|

市场调查报告书

商品编码

1630237

Gigabit乙太网路测试设备:市场占有率分析、产业趋势、成长预测(2025-2030)Gigabit Ethernet Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

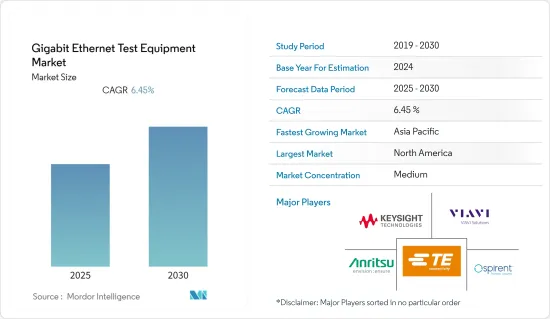

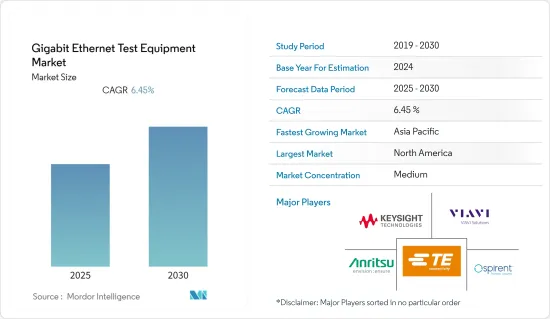

Gigabit乙太网路测试设备市场预计在预测期内复合年增长率为 6.45%。

主要亮点

- Gigabit乙太网路 (GbE) 测试设备可让企业、资料中心和服务供应商排除故障并测试网路连接,以实现较高的网路效能。此 EtherneEthernetd 用于广域网路 (WAN) 和区域网路(LAN) 连线。它用于简化复杂的网路管理并降低与基础设施相关的营运成本。

- 製造业对乙太网路日益增长的需求以及云端服务和巨量资料的采用正在推动市场成长。单对乙太网路 (SPE) 是最新的乙太网路改编之一,受到工业IoT(IIoT) 和工业 4.0 发展以及许多汽车应用的推动。

- 随着行动互联网需求的增加,对更高频宽的需求不断增加,这也是通讯业者积极投入研发的原因。云端处理、物联网 (IoT) 和 5G 等先进技术的出现需要强大的网路连接,这也增加了测试设备的使用。

- 主要挑战之一是缺乏技术技能。许多调查方法需要深入了解讯号完整性设计最佳实践。此外,许多测量需要彻底的校准过程和测试夹具去嵌入,一些工程师在从低速通讯转向 nx10G 串行技术时可能不熟悉这些。

- 由于COVID-19的爆发,企业采用远距工作模式,对云端基础的解决方案的需求大幅增长。然而,零售、製造业、BFSI 等各行业的收益在 2020 年都出现了大幅下降。随着远距工作模式的扩展,企业正在增加对云端基础的分析和保障、边缘运算和人工智慧驱动的网路技术的投资,预计这将推动调查市场的发展。

Gigabit乙太网路测试设备市场趋势

市场区隔预计将占据主要市场占有率

- 即将推出的 5G 技术的行动回程升级正在推动对强大的Gigabit乙太网路测试设备的需求。因此,对 5G 技术的快速投资预计将在预测期内推动市场成长。通讯和电子行业的几家顶级公司已经开始投资5G技术。

- 此外,该公司正在获取 4G 和 5G频宽,这正在推动Gigabit乙太网路测试设备市场的成长。例如,2022年Telkom以21亿美元收购了800MHz的20MHz和3500MHz的22MHz。 Telkom 支付了 11 亿令吉。 Telkom 将利用新获得的频谱来支援其资料主导的网路建置策略。 Telkom 认为 4G 和 5G 将共存一段时间,并正在根据当前资料流量和 5G 部署准备情况扩展其网路。 Telkom 93%的资料流量在4G网路上,68%的Telkom行动站点使用光纤回程传输,这使Telkom在5G部署方面具有优势。

- 例如,2021年5月,阿尔及利亚政府核准将Mobilis和Djezzy的通讯网路营运许可证续约五年。 Agance Ecofin 表示,在两家公司满足必要条件后,将于 2021 年 5 月 11 日向政府提交两项法令,授予公共电子通讯网路(包括行动电话)建设和营运许可证的更新。

- 两家公司也建立伙伴关係,以提供更好的服务,同时降低营运成本。例如,2021 年初,Ooredoo Algeria 部署了诺基亚的云端原生核心软体,以经济高效地增强网路效能和可靠性,并策略性地推出新服务来满足客户需求。这项实施将进一步完善国家数位生态系统。

亚太地区预计将创下最快成长率

- 由于无线网路部署的增加,预计亚太地区在预测期内将出现显着的成长。此外,人口成长、智慧型手机用户数量增加、云端服务的日益采用以及巨量资料的出现预计将推动该地区的市场扩张。

- 云端、物联网和巨量资料等技术的采用正在增加。例如,中国云端处理产业的发展得益于政府的大力支持和私人企业的大量投资。韩国政府利用全国超快的网路连线和稳定的 LTE 可用性,采用云端云端处理技术来增强电子政府服务。

- 值得注意的是,随着未来对5G技术的投资迅速扩大,中国企业面临充足的机会。例如,根据美国跨国投资银行和金融服务公司杰富瑞集团的预测,中国三大移动公司-中国电信、中国联通和中国移动预计将在2023年投资约1,800亿美元用于5G技术。

- 即将推出的 5G 技术的行动回程升级将推动对强大的Gigabit乙太网路测试设备的需求。因此,对 5G 技术的快速投资预计将在预测期内推动市场成长。

- 爱立信预计,到 2022 年,亚太地区将成为成长第二快的地区,所有合约的 10% 将涉及 5G。很少有通讯和电子行业的顶级公司开始投资 5G 技术。例如,在疫情爆发前,三星宣布将在汽车、生物製药以及包括5G在内的科技等各领域投资25兆韩元。

Gigabit乙太网路测试设备产业概述

Gigabit乙太网路测试设备市场的竞争是温和的,并由几家主要企业组成。在过去的十年里,市场已经获得了竞争力。然而,随着乙太网路测试设备的进步,许多公司正在透过建立新的伙伴关係关係来扩大其市场份额并开闢新市场。

- 2022 年 8 月 - 是德科技与诺基亚合作,展示了首次公开的 800Gigabit乙太网路准备和互通性测试。这项就绪测试是在 2022 年 6 月于马德里举行的诺基亚私人 SReXperts 客户活动中使用 Keysight AresONE 800GE 第 1-3 层 800GE 线速测试平台和诺基亚 7750 服务路由平台进行的。诺基亚的 FP5 网路处理器晶片和 800GE 可插拔光学元件使用 AresONE 进行了测试和认证。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 製造业对乙太网路的需求不断成长

- 行动回程成长

- 采用云端服务和巨量资料

- 市场挑战

- 缺乏技术专长

- 测量挑战

第六章 市场细分

- 按类型

- 1 GBE

- 10 GBE

- 25/50 GBE

- 按最终用户产业

- 车

- 製造业

- 通讯业

- 运输/物流

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Anritsu Corp.

- Spirent Communications PLC

- Keysight Technologies Inc.

- Viavi Solutions Inc.

- Exfo Inc.

- TE Connectivity Ltd

- Xena Networks Inc.

- IDEAL Industries Inc.

- Aquantia Corp.

- GAO Tek Inc.

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 65291

The Gigabit Ethernet Test Equipment Market is expected to register a CAGR of 6.45% during the forecast period.

Key Highlights

- Gigabit Ethernet (GbE) test equipment allows enterprises, data centers, and service providers to obtain high network performance by solving and testing network connectivity problems. This EtherneEthernetd is for wide area network (WAN) and local area network (LAN) connectivity. It is used to simplify complex network management and bring down the operational expenses associated with the infrastructure.

- The increasing need for ethernet manufacturing industries and the adoption of cloud services and Big Data fuel the growth of the market. Single-pair Ethernet (SPE) is one of the most recent Ethernet adaptions, driven by the development of industrial IoT (IIoT) and Industry 4.0, as well as many automotive applications.

- With the increasing demand for mobile internet, the need for higher bandwidth is rising, owing to which telecom operators are investing rigorously in R&D. The emergence of advanced technologies, such as cloud computing, Internet of Things (IoT), and 5G, requires a robust network connection, owing to which, the use of test equipment also rises.

- One of the major challenges is a lack of technical skills. Many test methodologies need a deep understanding of signal integrity design best practices. Furthermore, many measurements need thorough calibration processes and test fixture de-embedding, which some engineers may be unfamiliar with if transitioning from lower communication speeds to nx10G serial technology.

- With the outbreak of COVID-19, the demand for cloud-based solutions has seen significant growth owing to remote working models being adopted by enterprises; however, various industries such as retail, manufacturing, BFSI, and others have seen a significant slump in their revenues during 2020. With the growing remote working model, companies are increasing investments in cloud-based analytics and assurance, edge computing, and AI-powered networking technologies, which are expected to boost the studied market.

Gigabit Ethernet Test Equipment Market Trends

Telecommunication Segment is Expected to Hold a Significant Market Share

- The upgrades in the mobile backhaul for the imminent launch of 5G technology drive the need for robust GigE test equipment. Hence, rapid investments in the 5G technology are expected to boost market growth over the projected period. A few top communication and electronic companies have commenced their investments in 5G technology.

