|

市场调查报告书

商品编码

1630202

行动娱乐-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Mobile Entertainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

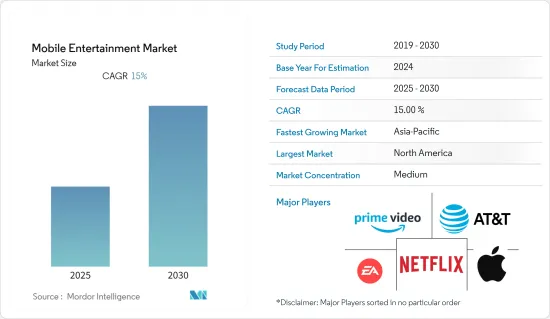

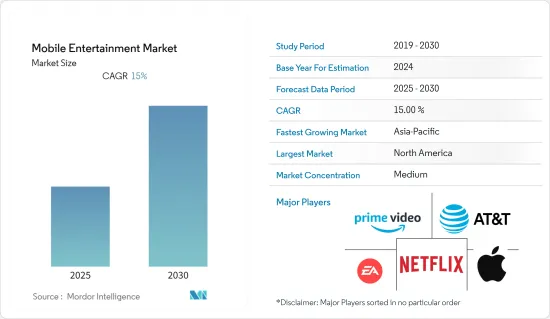

行动娱乐市场预计在预测期内复合年增长率为 15%

主要亮点

- 智慧型手机的普及为行动用户行为和行动娱乐带来了重大变化。在智慧型手机出现之前,行动娱乐现象由来电铃声、壁纸和一些完整的音轨组成。

- 行动电视、游戏、串流媒体影片和音乐彻底改变了数位娱乐,并为行动用户提供了健康的体验。最近,行动应用程式彻底改变了用户寻找和查看内容的方式。因此,近年来,音乐和游戏工作室发布了行动应用程序,作为用户探索和享受内容的网路基地台。

- 此外,智慧型手机在全球的普及率不断提高,以及近期 4G 和 5G 等行动网路存取的扩大,预计将推动行动娱乐市场的发展。然而,某些类型的付费版本可能会带来进一步的采用挑战,特别是在开发中国家。

- 随着全球大多数国家处于封锁状态以遏制病毒传播,包括手机游戏在内的数位娱乐消费大幅增加。领先的游戏供应商发现,在受 COVID-19 影响的市场中,多种类型手机游戏的下载量强劲成长。

行动娱乐市场趋势

订阅视讯点播 (SVOD) 的采用率有所提高

- 据思科称,联网电视将成为继 M2M 连接和智慧型手机之后成长第三快的市场(复合年增长率略低于 6%),到 2023 年将达到 32 亿台。在智慧型电视上观看线上影片的人中,大约 33% 使用支援影片的应用程序,而使用游戏机的比例为 23%。

- 在印度,前五名大都会占使用者整体的 55%,层级城市进一步占 36%。研究显示,从各平台的受访者订阅比例来看,Hotstar 在印度 OTT 视讯内容市场处于领先地位,其次是亚马逊的 Prime Video、SonyLIV、Netflix、Voot、Zee5、ALTBalaji 和 ErosNow。 ErosNow 用户是参与度最高的用户,68% 的用户表示他们每天都会观看内容。 ErosNow 透过伙伴关係不断发展。在印度,我们与小米合作,将其预先安装在智慧型电视上。

- 此外,一加也透过推出 OnePlus TV 进军印度智慧型电视市场。该设备结合了想像和智能,无缝连接行动和家庭网路,使互联的未来成为现实。 Hungama、Eros 和 ZEE5 内容已深度整合到 OnePlus Play 仪表板中。其他内容合作伙伴包括 Amazon Prime Video、Hotstar、SonyLiv 和 YouTube。预计这将为 SVOD(订阅视讯点播)领域带来显着成长。

