|

市场调查报告书

商品编码

1630227

美国黏合剂和密封剂:市场占有率分析、行业趋势和成长预测(2025-2030)United States Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

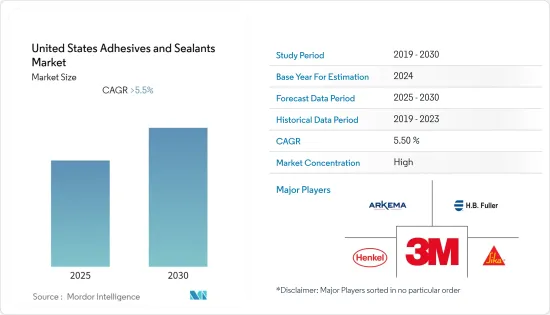

美国黏合剂和密封剂市场预计在预测期内复合年增长率将超过 5.5%

主要亮点

- 该地区包装行业的扩张可能会在未来几年显着推动市场发展。

- 然而,有关无挥发性有机化合物使用的严格规定预计将阻碍市场成长。

- 生物基和混合黏合剂的发展预计将是一个机会。

美国黏合剂和密封剂市场趋势

包装产业需求增加

- 就保护和提高产品安全性和寿命而言,包装在设计和技术方面是一个快速发展的行业。

- 消费者忙碌的生活方式、不断增长的消费能力以及相关因素正在推动该国对快速和便携式包装商品的需求。由于整个国家进入封锁状态,製造设施暂时关闭,COVID-19 大流行带来了多项挑战,包括供应链、进出口中断。

- 对公共卫生的日益担忧,以及美国各地电子商务活动的增加,可能会继续推动食品加工业的成长,这将进一步推动未来几年的包装需求。

- 近年来,美国包装业受到食品和饮料行业快速成长的推动。 2021年,食品和饮料零售商的包装产品销售额达到约8,800亿美元,较2020年成长约3.5%。

- 美国的瓦楞包装也正在经历显着成长。例如,该国2021年纸板包装出货量为4,160亿平方英尺,较2017年成长约8%。

- 因此,由于上述因素,包装产业的扩张可能会在预测期内推动市场。

扩大水性黏合剂的采用

- 水基黏合剂因其在多种应用和最终用户行业中的优势特性而成为全国消费的主要黏合剂技术。

- 水基黏合剂通常被设计为分散体或乳化。分散的聚合物(乳胶)颗粒呈球形,直径50至300 nm。高分子量通常在乳液聚合中实现,因为每个胶乳颗粒内形成的链的浓度很浅。

- 这些黏合剂通常用于木工和製鞋行业,以黏合木材、纸张、纺织品、皮革和其他多孔基材。

- 丙烯酸水性黏合剂因其成本低廉、环保性能好而成为主要的树脂类型。它还易于在多种基材上使用,并且具有适度的强度以及对温度和其他环境因素的抵抗力。

- 水性黏合剂是环保的,VOC 含量可以忽略不计,因此不会损害生产车间工人的安全,并且比其他类型的技术更便宜。

- 因此,预计这些因素将在未来几年推动水性黏合剂的需求。

美国黏合剂和密封剂产业概况

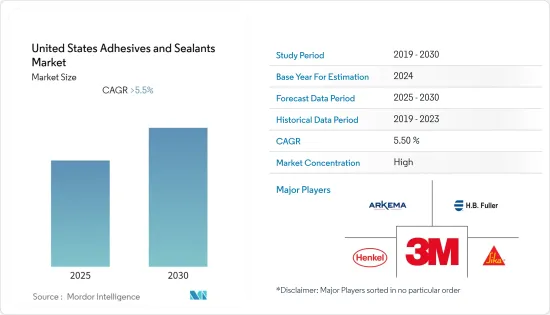

美国黏合剂和密封剂市场本质上是整合的。主要企业包括(排名不分先后)3M、阿科玛集团、西卡股份公司、HB Fuller Company 和汉高股份公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 包装产业需求增加

- 其他司机

- 抑制因素

- 关于使用不含 VOC 成分的严格规定

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(以金额为准、以销售额为准))

- 树脂黏合剂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 氰基丙烯酸酯

- VAE/EVA

- 其他的

- 黏合剂的技术

- 溶剂型被覆剂

- 反应性

- 热熔胶

- UV固化胶

- 树脂密封剂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 其他的

- 最终用户产业

- 建筑/施工

- 纸/纸板包装

- 运输

- 木工/细木工

- 鞋类/皮革

- 医疗保健

- 电力/电子

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema Group

- Illinois Tool Works Inc.

- Avery Dennison Corporation

- Huntsman International LLC

- Dow

- MAPEI SpA

- Sika AG

- Technical Adhesives

- HB Fuller Company

- Henkel AG & Co. KGaA

第七章 市场机会及未来趋势

- 生物基黏合剂和混合黏合剂的开发

简介目录

Product Code: 64051

The United States Adhesives and Sealants Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Key Highlights

- The expanding packaging industry in the region will likely drive the market significantly in the coming years.

- However, the strict regulations on the usage of VOC-free content are expected to hinder the market's growth.

- The development of bio-based and hybrid Adhesives is expected to be an opportunity.

US Adhesives & Sealants Market Trends

Increasing Demand from Packaging Industry

- Packaging is a fast-growing industry in terms of design and technology for protecting and enhancing products' safety and longevity.

- The demand for quick and on-the-go packaged items is increasing due to consumers' busier lifestyles, greater spending power, and related factors in the country. Due to the COVID-19 pandemic, the country-wide lockdowns and temporary shutdown of manufacturing facilities caused several issues, including disruptions in supply chains, imports, and exports.

- The growing interest in public health, along with the emerging e-commerce activities across the nation, is likely to continue boosting the growth of the food processing industry, which will further drive the packaging demand over the coming years.

- The United States packaging industry has been driven by the rapid growth of the food and beverage industry in recent years. The sales of packaging products to retail food and beverage stores amounted to around USD 880 billion in 2021, representing a growth of nearly 3.5% compared to 2020.

- Also, corrugated packaging in the United States is growing significantly. For example, the country shipped 416 billion square feet of corrugated packaging in 2021, representing a growth of nearly 8% compared to 2017.

- Thus, owing to the aforementioned factors, expanding the packaging industry will likely drive the market during the forecast period.

Growing Adoption of Water-borne Adhesives

- Water-borne is the majorly consumed adhesive technology across the country due to its favorable properties for multiple applications or end-user industries.

- Water-borne adhesives are often designed as dispersions or emulsions. The distributed polymer (latex) particles have a spherical form with a diameter of 50 - 300 nm. Since the concentration of the developing chains within each latex particle is shallow, high molecular weights are typically attained in emulsion polymerization.

- These adhesives are commonly used in the woodworking and footwear industries for bonding wood, paper, textiles, leather, and other porous substrates.

- Acrylic waterborne adhesives are the major resin type due to their cheaper cost and favorable environmental properties. They are also easier to use with multiple substrates and have moderate strength and resistance to temperature and other environmental factors.

- Waterborne adhesives are more environmentally friendly, have negligible VOC content that does not hamper the safety of workers at manufacturing sites, and are less expensive than other types of technologies.

- Thus, these factors are expected to boost demand for waterborne adhesives over the coming years.

US Adhesives & Sealants Industry Overview

The United States adhesives and sealants market is consolidated in nature. The major companies include 3M, Arkema Group, Sika AG, HB Fuller Company, and Henkel AG & Co. KGaA, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Packaging Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Regulations on the Usage of VOC-free Contents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Revenue)

- 5.1 Adhesives by Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Solvent-Borne Coatings

- 5.2.2 Reactive

- 5.2.3 Hot Melt

- 5.2.4 UV-Cured Adhesives

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Paper, Board, and Packaging

- 5.4.3 Transportation

- 5.4.4 Woodworking and Joinery

- 5.4.5 Footwear and Leather

- 5.4.6 Healthcare

- 5.4.7 Electrical and Electronics

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Illinois Tool Works Inc.

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Huntsman International LLC

- 6.4.6 Dow

- 6.4.7 MAPEI S.p.A.

- 6.4.8 Sika AG

- 6.4.9 Technical Adhesives

- 6.4.10 H.B. Fuller Company

- 6.4.11 Henkel AG & Co. KGaA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based and Hybrid Adhesives

02-2729-4219

+886-2-2729-4219