|

市场调查报告书

商品编码

1850315

客户自助服务软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Customer Self-Service Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

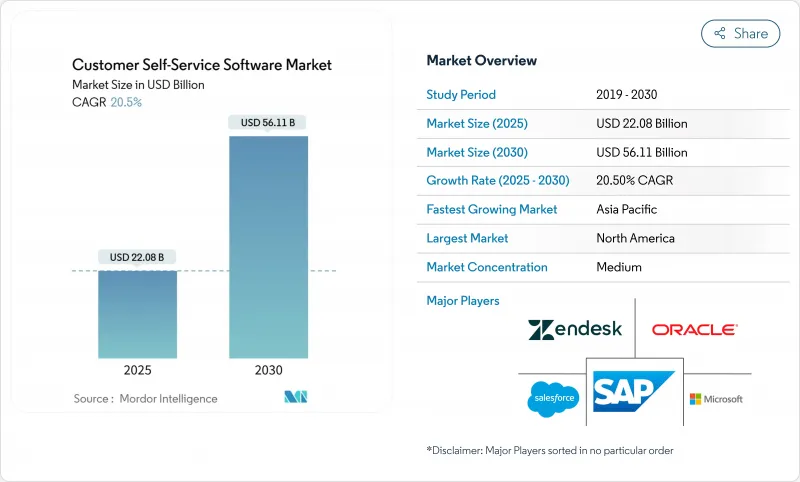

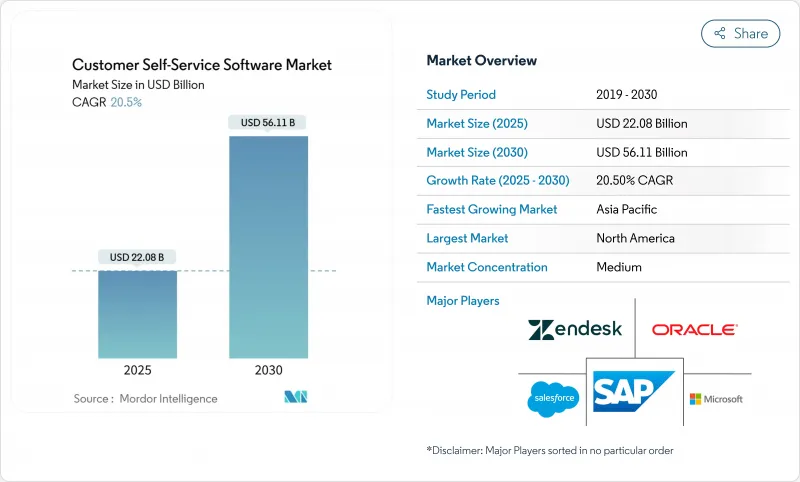

预计到 2025 年,客户自助服务软体市场规模将达到 220.8 亿美元,到 2030 年将达到 561.1 亿美元,预测期(2025-2030 年)复合年增长率为 20.5%。

这种成长反映了用户互动模式向自主模式转变的趋势,该模式利用对话式人工智慧、云端部署和高度个人化的工作流程来缩短等待时间并降低营运成本。中小企业也在加速采用这些模式,因为订阅定价模式无需大量资本支出。对话式介面正吸引持续的投资,因为它们符合消费者对自然、按需帮助的期望。区域资金筹措模式显示出整体发展势头,北美公司正在推进优化计划,而亚太公司则部署了第一批系统,以服务以行动端为中心的客户。

全球客户自助服务软体市场趋势与洞察

云端优先的客户体验转型

迁移到云端原生客户经验架构的企业报告称,成本节省高达 40-60%,并可实现 24 小时全天候服务,这促使企业进一步投资客户自助服务软体市场。跨触点的近乎即时的资料同步使客服人员和聊天机器人能够存取完整的历史记录,从而提高首次通话解决率 (FCR)。中小企业最能从订阅模式中获益,无需前期投资。然而,多区域资料驻留规则会使部署变得复杂,因此拥有强大迁移支援的供应商更具优势。

人工智慧驱动的自助服务成熟度曲线

生成式人工智慧如今能够让自动化入口网站透过解读使用者意图、搜寻记录和执行多步骤工作流程,解决高达 80% 的常见查询。将大规模语言模式整合到票务流程中的公司能够获得更高的净推荐值 (NPS),并让员工腾出精力专注于异常处理。随着准确率的提高,客户自助服务软体市场将从处理常规常见问题转向完成高价值、受监管的交易。