- 在美国,华特迪士尼公司宣布推出后用户突破1,000万,其Disney+服务排名第四。此外,Netflix 在美国拥有 6,997 万用户。美国用户约占 Netflix 全球串流用户的三分之一。

- 一些 OTT 应用程式提供通讯服务以及广播频道向其客户提供的功能。由于渗透率很高,用户可以向许多其他用户广播极具娱乐性的影片、音乐以及本地或国际新闻。如此广泛的应用正在加速 OTT 应用的普及。

亚太地区将经历最高的成长

- 智慧型手机普及率的上升、消费者偏好的快速变化、竞争的加剧以及尚未开发的人口结构是推动游戏公司投资印度行动游戏市场的主要因素。

- 印度是全球成长最快的智慧型手机市场之一,预计到 2022 年智慧型手机普及率将成长近一倍。这些活跃用户群大部分来自印度农村地区,那里的手机游戏仍然很受欢迎。

- 通讯业者和 OTT服务供应商正在组建策略联盟,向用户提供配套服务和折扣优惠,以便从行动 OTT 视讯消费的激增中受益。例如,Airtel和沃达丰等印度公司已与亚马逊Prime和Netflix合作,以低价提供影片串流服务。

- 线上游戏也推动了智慧型手机游戏的普及,超过 90% 的印度千禧世代更喜欢智慧型手机,而不是游戏电脑和其他设备。因此,许多厂商都渴望引进新技术,为手机游戏带来竞争优势。 2019 年 7 月,印度空军推出了一款新的行动 3D 电玩游戏,主题围绕着各种空战和任务,包括空袭。

- 据 Google 称,印度超过 60% 的线上游戏玩家年龄在 18 至 24 岁之间。随着年轻用户在智慧型手机上玩网路游戏,游戏应用程式的下载量将会激增。该公司也预测,到2021年,印度将有3.1亿网路游戏玩家。这主要是由于游戏付款选项的便利性和智慧型手机的高使用率。

- 由于游戏价格实惠,印度跻身全球线上和手机游戏用户前五名。根据NASSCOM资料预测,到2020年,印度行动游戏市场的用户数将达到6.28亿人。然而,由于冠状病毒的正面影响,这一数字预计还会增加。

- 根据 AppsFlyer 2020 年 4 月发布的一份报告,自 3 月 7 日报告的 COVID-19 感染数量开始增加以来,印度的游戏内应用程式安装量和会话数逐渐增加。据报道,2020 年 4 月,用户会话增加了 65%,自然安装量增加了 50%。

行动娱乐产业概况

行动娱乐市场的一些主要企业包括苹果、动视暴雪、艺电、AT&T、Google和 Rovio International。这些公司正在加强行动娱乐市场,我们预计这一趋势将持续下去。

- 2021 年 5 月 - 全球行动娱乐的领导者 OnMobile Global Limited 宣布推出新的 B2B 游戏产品 Challenge Arena。

- 2021 年 3 月 - NBCUniversal International 的现实点播 OTT 平台“hayu”在 Amazon Web Services 的支持下将个性化和资料分析变为现实。透过实施 Amazon Web Services (AWS) 的虚拟媒体处理功能,hayu 提高了服务效能、观众留任率和订阅收入,从而带来了显着的商业效益。

- 2020 年 10 月 - Netflix Inc. 与 Microsoft 合作,帮助程式设计师学习资料科学和人工智慧。微软正在推出全球技能计划,旨在帮助全球 2500 万人获得新的数位技能。微软宣布了一个新模组,灵感来自 Netflix 的新电影《Over the Moon》。引导使用者了解「资料科学」、「机器学习」和「人工智慧」的初级概念。

- 2020 年 9 月 - Google 宣布推出 YouTube Shorts,这是在 YouTube 上观看和创作的新方式。 Shorts 是一种全新的短影片体验,适合想要只使用行动电话拍摄引人入胜的短影片的创作者和艺术家。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 智慧型手机在全球的普及率不断扩大

- 近年来行动网路存取不断增长,包括 4G 和 5G

- 市场限制因素

- 问题在于付费应用程式的传播

- 波特五力分析-产业吸引力

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章技术概况

第六章 市场细分

- 按类型

- 游戏

- 影片

- 音乐

- 按作业系统

- iOS

- Android

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Amazon.com, Inc.

