|

市场调查报告书

商品编码

1640704

亚太分类系统市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

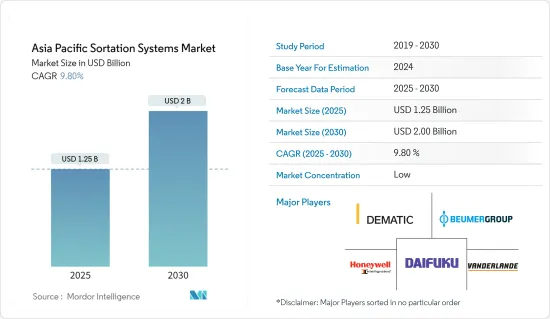

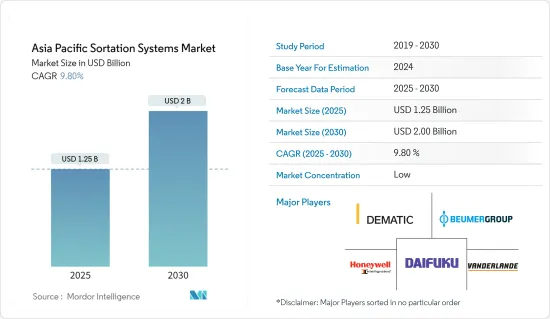

亚太地区分选系统市场规模预计在 2025 年为 12.5 亿美元,预计到 2030 年将达到 20 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.8%。

多年来,仓储业经历了重大转变,从一个无组织的哥德式结构转变为一个公认的重要资产类别。在亚太地区,网路普及率不断提高、可支配收入不断增加、年轻且受过良好教育的人口以及对更高生活水准的渴望,正在推动消费主义浪潮从一线市场向二线和三线城市蔓延。 。因此,随着公司搬迁到更靠近消费点以确保更快地向最终用户交付产品,城市内的仓库空间变得越来越重要。

关键亮点

- 数位化和自动化正在彻底改变物流和仓储行业,使得仓库库存管理对于提高效率、保持竞争力和实现客户满意度变得更加重要。 RFID(无线射频识别)等技术在仓库中至关重要,可以帮助重新设计仓库的基本功能以获得最佳效果。

- 印度网路消费者对国际品牌和外国产品的需求不断增长,从而产生了对自动化仓库的巨大需求,以满足日益增长的小包裹涌入。根据 Flipkart 的《2021年印度网购情况》报告,到 2026 年,电子零售市场规模预计将成长到 1,200 亿至 1,400 亿美元。

- 此外,2023 年 7 月,香港邮政与 Geek+ 合作推出了机器人小包裹分拣系统。透过将Geek+先进的分拣和行动解决方案与香港邮政企划团队的发展蓝图结合,这项新技术有可能改变和简化小包裹分拣流程,提高邮件处理的效率。

- 此外,2023 年 11 月,中国移动机器人公司力标机器人与印尼邮政公司 (Pos Ind) 合作,提供客製化的机器人分类解决方案。该公司提供的机器人是橙色的,而不是标准的黄色,目的是帮助印尼邮政公司提高订单履行能力,并使其现场业务整体上更有效率。

- COVID-19 疫情暴露了手动流程的脆弱性。受到劳动力短缺的影响,许多组织已经转向仓库自动化。疫情推动了供应链的改善,包括最后一哩配送、城市内配送以及各种其他混合模式。儘管出现停工现象,但投资自动化的公司的收益和利润率仍实现成长。工具和技术的日益普及降低了那些原本认为自动化解决方案遥不可及的公司的进入门槛。

