|

市场调查报告书

商品编码

1630167

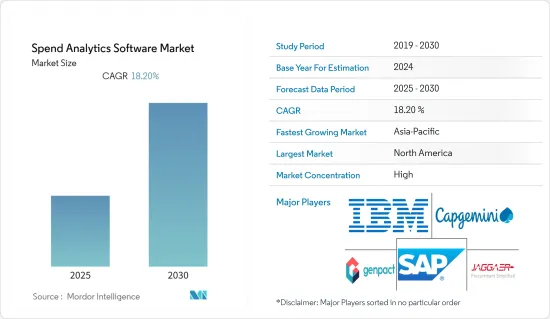

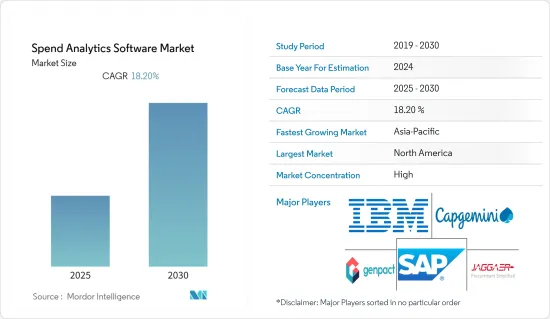

支出分析软体:市场占有率分析、产业趋势、成长预测(2025-2030)Spend Analytics Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

支出分析软体市场预计在预测期内复合年增长率为 18.2%

主要亮点

- 透过扩展资料分析流程并使资料更易于访问,支出分析改变了人类和机器与支出数据互动和使用支出资料的方式。供应链和物流、市场动态、製造和零售领域的各种应用正在改变市场动态。它可以帮助企业获得竞争优势并更有效地使用和消费支出资料。

- 支出分析的好处包括透过资料视觉化提供更深入的见解、协助部署成本降低流程、方便存取大型文件、即时更新和定位资料,这包括提高系统的扩充性。透过提高利用率和消耗率,组织可以减少投资。

- 例如,去年 3 月,Xeeva 是一家人工智慧驱动的支出管理和采购软体公司,为全球数百个地点和组织提供服务,宣布推出具有智慧机会的支出分析,并宣布了新的外观。这个具有增强用户介面的新版本允许 Xeeva 客户探索应用程式产生的节省和采购机会并采取行动。

- 此外,从旧有系统迁移的复杂性可能会阻碍市场扩张。缺乏定义的流程、过多的资料来源以及从旧有系统迁移的困难都会阻碍支出分析业务的未来成长。收紧监管规则也可能阻碍市场在资料安全和漏洞分析方面的支出。

- 由于 COVID-19 的爆发,资料科学团队正在分析大量可用资料,以基于可信任资料开发最佳的业务支出模型,以帮助决策者快速制定应急计划。公司使用人工智慧、机器学习和自然语言处理来挖掘大量资料并建立预测和规范模型。

在 COVID-19 大流行期间,许多组织都经历了各种意外和计划外的供应链中断。现在,支出分析使公司能够确定可以保留更多现金的领域。基于数位解决方案的智慧、结构化支出分析、采购和电子采购策略可以主动提供见解,以启动和部署应急计划,以应对我遇到的各种困难情况。

支出分析软体市场趋势

零售和电子商务可望强劲成长

- 零售和电子商务是依赖采购和供应链管理系统以及资料分析的行业。该行业的公司获得尽可能高的产品投资回报,快速准确地分析资料,并帮助采购团队做出及时、相关的决策,以实现其业务利益。零售和电子商务行业是一个快节奏的环境,决策是在最激烈的时刻做出的,以确保供应链尽可能有利可图。

- 这就是零售企业成为实施支出分析的顶级公司之一的原因之一。这些工具和平台可以帮助采购和采购团队识别供应链中的潜在挑战。零售企业的利润率通常很低,因此削减过度和不必要的支出至关重要。做出良好的支出决策的最重要部分是确保您的支出资料经过准确分类并且来自所有资料来源是最新的。可见的采购团队可以利用这些资料做出明智的、可重复的成本节约决策。

