|

市场调查报告书

商品编码

1630239

认知服务:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Cognitive Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

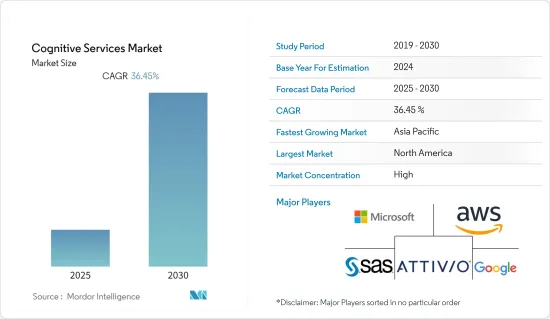

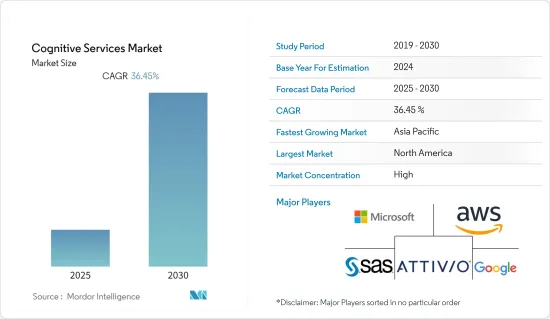

预计认知服务市场在预测期内的复合年增长率为 36.45%。

主要亮点

- 对聊天机器人和虚拟助理等对话式人工智慧解决方案不断增长的需求将有助于企业提高客户参与和支援。这些解决方案使用 NLP 和机器学习演算法来理解客户的询问并提供适当的回应。

- 认知服务市场是由对自然语言处理、电脑视觉、语音辨识和机器学习演算法不断增长的需求推动的,这些演算法使组织能够提高决策准确性并自动执行复杂的任务。

- 此外,各行业对自动化的需求不断增长,并且有更多资料可用于训练机器学习演算法。随着组织寻求简化流程、降低成本和提高效率的方法,自动化变得越来越重要。对采用自动化的公司的期望已经转向更快的价值速度。因此,随着各行业自动化程度的提高,认知服务提供者正在开发更多 API 来建立更智慧的应用程式。

- 然而,对资料隐私和安全的持续担忧正在挑战市场成长。随着组织越来越依赖人工智慧和机器学习演算法来做出决策,越来越需要确保这些演算法的安全性以及它们使用的资料受到保护。这对于经常处理敏感资讯的医疗保健和金融等行业尤其重要。

- COVID-19大流行的影响是巨大的,许多组织正在加快数位转型努力,以应对大流行带来的变化。这增加了对认知服务解决方案的需求,这些解决方案可以帮助组织自动化任务、提高客户参与和增强决策能力。

认知服务市场趋势

IT/通讯领域显着成长

- 资讯科技 (IT) 和通讯业是全球认知服务成长的主要贡献者。这些产业提供开发、部署和传播认知服务所需的基础设施和平台。

- IT 公司参与部署各种软体和硬体解决方案来支援认知服务。这些公司开发先进的人工智慧和机器学习演算法,可以分析大量资料并提供有意义的见解。例如,IBM、微软、谷歌和亚马逊等 IT 公司正在大力投资认知服务,为自然语言处理、图像和语音辨识以及决策演算法提供云端基础的平台。

- 此外,资料储存中心的大资料量和复杂性都在迅速增加,这有助于优化资料储存、增强安全性并加快业务决策速度,这导致了认知服务的引入。据Cisco称,这一数字在 2018 年达到 124Exabyte,预计 2021 年将达到 403Exabyte。

- 许多 IT 和通讯公司正在采用认知服务来提高客户参与、优化营运、开发网路基础设施并获得相对于其他公司的竞争优势。例如,2022年10月,爱立信与阿曼沃达丰合作,加强电信业者跨多个领域的网路基础设施开发。透过此次合作,爱立信将提供基于人工智慧的认知软体解决方案,用于网路优化、简化资料主导的决策并支援沃达丰的零接触操作(ZTO)实施。