- 拥有小包裹分类系统的仓库必须处理大量订单。然而,包裹尺寸和配置的多样性对输送机和其他小包裹分拣技术在包裹分拣准确性、速度和品质方面提出了重大挑战。

亚太分选系统市场趋势

电子商务市场的成长和快速工业化预计将推动市场

- 工业化往往与平均收入的提高和生活水准的改善相联繫。人们尝试了多种策略,并且取得了不同程度的成功。工业化带来经济成长、更有效率的分工、技术创新的激增。

- 在亚太地区,所谓的「亚洲四小龙」——香港、韩国、台湾和新加坡——透过为全球客户生产产品促进了经济成长。 2023年2月,中国製造业活动扩张速度创十多年来最快。

- 新兴国家的政府正采取主动行动,鼓励本国通讯基础设施的发展。凭藉廉价劳动力和工业 4.0 的高采用率,亚太地区正在成为许多公司的製造中心。

- 印度正处于独特的成长轨迹,预计未来几年将成为成长最快的大型经济体。该国计划采用人工智慧并利用下一代智慧工业丛集、互联工厂和高生产率资产在工业领域占据强势地位。

- 受智慧型手机设备日益普及、互联网普及率不断提高以及可支配收入不断增加的推动,亚太地区 B2C 电子商务市场规模预计到 2023 年将达到 37584 亿美元。在东南亚,随着市场向线上分销管道转变,电子商务和市场卖家的销售正在强劲增长。

- 2022 年 8 月,布勒为其位于班加罗尔的製造工厂推出了一台颜色分选机。该色选机是在可再生能源设施中製造的,从而优化了其碳足迹。

邮政和小包裹预计将占据最大市场占有率

- 自动分类可以显着减少人力和成本,提高标籤读取率,并增强产品识别。对于物流设施来说,高效处理容量同时高速提高生产力至关重要。然而,透过采用自动化小包裹分类流程,可以快速且准确地处理大量小包裹。

- 电子商务正在促进亚洲国家到世界各国的跨境运输。国际网站的网上购物是邮政和小包裹行业的最大贡献者。

- 物流公司正在投资当地和区域配送中心的小包裹分类。例如,菜鸟与泰国闪送公司合作,推出东南亚最大的智慧仓库。

- 2023 年 12 月,DTDC EXPRESS 与物流自动化解决方案供应商 Falcon Autotech 合作,在其位于清奈邦金奈的超级枢纽实现小包裹分类作业的自动化。这物流自动化公司利用其交叉带分类机技术,为 DTDC 设计了一个小包裹分类系统。

亚太地区分类系统产业概况

由于这一领域的参与企业众多,市场高度分散,製造商纷纷投资创新硬体和软体功能,以扩大业务伙伴关係。在此领域提供服务的主要企业包括 Dematic Corp.、Daifuku Co.、Beumer Group GmbH 和 Honeywell Intelligrated。

- 2023 年 11 月 - 总部位于日本大阪的自动化物料输送技术和解决方案提供商大福株式会社将在印度特伦甘纳邦建立一家製造工厂,投资额为 45 亿印度卢比(5,400 万美元)。该工厂将生产物流设备,包括自动储存和搜寻系统、输送机、分类车辆和分类机。

- 2022 年 9 月-Dexterity 和住友公司宣布一项联合计划,到 2026 年在日本各地的仓库部署 1,500 台 Dexterity 机器人。这些机器人将配备触觉、视觉和智能,以实现超人的多任务处理、处理复杂物品和执行重复任务的能力。

- 2022 年 7 月-Wayzim 在中国推出自动分类系统,以提高业务效率。此次推出的自动分类机拥有高强度的处理能力,每小时可分拣10,000件物品。该系统可以自动运输和分类各种物品,从小信封到重达 30 公斤的货物。其视觉识别系统透过将大堆分类好的物品分成单一物品来收集资讯并管理空间。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 市场限制

第六章 市场细分

- 按最终用户

- 邮政和小包裹

- 飞机场

- 饮食

- 零售

- 药品

- 按国家

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 台湾

- 泰国

第七章 竞争格局

- 公司简介

- Invata Intralogistics, Inc.

