|

市场调查报告书

商品编码

1630234

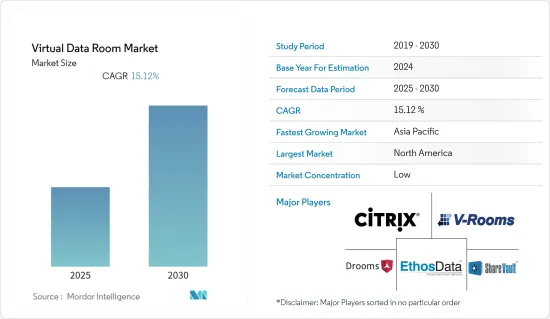

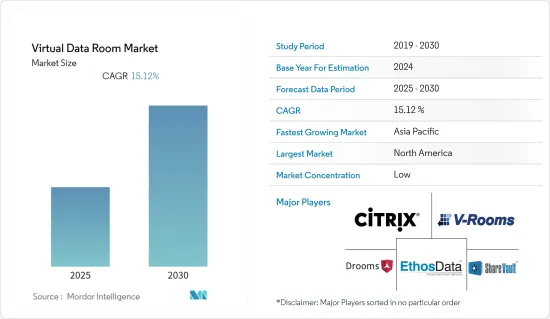

虚拟资料:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Virtual Data Room - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计虚拟资料市场在预测期内的复合年增长率为 15.12%。

主要亮点

- 云端储存技术的日益普及促进了虚拟资料市场的成长。因为这是一种经济高效的方式,可以消除实体储存需求、减少文书工作并减少差旅费用。

- 虚拟资料(VDR) 变得越来越流行,允许授权使用者存取以电子方式储存在伺服器上的资讯。许多法律资料高度敏感,需要高度的安全性。因此,公司正在关注安全的资料共用,以在业务交易期间为其服务和软体提供支援。

- 主要资料管理设施(例如资料中心)的流量增加是推动 VDR 需求的重要因素,这些设施并非旨在执行安全交易。

- 在过去的几年里,VDR 市场经历了显着的成长。除了被各种企业采用为必备工具外,风险管理需求的不断增长、知识产权的需求以及业务交易产生的业务资料量的不断增加也导致了VDR的出现。为了

- COVID-19 大流行对每个国家都产生了不同的影响。这场大流行导致虚拟资料处理的广泛采用,以实现高效的远端业务。因此,对虚拟资料等为协作和关键资讯提供安全环境的工具和解决方案的需求不断增长。 COVID-19 的爆发对市场产生了负面影响。然而,由于越来越多地使用虚拟平台进行资料存取和共用以及远端工作的持续接受,虚拟资料市场目前正在加速復苏。

虚拟资料市场趋势

IT 和通讯领域越来越多地使用虚拟资料来推动市场发展

- 虚拟资料(VDR) 已成为参与合约的每个人的线上会议室。 VDR工具贯穿整个交易流程,让各方合作更轻鬆、更可靠。用于开启、共用和列印文件的安全通讯协定为参与者和审核建立了详细的活动轨迹。

- 基于区块链的技术正在兴起,以增强整个 IT 生态系统的 VDR 安全性。 VDR 的用途已扩展到併购之外,现在大多数业务在网路上进行。许多着名的 IT 和通讯公司都拥有可以提供快速且有效率的资讯和通讯流的整合技术。

- VDR 已在整个 IT 领域发展成为一种促进整个企业的工具,从而随着云端技术应用的增加而广泛应用于各个最终用户细分市场的风险交易中。

- VDR 透过高度安全且高度适应性的云端基础平台提供,因此当您使用 VDR 时,您只需使用标准互联网浏览器即可安全地跨组织和地理边界传输大量资料。 VDR 工具可有效扩展,以满足跨多个公司的大型团队、小团体和单一组织内人员的需求。

- 此外,VDR平台还提供许多功能,例如统一内容管理、资讯权限管理、分析、彙报以及内建重新编辑和翻译通讯,以促进各种用例的高效和成功的企业协作。

预计北美将占据最大的市场占有率

- 由于加拿大和美国等新兴经济体各国政府和企业越来越多地采用VDR服务,北美在虚拟资料(VDR)市场中占据最大份额,这增加了对这些现有解决方案的需求。创新。

- 美国是全球最大的VDR市场之一。该地区是许多重要 VDR 参与者的所在地,是市场扩张的理想地区。北美地区的许多公司正在采用虚拟资料,以最先进的方式在组织内安全地储存、组织和共用大量资料。

- 对简单、安全的关键资料储存方式的需求不断增长,以及对透明、高效的资料共用选项的需求不断增长,正在推动资料安全和可靠的资料共用解决方案,并预测在此期间全部区域预计会有大量需求。

- 北美地区的虚拟资料产业主要由银行和金融业推动,因为它们越来越多地利用VDR进行文件储存和资料传输。这些因素预计将在未来几年加速该国虚拟资料中心市场的发展。

- 此外,资金筹措的增加、併购的增加以及与几家主要企业的合资企业正在推动该地区的市场发展。

虚拟资料产业概述

虚拟资料室市场竞争非常激烈,有几家主要公司进入该市场。很少有公司透过云端和储存技术的创新来扩展其在新兴经济体的现有业务。一些新参与企业正在向未开发的市场领域扩张并扩大其市场份额。

2022 年 1 月,AvePoint 推出了 Confide,这是一个虚拟资料,供企业管理敏感资料并更安全地进行协作。 Confide 是唯一完全连接到 Microsoft 365 并位于您的云端租赁中的虚拟资料,可提供最高等级的安全性和启动效率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 对经济高效的资料储存解决方案的需求不断增长

- 併购活动持续增加推动了对复杂资料高效处理的需求

- 严格的资料隐私法规

- IT和通讯领域虚拟资料的使用增加

- 市场限制因素

- 安全和资料整合挑战

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场区隔

- 按类型

- 软体

- 服务

- 按组织规模

- 中小型组织

- 大型组织

- 按业务功能

- 法律/合规

- 财务管理

- 智慧财产管理

- 销售/行销

- 其他业务功能

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 卫生保健

- 政府及法律服务

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争状况

- 公司简介

- Vault Rooms Inc.

- ShareVault(Pandesa Corporation)

- Drooms GmbH

- Citrix Systems Inc.

- Ethos Data

- Caplinked Inc.

- Brainloop AG

- BMC Group Inc.(SmartRoom)

- HighQ Solutions Limited

- Intralinks Holdings Inc.

- Firmex Corporation

- Ansarada Pty Limited

- SecureDoc Information Management Pty Ltd

- iDeals Solutions Group

- Merrill Corporation Ltd

第七章 投资分析

第八章 市场机会及未来趋势

The Virtual Data Room Market is expected to register a CAGR of 15.12% during the forecast period.

Key Highlights

- Increasing adoption of cloud storage technology is contributing to the growth of the virtual data room market, as it is a cost-effective way to eliminate the need for physical storage, reduce the use of paperwork, and decrease the cost of travel.

- As a virtual data room (VDR) is becoming increasingly popular, authorized users are granted access to the information that is stored electronically on the server. Most of the legal data is sensitive and needs high security. Thus, businesses focus on secured data sharing, enhancing their services and software during business deals.

- The increasing traffic in prime data management establishments, such as data centers not designed to perform secure transactions, is an excellent factor driving the demand for VDRs.

- Over the past few years, the VDR market has experienced prominent growth. This is due to its adoption across various enterprises as an essential tool, along with the increasing demand for risk management, the need for intellectual property, and a growing amount of business data arising from business deals, fueling the demand and requirement for VDRs.

- The COVID-19 outbreak had various effects on different nations. Due to the pandemic, virtual data processing was widely adopted for efficient distant operations. As a result, there was an increased need for tools and solutions like virtual data rooms that offered a safe environment for working together and getting important information. The COVID-19 pandemic negatively impacted the market. However, the virtual data room market is now rebounding at an accelerated rate thanks to the growing use of virtual platforms for data access and sharing and the continuing acceptance of remote work.

Virtual Data Room Market Trends

Increasing Use of Virtual Data Room in IT and Telecom Sector is Driving the Market

- Virtual data rooms (VDRs) emerged as online meeting rooms for everyone involved in an agreement. Cooperation between parties has become more straightforward and reliable as VDR tools are available throughout the deal journey. The security protocols around the opening, sharing, and printing of documents create a detailed activity trail for participants and auditors.

- Blockchain-based technologies are emerging to enhance VDR security across the IT ecosystem. VDR applications are being extended beyond M&A activities, as most business operations are conducted online nowadays. Many prominent IT and telecom companies have integrated technologies that could offer them quick and efficient information and communication flow.

- VDR has evolved across the IT space to become a tool to promote the entire venture, thereby widely finding applications for deals across various end-user segment ventures with the growing application of cloud technology.

- A vast quantity of data can be safely moved across organizational and regional borders using only a standard internet browser when using a VDR because they are provided through a highly secure and adaptable cloud-based platform. A VDR tool is effectively expandable, meeting the requirements of big teams spread across multiple businesses, small groups, and people within a single organization.

- Moreover, to promote efficient and successful corporate collaboration for a variety of use cases, VDR platforms include a number of capabilities, including integrated content management, information rights management, analytics, and reporting, along with embedded redaction and translation tools, which contribute to the growth of IT and telecom sector.

North America is Expected to Hold the Largest Market Share

- North America occupied the largest share of the virtual data room (VDR) market due to the increasing adoption of VDR services by various governments and businesses in developed economies, such as Canada and the United States, emphasizing innovation in these existing solutions.

- The United States is one of the world's biggest VDR markets. It is a desirable region for market expansion because it is home to many important VDR players. Numerous companies in North America have embraced virtual data rooms to safely store, arrange, and share a significant amount of data in organizations in a cutting-edge way.

- The rising demand for easy and secure methods for storing critical data and the increasing need for transparent and efficient data-sharing options fuel data security and secured-sharing solutions, which will likely be in great demand across the region during the forecast period.

- With the expanding banking and financial industries' rising use of VDRs for file storing and data transmission, the virtual data room industry in the North American region is primarily pushed by the industries. These elements are expected to accelerate the market for virtual data centers in the nation over the next few years.

- Moreover, the growing fundraising, rising number of mergers and acquisitions, and joint ventures with some prominent players have fueled the market across the region.

Virtual Data Room Industry Overview

The virtual data room market is highly competitive and consists of several major players. Few of the players are expanding their existing businesses across emerging economies with innovations in cloud and storage technology. Some of the new companies are increasing their market presence by moving across the untapped market space.

In January 2022, AvePoint introduced Confide, a virtual data room, to aid companies in managing their demands for sensitive data and collaborating more securely. Confide is the only virtual data room completely connected with Microsoft 365 and housed on the user's cloud tenancy, offering the highest level of security and initiation effectiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Cost-effective Data Storage Solutions

- 4.3.2 Sustained Increase in M&A Activity Driving Demand for Efficient Handling of Complex Data

- 4.3.3 Stringent Data Privacy Regulations

- 4.3.4 Increasing Use of Virtual Data Room in IT and Telecom Sector

- 4.4 Market Restraints

- 4.4.1 Security and Data Integration Challenges

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Organization Size

- 5.2.1 Small- and Medium-scale Organizations

- 5.2.2 Large Organizations

- 5.3 By Business Function

- 5.3.1 Legal and Compliance

- 5.3.2 Financial Management

- 5.3.3 Intellectual Property Management

- 5.3.4 Sales and Marketing

- 5.3.5 Other Business Functions

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunication

- 5.4.3 Healthcare

- 5.4.4 Government and Legal Services

- 5.4.5 Other End-user Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vault Rooms Inc.

- 6.1.2 ShareVault (Pandesa Corporation)

- 6.1.3 Drooms GmbH

- 6.1.4 Citrix Systems Inc.

- 6.1.5 Ethos Data

- 6.1.6 Caplinked Inc.

- 6.1.7 Brainloop AG

- 6.1.8 BMC Group Inc. (SmartRoom)

- 6.1.9 HighQ Solutions Limited

- 6.1.10 Intralinks Holdings Inc.

- 6.1.11 Firmex Corporation

- 6.1.12 Ansarada Pty Limited

- 6.1.13 SecureDoc Information Management Pty Ltd

- 6.1.14 iDeals Solutions Group

- 6.1.15 Merrill Corporation Ltd