|

市场调查报告书

商品编码

1630165

全球电介质蚀刻市场:市场占有率分析、产业趋势、成长预测(2025-2030)Global Dielectric Etchers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

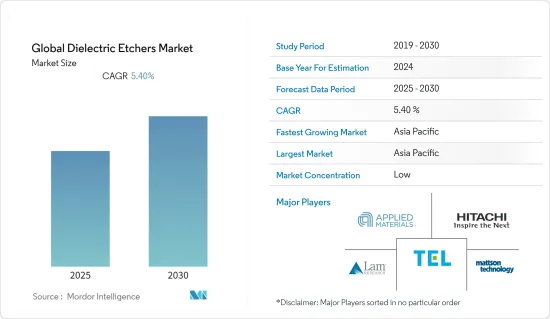

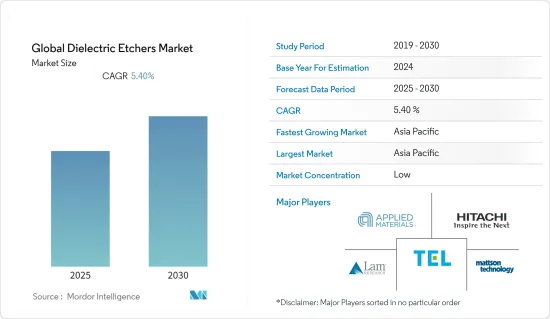

全球介电蚀刻市场预计在预测期内复合年增长率为 5.4%

主要亮点

- 对神经型态晶片的需求不断增长推动了 Etcher 市场对人工智慧、资料处理和分析的需求不断增长是影响全球神经型态晶片创新和采用的关键因素。蚀刻技术有助于选择性地去除晶圆上的涂层和材料以创建晶片特征。这些程序需要透过难以去除的材料组合来创建越来越小、越来越复杂的特征。

- 全球电介质蚀刻市场的最新趋势是 3D IC 的出现。对消费量高速运算设备的需求不断增长,大大推动了对3D晶片堆迭的需求。航太、汽车和医学等领域对电子设备小型化的需求日益增长,推动了对介电蚀刻的需求,介电蚀刻可以以0-10奈米甚至原子级精度改变结构。

- 蚀刻方法还可以创建高、高长宽比的特征,例如硅通孔 (TSV),从而实现晶片封装和电子机械系统整合 (MEMS)。例如,Lam Research 的电浆蚀刻系统提供了建造精密结构所需的高性能和生产率,从高而窄到短而宽,直到几埃的尺寸。

- 2021 年 5 月,应用材料公司宣布推出三款新材料工程解决方案,可实现 DRAM 扩展以及晶片性能、功耗、面积、成本和上市时间 (PPACt) 的最佳化。 DRAM 製造商正在使用应用材料公司开发的一种低介电常数材料 Black Diamond 来解决逻辑互连的可扩展性问题。

- COVID-19 的爆发在 2020 年初严重扰乱了供应链和生产。对于半导体製造商来说,影响更为严重,他们是半导体蚀刻设备的主要最终用户。人手不足迫使半导体供应链中的许多参与者缩减或关闭业务。该产业面临高亏损和需求增加,导致供应链出现巨大缺口。由于担心汽车等关键产业对晶片的需求下降,病毒最初的传播导致代工厂关闭并降低了运转率。儘管半导体铸造厂最初预测,随着需求的增加,产量下降导致全球半导体短缺。

介质蚀刻市场趋势

神经型态晶片的需求推动电介质蚀刻市场

- 神经型态晶片是受生物大脑处理能力启发的资料处理器,可实现快速、低功耗的学习和数百万个神经元的能力。这种晶片的尺寸够小,可以移动,应用范围很广。

- 此外,基于人工智慧的新兴企业的数量正在日益增加。人工智慧支援的技术需要神经型态晶片进行处理。因此,对人工智慧、资料处理和分析的需求不断增长是影响全球神经型态晶片创新和采用的关键因素,预计这将推动电介质蚀刻市场。

