|

市场调查报告书

商品编码

1850958

云端託管服务:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cloud Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

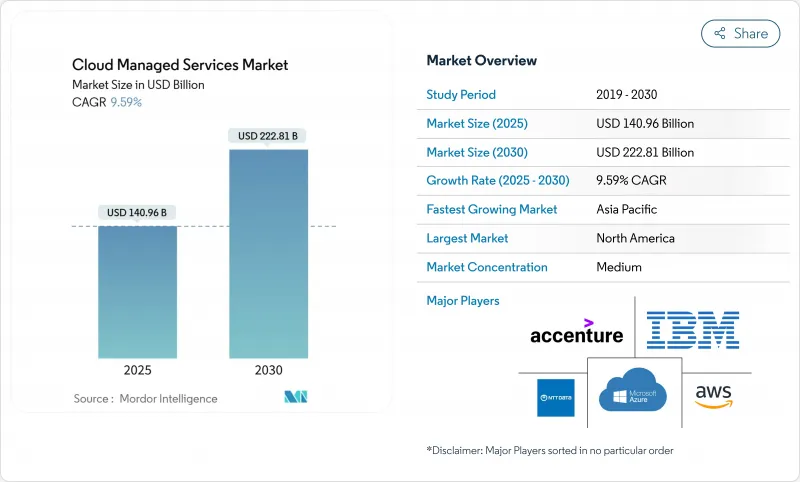

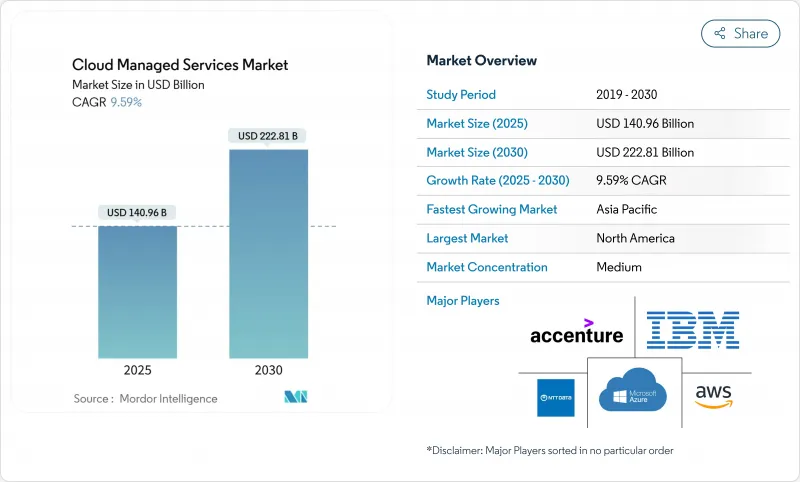

预计到 2025 年,云端託管服务市场规模将达到 1,409.6 亿美元,到 2030 年将成长至 2,228.1 亿美元。

企业正持续从资产密集型基础设施所有权模式转型为按需付费的计量收费模式,以提高敏捷性、创造现金流并缩短创新週期。随着多重云端的蔓延和网路安全威胁给企业内部IT团队带来压力,需求激增。金融服务业的数位转型、人工智慧主导的工作负载以及永续性目标,都推动了对专业外部管理的需求。虽然北美占据了大部分支出,但亚太地区凭藉其尚未开发的市场基础和支持云端运算的政策环境,成为成长最快的地区。竞争的焦点日益集中在自动化、合规深度和垂直行业专业知识上,而非简单的成本套利。

全球云端託管服务市场趋势与洞察

金融服务业数位优先外包

银行和保险公司如今正将託管云端服务置于其现代化蓝图的核心位置。 2024年4月,塔塔咨询服务公司(Tata Consultancy Services)扩大了与AWS的合作,承诺培训25,000名工程师,使其掌握银行级云端现代化模式。金融机构认为,与外部合作伙伴携手是实现生成式人工智慧、自动化合规检查和缩短产品发布週期的唯一可行途径。混合架构使下一代核心系统能够与传统平台共存,进而降低营运风险。改善客户体验是亚太地区银行的首要任务,其云端现代化预算拨款已超过成本节约目标。

企业中多重云端和混合云复杂性的快速成长

混合云端和多重云端部署已成为主流,但鲜有企业能够真正掌握内部跨平台编配。 VMware 的一份报告显示,93% 的客户计划长期维护混合架构。 Nutanix 的研究表明,到 2024 年,95% 的企业将在不同云端平台之间迁移应用程序,以提高安全性并加速创新。因此,能够提供跨云端统一可视性、自动化工作负载部署和成本管治的合作伙伴需求激增。

对资料外洩和不断演变的威胁的持续担忧

英国一项调查发现,儘管许多中小企业承认云端迁移具有灵活性和成本效益,但由于担心安全漏洞,他们仍在推迟云端迁移。合规性审核和客户信任度令他们倍感压力,导致他们与那些无法提供严格认证和事件回应指标的供应商签订了冗长的合约。

细分市场分析

託管基础设施服务将继续为资源配置奠定基础,预计到 2024 年将占总收入的 37.5%。然而,随着企业优先考虑持续威胁调查、零信任实施和合规性报告,託管安全服务将以 10.7% 的复合年增长率加速成长。这将使託管安全市场的规模超过大多数其他细分市场。人工智慧驱动的安全营运中心(例如 Viking Cloud 的平台,该平台每天分析数十亿个事件)透过缩短停留时间和自动化关联分析,增强了服务提供者的优势。网路、应用、备份和灾难復原服务仍然强劲,推动着复杂的现代化计划和传统系统支援。

随着供应商将安全性与基础设施和网路监控捆绑在一起,他们创建了整合平台,从而推高了切换成本。企业买家更重视独立解决方案中那些突出的功能,例如统一的仪錶板、一致的服务等级协定 (SLA) 以及跨多重云端环境的单一管治平台。

公共云端选项在超大规模可用区和丰富的原生工具的推动下,预计到 2024 年将保持 52% 的市场份额。然而,随着客户寻求延迟控制、资料驻留和成本优化等优势,混合模式正以 11.5% 的复合年增长率加速成长。野村综合研究所利用 AWS Outposts 使一家日本银行能够在当地运行 AWS 服务,从而满足其主权监管要求。 Equinix 日本与Sakura Internet的伙伴关係展示如何将託管和支援 GPU 的 AI 工作负载服务与公共经济效益和私人控制相结合。私有云端的成长仍然较为温和,主要局限于超低延迟和特定的监管用例。

託管服务供应商现在透过提供一致的策略引擎、成本仪表板以及跨公共、私有和边缘环境的可观测性来脱颖而出,而对执行时间和资料位置有严格要求的客户也越来越将供应商对混合整合的熟悉程度作为购买的先决条件。

云端託管服务市场按服务类型(託管基础设施服务、託管网路服务等)、部署类型(公共云端、私有云端、混合云端)、公司规模(大型企业、中小企业)、最终用户行业(银行、金融服务和保险 (BFSI)、IT 和电信、零售和电子商务等)以及地区进行细分。市场预测以美元计价。

区域分析

北美仍将是最大的消费地区,预计到2024年将占据云端託管服务市场37.3%的份额。早期采用、成熟的合作伙伴生态系统以及活跃的创业融资环境,都支撑着对最佳化、人工智慧营运和合规自动化的需求。美国企业倾向于基于结果的合同,而加拿大企业则利用跨境地理接近性来增强两地之间的业务弹性。墨西哥製造商正在整合託管边缘网关,以支援其工业4.0专案。

到2030年,亚太地区将以9.3%的复合年增长率实现最快增速,这主要得益于各国政府津贴数位化的补贴以及宽频接入的普及。华为云端的合作伙伴网路现已覆盖超过45,000家企业,并提供12,000个市场平台。印度IT巨头正在对其传统系统进行现代化改造,以服务出口至全球。韩国的5G骨干网路将加速边缘密集的工作负载部署。澳洲的地理位置相对封闭,因此对能够与全球资源无缝互联的本地管理节点的需求日益增长,OpenText公司正大力投资该领域,直至2025年。

欧洲复杂的监管体系促使服务提供者在资料驻留和永续性认证方面进行差异化竞争。德国中型製造商利用託管服务推进工业4.0,而法国和义大利则在国家人工智慧战略的推动下加大对公共云端的投资。英国金融机构委託部署统一威胁管理套件以满足审慎监理局(PRA)的要求。该地区的绿色交易和永续消费品监管指令(CSRD)的报告机制抑制了对缺乏透明排放指标的服务提供者的需求。微软承诺使用100%可再生能源为其资料中心供电,这项承诺影响了采购决策。

南美洲和中东及非洲是新兴但充满希望的地区,託管服务可以绕过有限的本地基础设施。 Expereo 指出,企业正在增加对 SD-WAN 和 SASE 的投入,以便在地理位置分散的营运中提供一致的应用程式效能。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 金融服务业的数位优先计画加速了託管云端外包

- 企业中多重云端和混合云复杂性的爆炸性成长

- 网路风险和合规性日益增长,需要全天候的安全管理。

- 资讯长预算面临的成本优化压力(营运支出与资本支出)