- The companies are also acquiring 4G and 5G bands which propel the growth of the gigabit ethernet test equipment market. For instance, In 2022, Telkom acquired 20MHz of 800MHz and 22MHz of 3500MHz for 2.1 billion. Telkom made a payment of MYR 1.1 billion. Telkom will use the newly acquired spectrum to support its strategy of building a data-led network. Telkom believes that 4G and 5G will co-exist for some time and is expanding its network based on current data traffic and readiness for 5G deployment. 93% of Telkom's data traffic is on a 4G network, and 68% of Telkom Mobile sites use fiber backhaul, giving Telkom the edge for 5G deployment

- The governments in various countries are also approving developments in the telecom sector; for instance, in May 2021, the Algerian government approved the five-year renewal of the telecoms network operating licenses of Mobilis and Djezzy. As per Agence Ecofin, the renewal of the licenses to build and operate public electronic communications networks (including cellular) was implemented via two draft decrees presented to the government on 11 May 2021, after the two companies met the requisite conditions.

- Companies are also forming partnerships to provide better services while controlling operating costs. For instance, during the start of 2021, Ooredoo Algeria deployed Nokia's cloud-native Core software to strengthen its network performance and reliability cost-effectively and strategically position itself to launch new services to meet customer needs. This deployment will further improve the digital ecosystem of the country.

Asia Pacific is Expected to Witness the Fastest Growth Rate

- The Asia Pacific is expected to witness a significant growth rate over the forecast period due to the increasing deployment of wireless networks. Additionally, the increasing population, rising number of smartphone users, mounting adoption of cloud services, and emergence of Big Data are expected to fuel the market expansion in the region.

- There has been growing adoption of technologies, such as cloud, IoT, and Big Data. For instance, the government's strong support and the private sector's substantial investments are behind the growth of China's cloud computing industry. The South Korean government-employed cloud computing technologies to enhance its e-government services by banking on the country's super-fast internet connectivity and stable LTE availability.

- Notably, the companies in China have ample opportunities, owing to the rapid growth in future investments in 5G technology. For instance, according to an American multinational investment bank and financial services company, Jefferies Group, the three Chinese mobile players, such as China Telecom, China Unicom, and China Mobile, are expected to invest about USD 180 billion in 2023 in 5G technologies.

- The upgrades in the mobile backhaul for the imminent launch of 5G technology drive the need for robust Gigabit Ethernet Test Equipment. Thus, the rapid investment in 5G technology is expected to boost the market's growth over the projected period.

- According to Ericsson, Asia Pacific is expected to be the second-fastest-growing region, with 10% of all subscriptions being 5G in 2022. Few top communication and electronic companies have started investing in 5G technology. For instance, before the pandemic, Samsung announced investing KRW 25 trillion in various domains, such as automotive, biopharmaceuticals, and technology, including 5G.

Gigabit Ethernet Test Equipment Industry Overview

The Gigabit Ethernet Test Equipment Market is moderately competitive and consists of several major players. The market has gained a competitive edge over the past decade. However, with advancements in ethernet test equipment, many companies are increasing their market presence by securing new partnerships, thereby tapping into the new markets.

- August 2022 - Keysight partnered with Nokia to Demonstrate the First 800 Gigabit Ethernet Readiness and Interoperability Public Test. The readiness testing was carried out in June 2022 at Nokia's private SReXperts customer event in Madrid, using Keysight's AresONE 800GE Layer 1-3 800GE line rate test platform and the Nokia 7750 Service Routing platform. Nokia's FP5 network processor silicon and 800GE pluggable optics were tested and certified using the AresONE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET BYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Ethernet in the Manufacturing Industries

- 5.1.2 Growth in Mobile Backhaul

- 5.1.3 Adoption of Cloud Services and Big Data

- 5.2 Market Challenges

- 5.2.1 Lack of Technical Expertise

- 5.2.2 Mesurement Challenges

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 1 GBE

- 6.1.2 10 GBE

- 6.1.3 25/50 GBE

- 6.2 End-user Industry

- 6.2.1 Automotive

- 6.2.2 Manufacturing

- 6.2.3 Telecommunication

- 6.2.4 Transportation and Logistics

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anritsu Corp.

- 7.1.2 Spirent Communications PLC

- 7.1.3 Keysight Technologies Inc.

- 7.1.4 Viavi Solutions Inc.

- 7.1.5 Exfo Inc.

- 7.1.6 TE Connectivity Ltd

- 7.1.7 Xena Networks Inc.

- 7.1.8 IDEAL Industries Inc.

- 7.1.9 Aquantia Corp.

- 7.1.10 GAO Tek Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219