- 对人工智慧、资料处理和分析的需求不断增长是推动神经型态晶片在全球范围内采用的关键因素,从而产生了对电介质蚀刻的需求。此外,先进智慧型设备的物联网应用的快速技术升级预计也将增加对技术先进的半导体的需求。因此,介电蚀刻的需求预计将大幅增加。

- 由于全球经济的数位转型,DRAM 的需求量很大。物联网正在边缘添加大量运算设备,导致传输到云端进行处理的资料量呈指数级增长。业界正在寻求让 DRAM 运行速度更快、功耗更低、尺寸更小、成本更低的进步,推动市场成长。

- 智慧型手机和消费性电子市场中需要半导体 IC 的其他应用正在推动对电介质蚀刻的需求。此外,随着物联网(IoT)设备数量的增加,半导体产业旨在投资该技术以生产更多创新产品。

亚太地区占比较大

- 全球集成设备製造商(IDM),包括高通、博通、NVIDIA、联发科、苹果和AMD,都采用了无晶圆厂经营模式。无晶圆厂经营模式使公司能够将利润集中在新技术的研发上,同时保持维持销售所需的高产量。

- 台积电、联华电子、DB Hitek 和中芯国际等组织利用代工厂根据客户要求和产量生产晶片组。这些铸造厂大多位于中国、台湾和韩国。

- 原子层蚀刻 (ALE) 是一种复杂的蚀刻工艺,可在浅层结构中提供出色的深度控制。随着装置特征尺寸的减小,对 ALE 的需求增加,以达到提高性能所需的精度。

- 製造尖端微电子装置需要高保真图案转移(蚀刻)。随着特征尺寸缩小到 10 nm 以下,并且新设备使用超薄 2D 材料,原子级精度变得更加重要。这导致对原子层蚀刻(ALE)的需求增加,该技术克服了原子级传统(连续)蚀刻的限制。

- 台积电是苹果A系列晶片的独家製造商。该晶片组采用名为 A13 的 7 奈米晶片组製造。汽车电子产业在亚太地区也非常活跃,为市场成长提供了充足的机会。

介质蚀刻产业概况

全球介电蚀刻市场竞争非常激烈。市场高度集中,各种规模的公司林立。所有主要公司都占有重要的市场份额,并致力于扩大其在全球的消费群。该市场的主要企业包括Applied Materials Inc.、Hitachi High-Technologies Corporation、Lam Research Corporation、Tokyo Electron、Mattson Technology, Inc.和Advanced Micro-Fabrication Equipment Inc.。公司正在透过建立多个伙伴关係关係和投资新产品发布来扩大市场占有率,以在预测期内获得竞争优势。

- 2022 年 7 月 - Tokyo Electron 和 IBM 合作开发先进的正面 3D 晶片堆迭,无需玻璃晶圆底座并简化流程。 IBM 和 Tokyo Electron 发现了一种为 3D 晶片製造创建硅载体晶圆的方法,没有任何缺点。该製程使用新的 300 毫米模组进行了演示,该公司称这是首款 300 毫米等级的 3D 堆迭硅晶片晶圆。 IBM希望其对3D晶片堆迭技术的重大投资能简化半导体生产流程,为全球晶片短缺带来一线希望。

- 2022 年 6 月 - Lam Research 与 SK Hynix 合作,利用干燥抗蚀剂极紫外线技术提高 DRAM 生产成本效率。 Ram 的创新干燥抗蚀剂製造技术是用于製造先进 DRAM 晶片的两个关键製程步骤的开发工具。这种干抗蚀剂技术由 LAM 于 2020 年推出,可提高极紫外光 (EUV) 微影的产量比率、解析度、生产率和生产率,而极紫外光 (EUV) 微影是下一代半导体製造的关键技术。在材料层面,Ram 的干式抗蚀剂技术解决了 EUV微影术的最大挑战,并实现了先进记忆体和逻辑的经济有效的扩展。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 全球对神经型态晶片的需求

- 3D IC 的出现

- 电子设备的小型化

- 市场挑战/限制

- 初始成本增加

第六章 市场细分

- 按类型

- 湿蚀刻

- 干蚀刻

- 原子级蚀刻 (ALE)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他领域

第七章 竞争格局

- 公司简介

- Applied Materials, Inc.

