|

市场调查报告书

商品编码

1850247

分类系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

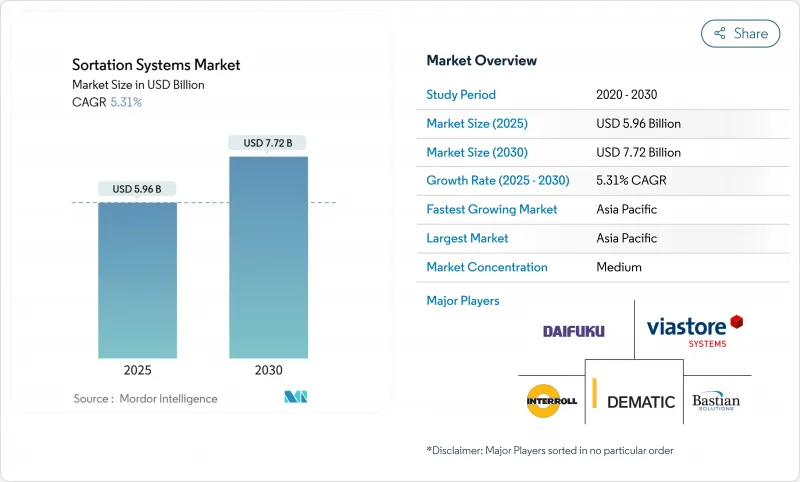

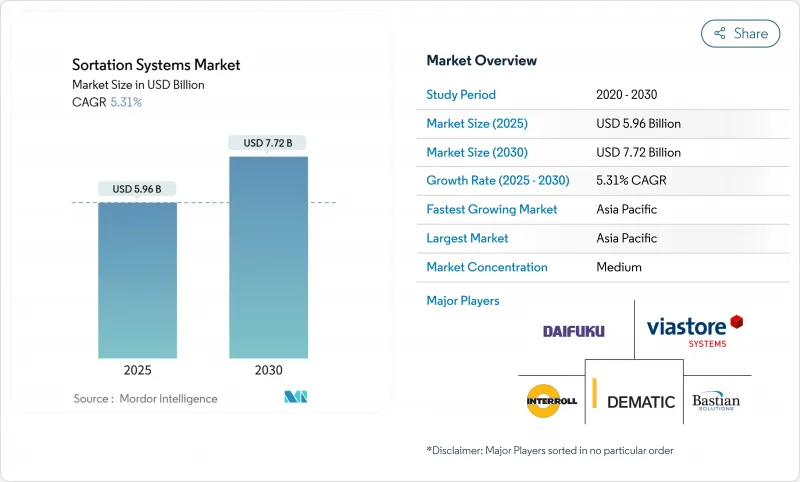

预计到 2025 年,分类系统市场规模将达到 59.6 亿美元,到 2030 年将扩大到 77.2 亿美元,复合年增长率为 5.31%。

缓慢但稳定的扩张标誌着该产业正从新型自动化转型为核心基础设施。交叉传送带设备也是成长最快的分拣平台,印证了其从高端利基产品转向业界标准的转变。市场主导地位的巩固和扩张速度的加快,表明交叉传送带技术正从高端解决方案发展成为行业标准,这主要得益于其对各种形状和重量包裹的卓越处理能力。电子商务和全通路营运商占据了大部分需求,这表明小包裹自动化仍有很长的路要走。虽然硬体仍然占据大部分收入,但向以软体为中心的价值创造模式的转变反映出,业界已认识到,竞争优势越来越依赖演算法效率,而不仅仅是机械速度。按地区划分,亚太地区将在2024年占据最大份额,这主要得益于中国跨境电商的发展以及印度的自动化投资,例如大DAIFUKU CO. LTD.计划于2025年在印度推出的工厂。

全球分类系统市场趋势与洞察

电子商务小包裹激增

小包裹成长重塑运力规划:预计到 2028 年,美国年度小包裹量将达到 280 亿件。中国跨境卖家加速数位化,并采用生成式人工智慧来改善需求预测。

人事费用上升和劳动短缺

仓库工资上涨和技术人员短缺正给部署时间表带来压力。 63%的业者表示,技术纯熟劳工短缺是他们面临的最大障碍,预计到本世纪中期,供应链技术人员的空缺将达到77万个。如今,采购标准不仅关註名义吞吐量,也同样重视远距离诊断和简化维护。

高额资本投入与不确定性的投资报酬率

全尺寸分类机需要数百万美元的投资和设施改造。营运商希望在18-24个月内收回成本,因此往往会放慢采用速度,更倾向于选择模组化附加元件,虽然这样可以延长投资回报期,但会损害长期效率。量化诸如降低解约率和提高客户忠诚度等软性收益仍然是一项挑战。