API 安全标准碎片化

不同的令牌通讯协定和不一致的加密方式推高了整合成本,并延缓了客户自助服务软体市场的推广。严格监管的行业正迫使CRM、ERP和知识库连接在单一安全模型下整合,但这也暴露出一些漏洞,从而引发新的安全隐患。一些供应商透过提供预认证连接器来解决这一痛点,并因此获得了市场认可。

细分市场分析

预计到2024年,云端运算市场占有率将达到58.7%,并在2030年之前维持22.1%的复合年增长率。云端运算的兴起提高了规模弹性,无需扩展资料中心即可实现全球发布。订阅定价模式降低了前期投资,并使财务团队能够将成本计入营运费用。供应商不断增强其产品,内建分析功能,使用户能够了解产品流失率和用户情绪。

在政府机构中,混合框架正变得越来越普遍。由于主权法规限制了敏感司法管辖区内SaaS的使用,而完整的本地部署架构仍然主要集中在政府机构中。从本地部署迁移到云端的公司通常会采取分阶段部署的方式,将新流量迁移到云端,同时保留原有的工单记录。维护负担的减轻和即时修补程式的更新进一步提升了混合框架的吸引力,也进一步巩固了客户自助服务软体市场的发展趋势。

到2024年,端到端套件将占总收入的62.3%,凸显了买家对融合知识库、聊天机器人和分析功能的整合平台的需求。随着企业对配置、培训和定期优化的需求不断增长,服务类别将以21.6%的复合年增长率成长。实施合作伙伴将制定行业指南,用于绘製工作流程图和管理基于角色的存取权限,从而指导企业克服变革管理中的各种挑战。

供应商透过加速器扩展价值,这些加速器与预先建置的范本打包在一起,符合 ITIL 流程或零售订单状态流程。持续的互动确保模组始终处于最佳状态,避免不断变化的业务规则与机器人意图之间出现偏差。这套专业服务层提高了平台的使用者黏性,并扩大了每次配置所附带的客户自助服务软体的市场规模。

客户自助服务软体市场按配置(云端、本地部署、混合部署)、产品/服务(解决方案和服务)、通路(入口网站、行动应用程式、其他)、公司规模(大型企业和中小企业)、最终用户行业(银行、金融服务和保险、医疗保健、零售和电子商务、其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区将在2024年贡献34.2%的收入,这主要得益于高云端采用率、成熟的全通路策略以及精通人工智慧模式调优的技术人才储备。许多公司已经完成了第一阶段的部署,目前正专注于透过更深入的分析来优化其部署路径。联邦政府对网路安全的重视正促使各机构和承包商转向符合零信任要求的平台,加剧了系统更新换代的循环。

亚太地区是成长最快的市场,预计到2030年将以21.7%的复合年增长率成长。以Z世代为首的行动优先消费者需要能够理解方言和卡拉OK式音译的聊天机器人。各国政府正在为中小企业提供数位化补贴,间接推动了零售、旅游、银行等产业对客户自助服务软体的需求。拥有多语言自然语言处理(NLP)流程的供应商能够在这种环境下脱颖而出。

在欧洲,儘管资料隐私法十分严格,但进展依然稳步推进。主权云端框架正在兴起,推动了区域资料中心的建设,并确保了合规性。企业买家在部署解决方案前会仔细审查审核能力和使用者许可管理,这有效地提高了竞争门槛。监管方面的繁琐流程会阻碍发展速度,但一旦某个解决方案被证明合规,它就能迅速扩展到相邻领域,从而确保长期稳定性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端优先的客户体验转型

- 人工智慧驱动的自助服务成熟度曲线

- 利用客户数据平台实现超个人化

- Z世代消费者对自助服务的接受度不断提高

- 将自助服务融入垂直 SaaS「分层蛋糕」中

- 自助式网路保险保费奖励

- 市场限制

- API 安全标准碎片化

- 使用「静默退出」来减少支援人员的训练数据

- 主权云端中资料储存位置的限制

- 中小企业采用顾客体验工具的成本不断上升

- 产业价值链分析

- 监管格局

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章 市场规模及成长预测(数值)

- 透过部署

- 云

- 本地部署

- 杂交种

- 报价

- 解决方案

- 服务

- 按频道

- 入口网站

- 行动应用

- 对话式聊天机器人/API

- 语音/互动语音应答

- 按公司规模

- 大公司

- 小型企业

- 按最终用户产业

- BFSI

- 卫生保健

- 零售与电子商务

- 政府

- 资讯科技/通讯

- 教育

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Microsoft Corporation

- Zendesk Inc.

