|

市场调查报告书

商品编码

1629789

拉丁美洲的油田服务:市场占有率分析、产业趋势与成长预测(2025-2030)South And Central America Oil Field Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

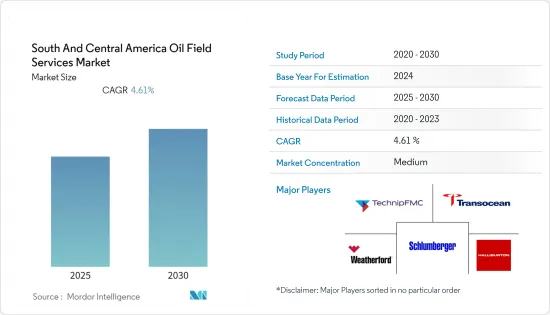

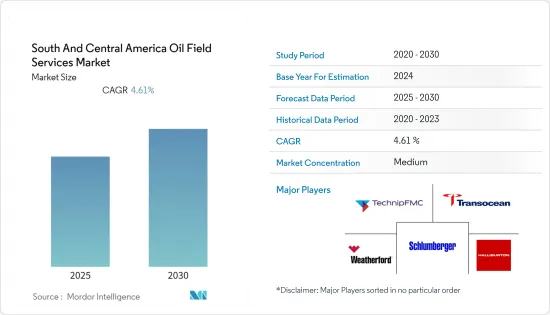

拉丁美洲油田服务市场预计在预测期内复合年增长率为4.61%

主要亮点

- 从长远来看,该地区海上作业的增加以及对页岩气等传统型碳氢化合物的需求增加等因素预计将在预测期内推动市场发展。

- 另一方面,随着可再生能源使用的增加,对天然气等碳氢化合物发电的需求预计将下降。因此,预计在预测期内市场成长将放缓。

- 墨西哥和阿根廷已发现页岩油气蕴藏量,其开发预计将在未来几年为拉美油田服务市场提供若干机会。

- 在预测期内,巴西拉丁美洲油田服务市场可能会显着成长。

拉丁美洲油田服务市场趋势

钻井服务预计将主导市场

- 钻井是整个勘探和生产 (E&P) 阶段中成本最高的部分之一,其中需要钻探新井。在工业界,通常估计钻井成本占一口井总成本的 70% 以上。因此,钻井服务预计将为市场带来大量资金。

- 由于俄罗斯和乌克兰之间的衝突,世界对碳氢化合物的需求不断增加,价格不断上涨,该地区大多数国家都转向钻探新井以增加石油产量,并从石油中赚取更多利润。拉丁美洲的钻机数量从 2021 年 1 月的 119 座增加到 2023 年 2 月的 181 座。

- 例如,阿根廷国家石油和天然气生产商YPF计划在2018年至2022年间投资300亿美元。它希望每年将碳氢化合物产量增加 5%,直到 2022 年达到每天 70 万桶石油当量。该公司计划开发29个计划,钻探1,600口井。 2022年1月有报告指出,自2021年1月起,阿根廷页岩气产量达6,900万立方公尺/日,较去年同月增加42%。

- 这可能会为製造冷却系统的公司带来新的商机。 2021年9月,阿根廷政府通过了一项鼓励投资碳氢化合物的法律。其目的是增加石油和天然气的出口和国内产量,包括瓦卡穆尔塔页岩地层的石油和天然气产量。

- 鑑于上述情况,拉丁美洲油田服务市场预计未来几年钻井服务将显着成长。

巴西市场预计将显着成长

- 由于巴西在大西洋的深海和超深海活动,预计将占据很大的市场份额。随着2021-2022年勘探和产量大幅成长,油田服务将投入更多资金。

- 去年的成长主要来自离岸部门。油田服务支出的增加可能与钻井和完井作业的增加有关,预计这将推动对液压系统冷却系统的需求。

- 巴西有多个大型海上上游计划正在进行中,预计2025年将生产全球20%以上的海上原油和冷凝油。根据BP世界能源统计年鑑,2022年巴西石油产量为310.7万桶/日。

- 预计大部分产量将来自坎波斯盆地的 Pao de Acucar 和 Calcara 油田。随着这两个油田的投产,上游和中游产业对冷却系统的需求将大幅增加,预计将在预测期内推动油田服务市场。

- 综上所述,在预测期内,巴西拉美油田服务市场可能会显着成长。

拉丁美洲油田服务业概况

拉丁美洲油田服务市场适度细分。该市场的主要企业(排名不分先后)包括 Schlumberger NV、Transocean LTD、Weatherford International plc、Halliburton Company 和 TechnipFMC PLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 海运业务增加

- 对非常规能源来源的需求不断成长

- 抑制因素

- 可再生能源需求

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 服务

- 钻井服务

- 竣工服务

- 生产设备

- 其他的

- 部署地点

- 陆上

- 离岸

- 地区

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- Key Companies Profile

- Schlumberger NV

- Transocean LTD.