欧洲预计将出现显着成长

- 认知服务的采用和使用正在整个全部区域迅速扩大。目前,北美占据认知服务的主要市场占有率。该地区的成长得益于研发投资的增加、云端基础的服务的采用以及智慧设备和物联网技术的普及。

- 北美在认知服务方面的优势主要归因于其对人工智慧、机器学习和自然语言处理等新兴技术的高度采用。该地区也是多家领先科技公司的所在地,这些公司正在大力投资认知服务,推动市场创新和成长。

- 例如,2022 年 5 月,微软扩大了与人工智慧 (AI) 研究公司 OpenAI Inc. 的长期合作关係,推出了 Azure 认知服务。该服务使开发人员能够独家存取 OpenAI 的各种 AI 模型,包括 GPT-3 基础系列、Codex 系列和嵌入模型。

- 此外,该地区大量的中小企业、新兴企业和研究机构为认知服务的创新和实验创造了肥沃的土壤。

认知服务产业概述

认知服务市场趋于集中,因为市场上有微软、谷歌和 AWS 等几家主要企业。这些公司在研发方面投入巨资,以改善各行业的认知服务并维持市场主导地位。

2023年1月,Vingroup支援的人工智慧医疗软体公司VinBrain与微软公司合作。据新闻稿称,此次合作将涉及人工智慧医疗保健的三个领域:资料共用、跨产品检验以及研发。作为合作的一部分,VinBrain 将利用 Azure 电脑视觉认知服务来检验新的深度学习模型,包括微软最新的电脑视觉模型 Florence。

2022 年 11 月,微软公司为开发人员推出了名为 Vision Studio 的新使用者介面 (UI),以试验电脑视觉 API。这是 Microsoft 在 Azure 上提供的认知服务的一部分。此 API 提供对用于处理媒体和传回资讯的高级演算法的存取。 Azure 的电脑视觉演算法可以透过上传媒体资产或指定媒体资产的 URL,根据输入或使用者选择以不同的方式分析视觉内容。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场洞察

- 市场驱动因素

- 更多地采用智慧 API 来建立更聪明的应用程式

- 资料量和复杂度不断增加

- 市场限制因素

- 实施高成本

第六章 市场细分

- 按发展

- 云

- 本地

- 按公司规模

- 小型企业

- 大公司

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 零售

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Amazon Web Services, Inc.

- Attivio, Inc.

- Enterra Solutions LLC

- Google LLC

- IBM Corporation

- Infosys Limited

- Microsoft Corporation

- Nokia Corporation

- SAS Institute Inc.

- Tata Consultancy Services Limited

- Wipro Limited

第八章投资分析

第9章 市场的未来

The Cognitive Services Market is expected to register a CAGR of 36.45% during the forecast period.

Key Highlights

- Growth in the demand for conversational AI solutions, such as chatbots and virtual assistants, can help organizations improve customer engagement and support. These solutions use NLP and machine learning algorithms to understand customer inquiries and provide relevant responses.

- The cognitive services market is driven by the increasing demand for natural language processing, computer vision, speech recognition, and machine learning algorithms that allow organizations to improve the accuracy of decision-making and automate complex tasks.

- Furthermore, the growing need for automation in various industries and the increasing data availability for training machine learning algorithms. Automation is becoming increasingly important as organizations look for ways to streamline processes, reduce costs, and improve efficiency. The expectations of the companies from adopting automation are shifting towards getting value at a higher speed. Hence, with the increasing automation across industries, cognitive service providers are gaining traction for developing more APIs to build smarter applications.

- However, the ongoing concern over data privacy and security is challenging market growth. As organizations increasingly rely on AI and machine learning algorithms to make decisions, there is a growing need to ensure that these algorithms are secure and that the data they use is protected. This is particularly important in industries such as healthcare and finance, where sensitive information is frequently processed.

- The impact of the COVID-19 pandemic was significant, with many organizations looking to accelerate their digital transformation efforts in response to the changes brought on by the pandemic. This led to an increase in demand for cognitive services solutions that helped organizations automate tasks, improve customer engagement, and enhance decision-making.

Cognitive Services Market Trends

IT and Telecommunication Segment to Grow Significantly

- The information technology (IT) and telecommunications industries significantly contribute to the growth of cognitive services globally. These industries provide the necessary infrastructure and platforms for developing, deploying, and disseminating cognitive services.

- IT companies are involved in the deployment of various software and hardware solutions that support cognitive services. They are developing advanced artificial intelligence and machine learning algorithms that can analyze vast amounts of data and provide meaningful insights. For example, IT companies like IBM, Microsoft, Google, and Amazon are investing heavily in cognitive services, offering cloud-based platforms for natural language processing, image and speech recognition, and decision-making algorithms.

- Moreover, the volume of big data in data storage centers is rapidly increasing in addition to its complexity leading to the adoption of cognitive services, as it helps optimize data storage, enhanced security, and accelerate business decision-making. According to Cisco Systems, this volume reached 124 Exabytes in 2018 and is estimated to reach 403 Exabytes by 2021.

- Many IT and telecommunication companies are adopting cognitive services to improve customer engagement, optimize operations, develop network infrastructure, and gain a competitive edge over others. For instance, in October 2022, Ericsson and Vodafone in Oman partnered to empower the telecom company's network infrastructure development across multiple domains. With this partnership, Ericsson would provide AI-based Cognitive Software solutions for network optimization to simplify data-driven decisions and support Vodafone in implementing zero-touch operations (ZTO).

Europe is Expected to Grow Significantly

- The adoption and usage of cognitive services are growing rapidly across the region. Currently, North America holds the major market share in cognitive services. The region's growth is attributed to increased investment in research and development, the adoption of cloud-based services, and the growing popularity of smart devices and IoT-enabled technologies.

- The dominance of North America in cognitive services is primarily due to the high adoption of new and emerging technologies such as artificial intelligence, machine learning, and natural language processing. The region is also home to several major technology companies that are heavily investing in cognitive services, driving innovation and growth in the market.

- For instance, in May 2022, Microsoft Corporation launched a service for Azure Cognitive Services, expanding its long-running relationship with the artificial intelligence (AI) research outfit OpenAI Inc. The service will enable developers to gain limited access to a range of OpenAI's AI models, including the GPT-3 base series, Codex series, and embedding models.

- Furthermore, the presence of a large number of small and medium-sized enterprises, startups, and research organizations in the region has created a fertile ground for innovation and experimentation with cognitive services.

Cognitive Services Industry Overview

The cognitive service market is inclined towards concentration with the presence of a few key players in the market, including Microsoft, Google, and AWS. These companies are highly investing in research and developments towards improving cognitive services for varied industries and continuing their market dominance.

In January 2023, AI healthcare software company VinBrain, a company backed by Vingroup, collaborated with Microsoft Corporation. As per the press release, the collaboration would work on three areas of AI healthcare: data sharing, cross-product validation, and R&D. As part of the collaboration, VinBrain would use Azure Cognitive Services for Computer Vision to validate new deep-learning models, including Microsoft's latest computer vision model called Florence.

In November 2022, Microsoft Corporation introduced a new User Interface (UI) for developers called Vision Studio to try its Computer Vision API. It is a part of Microsoft's Cognitive Services offering in Azure. The API provides access to advanced algorithms for processing media and returning information. Azure's Computer Vision algorithms can analyze visual content differently based on inputs and user choices by uploading a media asset or specifying a media asset's URL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Intelligent APIs to Build Smarter Applications

- 5.1.2 Increase in Data Volume and Complexity

- 5.2 Market Restraints

- 5.2.1 High Cost Incorporated with the Implementation

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-Premise

- 6.2 By Enterprise Size

- 6.2.1 Small and Medium Emterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunication

- 6.3.3 Retail

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle-East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services, Inc.

- 7.1.2 Attivio, Inc.

- 7.1.3 Enterra Solutions LLC

- 7.1.4 Google LLC

- 7.1.5 IBM Corporation

- 7.1.6 Infosys Limited

- 7.1.7 Microsoft Corporation

- 7.1.8 Nokia Corporation

- 7.1.9 SAS Institute Inc.

- 7.1.10 Tata Consultancy Services Limited

- 7.1.11 Wipro Limited