- FinOps 的采用对持续的云端成本管治提出了新的要求。

- 永续性和绿色云端指令改变了供应商的选择

- 市场限制

- 资料外洩的担忧依然存在,威胁情况也在不断变化。

- 供应商锁定风险会延缓大规模工作负载迁移。

- 全球认证云端架构师短缺

- 资料主权法律的碎片化增加了合规成本。

- 价值/供应链分析

- 监管环境

- 技术展望(边缘运算、5G、人工智慧运维)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类型

- 託管基础设施服务

- 主机服务

- 资安管理服务

- 託管应用程式服务

- 其他服务类型

- 按部署模式

- 公共云端

- 私有云端

- 混合云端

- 按公司规模

- 大公司

- 小型企业

- 按最终用户行业划分

- BFSI

- 资讯科技和通讯

- 零售与电子商务

- 医疗保健和生命科学

- 製造业

- 政府和公共部门

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services(AWS)

- Microsoft Corp.(Azure Managed Services)

- International Business Machines Corp.(IBM)

- Accenture plc

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Ericsson

- Fujitsu Ltd.

- NEC Corp.

- NTT DATA Corp.

- DXC Technology Co.

- Lumen Technologies, Inc.

- Rackspace Technology, Inc.

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- HCLTech

- Capgemini SE

- Cognizant Technology Solutions

- Infosys Ltd.

- Atos SE

第七章 市场机会与未来展望

The cloud managed services market size reaches USD 140.96 billion in 2025 and is set to grow to USD 222.81 billion by 2030, reflecting a 9.59% CAGR.

Enterprises continue moving from asset-heavy infrastructure ownership to pay-as-you-go operating models that improve agility, free cash and shorten innovation cycles. Demand rises sharply as multi-cloud sprawl and cybersecurity threats strain in-house IT teams. Financial-services digital mandates, AI-driven workloads and sustainability targets intensify the need for expert external management. North America holds the lion's share of spending, yet Asia Pacific's large untapped base and pro-cloud policy environment make it the fastest-expanding region. Competition increasingly revolves around automation, compliance depth and vertical expertise rather than simple cost arbitrage.

Global Cloud Managed Services Market Trends and Insights

BFSI Digital-First Mandates Intensify Outsourcing

Banks and insurers now place managed cloud services at the core of their modernization roadmaps. In April 2024 Tata Consultancy Services expanded its AWS alliance, pledging to train 25,000 engineers on bank-grade cloud modernization patterns. Institutions view external partners as the only realistic route to embed generative-AI, automate compliance checks and shorten product release cycles. Hybrid set-ups allow next-generation core systems to coexist with legacy platforms, lowering operational risk. Asia-Pacific banks stand out: budget allocations for cloud modernization now outweigh cost-cutting targets as customer-experience gains become paramount.

Surge in Multi-Cloud and Hybrid Complexity Among Enterprises

Hybrid and multi-cloud adoption has become mainstream, yet few firms can master cross-platform orchestration internally. VMware reports that 93% of its customers intend to keep hybrid architectures long term.Nutanix finds that 95% of enterprises shifted applications between clouds in 2024 to improve security or speed innovation. The result is a booming need for partners who deliver unified visibility, automated workload placement, and cost governance across cloud estates.

Persistent Data-Breach Anxiety and Evolving Threat Landscape

UK research shows many SMEs still delay cloud migration because of perceived security gaps, even though they acknowledge benefits in flexibility and cost. Compliance audits and customer trust weigh heavily, lengthening deal cycles for providers that cannot produce rigorous certifications and incident-response metrics.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Cyber-Risk and Compliance Push 24/7 Managed Security

- Cost-Optimization Pressure on CIO Budgets (Op-Ex vs Cap-Ex)

- Vendor Lock-In Risks Slow Large-Scale Workload Migration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed infrastructure services continue to deliver foundational provisioning, capturing 37.5% of 2024 revenue. Yet managed security services grow faster at 10.7% CAGR as firms prioritize continuous threat hunting, zero-trust enforcement and compliance reporting. The cloud managed services market size for managed security will therefore outpace most other segments. AI-driven security operations centers, such as VikingCloud's platform that analyzes billions of events daily, strengthen provider advantage by shortening dwell time and automating correlation. Network, application, backup and disaster-recovery services remain steady, channeling complex modernization projects and legacy support.

Second-order effects ripple across the cloud managed services industry as providers bundle security with infrastructure and network oversight, creating integrated platforms that raise switching costs. Enterprise buyers value unified dashboards, consistent SLAs and single-pane governance across multi-cloud estates features that independent point solutions struggle to match.

The public-cloud option retains 52% cloud managed services market share in 2024, anchored by hyperscale availability zones and rich native tooling. The hybrid model, however, accelerates at 11.5% CAGR as clients seek latency control, data residency and cost optimization advantages. Use of AWS Outposts by Nomura Research Institute lets Japanese banks run AWS services on-premises to satisfy sovereignty rules. Equinix Japan's partnership with Sakura Internet illustrates how co-location and GPU-ready services blend public economics with private control for AI workloads. Private-cloud growth remains modest, reserved for ultra-low-latency or niche regulatory cases.

Managed-service vendors now differentiate by offering consistent policy engines, cost dashboards and observability across public, private and edge footprints. Clients with strict uptime or data-location mandates increasingly treat provider proficiency in hybrid integration as a purchase prerequisite.

Cloud Managed Services Market is Segmented by Service Type (Managed Infrastructure Services, Managed Network Services, and More), Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), Enterprise Size (Large Enterprise and SMEs), End User Industry (BFSI, IT and Telecom, Retail and E-Commerce, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest spender, retaining 37.3% share of the cloud managed services market in 2024. Early adoption, mature partner ecosystems and a robust venture funding scene sustain demand for optimization, AI operations and compliance automation. US enterprises favor outcome-based contracts, while Canadian firms leverage cross-border proximity for dual-region resilience. Mexican manufacturers integrate managed edge gateways to underpin Industry 4.0 programs.

Asia Pacific records the fastest 9.3% CAGR through 2030 as governments subsidize digitization and broadband access widens. Huawei Cloud's partner network now counts more than 45,000 firms and 12,000 marketplace offers, linking finance, telecom and AI start-ups across the region. India's IT majors revamp legacy estates for global service exports. Japan's high trust threshold spurs demand for hybrid setups backed by local data centers, while South Korea's 5G backbone accelerates edge-heavy workloads. Australia's isolation intensifies calls for local managed nodes that interconnect seamlessly with global resources, an area where OpenText is investing heavily in 2025.

Europe's regulatory mosaic drives provider differentiation on data-residency and sustainability credentials. Germany's Mittelstand manufacturers tap managed services for Industrie 4.0, while French and Italian public-cloud spend rises under national AI strategies. UK financial institutions commission integrated threat-management suites to align with PRA expectations. The region's Green Deal and CSRD reporting dampen demand for providers without transparent emissions metrics; Microsoft's pledge to power data centers with 100% renewable energy influences sourcing decisions.

South America and the Middle East and Africa represent nascent yet high-potential territories where managed services circumvent limited local infrastructure. Expereo notes businesses boosting spending on SD-WAN and SASE to deliver consistent application performance across geographically dispersed operations.

- Amazon Web Services (AWS)

- Microsoft Corp. (Azure Managed Services)

- International Business Machines Corp. (IBM)

- Accenture plc

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Ericsson

- Fujitsu Ltd.

- NEC Corp.

- NTT DATA Corp.

- DXC Technology Co.

- Lumen Technologies, Inc.

- Rackspace Technology, Inc.

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- HCLTech

- Capgemini SE

- Cognizant Technology Solutions

- Infosys Ltd.

- Atos SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 BFSI digital-first initiatives accelerate managed-cloud outsourcing

- 4.2.2 Surge in multi-cloud and hybrid complexity among enterprises

- 4.2.3 Heightened cyber-risk and compliance push 24/7 managed security

- 4.2.4 Cost-optimization pressure on CIO budgets (Op-Ex vs Cap-Ex)

- 4.2.5 FinOps adoption creates new demand for continuous cloud cost governance

- 4.2.6 Sustainability and green-cloud mandates reshape provider selection

- 4.3 Market Restraints

- 4.3.1 Persistent data-breach anxiety and evolving threat landscape

- 4.3.2 Vendor lock-in risks slow large-scale workload migration

- 4.3.3 Global shortage of certified cloud-architect talent

- 4.3.4 Fragmented data-sovereignty laws inflate compliance cost

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Edge, 5G, Gen-AI Ops)

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Managed Infrastructure Services

- 5.1.2 Managed Network Services

- 5.1.3 Managed Security Services

- 5.1.4 Managed Application Services

- 5.1.5 Other Service Type

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Retail and E-Commerce

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Manufacturing

- 5.4.6 Government and Public Sector

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS)

- 6.4.2 Microsoft Corp. (Azure Managed Services)

- 6.4.3 International Business Machines Corp. (IBM)

- 6.4.4 Accenture plc

- 6.4.5 Cisco Systems, Inc.

- 6.4.6 Huawei Technologies Co., Ltd.

- 6.4.7 Ericsson

- 6.4.8 Fujitsu Ltd.

- 6.4.9 NEC Corp.

- 6.4.10 NTT DATA Corp.

- 6.4.11 DXC Technology Co.

- 6.4.12 Lumen Technologies, Inc.

- 6.4.13 Rackspace Technology, Inc.

- 6.4.14 Tata Consultancy Services Ltd.

- 6.4.15 Wipro Ltd.

- 6.4.16 HCLTech

- 6.4.17 Capgemini SE

- 6.4.18 Cognizant Technology Solutions

- 6.4.19 Infosys Ltd.

- 6.4.20 Atos SE

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment