|

市场调查报告书

商品编码

1687097

油田服务(OFS) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Oilfield Services (OFS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

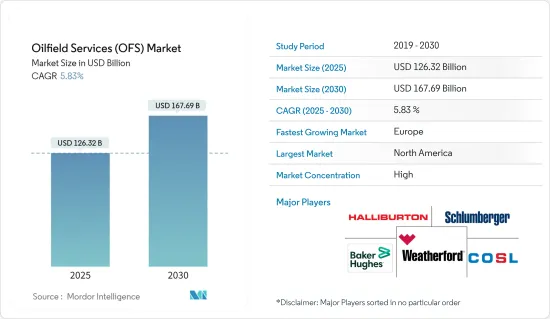

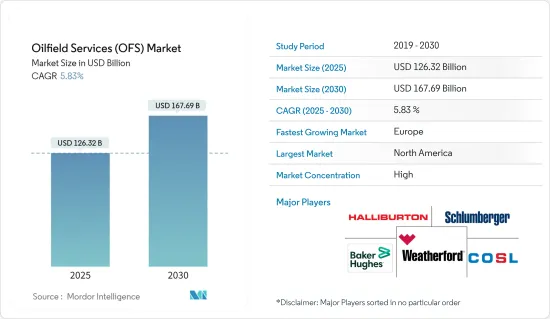

油田服务 (OFS) 市场规模预计在 2025 年为 1,263.2 亿美元,预计到 2030 年将达到 1,676.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.83%。

关键亮点

- 从中期来看,预计天然气蕴藏量开发增加以及先进技术、工具和设备等因素将在预测期内推动油田服务市场的发展。

- 另一方面,近期原油价格受供需缺口、地缘政治等多种因素影响波动,抑制了油田服务市场的需求成长。

- 然而,在预测期内,专注于优化碳氢化合物生产成本的新技术和方法预计将为油田服务市场创造一些机会。

- 由于页岩油田的钻探和生产活动活跃,预计北美将成为预测期内最大的市场。

油田服务市场趋势

钻井服务预计将占据市场主导地位

- 预计全球经济将支持石油需求大幅成长。强劲的经济体预计将消耗更多的石油,并且需求预计在未来多年仍将强劲成长。预计到2024年,印度和中国将占全球石油需求的50%左右。

- 根据石油输出国组织(OPEC)的统计,2023年全球原油需求量约为1.0221亿桶/日,高于2022年的9,957万桶/日。原油需求的增加正在增加全球对钻井服务的需求。

- 2023 年 4 月,海上钻井公司 Seadrill Limited 宣布成功收购 Aquadrill LLC。此次全股票收购价值 9.58 亿美元,打造了一支高规格船队,包括 12 座浮式钻井平台、3 座极端环境钻机、4 座良性自升式钻井平台和 3 座竞标辅助钻机。

- 2024年2月,中东最大的国有钻井公司阿布达比国家石油公司钻井公司获得在阿曼竞标钻机供应的竞标,并正在寻求核准参与沙乌地阿拉伯和科威特的竞标。到2024年底,该公司将持有足够的钻机部署到阿联酋以外的地方。

- 因此,大型石油和天然气公司面临着增加产量和满足日益增长的能源需求的压力。因此,随着传统型油田开始显露出成熟迹象,一些业者正将重点转向开发传统型蕴藏量。

- 2023年10月,Transocean宣布已获得三座陆地钻井钻机的新续约合约。其中一座钻机根据与信实工业公司签订的合约部署在印度,日租金为 33 万美元。合约已续约至2025年10月,每日津贴增加至348,000美元。当现有合约于2023年12月到期时,钻机将有45天的准备期,然后才能开始新的合约。

- 因此,鑑于上述情况,预计钻井服务将在预测期内占据油田服务市场的主导地位。

预计北美将主导市场

- 北美是世界海上石油和天然气工业最发达的地区之一,主要重点地区是墨西哥湾和阿拉斯加近海的丰富蕴藏量。随着钻井深度逐年增加,技术可采蕴藏量大幅增加,吸引了该地区对海上石油和天然气领域的投资。由于上述因素,该地区也是全球油田服务市场的热点,其中美国占据了大部分份额。