- Interroll Holding AG

- Dematic Corp.(KION GROUP)

- Daifuku Co. Ltd.

- Equinox

- Bastian Solutions Inc.

- Murata Machinery Ltd.

- Honeywell Intelligrated

- Fives Group

- Vanderlande Industries BV

- Beumer Group GmbH

第八章投资分析

第九章:市场的未来

The Asia Pacific Sortation Systems Market size is estimated at USD 1.25 billion in 2025, and is expected to reach USD 2.00 billion by 2030, at a CAGR of 9.8% during the forecast period (2025-2030).

The warehouse sector has changed tremendously over the years, from unorganized godown structures to being recognized as a prominent asset class. In the APAC region, the rising wave of consumerism has moved beyond tier-1 markets and is evident in tier 2 & 3 cities, due to increased internet penetration, rising disposable incomes, a young and educated population, and a desire for a higher standard of living. As a result, businesses are moving closer to consumption centers to ensure rapid deliveries to end-users, and in-city warehouse space is gaining importance.

Key Highlights

- Digitalization and automation have revolutionized the logistics and warehousing industry, and warehouse inventory management has become even more critical to improving efficiencies, staying competitive, and achieving customer satisfaction. Technologies such as radio frequency identification (RFID) are crucial in warehouses, as they help redesign fundamental warehouse functions to achieve the best outcomes.

- There is an increasing demand for international brands and foreign products among Indian online buyers, creating a significant demand for automated warehouses to handle the increased inflow of parcel volumes. According to Flipkart's 'How India Shops Online 2021' report, the e-retail market is expected to grow to USD 120-140 billion by 2026.

- Furthermore, in July 2023, Hong Kong Post and Geek+ have partnered to implement its robotic packet sorting system. Combining Geek+'s advanced sorting and moving solutions with the development blueprint of the Hong Kong Post project team, the new technology has the potential to transform and streamline the packet sorting process to improve the efficiency of mail handling.

- Moreover, November 2023, Chinese mobile robotics company Libiao Robotics has partnered with Pos Indonesia (Pos Ind) to offer a custom robotic sortation solution. The company has provided robots in orange rather than its standard yellow, with the deployment intended to assist Pos Indonesia in improving its order fulfillment capacity and efficiency throughout site operations.

- The COVID-19 pandemic showcased the fragility of manual processes. Many organizations experiencing labor shortages turned to warehouse automation. The pandemic resulted in the improvisation of the supply chain with last-mile delivery, in-city distribution, and various other hybrid models. Companies that invested in automation grew revenue and profitability despite the shutdowns. The increasing availability of tools and techniques has lowered the barriers to entry for companies that may have thought automation solutions were out of reach.

- Warehouses with parcel sortation systems have to process significant order volumes. However, a mixture of different packaging sizes and structures causes significant problems for conveyor and other parcel-sorting technologies regarding the precision, speed, and quality of packaging sortation.

Asia Pacific Sortation Systems Market Trends

Growing e-commerce Market and Rapid Industrialization are Expected to Drive the Market

- Industrialization is often associated with higher average incomes and improved living standards. Various strategies have been attempted over time, with varying degrees of success. Industrialization leads to economic growth, a more efficient division of labor, and a surge in technological innovation.

- In the Asia-Pacific region, the so-called Asian Tigers - Hong Kong, South Korea, Taiwan, and Singapore - contributed to economic growth by manufacturing goods for global customers. In February 2023, China's manufacturing activity expanded at its fastest pace in more than a decade.

- Governments in developing nations are taking initiatives to encourage the development of communication infrastructure in their countries. Due to cheap labor and the high adoption rate of Industry 4.0, Asia-Pacific is increasingly becoming a hub for manufacturing for many companies.

- India has followed a unique growth trajectory and is poised to be the fastest-growing large economy in the coming years. The country plans to achieve a robust position in the industrial sector by adopting AI and leveraging the next generation of smart industrial clusters, connected factories, and high-productivity assets.