- 将蓝牙和 Wi-Fi 整合到所有消费性电子产品和装置中不仅大大提高了资料产生的速度和数量,而且还提高了产生资料的品质。近年来,随着大型企业采购的电子商务采购规模不断扩大,企业对企业 (B2B) 线上交易大幅成长。这些公司对重新设计其供应链管理解决方案以与新时代的电子采购系统整合表现出兴趣。

- Coupa 是一家云端基础的支出管理软体公司,推出了其业务支出管理 (BSM) 解决方案的增强功能,包括声控库存管理、产品搜寻和使用 Amazon Alexa 的库存重新排序。物联网技术的进步和新兴经济体不断增长的潜力也鼓励企业将支出分析工具的采用范围扩大到新兴经济体。

亚太地区预计将出现显着成长

由于企业和消费者对分析工具的使用不断增加,预计亚太地区将成为支出分析软体成长最快的市场。巨量资料和分析领域的支出和收益成长正在推动该地区的支出分析市场。亚太地区的五个关键产业可能会对巨量资料和分析解决方案进行最重大的投资:银行、通讯、离散製造、中央政府和专业服务。

- 该地区的分析市场是由跨行业(主要是中国、日本和印度)的全面数位化部署所推动的。中国分析的主要驱动力是由于网路价格上涨、行动和智慧型手机普及、都市化加快、机器学习发展、演算法开发以及客户和行为分析的需求而导致的资料爆炸。

- 根据中小微型企业部最新资料,印度拥有5,000万家中小微型企业,是全球规模最大的中小微型企业。鑑于政府和小型企业对可扩展 IT 系统和解决方案的依赖,将敏感流程转移到云端是有意义的。在亚太地区,中小企业支出分析意识的增强是经济成长的主要贡献者,在大多数 APEC 经济体中,支出分析占 GDP 的 20% 至 50%。该地区对资料分析解决方案的需求正在增长。

- 各国政府透过实施各种倡议来提高企业对云端的信任,在亚太地区支出分析市场的未来成长中发挥关键作用。香港和新加坡等亚洲国家在云端采用方面处于领先地位,拥有资料隐私法规和政府对云端的大力支持。许多外国公司正在与本地公司合作,以利用亚太地区的新商机。 Hitachi, Ltd. 的完全子公司Hitachi Vantara 扩大了与全球领先的技术产品、服务和解决方案端到端经销商 Tech Data 的合作伙伴关係。

支出分析软体产业概述

支出分析软体市场的竞争并不激烈,目前由少数拥有资料分析技术专长的公司主导。全球市场预计将本质上一体化。拥有大量市场占有率的领先公司正致力于透过利用产品创新和策略合作措施来扩大其在不同国家的基本客群,以提高市场占有率和盈利。 Genpact Ltd.、Capgemini SE、WNS Global Services Pvt. Ltd.、IBM Corporation、SAP SE、Jaggaer Inc.、Zycus Inc.、Coupa Software Inc.、Ivalua Inc.、Proactis Inc.、GEP Solutions Pvt.Ltd.、Empronc Solutions Pvt. Ltd. 是当前市场上一些重要的公司。

2022 年 8 月,Archlet 成立,这是一家帮助采购部门更快、更好地做出采购决策的软体公司。 Sievo 宣布了一项新的合作,该合作将结合两个领先的平台,使采购能够策略性地管理业务支出,从支出分析到采购执行和监控节省。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 评估 COVID-19 对市场的影响

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 市场限制因素

第 6 章 技术概览

- 透过分析

- 说明公式

- 常规的

- 预测性的

- 按用途

- 财务管理

- 预测需求和供应

- 风险管理

- 供应商采购与绩效管理

- 其他用途

第七章 市场区隔

- 按发展

- 本地

- 在云端

- 按最终用户

- 医疗保健与生命科学

- 能源/公共产业

- 零售/电子商务

- 银行、金融服务和保险

- 製造业

- 资讯科技/通讯

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第八章 竞争格局

- 公司简介

- Genpact Ltd.

- Capgemini SE

- WNS Global Services Pvt. Ltd.

- IBM Corporation

- SAP SE

- Jaggaer Inc.

- Zycus Inc.

- Coupa Software Inc.

- Ivalua Inc.

- Proactis Inc

- GEP Solutions Pvt. Ltd.

- Empronc Solutions Pvt. Ltd.

第九章投资分析

第十章投资分析市场的未来

The Spend Analytics Software Market is expected to register a CAGR of 18.2% during the forecast period.

Key Highlights

- Spend analytics has evolved how humans and machines interact with and use spend data by broadening the data analysis processes and increasing the accessibility of the data. Its various applications in supply chain and logistics, BFSI, manufacturing, and retail are changing market dynamics. It helps companies to have a competitive advantage and give them better utilization and consumption of spending data.

- The benefits of spend analytics include providing more in-depth insight through data visualization, helping deploy cost-saving processes, making large files easy to access, and having data updated and located in real-time, increasing the system's scalability. It reduces the organization's investment by improving utilization and consumption.

- For instance, in March last year, Xeeva, the AI-powered spend management and procurement software company that serves hundreds of locations and organizations globally, announced the introduction of Spend Analytics with Intelligent Opportunities and a new look. With an enhanced user interface, this new edition enables Xeeva clients to examine and act on application-generated savings and sourcing opportunities.

- Furthermore, market expansion may be hindered by the complexity of migrating from legacy systems. The lack of a defined process, the number of data sources, and the difficulties in transferring from legacy systems can all hamper the future growth of the spend analytics business. Increasingly stringent regulatory rules can also hinder the market for spending on analytics pertaining to data security and breaches.

- With the outbreak of COVID-19, the data science teams were called into action to crunch the massive data available and build the best business spending models on trusted data for decision-makers to prepare contingency plans quickly. This is where enterprises used AI, ML, and natural language processing to mine massive data and build predictive or prescriptive models.

Many organizations were experiencing various unexpected and unplanned supply chain disruptions during the COVID-19 pandemic. With spend analytics, companies were better able to identify areas where they could retain more cash. Based on digital solutions, intelligent and structured spend analysis, sourcing, and eProcurement strategies could proactively provide insight to activate and deploy emergency plans to face a range of difficult circumstances.

Spend Analytics Software Market Trends

Retail and E-commerce is Expected to Witness Significant Growth

- Retail and e-commerce are sectors dependent on procurement and supply chain management systems, along with data analytics. The companies in this sector attain the highest possible return on investment in their products and, for the business, adopt solutions such that the data is analyzed quickly and accurately so that procurement and buying teams make the right timely decisions. The retail and e-commerce sectors are fast-paced environments to ensure the supply chain is as profitable as possible; decisions are time-critical.

- That's one of the reasons why the retail sector is one of the top implementers of spending analytics; these tools and platforms help procurement and buying teams identify potential challenges within their supply chain. The profit margins by which retail-based companies work are usually thin, so it's essential that they reduce, if not eliminate, excess and unnecessary spending. The most critical part of making the right spending decisions is ensuring that spending data is accurately classified and up-to-date from all data sources. Visualized procurement teams can make well-informed and repeatable cost-saving decisions with this data.

- The integration of Bluetooth and Wi-Fi in every consumer electronic product and piece of equipment has not only increased the data generation speed and quantity exponentially, Still, it has also improved the quality of the data generated, which is also anticipated to propel the demand for spend analytics, especially in the retail sector. Over the years, business-to-business (B2B) online transactions have seen a significant increase, with growing e-commerce procurement by large organizations for purchasing; these companies are showing interest in reengineering supply chain management solutions to integrate with new-age e-procurement systems.

- Coupa, a cloud-based spend management software company, has rolled out enhancements to its business spend management (BSM) solution through voice activation using Amazon Alexa to manage inventory, locate items, and reorder stock. The advancement in IoT technologies and increasing potential among growing economies are also encouraging organizations to expand the adoption of spend analytics tools to developing countries.

Asia-Pacific is Expected to Witness Significant Growth

Asia-Pacific is expected to be the fastest-growing market for spend analytics software, owing to increased take-up of analytics tools among consumers as well as businesses. Spending and revenues are growing in the big data and analytics sectors, driving the spending analytics market in the region. The five potential and leading industries that will make the most significant investments in Asia Pacific's big data and analytics solutions are banking, telecommunications, discrete manufacturing, central government, and professional services.

- The analytics markets in the region are primarily driven by full digital deployment across industries, mainly in China, Japan, and India. The primary drivers of analytics in China are the explosion of data due to increasing internet rates, mobile and smartphone penetration, growing urbanization, machine learning development, algorithm development, and the need for customer and behavioral analytics.

- According to recent data from the Indian Ministry of Micro, Small, and Medium Enterprises, India has 50 million MSMEs, making it among the world's largest. Given that the government and MSMEs rely on scalable IT systems and solutions, it is understandable that they shift their processes to the cloud with sensitive information. In Asia-Pacific, the increasing awareness of spend analytics among small and medium enterprises contributes significantly to economic growth, with their GDP ranging from 20% to 50% in most APEC economies. The need for data analytics solutions is thriving in the region.

- National governments are playing a critical role in the future growth of the Asia-Pacific spend analytics market by implementing various initiatives to increase business confidence in the cloud. Leading the way in cloud readiness are Asian countries such as Hong Kong and Singapore, which have defined data privacy regulations and solid governmental support for the cloud. Many foreign players are teaming up with local players to capitalize on emerging opportunities in Asia-Pacific. Hitachi Vantara, a wholly-owned subsidiary of Hitachi Ltd., expanded its partnership with Tech Data, the leading global end-to-end distributor of technology products, services, and solutions.

Spend Analytics Software Industry Overview

The spending analytics software market is moderately competitive and is currently dominated by a few players with technological expertise in data analytics. The global market is expected to be consolidated in nature. The major players with a significant market share are focusing on expanding their customer base across various countries by leveraging product innovation and strategic collaborative initiatives to increase their market share and profitability. Genpact Ltd., Capgemini SE, WNS Global Services Pvt. Ltd., IBM Corporation, SAP SE, Jaggaer Inc., Zycus Inc., Coupa Software Inc., Ivalua Inc., Proactis Inc., GEP Solutions Pvt. Ltd., and Empronc Solutions Pvt. Ltd. are some of the significant players present in the current market.

In August 2022, Archlet, a software company that helps procurement make better sourcing decisions faster, launched. Sievo announced a new collaboration that would enable procurement to strategically manage business spending from spend analysis through sourcing execution and savings monitoring by combining the two major platforms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Assessment on the Impact of COVID-19 on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 TECHNOLOGY SNAPSHOT

- 6.1 By Analytics

- 6.1.1 Descriptive

- 6.1.2 Prescriptive

- 6.1.3 Predictive

- 6.2 By Application

- 6.2.1 Financial Management

- 6.2.2 Demand & Supply Forecasting

- 6.2.3 Risk Management

- 6.2.4 Supplier Sourcing & Performance Management

- 6.2.5 Other Applications

7 MARKET SEGMENTATION

- 7.1 By Deployment

- 7.1.1 On-premise

- 7.1.2 On-cloud

- 7.2 By End-User

- 7.2.1 Healthcare & Life Sciences

- 7.2.2 Energy & Utilities

- 7.2.3 Retail & E-commerce

- 7.2.4 Banking, Financial Services & Insurance

- 7.2.5 Manufacturing

- 7.2.6 IT & Telecommunications

- 7.2.7 Other End-Users

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East & Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Genpact Ltd.

- 8.1.2 Capgemini SE

- 8.1.3 WNS Global Services Pvt. Ltd.

- 8.1.4 IBM Corporation

- 8.1.5 SAP SE

- 8.1.6 Jaggaer Inc.

- 8.1.7 Zycus Inc.

- 8.1.8 Coupa Software Inc.

- 8.1.9 Ivalua Inc.

- 8.1.10 Proactis Inc

- 8.1.11 GEP Solutions Pvt. Ltd.

- 8.1.12 Empronc Solutions Pvt. Ltd.