- 随着美国大力投资扩大石油和天然气生产能力,墨西哥湾已成为海上钻油平臺服务的重点热点。墨西哥湾为该地区提供了丰富的自然资源,包括石油和天然气。

- 由于页岩地层和緻密蕴藏量的钻井和水力压裂井数量不断增加,美国预计将成为最大的油田服务市场之一。这是由于盆地内较低的损益平衡价格所致。页岩气、水平钻井和水力压裂技术的最新发展大大增加了该地区对油田服务的需求。

- 美国一直处于领先地位,预计在预测期内将继续主导北美石油和天然气市场。美国是世界最大的石油和天然气生产国,预计未来几年将满足全球约60%的石油需求。然而,由于俄乌战争的影响,美国对俄罗斯的石油、精炼石油产品、天然气和煤炭实施了进口限制。这导緻美国各地天然气价格上涨,通膨压力加大,导致2022年资本预算和支出减少,产量受到限制,营运公司的钻井钻机数量减少。

- 不过,这种情况在2023年发生了逆转。例如,根据贝克休斯的油井数量,2024年2月美国共有626座运作中的旋转钻机,其中20座为海上钻机,606座为陆上钻机。与 2022 年底 15 座运作钻机相比,海上钻机数量增加。预计这些趋势将支持该国钻井服务的成长,并进一步推动油田服务市场的成长。

- 同样,加拿大拥有仅次于委内瑞拉和沙乌地阿拉伯的世界第三大原油蕴藏量,其中96%为油砂蕴藏量。该国可开采的原油密度大,含有大量沙粒。这增加了该国对油田服务的需求,因为需要高压和井下干预才能将石油从井底输送到地面。

- 因此,鑑于上述情况,预计北美将在预测期内主导油田服务市场。

油田服务业概况

油田服务市场是细分的。市场的主要企业(不分先后顺序)包括斯伦贝谢有限公司、贝克休斯公司、哈里伯顿公司、威德福国际公司和中海油田服务股份有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 2029 年石油和天然气产量及预测

- 2023年陆上和海上钻机运作

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 开发天然气蕴藏量并增加使用先进技术、工具和设备

- 全球油田服务投资增加

- 限制因素

- 近期原油价格波动,供需缺口较大

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 服务类型

- 钻井服务

- 完井服务

- 生产和干预服务

- 其他的

- 地点

- 陆上

- 海上

- 市场分析:按地区分類的市场规模及至2028年的需求预测(按地区划分)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 西班牙

- 北欧的

- 土耳其

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Schlumberger Limited

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- Transocean Ltd

- Valaris PLC

- China Oilfield Services Limited

- Nabors Industries Inc.

- Basic Energy Services Inc.

- OiLSERV

- Expro Group

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 更重视优化碳氢化合物生产成本的新技术和方法

简介目录

Product Code: 55022

The Oilfield Services Market size is estimated at USD 126.32 billion in 2025, and is expected to reach USD 167.69 billion by 2030, at a CAGR of 5.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing development of gas reserves and advanced technology, tools, and equipment are expected to drive the oilfield services market during the forecast period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the growth in the demand for the oilfield services market.

- However, the focus on new technologies and methods to optimize the production cost of hydrocarbons is expected to create several opportunities for the oilfield services (OFS) market during the forecast period.

- North America is expected to be the largest market during the forecast period, owing to high drilling and production activity in shale fields.

Oilfield Services (OFS) Market Trends

Drilling Services Are Expected to Dominate the Market

- The global economy is expected to underpin a substantial increase in oil demand. Strong economies are anticipated to consume more oil, and the demand is expected to grow significantly over the years. India and China will contribute around 50% of the global oil demand by 2024.

- According to the Organization of the Petroleum Exporting Countries (OPEC) statistics, the worldwide crude oil demand was around 102.21 million barrels per day in 2023, up from 99.57 million barrels in 2022. The rising demand for crude oil increases the demand for drilling services worldwide.

- In April 2023, Seadrill Limited, an offshore drilling company, announced acquiring Aquadrill LLC successfully. The all-stock acquisition, valued at USD 958 million, creates a high-spec fleet comprised of 12 floaters, three harsh environment rigs, four benign jack-ups, and three tender-assisted rigs.

