|

市场调查报告书

商品编码

1637767

亚太地区 SSD 快取:市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia Pacific SSD Caching - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

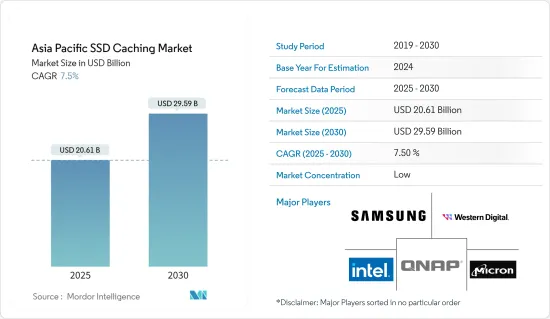

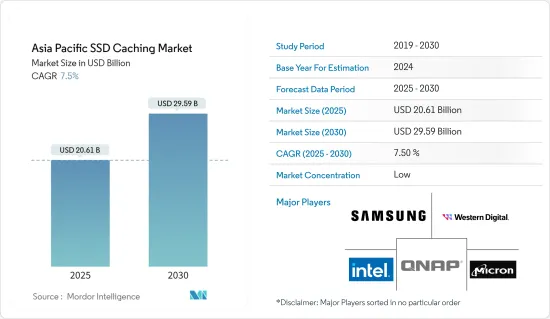

亚太地区SSD快取市场规模预计在2025年为206.1亿美元,预计到2030年将达到295.9亿美元,预测期间(2025-2030年)的复合年增长率为7.5%。

SSD 快取是使用固态硬碟 (SSD) 来加速电脑系统中传统硬碟 (HDD) 的效能。透过将 SSD 的速度与 HDD 的储存容量相结合,该技术旨在提高整体系统效能,特别是对于需要快速资料存取的应用程式。

主要亮点

- 随着企业数位化提高以及消费者对技术的依赖程度不断提高,对更快资料存取和储存解决方案的需求也日益增长。亚太地区的许多国家都投资改善其技术基础设施,包括网路连接和资料中心。这为SSD快取的发展提供了良好的环境。

- 电子商务平台、线上串流媒体服务和其他内容消费平台的成长推动了对高效资料储存和搜寻的需求,鼓励企业考虑使用 SSD 快取来改善用户体验。

- SSD 带来的改善与各行各业的需求一致,亚太地区对更快、更可靠、更节能的储存解决方案的需求日益增长。因此,利用 SSD 的这些优势来提高 HDD 效能的 SSD 快取正在市场上流行起来。

- SSD 每 GB 的价格往往比传统 HDD 贵。这种成本差异可能是一个挑战,尤其是对于采用 SSD 快取解决方案的企业和个人而言。与传统 HDD 相比,SSD 通常提供更低的延迟性能,但性能可能因 SSD 型号或品牌而异,甚至在不同代 SSD 技术之间也会有所不同。

亚太地区 SSD 快取市场趋势

企业储存应用领域预计将占据较大的市场占有率

- 亚太地区的企业越来越多地采用 SSD 快取来提高储存系统效能。 SSD 快取有助于加快资料搜寻速度、提高应用程式回应能力并减少延迟。这对于关键任务应用程式、资料库和虚拟环境尤其重要。

- 亚太地区的资料中心和云端服务供应商正致力于优化其基础设施,以满足快速成长的数位服务需求。 SSD 快取提高了此类环境中资料处理的效率和速度,有助于改善使用者体验。根据Cloudscene统计,截至2022年1月,中国共有443个资料中心。

- 随着该地区资料中心数量的增加,对支援这些设施资料处理需求的储存解决方案的需求也相应增加。资料中心依赖高效能储存系统提供高效率的服务,而SSD快取可以提高资料处理的速度和回应能力。

- 亚太地区的许多企业正在采用结合了 SSD 和 HDD 优势的混合式储存解决方案。透过将SSD快取与传统HHD结合部署,企业可以实现效能和成本效益之间的平衡。

- 受网路购物日益普及的推动,亚太地区的电子商务产业经历了快速成长。 SSD 快取在确保电子商务平台的顺畅和回应、改善使用者体验和降低尖峰时段停机风险方面发挥了重要作用。