- Apple Inc.

- AT&T Inc.

- Electronic Arts Inc.

- Google LLC

- Netflix Inc.

- OnMobile Global Limited

- Rovio Entertainment Corporation

- Snap Inc.

- Spotify Technology SA

- Tencent Holdings Limited

第八章 投资机会

第9章市场的未来

简介目录

Product Code: 62333

The Mobile Entertainment Market is expected to register a CAGR of 15% during the forecast period.

Key Highlights

- The proliferation of smartphones has brought about significant changes in mobile user behavior and mobile entertainment. Prior to the advent of smartphones, the mobile entertainment phenomenon consisted of ringtones, wallpapers, and some complete audio tracks.

- Mobile TV and games, streaming video, and music have transformed digital entertainment and provided mobile users with a healthy experience. Recently, mobile apps have revolutionized the way users find and display content. Thus, recent years have witnessed the release of music and game studios in mobile apps, which are becoming access points for users to explore and taste content.

- Also, the growing penetration of smartphones across the globe and the growth in mobile network accessibility in recent years, such as 4G and 5G, is expected to drive the mobile entertainment market. However, paid versions of some types can challenge further penetration, especially in developing countries.

- As most countries globally are under lockdown to control the spread of the virus, there has been significant growth in the consumption of digital entertainment, including mobile games. The major gaming vendors have witnessed strong growth in downloads of multiple types of mobile games in the COVID-19 affected markets.

Mobile Entertainment Market Trends

Increasing Adoption of Subscription video-on-demand (SVOD)

- According to Cisco, Connected TVs will grow third fastest (at a little less than a 6 percent CAGR), to 3.2 billion by 2023 after M2M connections and smartphones. Around 33% of people watch online videos on a Smart TV, with video-enabled apps compared to 23% who use a video game console.

- In India, the top 5 metro cities account for 55% of the total OTT video platform users, while Tier one cities account for another 36%. As per the survey, Hotstar leads the Indian OTT video content market, followed by Amazon's Prime Video, SonyLIV, Netflix, Voot, Zee5, ALTBalaji, and ErosNow in terms of the percentage of respondents subscribed to each platform. ErosNow users were the most engaged users, with 68% of its users indicating that they watched content daily. The platform continues to thrive through partnerships. In India, it partnered with Xiaomi for pre-installation on smart TVs.

- Further, OnePlus ventured into the Indian smart TV market with the launch of the OnePlus TV. The device combined imagination and intelligence to seamlessly connect mobile and home networks for the future of interconnectivity. Hungama, Eros, and ZEE5 content have been deep-integrated into the OnePlus Play dashboard. Other content partners include Amazon Prime Video, Hotstar, SonyLiv, and YouTube. This significantly shall provide growth to the Subscription video-on-demand (SVOD) segment.

- In a country such as the United States, The Walt Disney Company announced it had reached 10 million subscribers upon initial launch, putting its Disney+ service fourth on the list. Also, Netflix had 69.97 million U.S. subscribers. The subscriber base in the United States accounts for around a third of Netflix's worldwide streaming subscriber base.

- Along with providing messaging services, some OTT apps provide the functionalities that a broadcast channel provides to its customers. With a high adoption rate, users broadcast entertaining videos, music, local or international news to many other users. This wide range of applicabilities is accelerating its adopted growth.

Asia Pacific to Witness the Highest Growth

- The increasing smartphone penetration, rapidly changing consumer preferences, increasing competition, and untapped demographics are significant factors driving the gaming companies to invest in the Indian mobile gaming market.