- Weatherford International plc

- Halliburton Company

- TechnipFMC PLC

- COSL/Shs A Vtg 1.00(China Oilfield Services Limited)

- Saipem SpA

- National-Oilwell Varco, Inc.

- Superior Energy Services, Inc.

第七章市场机会与未来趋势

- 墨西哥和阿根廷页岩油气蕴藏量

简介目录

Product Code: 56713

The South And Central America Oil Field Services Market is expected to register a CAGR of 4.61% during the forecast period.

Key Highlights

- Over the long term, factors such increasing number of offshore operations in the region and rising demand from unconventional hydrocarbons, like shale gas, etc, is expected to drive the market in the forecast period.

- On the other hand, as more renewable energy is used, the demand for hydrocarbons like natural gas to make electricity is expected to go down. This will slow the growth of the market during the forecast period.

- Nevertheless, shale oil and gas reserves have been discovered in Mexico and Argentina, and their exploitation is expected to create several opportunities for the South and Central American oil field services market in the future.

- Brazil is likely to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Market Trends

Drilling Services Expected to dominate the market

- Drilling is one of the most cost-intensive parts of the entire exploration and production (E&P) phase, and new wells are being drilled. Most estimates in the industry say that drilling costs more than 70% of the total cost of a well. Because of this, drilling services are expected to bring in a lot of money for the market.

- As the global demand for hydrocarbons has gone up and prices have gone up because of the conflict between Russia and Ukraine, most countries in the region are spending a lot of money drilling new wells to increase oil production and make more money from oil.The rig count in South and Central America increased from just 119 in January 2021 to 181 in February 2023.

- For instance, YPF, Argentina's state-run oil and gas producer, planned to invest USD 30 billion between 2018 and 2022. It wanted to increase hydrocarbon production by 5% per year until it reached 700,000 barrels of oil equivalent per day by 2022. The company planned to develop 29 projects and drill 1,600 wells. In January 2022, it was reported that Argentina's shale gas production witnessed a 42% YoY growth from January 2021, up to 69 million cubic meters per day.

- This is likely to open up new business opportunities for companies that make cooling systems. In September 2021, the government of Argentina passed a bill to encourage investment in hydrocarbons. The goal was to increase oil and gas exports and domestic production in the huge Vaca Muerta shale formation and elsewhere.

- Due to the above, the South and Central American oil field services market is expected to see a lot of growth in drilling services over the next few years.

Brazil Expected to See Significant Market Growth

- Due to its deep-water and ultra-deep-water activities in the Atlantic Ocean, Brazil is likely to have a large share of the market. Exploration and production have grown a lot between 2021 and 2022, which has led to more money being spent on oilfield services.

- The growth during the last year mainly came from the offshore sector. The increased spending on oilfield services can be related to increased drilling and completion practices, which are expected to drive the demand for cooling systems for hydraulic systems.

- Brazil has a number of large-scale offshore upstream projects in the works, and it is expected that by 2025, the country will produce more than 20% of the world's offshore crude oil and condensate. According to the BP Statistical Review of World Energy, Brazil's oil production in 2022 was 3,107 thousand barrels per day.

- The majority of the production is expected to come from the Pao de Acucar in the Campos basin and Carcara fields. With the commencement of production from these two fields, the demand for cooling systems in the upstream industry, as well as the midstream industry, is expected to increase significantly, driving the oilfield services market during the forecast period.

- Hence, owing to the above points, Brazil is likely going to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Industry Overview

The South and Central America oil field services market is moderately fragmented. Some of the key players in this market (in no particular order) include Schlumberger NV, Transocean LTD, Weatherford International plc, Halliburton Company, and TechnipFMC PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Number of Offshore Operations

- 4.5.1.2 Demand Coming for Unconventional Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 Demand for Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Service

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production Equipment

- 5.1.4 Other Serivices

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Argentina

- 5.3.4 Rest of The South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profile

- 6.3.1 Schlumberger NV

- 6.3.2 Transocean LTD.

- 6.3.3 Weatherford International plc

- 6.3.4 Halliburton Company

- 6.3.5 TechnipFMC PLC

- 6.3.6 COSL/Shs A Vtg 1.00 (China Oilfield Services Limited)

- 6.3.7 Saipem SpA

- 6.3.8 National-Oilwell Varco, Inc.

- 6.3.9 Superior Energy Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shale Oil and Gas Reserves in Mexico and Argentina

02-2729-4219

+886-2-2729-4219