|

市场调查报告书

商品编码

1630193

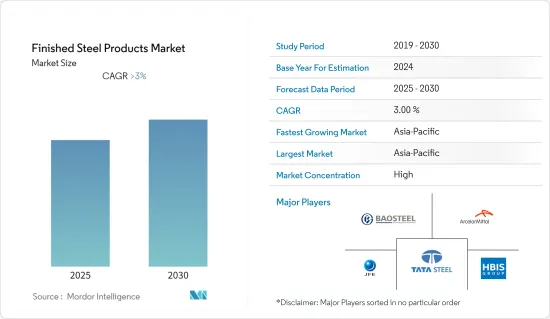

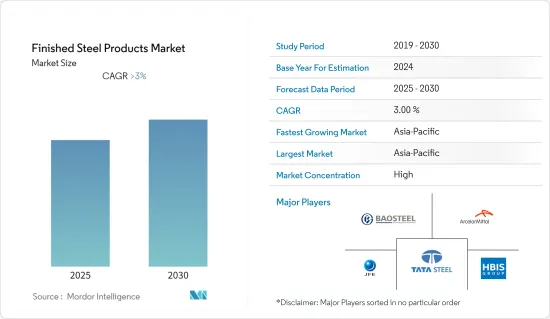

钢材成品 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Finished Steel Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计成品钢材市场在预测期内复合年增长率将超过3%。

COVID-19 的爆发对市场产生了负面影响,因为包括建筑、电气和电子以及运输在内的所有主要最终用户行业都暂时停止运作。製造工厂的无力导致这些行业各种商品的生产过程下降,从而限制了与成品钢材和镀锌钢材相关的活动的成长。然而,2021年,建筑和运输活动将出现正成长,导致预测期内成品钢材市场復苏。

主要亮点

- 推动市场成长的主要因素是建筑业的成长。

- 替代品的可用性和温度引起的性能变化可能会阻碍市场成长。

- 废钢供应量的增加可能会在未来几年为市场带来机会。

- 预计亚太地区将主导市场,并且在预测期内也可能呈现最高的复合年增长率。

钢材市场趋势

交通运输业的使用增加

- 钢材已成为全球汽车製造商首选的高效材料。增加汽车产业对钢材需求的特征包括高强度、安全性以及与其他材料相比相对较低的成本。

- 根据世界钢铁协会预测,2022年粗钢产量为18.785亿吨。建筑基础设施产业是成品钢材的最大消费者,约占全球钢材消费量的50%,其次是汽车和运输业。

- 然而,对轻型车辆日益增长的需求正在阻碍汽车行业钢材消费的成长。这可能会影响未来几年的钢铁消费。

- 此外,出于环境问题,许多政府计划停止使用石化燃料,特别是在欧洲、中国和美国,这可能会在未来几年加速电动车的发展。

- IEA数据显示,2022第一季全球电动车销量达200万辆,较2021年同期成长75%。到年终,我们预计将进一步成长 22%,达到约 180 万台。

- 由于这些因素,预计全球成品钢材市场在预测期内将成长。

亚太地区主导市场

- 预计亚太地区将主导市场。中国是发展最快的经济体之一,也是世界上最大的生产国之一。该国的製造业对该国经济做出了重大贡献。

- 中国是世界上最大的汽车製造国。该国的汽车产业正在不断发展其产品,重点在于创造确保燃油效率并最大限度地减少排放气体的产品(因为该国的污染日益严重,环境问题日益严重)。

- 据印度钢铁部称,2021-22年成品钢材总消费量为111.8吨,预计2024-25年将达到160吨,2030-31年将达250吨。

- 由于这些因素,预计该地区的成品钢材市场在预测期内将稳定成长。

钢材行业概况

成品钢材市场本质上是部分一体化的。该市场的一些主要企业包括安赛乐米塔尔、河钢集团、宝钢集团、塔塔钢铁公司和 JFE 钢铁公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的需求不断增加

- 抑制因素

- 替代品的可用性

- 温度引起的特性变化

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 形式

- 盘子

- 条

- 桿

- 轮廓

- 管子

- 金属丝

- 其他形式

- 流程

- 轧延

- 轧延

- 锻造

- 其他的

- 最终用户产业

- 运输

- 建造

- 活力

- 货柜包装

- 电力/电子

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- Baosteel Group

- China Ansteel Group Corporation Limited

- Gerdau S/A

- HBIS GROUP

- JFE Steel Corporation

- Jiangsu Shagang Group

- NIPPON STEEL CORPORATION

- Nucor

- POSCO

- Tata Steel

- United States Steel

第七章 市场机会及未来趋势

- 提高废钢的可用性

The Finished Steel Products Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 outbreak negatively impacted the market since all the major end-user industries, including building and construction, electrical and electronics, and transportation, were shut down on a temporary basis. Due to the non-functioning of the manufacturing plants, the production process of various goods in these industries declined, resulting in restricted growth in the activities involving finished steel products and galvanized steel. However, in 2021, the construction and transportation activities registered positive growth, resulting in the recovery of the finished steel products market in the forecast period.

Key Highlights

- The major factor driving market growth is the increasing construction industry.

- The availability of substitutes and their changing properties with temperature are likely to hinder the growth of the market.

- The increasing availability of steel scrap is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Finished Steel Products Market Trends

Increasing Usage in the Transportation Industry

- Steel has been an efficient material of choice for automakers globally. Some of the characteristics that increase the demand for steel products in the automotive industry include high strength, safety, and relatively low costs compared to other materials.

- According to the World Steel Association, in 2022, the production of crude steel will be 1,878.5 million tons. The building and infrastructure industry is the largest consumer of finished steel and accounts for approximately 50% of total world steel consumption, followed by the automotive and transportation industries.

- However, the increasing need to reduce the weight of an automobile is hindering the growth in the consumption of steel products in the automotive industry. This will affect the consumption of steel in the coming years.

- Also, the development of electric vehicles may continue to pick up speed in the coming years, especially in Europe, China, and the United States, where many government programs are trying to get people to stop using fossil fuels because of environmental concerns.

- According to the IEA, the global sales of electric cars in 2022 were 2 million units in the first quarter, up 75% from the same period in 2021. It is expecting a further 22 percent increase, or around 1.8 million units, by the end of this year.

- Owing to all these factors, the market for finished steel products is likely to grow across the world during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market. China is one of the fastest-emerging economies and has become one of the biggest production houses in the world. The country's manufacturing sector is one of the major contributors to the country's economy.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products in order to ensure fuel economy and minimize emissions (owing to the growing environmental concerns due to mounting pollution in the country).

- In India, according to the Ministry of Steel, the total finished steel consumption for the fiscal year 2021-22 was 111.8 MT, which is expected to reach 160 MT by 2024-25 and is estimated at 250 MT by 2030-31.

- Due to all such factors, the market for finished steel products in the region is expected to have steady growth during the forecast period.

Finished Steel Products Industry Overview

The finished steel products market is partially consolidated in nature. Some of the major players in the market include ArcelorMittal, HBIS Group, Baosteel Group, Tata Steel, and JFE Steel Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Industry

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Change in Properties with Temperature

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Plate

- 5.1.2 Strip

- 5.1.3 Rod

- 5.1.4 Profile

- 5.1.5 Tube

- 5.1.6 Wire

- 5.1.7 Other Forms

- 5.2 Process

- 5.2.1 Hot-Rolling

- 5.2.2 Cold-Rolling

- 5.2.3 Forging

- 5.2.4 Other Processes

- 5.3 End-user Industry

- 5.3.1 Transportation

- 5.3.2 Construction

- 5.3.3 Energy

- 5.3.4 Containers and Packaging

- 5.3.5 Electrical and Electronics

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Baosteel Group

- 6.4.3 China Ansteel Group Corporation Limited

- 6.4.4 Gerdau S/A

- 6.4.5 HBIS GROUP

- 6.4.6 JFE Steel Corporation

- 6.4.7 Jiangsu Shagang Group

- 6.4.8 NIPPON STEEL CORPORATION

- 6.4.9 Nucor

- 6.4.10 POSCO

- 6.4.11 Tata Steel

- 6.4.12 United States Steel

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Availability of Steel Scrap