|

市场调查报告书

商品编码

1629811

分类系统 -市场占有率分析、产业趋势/统计、成长预测 (2025-2030)Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

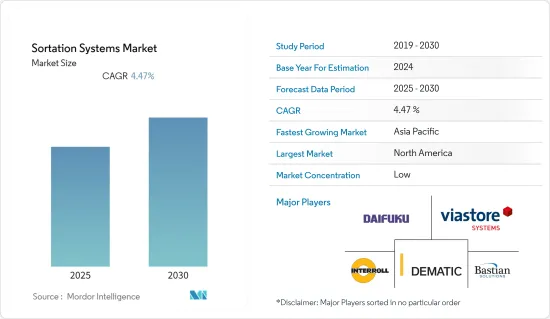

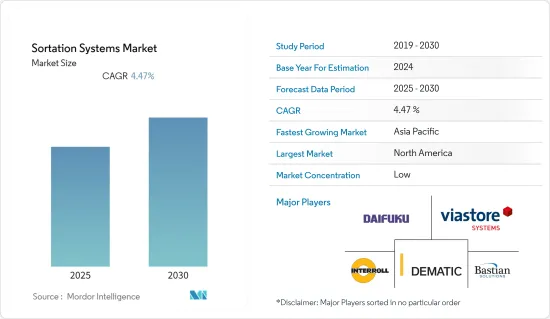

预计分类系统市场在预测期间内复合年增长率为 4.47%

主要亮点

- 库存单位 (SKU) 的快速成长使得批发商和经销商难以就业务做出明智的决策。这增加了对劳动力、设备和技术更具创新性使用的需求。

- 此外,由于可用产品数量不断增加以及对更频繁和更小交付的需求,当前的竞争格局需要交付业务的自动化。这可以立即将您组织的订单准确性降低一半,并将其提高几个百分点。

- 此外,物联网(IoT)技术的采用涵盖了预测期内的市场成长。市场参与企业专注于利用技术来增强其产品供应并满足不同最终用户的不同需求。此外,分类在製药公司中发挥重要作用。这些公司面临浪费问题,因为在储存温度范围之外长期分类的产品变得无法使用。为了克服这项挑战,市场相关人员正在利用物联网连接来执行更快的分类并提高产品位置的可见性。

- 製造这些系统的高额初始投资对自动分类系统市场的成长产生了负面影响。此外,参与企业必须製造符合各个监管机构制定的标准的系统。这阻碍了市场的发展。然而,随着游客数量的增加,机场行李分拣设施中的这些产品预计将在未来几年推动市场成长。

- 此外,各行业对仓库自动化的投资都在增加,预计这将在预测期内提振市场。例如,可口可乐欧洲合作伙伴宣布投资 4,960 万美元在英国工厂建造自动化仓库。此投资用于增加设施的储存容量并安装自动移动约 25,000 个托盘的系统。

分类系统市场趋势

零售业预计将占据主要市场占有率

- 零售市场是世界上最大的市场之一。全通路供应商拥有强大的影响力,是分类系统等物料输送解决方案的最大消费者之一。电子商务营运商对分类系统的需求非常高,因为履约中心需要高吞吐量。

- 此外,工业自动化系统的采用补充了印度市场的成长,不同的公司提供不同的解决方案,其特点是最新的趋势。例如,台达电子提供广泛的自动化产品和解决方案,包括仓库机器人解决方案。

- 技能印度和数位印度等旗舰项目的整合是实现这一目标的关键,从而促进该国的市场成长。 2020年12月,技能部与塔塔共同揭牌了第一批印度技能实验室。印度正在推出此类计划,以培养工厂自动化和分类系统的技能,并提高公众和商业组织的认识。

- 随着冠状病毒大流行期间需求激增,一些公司正在投资开发筛检系统。例如,2020 年 7 月,加拿大下一代製造公司 (Ngen) 投资 500 万美元用于开发和生产自动化技术的计划,以取代体力劳动,阻止冠状病毒的传播。

- 此外,GreyOrange 还宣布了其最新的模组化分类系统,专为服务零售、宅配和快递公司的现代化配送和物流中心而设计。此外,柔性机器人系统每小时可处理多达 12,000 个小包裹,并可分拣数百个目的地,包括标准邮件和重达 15 公斤(33 磅)的宅配。

北美占最大市场占有率

- 自动化仓库和订单履约业务已成为北美的关键策略,旨在最大限度地提高客户服务水平,同时确保供应链生产力和财务目标。此外,美国约占北美分类系统市场91%的销售份额。

- 透过自动化物流业务,北美公司将订单准确性从 0.5% 提高到几个百分点。实现自动化的公司可以显着降低营运成本并显着提高服务水平,这对整体盈利和市场占有率成长产生了直接影响。

- 此外,对永续性的日益担忧,加上成本控制推动的强劲经济,正在推动美国对分类系统的需求。在美国,邮局在整个小包裹处理模组中采用了滚筒分拣系统,从而使小包裹处理应用节省了 60% 的能源。

- 该地区经济强劲,港口运输量显着成长,电子商务活动增加,关键製造业指标可望推动该国分类系统的需求,从而带动製造业成长。这些场景,加上工业 4.0 在各行业的高采用率,预计将在预测期内在整个全部区域产生巨大的需求。

- 此外,2021 年 7 月,物料输送自动化和软体解决方案单一来源供应商 MHS 从其研发组织中推出了一个独立的机器人专家部门。该集团名为 MHS Robotics,在内部开发先进技术并培养外部关係,为电子商务和小包裹物流设施提供市场就绪的机器人解决方案。

分类系统产业概况

分类系统市场分散且竞争激烈。产品发布、研发投入、伙伴关係、收购等是企业维持激烈竞争的主要成长策略。近期市场趋势如下。

- 2021 年 6 月 - Satake 宣布推出最新、最大尺寸和容量的色分类机:「NIRAMI 系列」。 Satake 最新的高规格色分类机「NIRAMI」旨在高效分选谷物、豆类、种子和许多其他产品。 Nirami 有多种尺寸、宽溜槽和灵活的配置,使其成为各种应用和处理能力的理想选择。新设计的光学系统使用全彩 RGB 相机和可选的红外线 (IR) 相机来检测和区分细微的色差。

- 2021 年 3 月 - Interroll 推出了新型托盘分类机 Split Tray Sorter MT015S,在其成功的自动化分类解决方案产品组合中添加了一个面向广泛潜在用户的系统。这款新产品将使企业更容易进入电子商务市场,并为现有的分类解决方案提供灵活性。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对提高订单准确性和增加 SKU 的需求不断增长

- 人们对人事费用的担忧日益加剧

- 市场问题

- 需要熟练的劳动力

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 按最终用户产业

- 小包裹

- 飞机场

- 饮食

- 零售

- 药品

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 义大利

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 南非

- 以色列

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Daifuku Co. Ltd

- Interroll Holding AG

- Dematic Corp.

- Viastore Systems Gmbh

- Bastian Solutions Inc.

- Murata Machinery Ltd

- Honeywell Intelligrated

- Beumer Group Gmbh

- KNAPP AG

- Vanderlande Industries Nederland BV

- Siemens AG

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 57264

The Sortation Systems Market is expected to register a CAGR of 4.47% during the forecast period.

Key Highlights

- With the rapid growth in stock-keeping units (SKUs), wholesalers and distributors find it hard to make informed decisions about their operations. This drives the need for the more innovative use of labor, equipment, and technology.

- Additionally, the increasing number of available products and demand for more frequent and smaller deliveries in the current competitive landscape automates distribution operations. It can immediately increase an organization's order accuracy by half a percent up to several percentage points.

- Moreover, the adoption of Internet of Things (IoT) technology covers market growth during the forecast period. The players in the market are focusing on utilizing the technology to enhance their product offering and meet the various requirements of different end-users. Further, sortation plays a vital role in pharmaceutical companies. These companies face wastage issues because their products that are sorted outside their storage temperature range for a long time are rendered unusable. To overcome this challenge, market players utilize IoT connectivity and provide sortation at high speed and better visibility related to the product's location.

- High initial investments in the manufacturing of these systems adversely affect the growth of the automated sortation systems market. Moreover, the players need to manufacture systems that meet the standards set by various regulatory bodies. This limits the development of market players. However, with the growing tourism, these products at airport facilities for sorting luggage are expected to drive market growth over the next few years.

- Further, increasing investments in warehouse automation in various sectors are expected to boost the market over the forecast period. For instance, Coca-Cola European Partners announced an investment worth USD 49.6 million in its automated warehouse at its factory in the U.K. The investment was made to increase the facility's storage capacity and have systems automatically moving around 25,000 pallets.

Sortation Systems Market Trends

Retail Industry is Expected to Hold Significant Market Share

- The retail market is one of the largest in the world. It has a high presence of omnichannel vendors that stand to be one of the largest consumers of material handling solutions, such as sorting systems. The demand for sorting systems is exceptionally high from the e-commerce establishments that require high throughput operations in their fulfillment centers.

