔细平衡保护现有投资与购买合适的云端储存以满足不断增长的需求。此外,企业在提高现有员工技能方面面临新的挑战,因为云端的采用需要特定的技能和知识来确保有效迁移到新平台。

- 连接网路的用户数量迅速增加,小型企业和云端服务供应商数量不断增加,正在为整个全部区域创造巨大的成长机会。据阿联酋电信监管局(UAE)称,截至今年3月,阿联酋宽频网路用户数约为367万人。

云端储存需求推动市场成长

- 混合云技术在业界已经达到了很高的成熟度,让客户在混合环境中运行工作负载,同时利用云端而不中断业务(例如AWS Outpost、Azure Stack、Google Anthos等)。近年来,云端平台正在支援新的复杂经营模式,并在全球范围内组织更整合的网路。在云端上部署储存解决方案可以提高便利性并降低整体拥有成本,因为服务供应商负责提供最长的执行时间、资料安全性和定期更新。

- 透过将资料移近客户来减少延迟的需求,以及要求资料在不同地区本地储存的政府和企业法规,预计将推动中东和非洲的云端储存成长。该地区部署复杂云端基础架构的公司需要能够快速储存、搜寻、处理和分析大量业务关键资料的系统。由于这种需求,中东和非洲的许多企业正在从基于 SATA 的 SSD 转向基于 NVMe 的 SSD 作为主储存。最新的 NVMe SSD 具有快取功能。资料中心产业正在迅速扩张,并且越来越注重效率和最大运作。

- 此外,云端还充当 IT 转型的催化剂,让您可以灵活地将您的首选云端与现有的本地基础设施按照最适合您工作负载的比例进行混合和匹配。据Cisco称,今年中东和非洲的云端流量预计将达到 304Exabyte。

- 此外,对成本优化和业务敏捷性的日益关注也导致了云端资料中心的扩张。云端服务还可以轻鬆适应不断变化的条件,以满足新的要求。这使得客户公司能够专注于他们的核心竞争力,进而带来整体成长。

- 非结构化资料每年成长超过 50%,託管服务供应商正在转向云端储存作为领先商机。对储存管理的需求持续成长。先进技术的发展促使公司专注于更新其储存系统以跟上竞争的步伐。混合云端就是这样一种趋势,将显着促进市场成长。然而,安全和资料传输对更多网路频宽的需求可能会为市场发展带来挑战。

中东和非洲:SSD快取产业概况

中东和非洲 SSD 快取市场因英特尔公司、三星电子、美光科技公司、西部数据公司和 QNAP 系统公司等主要企业的存在而得到巩固。市场参与企业正在采取伙伴关係、併购、创新和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022 年 11 月,运算、网路和储存解决方案的创新者 QNAP Systems, Inc. 推出了高效能 TVS-hx74 QuTS Hero NAS 系列。该系列包括4盘位TVS-h474、6盘位TVS-h674和8盘位TVS-h874型号,均配备第12代Intel多核心/多执行绪处理器。 TVS-hx74 运行基于 ZFS 的 QuTS Hero 作业系统,可确保资料完整性并实现内联重复资料删除和压缩、近乎无限的简介以及即时 SnapSync。可靠的 TVS-hx74 为储存、备份、虚拟和应用伺服器等业务应用提供 PCIe Gen 4(传输速度高达 Gen3 的 2 倍)可扩充性、M.2 NVMe SSD 快取和 2.5GbE 网路。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 采用市场动态

- 市场驱动因素

- SSD 相对于传统 HDD 的改进

- 云端储存需求推动市场成长

- 市场问题

- SSD高产品成本与低时延的矛盾

第六章 市场细分

- 目的

- 企业储存

- 个人储存

第七章 竞争格局

- 公司简介

- Intel Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Western Digital Corporation

- QNAP Systems Inc.

- NetApp Inc.

- Kioxia(Toshiba Memory Corporation)

- SK Hynix Inc.

- ADATA Technology Co. Ltd

- Seagate Technology LLC

- Transcend Information Inc.

- Inspur Group

- Microsemi(Microchip Technology Inc.)

第八章投资分析

第9章市场的未来

The Middle East and Africa SSD Caching Market is expected to register a CAGR of 7.89% during the forecast period.

Key Highlights

- SSD Caching requires a combination of an SSD drive and associated software to work properly. Because SSD drives are expensive, they are used with regular hard drives to improve performance efficiency. The market is constantly expanding, with businesses implementing these solutions to save costs and enhance productivity. Organizations should examine massive data sets obtained from diverse data sources. SSD solutions simplify the process without requiring a large investment in high-powered drives and solutions.

- SSDs based on NAND flash memory is ideal for Big Data applications because they provide ultra-fast storage performance and a quick return on investment. SSDs can be used as host cache, network cache, all-SSD storage arrays, or as the SSD layer in hybrid storage arrays.

- According to OECD, the external financial flows to African economies and its population are increasing. In terms of employment, growth has been increasing, but the rate of job creation remains slow. According to the Internet World Stats, as of December last year, the number of internet users in Africa is 601.32 million, and 205.02 million in the Middle East.

- SSD drives are costly; hence a combination of them needs to be used with traditional hard drives to enhance performance efficiency. The market is still growing, and many enterprises are deploying these solutions to cut costs and improve efficiency. These enterprises must analyze huge data sets coming from various data sources. SSD solutions simplify the task without investing too much in high-powered drives and solutions.

- The outbreak of COVID-19 has had a significant effect on the market. The raw materials supply is affected. Hence the value chain is disrupted, causing an inflationary risk on products. The supply chain gap is projected to narrow as the electronics supply chains in China and South Korea recover after the pandemic.

MEA SSD Caching Market Trends

Enterprise Storage Expected to Hold Major Share

- Servers are typically configured with banks of hard disc drives (HDD) or connected to storage area networks (SANs), which are large banks of hard drives. In the business storage network, improvements in server technology caused an I/O performance gap. SSD-based caching closes the I/O performance gap by lowering I/O latency and enhancing IOPS performance. Server-based caching does not necessitate storage array upgrades or the installation of any other appliances in the data path of important networks. SSD caching in servers effectively reduces the requirement for storage networks and arrays by servicing large percentages of the I/O demand of important servers at the network edge. This decrease in demand improves storage performance for other associated servers, potentially extending the storage infrastructure's useful life.

- In a corporate environment, SSD caching stores previously requested data as it passes through the network, allowing it to be retrieved fast when needed. Placing previously requested material in temporary storage lessens the demand on an enterprise's bandwidth and speeds up access to the most up-to-date information. Enterprise SSDs store data permanently or momentarily cache data in nonvolatile semiconductor memory. NAND flash memory is used in these SSDs, providing better performance and less power than spinning HDDs. SSD caching is becoming more important as the demand for computing speed rises across various industries in the MEA region. As a result, many companies have entered the SSD cache market. This resulted in a decrease in the cost of SSD caches.

- Data-center applications in various businesses are processing an expanding volume of data sets. The page cache's caching impact is hampered by its low capacity. Compared to hard discs and DRAM, emerging flash-based SSDs provide lower latency and costs. As a result, SSD-based caching is commonly used in data centers. According to the worldwide cloud index, data center traffic has increased data storage requirements. Because of its high-performance features, the high-traffic data center will increase demand for SSD caching. SSD caching allows data centers and cloud computing environments to host more users and complete more transactions per second by accelerating input/output operations per second (IOPs) and reducing latency.

- Maintaining investments, on the other hand, is the most difficult task. Due to the pandemic, company and customer workloads have increased dramatically, necessitating a careful balance between protecting existing investments and buying the appropriate cloud storage to meet the increasing demand. Furthermore, organizations have faced additional problems upskilling their current workforces, as cloud adoption necessitates certain skills and knowledge to ensure effective migrations to new platforms.

- The rapid expansion of Internet-connected users and an expanding number of SMEs and cloud service suppliers has created tremendous growth opportunities across the region, where interconnection bandwidth is accelerating due to strong demand. According to Telecommunications Regulatory Authority (UAE), as of March this year, there were around 3.67 million broadband internet subscriptions in the United Arab Emirates.

Demand for the Cloud Storage Driving the Market Growth

- Hybrid cloud technologies have reached a high level of maturity in the industry, allowing clients to operate workloads in a hybrid environment while guaranteeing that they are exploiting the cloud without disrupting business operations (e.g., AWS Outpost, Azure Stack & Google Anthos). Cloud platforms enabled new, complex business models and have been orchestrating more global-based integration networks in recent years. The deployment of storage solutions over the cloud offers greater convenience, as the service vendor is solely responsible for providing maximum uptime, data security, and periodic updates, thus, decreasing the total cost of ownership.

- The need to reduce latency by moving data closer to the customer and governmental and business regulations for data to be kept locally within different areas are projected to drive growth in cloud storage in the MEA region. Enterprises in the region installing complex cloud infrastructures want systems that can quickly store, retrieve, process, and analyze large amounts of business-critical data. As a result of this demand, many firms in the Middle East and Africa are switching from SATA-based SSDs to NVMe-based SSDs for primary storage. The latest NVMe SSDs include caching capabilities. The data center sector is rapidly expanding, with a greater emphasis on efficiency and maximum uptime.

- In addition, the cloud acts as a catalyst for IT transformation, providing the flexibility to combine the preferred clouds and existing on-premises infrastructure in the ratio best suited for the workload. According to Cisco Systems, This year, cloud traffic in the Middle East and Africa would amount to an estimated 304 exabytes.

- Furthermore, the rising focus on cost optimization and business agility has led to the expansion of cloud data centers. Also, cloud services adapt easily to the changing landscape to meet new requirements. This allows the client organization to focus on its core competency, which, in turn, results in its overall growth.

- With unstructured data expanding by more than 50% annually, managed service providers are looking at cloud storage as an upfront revenue opportunity. The greater need for storage control further augmented this. The foray into advanced technologies prompts companies to emphasize updating their storage system to match the competition. The hybrid cloud is one such trend that significantly boosts the market growth. However, security and the need for more network bandwidth for data transfer can challenge the development of the market.

MEA SSD Caching Industry Overview

The SSD Caching Market in the Middle East and Africa is consolidated with the presence of key players like Intel Corporation, Samsung Electronics Co. Ltd, Micron Technology Inc., Western Digital Corporation, and QNAP Systems Inc. Players in the market are adopting strategies such as partnerships, mergers, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022: QNAP Systems, Inc., a computing, networking, and storage solution innovator, launched the high-performance TVS-hx74 QuTS hero NAS series, which includes the 4-bay TVS-h474, 6-bay TVS-h674, and 8-bay TVS-h874 models, all of which feature 12th Gen Intel, multi-core/multi-thread processors. The TVS-hx74, which runs the ZFS-based QuTS hero operating system, assures data integrity and enables inline data deduplication and compression, near-infinite snapshots, and real-time SnapSync. The dependable TVS-hx74 handles tough business difficulties in storage, backup, virtualization, and application servers with PCIe Gen 4 (up to twice the transmission speed of Gen 3) expandability, M.2 NVMe SSD caching, and 2.5GbE networking.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Improvements Offered by SSDs Over Conventional HDDs

- 5.2.2 Demand for the Cloud Storage Driving the Market Growth

- 5.3 Market Challenges

- 5.3.1 High Cost of Products and Inconsistency regarding Low-rate Latency by SSDs

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Enterprise Storage

- 6.1.2 Personal Storage

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Micron Technology Inc.

- 7.1.4 Western Digital Corporation

- 7.1.5 QNAP Systems Inc.

- 7.1.6 NetApp Inc.

- 7.1.7 Kioxia (Toshiba Memory Corporation)

- 7.1.8 SK Hynix Inc.

- 7.1.9 ADATA Technology Co. Ltd

- 7.1.10 Seagate Technology LLC

- 7.1.11 Transcend Information Inc.

- 7.1.12 Inspur Group

- 7.1.13 Microsemi (Microchip Technology Inc.)