|

市场调查报告书

商品编码

1629791

北美压力感测器:市场占有率分析、产业趋势、成长预测(2025-2030)NA Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

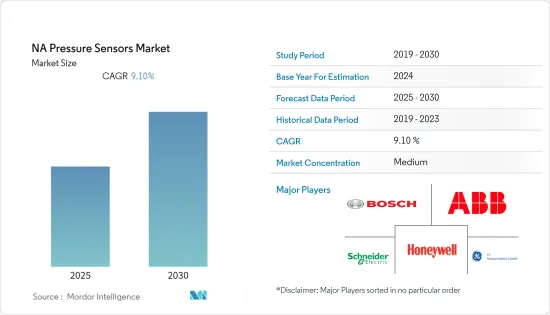

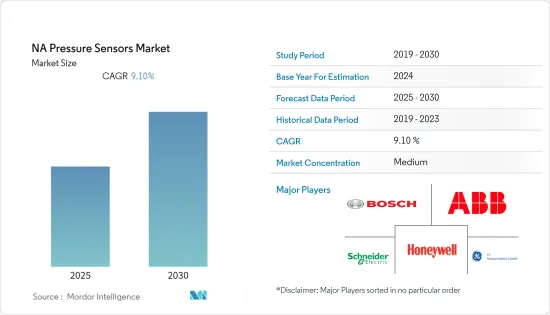

北美压力感测器市场预计在预测期内复合年增长率为 9.1%

主要亮点

- 由于压力感测器在航太、汽车、医疗保健和消费品等各行业的广泛应用,压力感测器多年来经历了显着增长。这是由于测量技术的发展,压力和液位测量设备与其应用领域一样多种多样,从实验室应用、工厂和机械工程到製程技术。

- MEMS(电子机械系统)已上市一段时间,但近年来压力测量行业最显着的趋势是推动更小的元件、更高的精度和更高的可靠性。随着製造商利用微处理器技术的进步在压力测量领域进行重大改进,这引发了基于 MEMS 的压力感测器的成长。

- 由于压力感测器正在改变智慧家庭、智慧建筑、智慧城市和智慧工厂的发展,物联网连接设备的成长预计将推动所研究市场的成长。

- COVID-19 大流行对该行业产生了负面影响,因为大多数企业活动和升级计划都被搁置,以阻止病毒的传播。不过,市场在2021年初復苏,未来成长可期。

北美压力感测器市场趋势

汽车工业显着成长

- 由于压力感测器在汽车和汽车行业的多种应用,汽车行业按应用类型占据最大的市场占有率。无论是在引擎、轮胎或乘客舱中,合适的汽车压力感知器都能提供经济高效的可靠性和较长的使用寿命。

- 对感测器类型的需求因安装位置而异。如果 TMPS 安装在轮圈内部,通常会配备使用磁感应的无线供电系统,因为这些感测器一旦安装就很难进行电池更换。

- 此外,有关蒸发排放的法规也越来越严格,特别是在北美和欧洲。全球高达 20% 的碳氢化合物排放排放汽车,开发更有效率的 EVAP 系统对汽车製造商来说是一项重大挑战,而更好的蒸气压感测器的研发工作也日益活跃。

- 然而,挡风玻璃擦拭技术的最新创新正在为压力感测器市场创造新的机会。梅赛德斯在其 S-Class 和 SL 级汽车上引入了一种名为 Magic Vision Control 的新型擦拭技术。

美国占最高市场占有率

- 北美在全球压力感测器市场中占据主导地位,预计在市场估计和预测期内将显着成长。

- 该地区在几乎所有行业中自动化和智慧设备的采用率也是最高的。由于自动化率高,该地区在智慧家庭和智慧办公室市场占据主导地位。与世界其他地区相比,该地区在医疗保健行业采用资讯技术方面也是最先进的。

- 根据美国汽车政策委员会的数据,汽车製造商及其供应商是美国最大的製造业,占美国GDP的3%。它也是美国最大的出口商,过去5年出口了超过6,900亿美元的汽车和零件,比第二大出口商航太业多出约760亿美元。

- 哈佛大学研发部门开发了一个平台来创建软性机器人,该机器人包含先进的压力感测器,可以感知运动、压力、触摸,甚至温度。

- 该地区政府为确保汽车行业乘客安全而製定的法规预计将成为压力感测器市场的主要成长要素。例如,美国政府通过了TREAD法案,要求所有车辆配备轮胎压力监测系统(TPMS),使驾驶员能够在检测到车辆气压不足后20分钟内向驾驶员发出警报。

北美压力感测器产业概况

北美压力感测器市场部分分散,由多家公司组成。从市场占有率来看,目前该市场由几家大型企业占据主导地位。然而,凭藉创新和永续的包装,许多公司正在透过赢得新契约和开发新市场来扩大其市场份额。

- 2021 年 9 月 - TDK Corporation(总裁:Takehiro Kamigama)宣布推出 InvenSense ICP-20100 平台,这是一款功能丰富的新一代气压感测器,非常适合智慧型手机、平板电脑、无人机和智慧家电等应用。它将在全球发行。 ICP-20100 提供了架构创新,可提高业界领先的 SmartPressure 产品系列的精度、长期漂移和温度稳定性。

- 2021 年 2 月 - 北卡罗来纳州立大学研究人员报告了一种轻质、柔软的基于织物的感测器原型贴片。该设备包含一个导电线网格,并连接到一台小型电脑。研究人员在义肢和两名志愿者的步行实验中测试了该系统,发现它可以可靠地即时追踪压力变化。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 汽车和医疗保健等最终用户行业的成长

- MEMS 和 NEMS 系统在工业中的采用率不断提高

- 市场限制因素

- 与感测产品相关的高成本

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- 汽车(轮胎压力、煞车油压力、燃料箱蒸气压、燃油喷射和CDRi、歧管绝对压力等)

- 医疗(CPAP、人工呼吸器、吸入器、血压监测等)

- 家用电子产品

- 工业的

- 航太/国防

- 饮食

- 空调

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- GMS Instruments BV

- Honeywell International Inc.

- Invensys Ltd

- Kistler Group

- Rockwell Automation Inc.

- Rosemount Inc.(Emerson Electric Company)

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Corporation

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 56724

The NA Pressure Sensors Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- Owing to numerous applications across various industries, such as aerospace, automotive, healthcare, consumer goods, etc., pressure sensors have witnessed significant growth over the years. This can be attributed to the evolution of measurement technologies, as pressure and level measuring devices have become as diverse as their areas of application, ranging from laboratory applications, plant and mechanical engineering to process technology.

- Though MEMS (micro-electro-mechanical systems) have been in the market for a long time, the most prominent trend in the pressure measurement industry over the past few years has been a drive toward smaller parts, increased accuracy, and improved reliability. This has triggered the growth of MEMS-based pressure sensors, as manufacturers leverage advances in microprocessor technology to introduce key improvements in the area of pressure measurement.

- The growth in IoT connected devices is projected to fuel the growth of the market studied, as pressure sensors are transforming the development of smart homes and buildings, smart cities, and smart factories.

- Covid-19 pandemic had an adverse impact on the industry as most of the businesses activities and upgradation projects were put on hold to contain the spread of the virus. However, the market has witnessed a comeback in early 2021 and is expected to grow henceforth.

North America Pressure Sensors Market Trends

Automotive Industry to Show Significant Growth

- The automotive sector accounted for the largest market share by application type, owing to several applications of pressure sensors in automobiles and in the automotive industry. The appropriate automotive pressure sensor can deliver cost-effective reliability and long operational life, whether the application is in the engine, tire, or passenger compartment.

- The demand for the type of sensor depends on the location of installation. If TMPS is located inside of the rims, they are often equipped with wireless power systems enabled by magnetic induction, as these sensors are hard to reach for battery replacement activities once installed.

- Further, evaporative emissions are being subjected to more stringent regulations, especially in North America and Europe. With up to 20% of global hydrocarbon emissions occurring from vehicles, there is a considerable challenge for automotive manufacturers to develop more efficient EVAP systems, triggering research and development activities for better vapor pressure sensors.

- However, in recent times, innovations in windshield wiping technology are increasingly opening up new opportunities to the pressure sensors market. Mercedes has adopted a new windshield wiping technology called Magic Vision Control in its S and SL class vehicles, which washer into wiper.

United States to Hold the Highest Market Share

- North America is dominating the global pressure sensor market and is estimated to grow significantly over the forecast period.

- The region also has the highest adoption of automation and smart devices in almost every industry. Owing to a high rate of automation, the region is a dominating market for smart homes and smart offices. In comparison to the world, the region has also witnessed the highest adoption of IT in the healthcare industry.

- According to the American Automotive Policy Council, automakers and their suppliers are America's largest manufacturing sector, responsible for 3% of America's GDP. They are also America's largest exporters and have exported more than USD 690 billion in vehicles and parts over the last five years, approximately USD 76 billion more than the next largest exporter, i.e., aerospace.

- The researchers at Harvard University have developed a platform for creating soft robots with embedded advanced pressure sensors that can sense movement, pressure, touch, and even temperature.

- Governmental regulations in the region to ensure passenger safety in the automobile sector are expected to be a significant growth factor for the pressure sensor market. For instance, the US government passed the TREAD Act to mandate the installation of the Tire Pressure Monitoring System (TPMS) in all types of automobiles so that drivers can be cautious about the under-inflation of automobiles within 20 minutes of its detection.

North America Pressure Sensors Industry Overview

The North American Pressure Sensor market is partially fragmented and consists of several players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and tapping new markets.

- September 2021 - TDK Corporation (TSE: 6762) announces the worldwide availability of the InvenSense ICP-20100 platform, a new generation, feature-rich barometric pressure sensor ideal for applications in smartphones, tablets, drones, and smart home appliances. With architectural innovations, ICP-20100 improves on the industry-leading accuracy, long-term drift, and temperature stability of the SmartPressure product family.

- February 2021 - North Carolina State University researchers reported on the lightweight, soft textile-based sensor prototype patch. The device incorporates a lattice of conductive yarns and is connected to a tiny computer. They tested the system on a prosthetic limb and in walking experiments with two human volunteers, finding the system could reliably track pressure changes in real-time.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Automotive and Healthcare

- 4.3.2 Increasing Adoption of MEMS and NEMS Systems in the Industry

- 4.4 Market Restraints

- 4.4.1 High Costs Associated with Sensing Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Automotive (Tire Pressure, Break Fluid Pressure, Vapor Pressure in Fuel Tank, Fuel Injection and CDRi, and Manifold Absolute Pressure among others)

- 5.1.2 Medical (Continuous Positive Airway Pressure (CPAP), Ventilators and Inhalers, and Blood Pressure Monitoring, Among Others)

- 5.1.3 Consumer Electronics

- 5.1.4 Industrial

- 5.1.5 Aerospace and Defence

- 5.1.6 Food and Beverage

- 5.1.7 HVAC

- 5.2 By Country

- 5.2.1 United States

- 5.2.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 All Sensors Corporation

- 6.1.3 Bosch Sensortec GmbH

- 6.1.4 Endress+Hauser AG

- 6.1.5 GMS Instruments BV

- 6.1.6 Honeywell International Inc.

- 6.1.7 Invensys Ltd

- 6.1.8 Kistler Group

- 6.1.9 Rockwell Automation Inc.

- 6.1.10 Rosemount Inc. (Emerson Electric Company)

- 6.1.11 Sensata Technologies Inc.

- 6.1.12 Siemens AG

- 6.1.13 Yokogawa Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219