- In February 2024, ADNOC Drilling, the largest national drilling company in the Middle East, was qualified to bid to supply rigs in Oman and is seeking approvals to participate in tenders in Saudi Arabia and Kuwait. By the end of 2024, the company will have enough rigs to deploy outside the United Arab Emirates.

- Hence, the top oil and gas operating companies are under increasing pressure to increase production and meet the increasing energy demand. As a result, several operating companies have shifted their focus toward exploiting unconventional reserves, as the conventional fields have started showing signs of maturity.

- In October 2023, Transocean announced that it secured a new extension contract for three of its onshore drilling rigs. One of those rigs is deployed in India under contract with Reliance Industries Limited at a day rate of USD 330,000. The agreement was renewed until October 2025 with an increased day rate of USD 348,000. Following completion of the current contract in December 2023, the rig will undergo a 45-day preparation period before commencing the new contract.

- Therefore, owing to the above points, drilling services are expected to dominate the oilfield services (OFS) market during the forecast period.

North America is Expected to Dominate the Market

- North America has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and offshore Alaska region. As drilling depths increased over the years, the volume of technically recoverable reserves increased significantly, attracting investments in the region's offshore oil & gas sector. Due to the factors mentioned above, the region is also a global hotspot for the oilfield services market, with most of the share from the United States.

- As the United States invested heavily in expanding its oil & gas production capacity, the Gulf of Mexico has become a key hotspot for offshore drilling rig services. The Gulf of Mexico is responsible for the region's rich natural resources, including oil and gas.

- The United States is expected to be one of the largest markets for oilfield services, mainly due to the increasing number of wells being drilled and fracked in shale and tight reserves. The basins' low breakeven price supports this. The recent development of shale plays, horizontal drilling, and fracking has resulted in a massive increase in demand for oilfield services in the region.

- The United States has always been at the forefront and is expected to continue dominating North America's oil and gas market during the forecast period. The United States is a major crude oil and natural gas producer globally, and it is expected to cover around 60% of the world's oil demand in the coming years. However, owing to the negative impact of the Russia-Ukraine War, the United States imposed restrictions on importing oil, refined petroleum products, natural gas, and coal from Russia. This led to higher gas prices and increased inflation pressure across the United States, leading to a decline in the capital budget and expenditure, curtailed production, and reduced drilling rig count by the operating companies in 2022.

- However, this scenario recovered in 2023. For instance, according to the Baker Hughes Rig Count, in February 2024, the United States had 626 active rotary rigs, of which 20 were offshore rigs and 606 onshore rigs. This recorded a rise in the offshore rig counts compared to the 15 active rigs at the end of 2022. These trends will likely support the growth of the country's drilling services and further promote the growth of the oilfield services market.

- Similarly, Canada has the world's third-largest crude oil reserves, after Venezuela and Saudi Arabia, of which 96% are oil sand reserves. The oil available in the country is high-density and has a high sand particle content. Due to this, oil transport from the bottom hole of the oil well to the surface requires high pressure and wellbore intervention, thus increasing the demand for oilfield services in the country.

- Therefore, owing to the above points, North America is expected to dominate the oilfield services (OFS) market during the forecast period.

Oilfield Services (OFS) Industry Overview

The oilfield services market is fragmented. Some of the major players in the market (in no particular order) include Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International PLC, and China Oilfield Services Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Crude Oil and Natural Gas Production and Forecast, till 2029

- 4.4 Onshore and Offshore Active Rig Count, till 2023

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Increasing Development of Gas Reserves and Advanced Technology, Tools, and Equipment

- 4.7.1.2 Increasing Investment in the Oilfield Services across World

- 4.7.2 Restraints

- 4.7.2.1 The Volatile Oil Prices Over the Recent Period, Owing to the Supply-Demand Gap

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production and Intervention Services

- 5.1.4 Other Services

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 NORDIC

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Weatherford International PLC

- 6.3.3 Baker Hughes Company

- 6.3.4 Halliburton Company

- 6.3.5 Transocean Ltd

- 6.3.6 Valaris PLC

- 6.3.7 China Oilfield Services Limited

- 6.3.8 Nabors Industries Inc.

- 6.3.9 Basic Energy Services Inc.

- 6.3.10 OiLSERV

- 6.3.11 Expro Group

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on New Technologies and Methods to Optimize its Production Cost of Hydrocarbons

02-2729-4219

+886-2-2729-4219