- Hitachi High-Technologies Corporation

- Lam Research Corporation

- Tokyo Electron Limited

- Mattson Technology

- Advanced Micro-Fabrication Equipment Inc.

- Jusung Engineering

- Oxford Instruments

- SEMES Co. Ltd.

- ULVAC, Inc.

第八章投资分析

第9章市场的未来

The Global Dielectric Etchers Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- An increase in demand for neuromorphic chips will drive the market for etchers. The rising demand for artificial intelligence, data processing & analytics is a major factor influencing the innovation & adoption of neuromorphic chips across the globe. Etch techniques aid in creating chip features by eliminating coatings and materials put on the wafer selectively. These procedures entail producing increasingly small and intricate features with difficult-to-remove material combinations.

- The latest trend in the global dielectric etchers market is the emergence of 3D ICs. With the increasing demand for faster computing devices that consume less amount of energy will significantly drive the demand for 3D chip stacking. The growing need for miniaturizing electronic devices in fields such as Aerospace, Automotive & Medical sectors will drive the demand for dielectric etchers, which are capable of altering structures to a precision of 0 - 10 nm & even at an atomic level.

- Etch methods also produce tall, high-aspect-ratio features, like through-silicon vias (TSVs), which allow chip packaging and micro-electromechanical system integration (MEMS). For instance, Lam Research plasma etch systems provide high-performance and high-productivity capabilities required to build precise structures, ranging from tall and narrow, short and wide, to a few angstroms in size.

- In May 2021, Applied Materials, Inc. announced three new materials engineering solutions that enable its memory customers three new options to scale DRAM and optimize chip performance, power, area, cost, and time to market (PPACt). DRAM manufacturers use black diamond, a low-k dielectric material developed by Applied Materials, to solve logic interconnect scalability problems.

- The outbreak of COVID-19 significantly disrupted the supply chain and production during the initial phase of 2020. The impact was more severe for semiconductor manufacturers, the major end users for semiconductor etch equipment. Due to labor shortages, many players in the semiconductor supply chain had to reduce or even suspend their operations. The industry was riddled with a high deficit and increasing demand, which led to a significant supply chain gap. The initial spread of the virus led to the shutting down or reduction of foundry capacity utilization, fearing the decreasing demand for chips across major sectors, like the automotive. Diminished output led to a global shortage of semiconductors as demand increased, despite the initial estimates by semiconductor foundries.

Dielectric Etchers Market Trends

Demand for Neuromorphic Chip to Boost Dielectric Etchers Market

- A neuromorphic chip is a data processor inspired by biological brain processing ability to achieve high-speed & low power learning and constructed with capabilities of millions of neurons. The size of these chips is small enough to go mobile, and applications are broad.

- Besides, AI-based startups are increasing day by day. The technologies enabled by AI require neuromorphic chips for processing. Therefore, the rising demand for artificial intelligence, data processing & analytics is a major factor influencing the innovation & adoption of neuromorphic chips across the globe, which in turn is expected to drive the market for dielectric etchers.

- The rising demand for artificial intelligence, data processing, and analytics is a significant factor that drives the adoption of neuromorphic chips worldwide, thereby creating the need for dielectric etchers. Moreover, rapid technological upgradation of Internet of Things applications for advanced intelligent devices is also anticipated to boost the demand for technologically advanced semiconductors. This, in turn, is predicted to create significant demand for dielectric etching in the market.

- DRAM is in high demand due to the global economy's digital transition. The Internet of Things creates significant additional computer devices at the edge, resulting in an exponential rise in data that is transported to the cloud for processing. The industry needs advancements that would allow DRAM to scale down in size and cost while running at greater speeds and consuming less power, which drives the market growth.