- Moreover, the growth of the market in India is complemented by the adoption of industrial automation systems with various companies offering different solutions and is characterized by recent developments. For instance, Delta Electronics provides a wide range of automation products and solutions, including robot solutions for warehouses.

- The convergence of flagship programs, such as Skill India and Digital India, is the key to achieving this goal, thereby driving the country's market growth. In December 2020, Skill Ministry and Tata launched the first batch of the Indian Institute of Skills. Such programs are rolled out in India to develop Factory Automation and Sorting System skills and create greater awareness amongst the general public and business organizations.

- Some players invest in developing sorting systems due to the sudden increase in demand during the coronavirus pandemic. For instance, in July 2020, Next Generation Manufacturing Canada (Ngen) invested USD 5 million in projects leading to the development and production of automation technologies instead of manually to help stop coronavirus spread.

- Moreover, GreyOrange has launched its latest modular sortation system, designed for modern distribution and logistics centers serving retail, courier, and express companies. Additionally, the Flexo robotics system can handle up to 12,000 parcels per hour, sorting up to hundreds of destinations, including standard post and courier items up to 15 kgs (33 pounds).

North America Accounts For the Largest Market Share

- Automating warehouse and order fulfillment operations has become the primary strategy to ensure supply chain productivity and financial goals while maximizing customer service levels in North America. Additionally, the United States is contributing around 91% of the revenue share in the sortation systems market in North America.

- By automating distribution operations, organizations across North America increase order accuracy ranging from half a percent up to several percentage points. Businesses that automate realize a significant reduction in operational costs and a measurable increase in service levels, which have an immediate impact on overall profitability and a long-term positive effect on the market share growth.

- Moreover, increasing interest in sustainability, coupled with a robust economy resulting from cost containment, has led to the demand for the sortation systems in the US. In the United States, post offices have seen a 60% energy savings in parcel handling applications after employing a roller sortation system across their parcel handling module.

- The region's strong economy, with substantial port traffic, increased e-commerce activity, and critical manufacturing indices resulting in manufacturing growth are poised to drive the country's demand for a sortation system. These scenarios, coupled with the high adoption rate of Industry 4.0 across industries, are expected to create considerable demand across the region over the forecast period.

- Further, in July 2021, MHS, a single-source material handling automation and software solutions provider, has launched a dedicated robotics division spun off from its research and development organization. Known as MHS Robotics, the group develops advanced technologies in-house and nurtures external relationships to deliver market-ready robotics solutions for e-commerce and parcel logistics facilities.

Sortation Systems Industry Overview

The Sortation Systems Market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies to sustain the intense competition. Some of the recent developments in the market are -

- June 2021 - Satake has announced a debut of its latest and largest optical sorter in size and capacity: "NIRAMI series." Satake's latest high specification Optical Sorter "NIRAMI" is designed to efficiently sort grains, pulses, seeds, and many other products. With various sizes available, all featuring extra-wide chutes and flexible configurations, Nirami ideally suits a wide variety of applications and processing capacities. These newly designed optics detect and distinguish subtle color differences utilizing RGB full-color cameras and optional infrared (IR) cameras.

- March 2021 - Interroll has added a system for a wide range of potential users to its successful range of automated sortation solutions with the launch of a new drop tray sorter, the Split Tray Sorter MT015S. The new product makes it easier for companies to enter the e-commerce market or be used flexibly to existing sortation solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Improving Order Accuracy and SKU Proliferation

- 4.2.2 Increasing Concerns about Labor Costs

- 4.3 Market Challenges

- 4.3.1 Need for Skilled Workforce

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment Of COVID-19 Impact On The Industry

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Post and Parcel

- 5.1.2 Airport

- 5.1.3 Food and Beverages

- 5.1.4 Retail

- 5.1.5 Pharmaceuticals

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 Germany

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Mexico

- 5.2.4.4 Rest of Latin America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Israel

- 5.2.5.3 Saudi Arabia

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 Interroll Holding AG

- 6.1.3 Dematic Corp.

- 6.1.4 Viastore Systems Gmbh

- 6.1.5 Bastian Solutions Inc.

- 6.1.6 Murata Machinery Ltd

- 6.1.7 Honeywell Intelligrated

- 6.1.8 Beumer Group Gmbh

- 6.1.9 KNAPP AG

- 6.1.10 Vanderlande Industries Nederland BV

- 6.1.11 Siemens AG

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219