- India is one of the fastest-growing smartphone markets globally, with the number of smartphones expected to double by 2022 nearly. Much of this active user base comes from rural India, where mobile gaming is still gaining popularity.

- Carriers and OTT service providers have entered into strategic partnerships to offer users bundled services and discounted subscriptions to benefit from the surge in mobile-based OTT video consumption. For example, Indian companies such as Airtel and Vodafone work with Amazon Prime and Netflix to offer video streaming services at lower rates.

- Online gaming is also fueling smartphone games' penetration, with more than 90% of millennials preferring smartphones over gaming PCs and other devices in India. This motivates many vendors to launch new technologies that enable mobile games to gain a competitive advantage. In July 2019, the Indian Air Force launched a new mobile 3D video game themed on various aerial combats and missions, including airstrikes.

- According to Google, more than 60% of India's online gamers are in the 18-24 age group. Young users play online games on their smartphones, leading to a surge in gaming apps downloads. The company also estimates that there will be 310 million online gamers in India by 2021, mainly due to ease of access to gaming payment options and the high occurrence of smartphone use.

- Due to affordable gaming experience, India is now in the top five markets globally based on the number of users for online and mobile gaming. According to NASSCOM data estimates, the Indian mobile gaming market will reach 628 million users by 2020. However, this number is expected to increase due to the positive impact resulting from coronavirus.

- As per AppsFlyer's report released in April 2020, India has been experiencing a gradual increase in in-game app installs and sessions since March 7, when the number of reported COVID-19 cases in the country started to climb. User sessions were reported to have increased by 65% and organic installs by 50% in April 2020.

Mobile Entertainment Industry Overview

The key companies operating in the Mobile Entertainment market include Apple, Activision Blizzard, Electronic Arts, AT&T Inc, Google, and Rovio International are some of the major players in mobile entertainment market. These players are bolstering the mobile entertainment market and will continue to do so shortly.

- May 2021- OnMobile Global Limited, the global leader in mobile entertainment, has launched a new B2B gaming product, Challenges Arena, a single destination of everyday challenges that provides an unparalleled gamified experience.

- March 2021 - With the help of Amazon Web Services, NBCUniversal International's reality on-demand OTT platform hayu gains personalization and data analysis. The business benefits are substantial, as hayu has improved its service's performance, viewer retention, and subscription income by implementing virtualized media processing capabilities from Amazon Web Services (AWS).

- October 2020 - Netflix Inc. partnered with Microsoft to help coders in their learning journey of Data Science and AI. Microsoft launched the Global Skills Initiative, aimed at helping 25 million people worldwide acquire new digital skills. It has launched new modules that are inspired by the new Netflix original, "Over the Moon. "It will take the user through beginners' concepts in data science, machine learning, and artificial intelligence.

- September 2020 - Google announced that they are working on YouTube Shorts, a new way to watch and create on YouTube. Shorts is a new short-form video experience for creators and artists who want to shoot short, catchy videos using nothing but their mobile phones.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing penetration of smartphones across the globe

- 4.2.2 Growth in mobile network accessibility in recent years such as 4G and 5G

- 4.3 Market Restraints

- 4.3.1 Paid version of some applications can challenge further penetration

- 4.4 Porter's Five Forces Analysis - Industry Attractiveness

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Games

- 6.1.2 Video

- 6.1.3 Music

- 6.2 By Operating System

- 6.2.1 iOS

- 6.2.2 Android

- 6.2.3 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com, Inc.

- 7.1.2 Apple Inc.

- 7.1.3 AT&T Inc.

- 7.1.4 Electronic Arts Inc.

- 7.1.5 Facebook

- 7.1.6 Google LLC

- 7.1.7 Netflix Inc.

- 7.1.8 OnMobile Global Limited

- 7.1.9 Rovio Entertainment Corporation

- 7.1.10 Snap Inc.

- 7.1.11 Spotify Technology SA

- 7.1.12 Tencent Holdings Limited

8 INVESTMENT OPPORTUNITIES

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219