|

市场调查报告书

商品编码

1629809

拉丁美洲的 AMH(自动物料输送):市场占有率分析、产业趋势、成长预测(2025-2030 年)LA AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

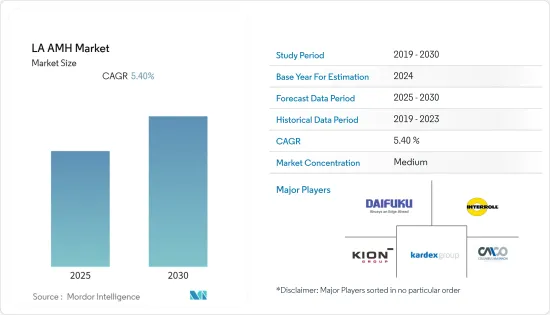

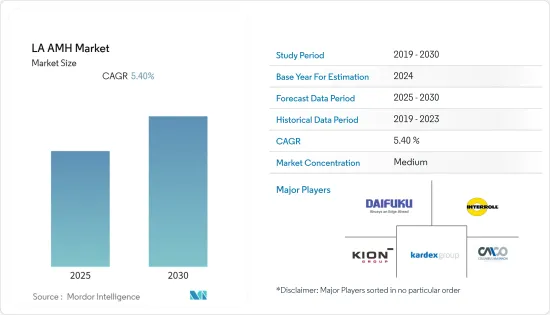

拉丁美洲 AMH(自动物料输送)市场预计在预测期内复合年增长率为 5.4%

主要亮点

- 拉丁美洲经济不断扩张,资源丰富,人口结构良好。因此,这是一个充满前景的自动化市场。该地区的上层和中产阶级人口迅速增长,预计自动化的采用将增加。然而,许多经营模式可能会发生变化,这主要是由于人事费用的急剧增加。

- 在巴西,自动化带来的收益回报 (ROI) 通常更快。 2-4年即可实现投资回报,与其他新兴国家相比较低。部署自动化以降低营运成本并从根本上降低流程效率低下,在巴西的自动化实施中发挥重要作用。拣选和托盘搬运是关键领域,借助自动化技术可以实现许多好处。

- 该地区对电子商务的投资正在增加。例如,PayPal 向阿根廷电商巨头 MercadoLibre 投资 7.5 亿美元、Dragoneer 投资 1 亿美元后,该地区在阿根廷、巴西和墨西哥开设了多个新的物流中心。

- 预计巴西也将占该地区零售电子商务收益的最大份额,达到 173.5 亿美元,这一份额在预测期内将保持一定程度的稳定。

- COVID-19 大流行促使多家公司采用物料输送产品,以最大限度地减少人与人之间的互动。为此,2021年7月,酵母机械公司指定巴西圣若泽杜斯坎普斯(圣保罗)的CMP Trading作为其自动切割系统、物料输送设备和设计软体的经销商。

拉丁美洲 AMH(自动物料输送)市场趋势

墨西哥成长最快

- 墨西哥拥有多种工业,包括汽车和航太工业。自动化投资将有助于增加墨西哥的高薪就业机会,因为墨西哥是人均工程毕业生比例最高的国家之一。

- 随着墨西哥自动化的蓬勃发展,该地区采用机器人技术和先进自动化的公司有望实现创纪录的成长。过去,有些公司完全避免在墨西哥投资,而有些公司则仅将墨西哥的资源作为廉价劳动力的来源。然而,墨西哥的自动化产业正变得越来越复杂,使其与其他主要国家相比更具竞争力。

- 此外,该国正在加强提高自动化程度。例如,墨西哥自动化促进协会(A3)宣传自动化的好处,同时促进该国相关人员和自动化社区成员之间的聚会和交流。

- 此外,由于建立新机场和加强现有机场基础设施的投资增加,预计该国 AMH(自动物料输送)系统的采用将会增加。

成长率最高的食品和饮料

- 食品和饮料行业是该地区最大的经济贡献者之一。在拉丁美洲,巴西出口冷冻食品和肉品,阿根廷是包装和加工食品领域的领先国家。

- 墨西哥拥有庞大的饮料工业。由于毗邻美国和贸易协定,哥伦比亚的食品和饮料行业在过去十年中增长了 50% 以上,而秘鲁和智利在处理水产品和冷冻食品方面处于领先地位。食品和饮料行业的高成长前景加上自动化服务供应商在该地区的渗透正在推动该行业对 AMH 系统的需求。

- 许多墨西哥製造商正在转向混合自动化而不是完全自动化。由于墨西哥缺乏技术纯熟劳工,许多自动化提供者支持这种做法。透过采用混合自动化,现有工人只需最少的培训即可开发新技能。

- 因此,市场上对协作机器人和半自动化解决方案的需求不断增长。这种趋势在海鲜加工公司中尤其明显,这些公司以加工章鱼、沙丁鱼、虾和龙虾等复杂农产品而闻名。

拉丁美洲 AMH(自动化物料输送)产业概况

拉丁美洲 AMH(自动物料输送)市场分散且竞争适中。产品推出、高额研发投入、伙伴关係与收购是国内企业维持激烈竞争所采取的主要成长策略。

- 2021 年 5 月 - ZKW 集团是创新高端照明系统和电子产品的专家,与瑞仕格合作,在其位于墨西哥锡劳的工厂安装 Tornado 微型负载起重机、快速移动输送机系统和过道货架。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对市场的影响

- 市场驱动因素

- 电子商务产业的崛起

- 工业 4.0 投资推动自动化和物料输送的需求

- 市场限制因素

- 确保人力资源的问题

- 初始成本高

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依产品类型

- 硬体

- 软体

- 服务

- 依设备类型

- 移动机器人

- 自动导引运输车(AGV)

- 自动堆高机

- 自动拖车/拖拉机/标籤

- 单元货载

- 组装

- 特殊用途

- 自主移动机器人(AMR)

- 雷射导引车

- 自动储存和搜寻系统(ASRS)

- 固定通道(堆垛机高机+穿梭系统)

- 轮播(水平轮播+垂直轮播)

- 垂直升降模组

- 自动输送机

- 腰带

- 滚筒

- 调色盘

- 开卖

- 堆垛机

- 常规型(高电位+低电位)

- 机器人

- 分类系统

- 移动机器人

- 按最终用户

- 飞机场

- 车

- 饮食

- 零售/仓库/配送中心/物流中心

- 一般製造业

- 药品

- 小包裹

- 其他最终用户

- 按国家/地区

- 巴西

- 阿根廷

- 墨西哥

- 哥伦比亚

- 秘鲁

- 智利

- 其他拉丁美洲

第六章 竞争状况

- 公司简介

- Daifuku Co. Ltd

- Interroll Group

- Kardex Group

- KION Group

- Columbus McKinnon Group

- BEUMER Group GmbH & Co. KG

- **List is not Exhaustive

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 57262

The LA AMH Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Latin America is economically expanding, is resourceful, and demographically buoyant. Thus, it is a promising market for automation. The burgeoning population of the upper and middle classes in the region is expected to increase automation adoption. However, primarily due to a rapid increase in labor costs, many business models are likely to change.

- The delivery of a return on investment (ROI) from automation is generally fast in Brazil. ROI of 2-4 years is achievable, which is less as compared to other emerging countries. Decreasing operating costs and radically reducing inefficiencies in the processes by implementing automation are playing major roles in the adoption of automation in the country. Picking and pallet handling are the major areas in which many gains can be achieved with the help of automation technologies.

- The region has witnessed an increasing investment in e-commerce. For instance, the region witnessed the establishment of several new distribution centers in Argentina, Brazil, and Mexico post the investment of USD 750 million and USD 100 million by PayPal and Dragoneer in Argentina-based e-commerce giant, MercadoLibre.

- Besides, Brazil is expected to account for the most considerable retail e-commerce revenue in the region, with a value of USD 17.35 billion, at a slightly constant rate over the forecast period.

- The Covid-19 pandemic has ushered several companies to incorporate Material Handling products to minimize human interaction on the floor. Thus, to tap into this demand, in July 2021, Eastman Machine Company appointed CMP Trading of Sao Jose dos Campos (Sao Paulo), Brazil, to represent its line of automated cutting systems, material handling equipment, and design software.

Latin America AMH Market Trends

Mexico to witness the Highest Growth

- Mexico is home to various industries, including substantial automotive and aerospace manufacturing sectors. Automation investments can help increase the number of well-paying jobs in Mexico since the country has one of the highest ratios of engineering graduates per capita.

- With the boom of automation in Mexico, any company that employs robotics or advanced automation in the region is poised to register growth. In the past, some companies completely avoided investing in Mexico or only used the resources for cheap labor. However, the automation industry in Mexico is becoming more advanced, which is providing it with a competitive edge over other major countries.

- Furthermore, the country has been witnessing an increase in initiations to promote automation. For instance, the Association for the Advancement of Automation (A3) Mexico promotes the benefits of automation while facilitating gatherings and interchanges between the stakeholders and members of the automation community in the country.

- Moreover, the country is anticipated to witness growth in the adoption of automated material handling systems due to the increasing investments in establishing new airports and enhancing the existing airports' infrastructure.

Food and Beverage to witness the Highest growth rate

- The food and beverage industry is one of the most significant economic contributors to the region. In Latin America, Brazil exports frozen food and meat products, while Argentina is the leading country in the packaged and processed food segment.

- Mexico has a large beverage industry. Due to its proximity to the United States and trade agreements, the Colombian food and beverage industry experienced a growth of over 50% in the last decade, while Peru and Chile were at the forefront in dealing with seafood and frozen food. A high prospect for growth in the food and beverage industry, coupled with the penetration of the automation service providers in the region, is driving the need for AMH systems in the sector.

- Most of the Mexican manufacturers are inclined toward hybrid automation rather than complete automation. Many automation providers support this practice, as the country has a considerable scarcity of skilled workforce. Employing hybrid automation would allow existing workers to cultivate new skills with minimal training.

- As a result, there is a high demand for collaborative robots and semi-automation solutions in the market. This trend is highly visible in the seafood processing companies that are highly renowned for processing complex produce, including Octopus, Sardine, Shrimp, and Lobster.

Latin America AMH Industry Overview

The Latin America automated material handling market is fragmented and moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- May 2021 - The ZKW Group, the specialist for innovative, premium lighting systems and electronics, has partnered with Swisslog to install Tornado miniload cranes, QuickMove conveyor systems, and aisle racking in its facility located in Silao, Mexico.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Rising E-commerce Industry

- 4.3.2 Industry 4.0 investments driving the demand for automation and material handling

- 4.4 Market Restraints

- 4.4.1 The Staffing Challenge

- 4.4.2 High Initial Costs

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.1.3 Laser Guided Vehicle

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional (High Level + Low Level)

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 By End-user Vertical

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Other End Users

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Mexico

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Chile

- 5.4.7 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 Interroll Group

- 6.1.3 Kardex Group

- 6.1.4 KION Group

- 6.1.5 Columbus McKinnon Group

- 6.1.6 BEUMER Group GmbH & Co. KG

- 6.1.7 ** List is not Exhaustive

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219