- Smartphones and other applications in the consumer electronics market that require semiconductor ICs drive the demand for dielectric etcher. Furthermore, as the number of Internet of Things (IoT) devices grows, the semiconductor industry aims to invest in this technology to produce more innovative products.

Asia Pacific Region to Hold a Significant Share

- Integrated Device Manufacturers (IDM) such as Qualcomm, Broadcom Ltd., Nvidia, MediaTek, Apple, AMD, etc. across the globe are adopting fabless business model, where the organization will design the chipset layout and outsource the manufacturing to chipset manufacturers such as TSMC, UMC & SMIC. The fabless business model helps organizations to concentrate their efforts on investing profits in research and development of new technologies while maintaining the high production volumes needed to maintain sales.

- Organizations such as TSMC, UMC, DB Hitek, SMIC, etc. utilize their foundries to produce the chipset according to the specifications and volumes requirement of the customers. A major share of these foundries operates from China, Taiwan & South Korea.

- Atomic layer etching (ALE) is a sophisticated etching process that provides superior depth control on shallow structures. As device feature size shrinks, ALE becomes increasingly necessary to attain the accuracy required for enhanced performance.

- The production of advanced microelectronic devices requires high-fidelity pattern transfer (etching). As features drop to sub-10nm sizes and new devices use ultra-thin 2D materials, atomic-scale accuracy becomes more important. This raised the demand for atomic layer etching (ALE), a technique that overcomes the limits of traditional (continuous) etching at the atomic level.

- TSMC has been Apple's exclusive manufacturer of Apple's A-series chips. This chipset will be fabricated using a 7-nanometer chipset called A13. Besides, with automotive electronics industry flourishing exceedingly in the region, Asia-Pacific is providing a plethora of opportunities for market growth.

Dielectric Etchers Industry Overview

The Gloabl Dielectric Etchers Market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Applied Materials Inc., Hitachi High-Technologies Corporation, Lam Research Corporation, Tokyo Electron, Mattson Technology, Inc., Advanced Micro-Fabrication Equipment Inc., and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- July 2022 - Tokyo Electron and IBM collaborated for the latest front 3D chip stacking that removes the need for a glass wafer base, streamlining the process. IBM and Tokyo Electron, however, have found a way to enable silicon carrier wafers for 3D chipmaking without the drawbacks. This process was demonstrated using a new 300mm module, which the companies say is the first 3D stacked silicon chip wafer at the 300mm level. IBM hopes that the considerable investments in 3D chip stacking technology can help streamline the production process of semiconductors and offer a silver lining to the global chip shortage.

- June 2022 - Lam Research collaborated with SK Hynix to enhance DRAM production cost efficiency with dry resist Extreme Ultraviolet technology. Lam's innovative dry resist fabrication technology is a development tool for two key process steps for producing advanced DRAM chips. This technology introduced by LAM in 2020, dry resist, extends the yield, resolution, productivity, and of EUV (Extreme Ultraviolet) lithography, a pivotal technology in producing next-generation semiconductors. At the material level, Lam's dry resist technology addresses EUV lithography's biggest challenges, enabling cost-effective scaling for advanced memory and logic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Global Demand of Neuromorphic Chip

- 5.1.2 Emergence of 3D ICs

- 5.1.3 Miniaturizing Electronic Devices

- 5.2 Market Challenge/Restraint

- 5.2.1 Higher Initial Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wet Etching

- 6.1.2 Dry Etching

- 6.1.3 Atomic Level Etching (ALE)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials, Inc.

- 7.1.2 Hitachi High-Technologies Corporation

- 7.1.3 Lam Research Corporation

- 7.1.4 Tokyo Electron Limited

- 7.1.5 Mattson Technology

- 7.1.6 Advanced Micro-Fabrication Equipment Inc.

- 7.1.7 Jusung Engineering

- 7.1.8 Oxford Instruments

- 7.1.9 SEMES Co. Ltd.

- 7.1.10 ULVAC, Inc.