- Verint Systems Inc.

- NICE Ltd.

- Genesys Telecommunications Laboratories Inc.

- Freshworks Inc.

- ServiceNow Inc.

- Atlassian Corporation(Jira Service Management)

- HubSpot Inc.

- Intercom Inc.

- Pega Systems Inc.

- Zoho Corporation Pvt. Ltd.

- Zappix Inc.

- Ada Support Inc.

- LivePerson Inc.

- Richpanel Technologies Pvt. Ltd.

- Help Scout PBC

- Drift.com Inc.

- WalkMe Ltd.

- Kustomer LLC

- RingCentral Inc.

- Avaya Inc.

- BMC Software Inc.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Customer Self-Service Software Market size is estimated at USD 22.08 billion in 2025, and is expected to reach USD 56.11 billion by 2030, at a CAGR of 20.5% during the forecast period (2025-2030).

The growth reflects a shift toward autonomous engagement models in which conversational AI, cloud deployment, and hyper-personalised workflows reduce wait times and trim operating costs. Vendors offering integrated platforms rather than narrow point tools earn preference, while small and mid-sized enterprises (SMEs) accelerate adoption as subscription pricing removes large capital outlays. Conversational interfaces attract sustained investment because they align with consumer expectations for natural, on-demand help. Regional funding patterns reinforce overall momentum as North American enterprises pursue optimisation projects and Asia-Pacific companies deploy first-wave systems to serve mobile-centric customers.

Global Customer Self-Service Software Market Trends and Insights

Cloud-first CX Transformation Wave

Enterprises migrating to cloud-native customer experience stacks report 40-60% cost reductions and round-the-clock availability, results that encourage further investment in the customer self-service software market. Near-instant data synchronisation across touchpoints lets agents and bots access complete history, which raises first-contact resolution rates. SMEs gain the most because subscription models avoid up-front capital requirements. Nevertheless, multi-region data residency rules complicate rollouts and reward vendors with strong migration support.

AI-powered Self-service Maturity Curves

Generative AI now interprets intent, retrieves records, and executes multi-step workflows, letting automated portals resolve up to 80% of common queries. Companies that embed large language models inside ticketing flows register higher net-promoter scores and free staff to handle exceptions. As accuracy improves, the customer self-service software market will transition from handling routine FAQs to completing high-value, regulated transactions.

Fragmented API Security Standards

Mismatched token protocols and inconsistent encryption raise integration costs, slowing deployments in the customer self-service software market. Highly regulated verticals must align CRM, ERP, and knowledge-base connections under one security model, and gaps expose new vulnerability surfaces. Vendors answering this pain point with pre-certified connectors gain traction.

Other drivers and restraints analyzed in the detailed report include:

- Hyper-personalisation via Customer Data Platforms

- Rising Self-service Adoption by Gen-Z Consumers

- Data Residency Constraints in Sovereign Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The cloud segment commanded 58.7% customer self-service software market share in 2024 and is forecast to maintain a 22.1% CAGR through 2030. Its rise adds scale elasticity, enabling global releases without data-centre expansion. Subscription pricing trims up-front investment and lets finance teams recognise expenses as operating outlays. Vendors continue to enrich offerings with built-in analytics that surface deflection rates and user sentiment.

Hybrid frameworks persist where sovereignty rules block SaaS in sensitive jurisdictions, while fully on-premise stacks remain concentrated in government agencies. Firms migrating from on-premises commonly adopt phased rollouts that preserve legacy ticket records yet shift new traffic to the cloud. Lower maintenance burdens and instant patching further cement the appeal, reinforcing the customer self-service software market trajectory.

End-to-end suites held 62.3% of revenue in 2024, revealing buyer desire for unified hubs that blend knowledge bases, chatbots, and analytics. The services category will grow at 21.6% CAGR as enterprises need configuration, training, and periodic optimisation. Implementation partners craft industry playbooks that map workflows and govern role-based access, guiding firms through change-management hurdles.

Vendors extend value with packaged accelerators-pre-built templates that align to ITIL processes or retail order-status flows. Continuous-improvement engagements keep modules tuned, avoiding drift between evolving business rules and bot intents. These professional-service layers deepen platform stickiness and enlarge the customer self-service software market size attached to each deployment.