印度可望占据主要市场占有率

- 印度是一个快速成长的技术产品和服务市场,包括 SSD 快取等储存解决方案。印度各产业正在经历数位转型,包括金融、电子商务和医疗保健。随着企业和组织将业务数位化,对更快的资料存取和更高的应用程式效能的需求也日益增加,而 SSD 快取有助于实现这一目标。

- 由于网路购物和数位交易的迅速普及,印度的电子商务产业正在迅速成长。电子商务平台需要快速的资料存取和回应能力来提供无缝的购物体验,这使得 SSD 快取成为一项有价值的技术。

- 印度品牌股权基金会指出,随着网路使用者数量的不断增长和良好的市场环境,印度的电子商务产业具有巨大的潜力。指数级成长的印度电子商务产业市场价值在2022年约为748亿美元。预计到2030年这数字将达到约3,500亿美元。

- 随着游戏玩家和游戏爱好者数量的不断增长,印度的游戏产业正在蓬勃发展。 SSD 快取可以透过减少载入时间和提高整体效能来显着改善您的游戏体验。

- 印度政府非常重视「数位印度」等倡议,智慧城市的推广也使得政府更加重视科技的采用。这些工作需要高效的储存解决方案来处理各种数位服务产生的资料。

亚太地区 SSD 快取产业概况

亚太地区的 SSD 快取市场高度分散,主要参与者包括英特尔公司、三星电子、美光科技公司、西部数据公司和威联通系统公司。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

2023 年 1 月,QNAP 将推出采用全新储存介面和技术的先进 NAS 解决方案。其中包括 QNAP 首款全快闪 NAS TBS-574X,它支援热插拔 E1.S NVMe SSD,能够以更高的可维护性满足对性能要求高的视讯製作需求。配备NPU 来增强影像识别应用和视讯监控。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- SSD 相比传统 HDD 有哪些改进?

- 市场挑战

- 产品成本高与SSD低延迟的矛盾

第六章 市场细分

- 按应用

- 企业储存

- 个人储存

- 按国家

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

第七章 竞争格局

- 公司简介

- Intel Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Western Digital Corporation

- QNAP Systems Inc.

- NetApp Inc.

- Kioxia(Toshiba Memory Corporation)

- SK Hynix Inc.

- ADATA Technology Co. Ltd

- Seagate Technology LLC

- Transcend Information Inc.

- Inspur Group

- Microsemi(Microchip Technology Inc.)

第八章投资分析

第九章:市场的未来

The Asia Pacific SSD Caching Market size is estimated at USD 20.61 billion in 2025, and is expected to reach USD 29.59 billion by 2030, at a CAGR of 7.5% during the forecast period (2025-2030).

SSD caching involves using solid-state drives (SSDs) to accelerate the performance of traditional hard disk drives (HDDs) in computer systems. This technology aims to combine the speed of SSDs with the storage capacity of HDDs to enhance overall system performance, especially for applications that require fast data access.

Key Highlights

- The increasing digitization of businesses and the general population's reliance on technology have led to higher demands for faster data access and storage solutions. Many countries in the Asia Pacific region have been investing in improving their technological infrastructure, including network connectivity and data centers. This provided a favorable environment for SSD caching to thrive.

- The growth of E-commerce platforms, online streaming services, and other content consumption platforms drove the need for efficient data storage and retrieval, pushing businesses to consider SSD caching to enhance user experiences.

- The improvements offered by SSDs align with the demands of various industries and the growing need for faster, more reliable, and energy-efficient storage solutions in the Asia Pacific region. As a result, SSD caching, which leverages these SSD benefits to enhance HDD performance, has been gaining traction in the market.

- SSDs tend to be more expensive than traditional HDDs on a per-gigabyte basis. This cost differential can be challenging, especially for businesses or individuals adopting SSD caching solutions. While SSDs generally offer low-latency performance compared to traditional HDDs, there can be variability in performance across different SSD models, brands, and even generations of SSD technology.