- The B2C ecommerce market in Asia Pacific is predicted to reach 3,758.4 billion USD in 2023, driven by increasing access to smartphone devices, growing internet penetration, and rising disposable income. In Southeast Asia, e-commerce marketplace sellers have experienced strong growth in sales amid the growing shift to online sales channels.

- In August 2022, Buhler launched color sorters for a manufacturing facility in Bangalore. These color sorters are manufactured in a renewable energy facility and will optimize the carbon footprint.

Post and parcel is expected to hold the largest market share

- Automated sortation can significantly reduce manpower and costs, improve label read rates, and enhance product identification. It is crucial for logistics facilities to effectively process their throughput while improving productivity rates at high speeds. However, the adoption of automated parcel sortation processes can accurately handle high volumes at high speeds.

- E-commerce is driving cross-border package deliveries from Asian countries to nations around the world. Online purchasing from foreign websites contributes the most to the post and parcel industry.

- Logistics companies are investing in parcel sortation at local and regional distribution centers. For instance, Cainiao partnered with Thailand's Flash Express to launch the largest smart warehouse in Southeast Asia.

- In December 2023, DTDC EXPRESS partnered with Falcon Autotech, the supplier of intralogistics automation solutions, to automate parcel sorting operations at its super hub in Chennai, Tamil Nadu. Using its cross-belt sorter technology, the intralogistics automation company has designed DTDC's parcel sorting system, which can handle 9,000 packages per hour, operate in a 24/7 environment, and expand to help grow operations.

Asia Pacific Sortation Systems Industry Overview

With many players involved in this sector, the market is highly fragmented and has the potential to grow further as manufacturers invest in innovative hardware and software features in their products and extend partnerships to expand their business. Some significant players offering services in this sector include Dematic Corp., Daifuku Co. Ltd., Beumer Group GmbH, and Honeywell Intelligrated.

- November 2023 - Daifuku Co., an Osaka (Japan) based company that offers automated material handling technology and solutions, would set up a manufacturing facility in India in Telangana with an investment of INR 450 crore (USD 54 Million). The facility would produce intra-logistics equipment such as automated storage and retrieval systems, conveyors, sorting transfer vehicles, and sorters.

- September 2022 - Dexterity and Sumitomo announced a joint project to deploy 1,500 Dexterity-powered robots in warehouses across Japan by 2026. These robots will be equipped with the sense of touch, vision, and intelligence to multi-task, handle complicated goods, and achieve throughput beyond human capacity in repetitive tasks.

- July 2022 - Wayzim launched an automatic sorting system in China to improve the efficiency of operations. The newly launched automated singulator system can sort 10,000 pieces per hour through high-intensity handling. The system can automatically convey and sort various items, from small envelopes to cargo up to 30kg. Its visual identification system collects information and controls space by separating the batch stacking of assorted items into a single piece.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By End-User

- 6.1.1 Post and Parcel

- 6.1.2 Airport

- 6.1.3 Food and Beverages

- 6.1.4 Retail

- 6.1.5 Pharmaceuticals

- 6.2 By Country

- 6.2.1 China

- 6.2.2 India

- 6.2.3 Indonesia

- 6.2.4 Japan

- 6.2.5 Malaysia

- 6.2.6 Singapore

- 6.2.7 South Korea

- 6.2.8 Taiwan

- 6.2.9 Thailand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Invata Intralogistics, Inc.

- 7.1.2 Interroll Holding AG

- 7.1.3 Dematic Corp.(KION GROUP)

- 7.1.4 Daifuku Co. Ltd.

- 7.1.5 Equinox

- 7.1.6 Bastian Solutions Inc.

- 7.1.7 Murata Machinery Ltd.

- 7.1.8 Honeywell Intelligrated

- 7.1.9 Fives Group

- 7.1.10 Vanderlande Industries B.V.

- 7.1.11 Beumer Group GmbH