Customer Self-Service Software Market is Segmented by Deployment (Cloud, On-Premise, and Hybrid), Offering (Solution and Service), Channel (Web Portal, Mobile App, and More), Enterprise Size (Large Enterprises and Small and Mid-Sized Enterprises), End-User Industry (BFSI, Healthcare, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.2% of 2024 revenue, supported by high cloud penetration, mature omnichannel strategies, and a tech workforce skilled in AI model tuning. Many enterprises completed first-wave deployments and now focus on fine-tuning journeys using deeper analytics. Federal-level attention to cybersecurity nudges agencies and contractors toward platforms meeting zero-trust mandates, sustaining replacement cycles.

Asia-Pacific represents the fastest expansion vector with a projected 21.7% CAGR through 2030. Its mobile-first consumer base, dominated by Gen-Z cohorts, demands chatbots that understand local dialects and karaoke-style transliteration. Governments sponsor SME digitalisation grants, indirectly enlarging demand for the customer self-service software market across retail, travel, and banking. Vendors with multilingual NLP pipelines differentiate in these environments.

Europe advances steadily despite stringent privacy statutes. The emergence of sovereign-cloud frameworks spurs regional data-centre builds, ensuring compliance. Enterprise buyers scrutinise audit capabilities and consent management before green-lighting rollouts, effectively raising the competitive bar. Although regulatory overhead tempers speed, once solutions prove compliant, adoption spreads quickly across adjacent departments, securing long-run stability.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Microsoft Corporation

- Zendesk Inc.

- Verint Systems Inc.

- NICE Ltd.

- Genesys Telecommunications Laboratories Inc.

- Freshworks Inc.

- ServiceNow Inc.

- Atlassian Corporation (Jira Service Management)

- HubSpot Inc.

- Intercom Inc.

- Pega Systems Inc.

- Zoho Corporation Pvt. Ltd.

- Zappix Inc.

- Ada Support Inc.

- LivePerson Inc.

- Richpanel Technologies Pvt. Ltd.

- Help Scout PBC

- Drift.com Inc.

- WalkMe Ltd.

- Kustomer LLC

- RingCentral Inc.

- Avaya Inc.

- BMC Software Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first CX transformation wave

- 4.2.2 AI-powered self-service maturity curves

- 4.2.3 Hyper-personalisation via customer data platforms

- 4.2.4 Rising self-service adoption by Gen-Z consumers

- 4.2.5 Embedded self-service in vertical SaaS "layer-cake"

- 4.2.6 Cyber-insurance premium incentives for self-service

- 4.3 Market Restraints

- 4.3.1 Fragmented API security standards

- 4.3.2 "Quiet quit" of support agents lowering training data

- 4.3.3 Data residency constraints in sovereign clouds

- 4.3.4 Rising CX tool sprawl cost for SMEs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.1.3 Hybrid

- 5.2 By Offering

- 5.2.1 Solution

- 5.2.2 Service

- 5.3 By Channel

- 5.3.1 Web Portal

- 5.3.2 Mobile App

- 5.3.3 Conversational Chatbot/API

- 5.3.4 Voice/IVR

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-Sized Enterprises (SMEs)

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare

- 5.5.3 Retail and E-commerce

- 5.5.4 Government

- 5.5.5 IT and Telecommunication

- 5.5.6 Education

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation

- 6.4.2 Salesforce Inc.

- 6.4.3 SAP SE

- 6.4.4 Microsoft Corporation

- 6.4.5 Zendesk Inc.

- 6.4.6 Verint Systems Inc.

- 6.4.7 NICE Ltd.

- 6.4.8 Genesys Telecommunications Laboratories Inc.

- 6.4.9 Freshworks Inc.

- 6.4.10 ServiceNow Inc.

- 6.4.11 Atlassian Corporation (Jira Service Management)

- 6.4.12 HubSpot Inc.

- 6.4.13 Intercom Inc.

- 6.4.14 Pega Systems Inc.

- 6.4.15 Zoho Corporation Pvt. Ltd.

- 6.4.16 Zappix Inc.

- 6.4.17 Ada Support Inc.

- 6.4.18 LivePerson Inc.

- 6.4.19 Richpanel Technologies Pvt. Ltd.

- 6.4.20 Help Scout PBC

- 6.4.21 Drift.com Inc.

- 6.4.22 WalkMe Ltd.

- 6.4.23 Kustomer LLC

- 6.4.24 RingCentral Inc.

- 6.4.25 Avaya Inc.

- 6.4.26 BMC Software Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment