|

市场调查报告书

商品编码

1630208

软体定义资料中心 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Software Defined Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

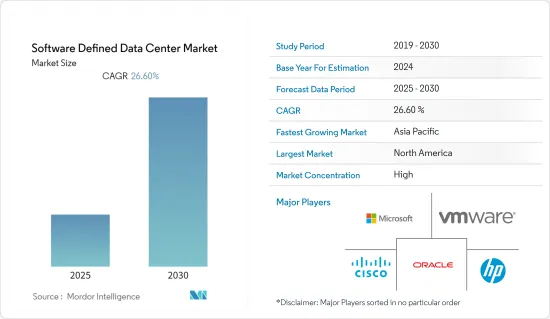

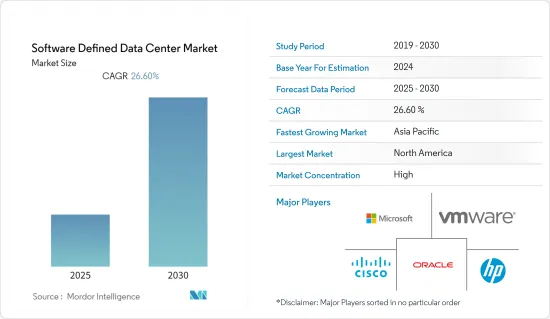

软体定义资料中心市场预计在预测期间内复合年增长率为 26.6%

主要亮点

- 除了一些重要的例外之外,SDDC 在几个方面与传统资料中心不同。特别是虚拟、抽象化、资源池和自动化。软体定义资料中心是一个 ITaaS(IT 即服务)平台,可满足您业务的平台、基础架构和软体要求。 SDDC 可在现场、MSP、託管、私有或公共云端中使用。 SDDC 容纳伺服器、储存设备、网路硬体和安全设备,与传统资料中心类似。传统的资料中心操作由 SDDC 使用虚拟环境以程式设计方式提供。

- 随着融合式基础架构(所有IT基础设施均在软体中定义和部署)的采用,网路和技术现在可以支援云端 SDDC 和 ITaaS 的目标。

- 就物联网而言,从中长期来看,COVID-19 的影响预计将非常正面。公司预计将加快数位化进程,以克服停机、生产力损失和供应链问题等问题。

- 窃取关键资讯的安全威胁数量持续增加,这可能会阻碍市场成长。 SDDC 必须具有身份验证和存取管理来管理使用者、作业系统安全性来保护虚拟伺服器以及资料安全性来保护静态和动态资讯。为了保护您的 SDDC,您应该尽可能实施双因素认证。

软体定义资料中心市场趋势

软体定义储存主导市场

- 随着企业资源更加分散和容量增加,软体定义储存已成为必要。这也称为储存虚拟或虚拟SAN。储存虚拟可让您将多个储存单元合併为一个,并从视图中删除实体储存。对于不想在硬体上花费额外资金或需要更多储存设施来满足 SLA 的组织非常有用。

- 资料流量的增加是支援资料储存需求的关键因素。随着物联网在全球的普及,设备的连接性也不断增强。因此,累积了大量的资料。

- 根据思科估计,全球有超过 500 亿台智慧连网设备。分析从此类设备收集的资料可以产生客户交易模式并帮助企业了解消费者趋势。此外,IBM 报告称,大约 90% 的资料是在过去两年中产生的。

- 物联网 (IoT) 描述了互联网的当前和未来状态。将连接到互联网的大量设备(事物)产生的大量资料转换为可用资讯需要许多努力和处理步骤。全面的软体定义框架透过将软体定义网路、软体定义储存和安全性整合到一个基于软体定义的控制模型中,简化了物联网管理流程。传统的物联网架构难以传输、储存和保护物联网物件产生的资料,因此我们列出了关键解决方案。如图所示,分析了不断成长的物联网设备对预测期内市场成长率的贡献。

亚太地区将经历最高的成长

- 由于经济稳定成长、网路和智慧型手机的快速普及以及相关业务需求的不断增加,新兴企业激增,亚太地区成为该市场成长最快的地区。

- 这一趋势吸引了该地区的创业投资,并带动了许多公司的发展。结果,产生的资料量也在增加。近年来,亚太地区的金融中心不断进步。该地区排名前 8 名的中心目前各项指标均跻身前 15 名。这表明,随着创新的增加,各国也需要注意自己的资料储存能力。

- 维护良好的 SDDC 架构支援迁移到混合云端。 SDDC 是虚拟资源池,是混合云端系统的完美基础。它描述了私有云端云和公有云的通用平台,公共云端自动化资源分配和任务、简化和加速应用程式部署,并作为高度可用的基础架构的基础。

- 由于其成本效率、可扩展性、敏捷性和安全性,亚太地区的混合云预计在未来几年将显着成长。混合云透过提高敏捷性和效率并以更低的成本快速交付 IT 资源,缩小了资讯技术 (IT) 与企业之间的差距。 COVID-19 显着加速了数位技术的采用,并导致了向混合云的重大转变。

- 发展中国云端产业是中央政府的重大战略目标,也是中国「十二五」、「十三五」规划的突出内容。云端运算技术被选为政府支持的11个重点技术领域之一。国家发展和改革委员会(NDRC)和工业和资讯化部(MIIT)已在北京、杭州、上海、深圳和无锡五个城市设立云端试点计画。

- 越来越多的中国企业正在采用混合云方法来加速数位转型。阿里云 VMware 服务帮助客户更快、更低成本地实现应用程式、基础架构和营运的现代化。此连接器提供企业级运算、储存和网路功能,以及整合基础设施和管理,以提高可视性和自动化。这些因素在预测期内显着推动市场成长率。

软体定义资料中心产业概述

SDDC 市场由 Oracle、VMware 和 Microsoft 等公司高度主导,这些公司提供从大型企业到小型企业都使用的虚拟软体。新参与企业通常被大公司收购,从而增加后者的产品系列。

2022 年 2 月 - 混合多重云端运算领先供应商 Nutanix 宣布向世界提供简化的产品套件,以满足快速变化的客户需求。 Nutanix 统一储存 (NUS) 为部署在任何地方的各种应用程式提供跨多种通讯协定(磁碟区、檔案和物件)的分散式软体定义储存。

2022 年5 月- Broadcom Inc.,一家设计、开发和供应半导体和基础设施软体解决方案的全球技术领导者。 ,并扩充由VMware 提供的服务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 硬体和其他资源成本的降低推动市场成长

- 市场限制因素

- 引入SDDC时资料安全是一个主要问题

第六章 市场细分

- 依产品类型

- 解决方案

- 软体定义网路 (SDN)

- 软体定义储存 (SDS)

- 软体定义计算(SDC)

- 按服务

- 解决方案

- 按最终用户

- 电信与资讯技术

- 医疗保健

- 零售

- BFSI

- 製造业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Hewlett Packard Enterprise Company

- Oracle Corporation

- Cisco Systems

- VMware Inc.

- IBM Corporation

- Citrix Systems, Inc.

- Melillo Consulting Inc.

- Huawei Technologies Co., Ltd.

- NEC Corporation

- Dell EMC

第八章投资分析

第9章市场的未来

The Software Defined Data Center Market is expected to register a CAGR of 26.6% during the forecast period.

Key Highlights

- With a few significant exceptions, SDDCs differ from traditional data centers in several ways, notably through virtualization, abstraction, resource pooling, and automation. A software-defined data center is an IT-as-a-Service (ITaaS) platform that meets a business's platform, infrastructure, and software requirements. An SDDC may be on-site, at an MSP, or in hosted, private, or public clouds. SDDCs house servers, storage devices, networking hardware, and security devices like conventional data centers. The operations of a traditional data center are delivered programmatically by an SDDC using a virtualized environment.

- With the introduction of hyper-converged infrastructure-where all IT infrastructure pieces are software-defined and deployed-network, technology can now support cloud SDDC and ITaaS ambitions.

- For IoT in the medium to long term, the Covid-19 impact is expected to be highly positive. Enterprises are expected to speed up their digitization process to overcome problems such as downtime, productivity loss, and supply chain issues, among others.

- Ever-growing security threats that steal critical information can hamper the market's growth. SDDCs must have identity and access management to control users, OS security to safeguard the virtual server, and data security to protect information at rest and in motion. Two-factor authentication must be put in wherever possible to make the SDDC secure.

Software Defined Data Center Market Trends

Software-Defined Storage to Dominate the Market

- Software-Defined storage has become mandatory as enterprise resources are decentralized and increasing in volume. It is also called Storage Virtualization or virtual SAN. Storage virtualization allows many storage units to be combined into one and remove any physical storage in sight. It is helpful for organizations that spend excess on hardware or need more storage facilities to meet SLA.

- Increased data traffic has been the main underlying factor responsible for the demand for data storage. With an increase in IoT adoption worldwide, device connectivity is also growing. Hence, there is an accumulation of vast piles of data.

- As per estimates by Cisco, there are over 50 billion smart connected devices in the world. The data collected from such devices can be analyzed to generate customer transaction patterns and help companies understand the proclivity of their consumers. Also, IBM reported that approximately 90% of the data was generated in the last two years.

- The "internet of things" (IoT) represents the internet's present and future states. It requires a lot of effort and processing procedures to convert the enormous volume of data produced by a big number of linked devices (objects) to the internet into usable information. A comprehensive software-defined framework streamlines the IoT management process by combining the software-defined network, software-defined storage, and security into one software-defined-based control model. It offers a critical solution for the difficulties in the traditional IoT architecture to forward, store, and secure the produced data from the IoT objects. As indicated in the graph, the growing IoT devices are analyzed to contribute to the market growth rate during the forecast period.

The Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific is the fastest growing region for this market due to more startups mushrooming due to steady economic growth, the rapid spread of the internet and smartphones, and increased related business demand.

- This trend is attracting venture capitalists in this region, leading to growth in many companies. Thus, the amount of data generated is also increasing. There has been a strong trend of Asia-Pacific financial centers improving over several years. The top eight centers in the region are now in the top fifteen centers in the whole index. This indicates that with an increase in innovation, the countries would also have to take care of data-storing capabilities.

- A well-maintained SDDC architecture sets up an organization for its transition to a hybrid cloud. As a pool of resources that have been virtualized, SDDC is the optimal foundation for hybrid cloud systems. By automating resource allocations and tasks, streamlining and accelerating application deployment, and serving as the foundation of a high-availability infrastructure, it offers a common platform for both private and public clouds.

- The hybrid cloud in the Asia-Pacific is expected to witness growth in the coming years with a significant growth rate due to cost efficiency, scalability, agility, and security. The hybrid cloud bridges the gap between Information Technology (IT) and businesses by improving agility and efficiency and rapidly delivering IT resources at a low cost. COVID-19 has significantly accelerated the adoption of digital technologies and led to a substantial shift toward the hybrid cloud.

- The development of China's cloud industry is a major strategic objective for the central government, and it was highlighted prominently in the country's 12th and 13th Five-Year Plans. Cloud computing technology has been selected as one of the 11 key technology sectors backed by the government. The National Development and Reform Commission (NDRC) and the Ministry of Industry and Information Technology (MIIT) have built pilot cloud schemes in five cities: Beijing, Hangzhou, Shanghai, Shenzhen, and Wuxi.

- More and more Chinese firms are adopting a hybrid cloud approach to speed up their digital transformation. Alibaba Cloud VMware Service enables clients to modernize apps, infrastructure, and operations more quickly and affordably. The connectors provide enterprise-class computing, storage, and networking capabilities, as well as unified infrastructure and management for increased visibility and automation. These factors are significantly boosting the market growth rate during the forecast period.

Software Defined Data Center Industry Overview

The market for SDDC is highly dominated by players like Oracle, VMware, and Microsoft, which provide virtualization software used by all big and small enterprises. The new entrants are generally acquired by big companies, which increases the latter's product portfolio.

February 2022 - Nutanix, a leading provider of hybrid multi-cloud computing, announced the global availability of a simplified product range to meet fast-changing client needs. This consists of Nutanix Unified Storage (NUS) which provides distributed and software-defined storage for several protocols (volumes, files, and objects) to serve a range of applications deployed everywhere.

May 2022-Broadcom Inc., a global technological leader in the design, development, and supply of semiconductor and infrastructure software solutions, and VMware, Inc., a leading creator in enterprise software, announced an agreement under which Broadcom acquired all of VMware's outstanding shares in a cash-and-stock transaction valued at approximately USD 61 billion. The Broadcom Software Group will join VMware after the acquisition closes, adopting Broadcom's current infrastructure and security software solutions as a part of an expanded VMware offering.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Reduction in Hardware and Other Resources is Driving the Growth of the Market.

- 5.2 Market Restraints

- 5.2.1 Data Security While Deploying SDDC is a Major Challenge

6 MARKET SEGMENTATION

- 6.1 By Type of Product

- 6.1.1 Solution

- 6.1.1.1 Software-Defined Networking (SDN)

- 6.1.1.2 Software-Defined Storage (SDS)

- 6.1.1.3 Software-Defined Computing (SDC)

- 6.1.2 Services

- 6.1.1 Solution

- 6.2 By End User

- 6.2.1 Telecom & IT

- 6.2.2 Healthcare

- 6.2.3 Retail

- 6.2.4 BFSI

- 6.2.5 Manufacturing

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 Oracle Corporation

- 7.1.4 Cisco Systems

- 7.1.5 VMware Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Citrix Systems, Inc.

- 7.1.8 Melillo Consulting Inc.

- 7.1.9 Huawei Technologies Co., Ltd.

- 7.1.10 NEC Corporation

- 7.1.11 Dell EMC