APAC SSD Caching Market Trends

Enterprise Storage Application Segment is Expected to Hold Significant Market Share

- Enterprises in the Asia Pacific region were increasingly adopting SSD caching to enhance the performance of their storage systems. SSD caching helps accelerate data retrieval, improving application responsiveness and reducing latency. This is particularly crucial for mission-critical applications, databases, and virtualized environments.

- Data centers and cloud services providers in the Asia Pacific region focused on optimizing their infrastructure to meet the rapidly growing digital services demand. SSD caching improved the efficiency and speed of data processing in these environments, contributing to a better user experience. According to Cloudscene, as of January 2022, 443 data centers were in China.

- As the number of data centers in the region increases, there is a corresponding demand for storage solutions to support the data processing needs of these facilities. Data centers rely on high-performance storage systems to deliver efficient services, and SSD caching can enhance the speed and responsiveness of data processing.

- Many enterprises in the Asia Pacific region were adopting hybrid storage solutions that combine the strengths of SSDs and HDDs. By implementing SSD caching in conjunction with traditional HHDs, businesses could achieve a balance between performance and cost-effectiveness.

- The e-commerce sector in the Asia Pacific region experienced rapid growth, driven by increasing online shopping trends. SSD caching played a role in ensuring smooth and responsive e-commerce platforms, enhancing user experiences, and reducing the risk of downtime during peak traffic times.

India is Expected to Hold Significant Market Share

- India is a rapidly growing market for technology products and services, including storage solutions like SSD caching. India has undergone significant digital transformation across various industries, including finance, e-commerce, healthcare, and more. As businesses and organizations digitize their operations, there's an increasing need for faster data access and improved application performance, which SSD caching can help.

- The e-commerce sector in India has been expanding increasingly, driven by the rapid use of online shopping and digital transactions. E-commerce platforms require quick data access and responsiveness to deliver a seamless shopping experience, making SSD caching a valuable technology.

- According to the India Brand Equity Foundation, Owing to the growing Internet user base and favorable market conditions, the country has potential in the e-commerce industry. Increasing at an exponential rate, the market value of the e-commerce industry in India was about USD 74.8 billion in 2022. This number is estimated to reach approximately USD 350 billion by 2030.

- The gaming industry in India has been on the rise, with a growing number of gamers and game enthusiasts. SSD caching can significantly improve gaming experiences by reducing load times and improving overall performance.

- The Indian government is focused on initiatives such as "Digital India," and the push for smart cities has led to an increased emphasis on technology adoption. These initiatives require efficient storage solutions to handle the data generated by various digital services.

APAC SSD Caching Industry Overview

The Asia Pacific SSD Caching market is highly fragmented, with the presence of major players like Intel Corporation, Samsung Electronics Co. Ltd, Micron Technology Inc., Western Digital Corporation, and QNAP Systems Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, QNAP introduced advanced NAS solutions by adopting a new storage interface and technologies that include the TBS-574X - QNAP's first all-flash NAS that supports hot-pluggable E1.S NVMe SSDs to fulfill performance-demanding video production with higher serviceability, and the TS-AI642 that features on-device AI with NPUs for boosting image recognition applications and video surveillance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improvements Offered by SSDs Over Conventional HDDs

- 5.2 Market Challenges

- 5.2.1 High Cost of Products and Inconsistency Regarding Low-rate Latency by SSDs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Enterprise Storage

- 6.1.2 Personal Storage

- 6.2 By Country

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 India

- 6.2.4 South Korea

- 6.2.5 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Micron Technology Inc.

- 7.1.4 Western Digital Corporation

- 7.1.5 QNAP Systems Inc.

- 7.1.6 NetApp Inc.

- 7.1.7 Kioxia (Toshiba Memory Corporation)

- 7.1.8 SK Hynix Inc.

- 7.1.9 ADATA Technology Co. Ltd

- 7.1.10 Seagate Technology LLC

- 7.1.11 Transcend Information Inc.

- 7.1.12 Inspur Group

- 7.1.13 Microsemi (Microchip Technology Inc.)