细分市场分析

预计到2024年,交叉带式分类机的销售量将成长38%,年均成长7.8%,使其成为分类系统市场中规模最大、成长最快的细分市场。使用者青睐能够处理不规则货物而不降低运转速度的设备。倾斜托盘式和滑靴式分类机非常适合易碎品或尺寸统一的纸箱占主导地位的应用场景。窄带式分类机仍然在占地面积有限的老旧厂房中广泛应用。随着营运商寻求更高的灵活性和运转率,弹出式轮和分流器系统的应用正在减少。

预计到 2030 年,交叉传送带平台分类系统的市场规模将超过 30 亿美元,反映出其从利基市场向主流市场的转变;而滑动鞋式分拣系统的市场份额将以中等个位数的速度增长,随着其适用于需要温和流量控制的服装和宅配中心,其市场份额将以较低的个位数速度增长。

2024年,电子商务和全通路零售商将占41.2%的交易量,年均成长率达7.4%。邮政和小包裹业者仍是第二大市场,但利润率压力使得自动化更成为一种成本控製手段,而非成长催化剂。随着枢纽机场对行李传送系统进行现代化改造,机场持续提供企划为基础的合作机会。食品饮料和製药生产线正在采用高精度分类技术以确保合规性,从而推动了配备感测器的交叉传送带和高速托盘单元的普及。

预计到 2030 年,电子商务产业将占市场份额的 30 亿美元以上。机场专案预计在客运和货运投资的共同推动下,实现暂时的个位数中期复合年增长率。

全球分类系统市场按分类机类型(例如,交叉带分拣机、倾斜托盘分类机、滑靴分类机)、终端用户行业(例如,邮政小包裹、电子商务及全通路零售、机场)、提供的服务(例如,硬体、软体)、吞吐量(例如,低速、中速)和地区进行细分。市场预测以美元计价。

区域分析

亚太地区占据分类系统市场36.5%的份额,年复合成长率达8.6%。中国物流业正利用人工智慧技术将取货效率提升30%,配送效率提升35%,进而推动智慧分类机的进一步普及。印度大力推动自动化,DAIFUKU CO. LTD.的2025製造中心便是例证,该中心旨在实现生产在地化并缩短前置作业时间。东南亚电子商务的蓬勃发展也带动了都市区微型履约中心灵活分类技术的投资。

北美地区仍然是收入成长的主要驱动力,这主要得益于机场行李处理设施的持续改造和小包裹中心的升级。由于许多首批设施已经自动化,投资正转向维修、软体和永续性升级,实现了4%左右的温和成长。欧洲则在绿色环保要求和营运绩效之间寻求平衡,营运商倾向于使用节能马达和可回收的传送带材料,以符合欧盟的循环经济目标。

在中东和非洲,随着海湾地区机场加大对枢纽设施的投资,以及非洲电子商务取代传统零售,需求虽处于起步阶段但正在成长。南美洲则在主要城市走廊进行选择性部署,这些地区的小包裹量和劳动成本上涨使得资本支出物有所值。巴西和智利的政策制定者已表示有意简化海关程序,这间接支援了在出口导向物流园区部署分类机。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务小包裹激增

- 劳动成本上升和人手不足

- 更多SKU需要更精确的管理

- 机场行李处理升级

- 配备人工智慧视觉的动态分类机

- 以永续性为重点的节能措施

- 市场限制

- 高额资本投入与不确定性的投资报酬率

- 熟练工程师短缺

- 软体层互通性差距

- 城市噪音管制值

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依分类机类型

- 交叉带分类机

- 倾向性特征分类器

- 滑动鞋分类机

- 窄频分类机

- 推式托盘/分类托盘分类机

- 弹出式轮式分类机

- 按最终用户行业划分

- 邮政和小包裹递送公司

- 电子商务与全通路零售

- 机场(行李处理)

- 食品/饮料

- 製药和医疗保健

- 第三方物流和合约物流

- 汽车和工业製造

- 报价

- 硬体

- 软体

- 服务(安装、MRO)

- 按吞吐量

- 慢速(低于3k)

- 中速(3k-10k)

- 高速(10k-25k)

- 速度超快(超过 25k)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 东南亚

- 亚太其他地区

- 中东和非洲

- 海湾合作委员会(原沙乌地阿拉伯)

- 沙乌地阿拉伯

- 土耳其

- 南非

- 以色列

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Daifuku Co., Ltd.

- Vanderlande Industries

- Honeywell Intelligrated

- Siemens Logistics

- Beumer Group GmbH

- Interroll Holding AG

- Dematic Corporation(KION Group)

- Murata Machinery Ltd.

- KNAPP AG

- Bastian Solutions

- Viastore Systems Gmbh

- SSI Schaefer

- TGW Logistics

- Fives Intralogistics

- BOWE SYSTEC

- Pitney Bowes

- Equinox MHE

- Falcon Autotech

- GBI Intralogistics

- OPEX Corporation

- Okura Yusoki

- Zebra Technologies(Fetch Robotics)

第七章 市场机会与未来展望

The sortation systems market reached USD 5.96 billion in 2025 and is projected to advance to USD 7.72 billion by 2030 at a 5.31% CAGR.

Moderate but steady expansion shows the field is transitioning from novel automation toward core infrastructure. Cross-belt equipment is also the fastest-expanding sorter platform, confirming a shift from premium niche toward de-facto standard. The convergence of dominant position and accelerated expansion signals cross-belt technology's evolution from premium solution to industry standard, driven by its superior handling of diverse package geometries and weights. E-commerce and omnichannel operators dominate demand, illustrating that parcel automation remains in a long runway. Hardware continues to account for majority of sales, yet the shift toward software-centric value creation reflects industry recognition that competitive differentiation increasingly depends on algorithmic efficiency rather than mechanical speed alone. Geographically, APAC leads highest share in 2024, fuelled by Chinese cross-border e-commerce and Indian automation investments exemplified by Daifuku's 2025 plant launch

Global Sortation Systems Market Trends and Insights

E-commerce parcel surge

Parcel growth reshapes capacity planning. United States annual parcel flow is forecast to hit 28 billion by 2028, a 5% yearly increase. Chinese cross-border sellers accelerate digitalisation and employ generative AI to improve demand forecasting, allowing facilities to move from reactive peaks to predictive load balancing.Sorters that self-adjust to volume spikes and shift routing rules on the fly now underpin peak-season resilience.

Labor-cost escalation & scarcity

Warehouse payroll inflation and technician shortages compress deployment timelines. A 63% majority of operators cite skilled labour gaps as the top obstacle, while 770,000 supply-chain technician vacancies are expected by mid-decade. Procurement criteria now weigh remote diagnostics and simplified maintenance as heavily as nominal throughput.

High capex & ROI uncertainty

Full-scale sorters require multimillion-dollar outlays plus facility remodelling. Operators demanding 18-24-month payback often delay adoption, favouring modular add-ons that can stretch ROI but impair long-term efficiency. Quantifying soft returns such as reduced churn and customer loyalty remains challenging.

Other drivers and restraints analyzed in the detailed report include:

- SKU proliferation demands accuracy

- Airport baggage-handling upgrades

- AI-vision powered dynamic sorters

- Sustainability-driven energy savings

- Skilled-technician shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cross-belt units generated 38% revenue in 2024 and are set to rise 7.8% annually, giving the sorter class the largest and fastest path within the sortation systems market. Facilities prefer its capability to handle irregular packages without speed loss. Tilt-tray and sliding-shoe equipment stay relevant where either fragile goods or uniform cartons dominate. Narrow-belt installations persist in legacy buildings with limited floor plates. Pop-up wheel and diverter systems continue to fade as operators pursue higher flexibility and uptime.

The sortation systems market size for cross-belt platforms is projected to exceed USD 3 billion by 2030, reflecting entrenched migration from niche to mainstream. Meanwhile, sliding-shoe products hold a mid-single-digit sortation systems market share and show low-single-digit expansion as they retain fit in apparel and parcel hubs demanding gentle flow control.

E-commerce and omnichannel retailers captured 41.2% of 2024 turnover and are increasing 7.4% annually. Post-and-parcel operators remain the second-largest cohort, yet margin pressure converts automation into a cost-containment lever rather than growth catalyst. Airports contribute stable, project-based opportunities as hubs modernise baggage loops. Food, beverage and pharma lines embrace high-accuracy sorting to honour compliance, fuelling adoption of sensor-laden cross-belt and high-speed tray units.

By 2030, the e-commerce segment is expected to command more than USD 3 billion of the sortation systems market size. Airport programmes, though lumpy, could achieve mid-single-digit CAGR on the back of combined passenger and cargo investments.

Global Sortation System Market is Segmented by Sorter Type (Cross-Belt Sorters, Tilt-Tray Sorters, Sliding-Shoe Sorters, and More), by End-User Industry (Post and Parcel, E-Commerce and Omnichannel Retail, Airport, and More), by Offering (Hardware, and Software), by Throughput Rate (Low-Speed, Medium-Speed, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC dominated the sortation systems market with 36.5% 2024 share and is expanding at 8.6% CAGR. China's logistics sector uses AI to lift collection efficiency 30% and delivery 35%, spurring further adoption of intelligent sorters. India's automation drive is illustrated by Daifuku's 2025 manufacturing complex designed to localise production and lower lead times. Southeast Asian e-commerce growth also channels investment into flexible sorting in urban micro-fulfilment nodes.

North America remains a core revenue pillar through airport baggage rebuilds and ongoing parcel-centre upgrades. Growth moderates to a mid-4% rate as many first-wave facilities are already automated, causing spend to pivot towards retrofits, software, and sustainability upgrades. Europe balances green mandates with performance. Operators favour energy-efficient motors and recyclable belt materials to align with EU circularity targets.

Middle East and Africa present nascent but rising demand as Gulf airports invest in hub capability and African e-commerce leapfrogs conventional retail. South America exhibits selective uptake in metropolitan corridors where parcel volumes and labour inflation justify capital outlays. Policymakers in Brazil and Chile have signalled intent to streamline customs processes, indirectly supporting sorter adoption in export-oriented logistics parks.

- Daifuku Co., Ltd.

- Vanderlande Industries

- Honeywell Intelligrated

- Siemens Logistics

- Beumer Group GmbH

- Interroll Holding AG

- Dematic Corporation (KION Group)

- Murata Machinery Ltd.

- KNAPP AG

- Bastian Solutions

- Viastore Systems Gmbh

- SSI Schaefer

- TGW Logistics

- Fives Intralogistics

- BOWE SYSTEC

- Pitney Bowes

- Equinox MHE

- Falcon Autotech

- GBI Intralogistics

- OPEX Corporation

- Okura Yusoki

- Zebra Technologies (Fetch Robotics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce parcel surge

- 4.2.2 Labor-cost escalation & scarcity

- 4.2.3 SKU proliferation demands accuracy

- 4.2.4 Airport baggage-handling upgrades

- 4.2.5 AI-vision powered dynamic sorters

- 4.2.6 Sustainability-driven energy savings

- 4.3 Market Restraints

- 4.3.1 High capex & ROI uncertainty

- 4.3.2 Skilled-technician shortage

- 4.3.3 Software-layer interoperability gaps

- 4.3.4 Urban-noise compliance limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sorter Type

- 5.1.1 Cross-belt Sorters

- 5.1.2 Tilt-tray Sorters

- 5.1.3 Sliding-shoe Sorters

- 5.1.4 Narrow-belt Sorters

- 5.1.5 Push-tray / Split-tray Sorters

- 5.1.6 Pop-up Wheel & Diverter Sorters

- 5.2 By End-user Industry

- 5.2.1 Post & Parcel Operators

- 5.2.2 E-commerce & Omnichannel Retail

- 5.2.3 Airports (Baggage Handling)

- 5.2.4 Food & Beverages

- 5.2.5 Pharmaceuticals & Healthcare

- 5.2.6 3PL & Contract Logistics

- 5.2.7 Automotive & Industrial Manufacturing

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services (Installation, MRO)

- 5.4 By Throughput Rate

- 5.4.1 Low-speed (<3k)

- 5.4.2 Medium-speed (3k-10k)

- 5.4.3 High-speed (10k-25k)

- 5.4.4 Ultra High-speed (>25k)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia & New Zealand

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East & Africa

- 5.5.5.1 GCC (ex-Saudi)

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Israel

- 5.5.5.6 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Vanderlande Industries

- 6.4.3 Honeywell Intelligrated

- 6.4.4 Siemens Logistics

- 6.4.5 Beumer Group GmbH

- 6.4.6 Interroll Holding AG

- 6.4.7 Dematic Corporation (KION Group)

- 6.4.8 Murata Machinery Ltd.

- 6.4.9 KNAPP AG

- 6.4.10 Bastian Solutions

- 6.4.11 Viastore Systems Gmbh

- 6.4.12 SSI Schaefer

- 6.4.13 TGW Logistics

- 6.4.14 Fives Intralogistics

- 6.4.15 BOWE SYSTEC

- 6.4.16 Pitney Bowes

- 6.4.17 Equinox MHE

- 6.4.18 Falcon Autotech

- 6.4.19 GBI Intralogistics

- 6.4.20 OPEX Corporation

- 6.4.21 Okura Yusoki

- 6.4.22 Zebra Technologies (Fetch Robotics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment