|

市场调查报告书

商品编码

1644308

认知操作:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cognitive Operations - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

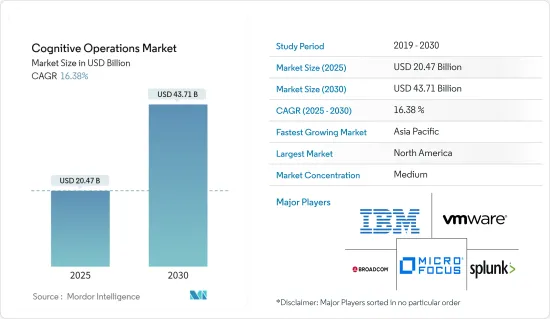

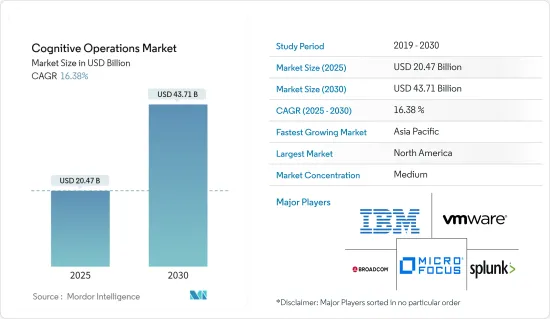

认知营运市场规模预计在 2025 年为 204.7 亿美元,预计到 2030 年将达到 437.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.38%。

主要亮点

- 企业正在将其关键任务业务应用程式迁移到云端,因为扩充性、低成本且易于部署。透过利用云端基础的技术,预测分析技能可以快速整合到各种企业应用程式中。这些优势可能会推动云端基础的认知操作解决方案的需求。

- 随着技术达到新的水平,机器人流程自动化 (RPA) 将与认知操作结合。认知 RPA 使用自然语言处理 (NLP)、光学字元辨识 (OCR) 和机器学习来理解大量资料,从而提高生产力、可扩展性和效率。透过将认知过程与 RPA 结合,聊天机器人可以使用企业资料并导航传统企业系统,以更好地管理来自客户和员工的复杂即时请求。

- 新冠肺炎疫情为社区和企业的生活带来了重大变化。不断变化的客户购物行为和需求促使企业实施自动化流程以保持竞争力。认知运算在电子商务行业的应用使公司能够监控买家的购物行为,包括品牌偏好、线上购买频率和店内导航模式。同样,认知解决方案可以根据您的行业进行定制,以帮助扩大您的业务并产生收入。

- 认知业务的初始投资很高。为这些系统创建软体需要很长时间,并且需要高技能的开发团队。系统需要利用大量资料集进行广泛而彻底的训练才能理解特定的业务和程序。由于这些因素,企业很难说服其他人采用认知操作,因此市场成长缓慢。

认知操作市场趋势

IT 和通讯领域强劲成长

- 认知服务有助于将您的通讯后勤部门转变为专业的客户服务团队。此外,通讯业可以透过为顾客关怀机器人实现自然语言解释和文字翻译的自动化来改善基本业务运作。智慧网路运营,即认知网路运营中心,使用人工智慧 (AI)、机器学习 (ML) 和高级分析来支援自我修復、自我优化和自主传输网路。

- IT 和通讯业的认知操作解决方案可以帮助从使用者和网路产生的大量资料中提取有价值的见解。这提高了客户体验。认知服务将透过自动协助机器人理解自然语言和翻译文本,使电讯业能够更好地执行基本业务功能。

- 领先的对话式 AI 公司之一 Jio Haptik 正在利用 Microsoft Azure 认知服务来提高其现有印地语对话式 AI 模型的准确性和效率。这项业界领先的人工智慧翻译技术是印地语、英语甚至印式英语端到端互动的关键推动因素,使用户可以与 Jio Mobility 的智慧虚拟助理聊天。

- 随着网路攻击的增加以及知识渊博的网路安全负责人的短缺,公司需要认知运算等现代技术来对抗因资料量不断增长而产生的网路风险。认知演算法可以提供识别虚假资讯和欺骗性资料的技术手段,有助于防止网路攻击。因此,客户不太容易受到操纵。

- 《富比士》声称,每年的资料量成长速度比以往任何时候都快。到2025年,预计每人每秒将产生3.2GB的资讯。光是一年时间,全球资料总量就将达到64兆GB。透过采用认知操作,组织可以获得正确的知识,从而做出更快、更准确的业务决策。

亚太地区将迎来显着成长

- 由于新加坡、澳洲、中国和印度等国家在技术方面的支出不断增加,亚太地区预计将成为资料管治成长最快的地区。中小型企业需要经济实惠的资料管理和管治解决方案和服务。这推动了该地区对认知营运市场的需求。

- 该地区对智慧製造和数数位化的投资不断增加,推动了对认知操作的需求。认知製造可帮助公司在产品开发的所有阶段(从设计到生产再到保固服务)始终关注品质。

- 根据 IBM 商业价值研究院的一项研究,财富 500 强公司可能会因库存放错或製造错误的 SKU 和通路组合而损失 2% 至 5% 的收益。透过开发数位孪生、规范和认知能力,企业可以将供应链生产力提高 10% 至 15%,将非增值工作减少 50% 至 60%,并将中断的回应时间从几天缩短到几小时或几分钟。

认知操作产业概览

认知操作市场竞争相对不激烈,只有少数参与者利用其产品。然而,在研究期间仍有巨大的成长潜力。这些认知营运提供者正在发布整合人工智慧技术的改进产品,以降低成本、提高客户满意度并提高使用非结构化资料的复杂业务流程的准确性。随着企业向数位技术转变,其扩张范围也不断扩大。在该领域提供服务的一些重要公司包括 Micro Focus International Plc、Broadcom Corporation、IBM Corporation 和 VMware, Inc.

- 2023 年 3 月 - 保险科技新兴企业i3systems 与 Microsoft Azure 合作,为关键的 BFSI 流程带来业界领先的文件和资料智慧准确性。 i3systems 的特定领域 AI 模型由 Microsoft Azure Cognitive Vision 提供支援,可为健康和人寿保险公司提供协助。 i3systems 用户注意到客户 NPS 显着改善,处理时间和成本减少了 70%。

- 2022 年 10 月-塔塔咨询服务公司推出认知业务营运解决方案 TCS Cognix。它是一个预先建立的、人工智慧主导的人机协作套件,将业务流程管理、IT 应用程式或软体、资料中心和伺服器整合在一个产品中。 COGNIZ 为财务长提供现金流量指挥中心,提供有关公司将收到多少钱的资料以及预测,包括哪些客户遇到付款困难。

- 2022 年 8 月 – Operaize 加入 SAP PartnerEdge 製造业计划,以加速基于 AI 的云端生产计画和调度创新。 Operaize 将把其基于 AI 的生产计画和调度解决方案 Cognitive Operations 与 SAP ERP Central Component (SAP ECC) 和 SAP S/4HANA 中的生产计画元件结合。该解决方案利用人工智慧来推动客户价值、实现速度和准确性,同时管理复杂性。该解决方案使客户能够将卓越营运提升到新的高度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 越来越注重选择云端基础的认知 IT 营运解决方案

- 监控复杂 IT 环境的需求不断增加

- 市场限制

- 将认知操作能力与目前系统结合

- 缺乏技能和专业知识

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场区隔

- 按组件

- 解决方案

- 按服务

- 依部署方式

- 云

- 本地

- 按公司规模

- 大型企业

- 中小型企业

- 按应用

- IT 营运分析

- 应用程式效能管理

- 网路分析

- 安全分析

- 基础设施管理

- 其他用途

- 按行业

- BFSI

- 医疗保健与生命科学

- 资讯科技和电信

- 零售与电子商务

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Broadcom Inc.

- IBM Corporation

- VMware, Inc.

- Micro Focus International Plc

- Splunk Inc.

- HCL Technologies Limited

- BMC Software, Inc.

- New Relic, Inc.

- CloudFabrix Software Inc.

- Servicenow Inc.

- Loom Systems Inc.

- Dynatrace LLC

- Interlink Software Services Ltd

- DEVO Technology Inc.

- Correlata Solutions Inc

- ScienceLogic Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Cognitive Operations Market size is estimated at USD 20.47 billion in 2025, and is expected to reach USD 43.71 billion by 2030, at a CAGR of 16.38% during the forecast period (2025-2030).

Key Highlights

- Organizations are moving their essential business apps to the cloud because of its scalability, lower cost, and ease of deployment. Predictive analytics skills can be swiftly integrated into a variety of corporate applications with the use of cloud-based technologies. These advantages likely increase demand for cloud-based cognitive operations solutions.

- As the technology reaches the next level, Robotic Process Automation (RPA) integrates with Cognitive Operations. Cognitive RPA is utilized to produce higher productivity, scalability, and enhanced efficiency since it can use Natural Language Processing (NLP), Optical Character Recognition (OCR), and Machine Learning to make sense of masses of data. Integrating cognitive processes with RPA helps Chatbots better manage complicated, real-time requests from customers and employees by using company data and navigating legacy enterprise systems.

- The Covid-19 outbreak brought a significant transformation in the lives of communities and businesses. Customer shopping behavior and demand changes urged companies to adopt automated processes to remain competitive. By using Cognitive Computing in the e-commerce industry, companies can monitor the shopping behavior of the buyers, like their brand preference, online purchase frequency, navigation pattern in the store, and so on. Similarly, based on the industry, cognitive solutions can be customized and help businesses expand and generate revenue.

- The initial investment in cognitive operations is high. It takes a long time and requires skilled development teams to create the software for these systems. The systems need extensive, in-depth training with large data sets to understand specific jobs and procedures. Due to these factors, the companies are not easily convinced to adopt these cognitive operations, and thus, there is slow growth in the market.

Cognitive Operations Market Trends

IT and Telecommunication Segment to Grow Significantly

- Cognitive services help to transform the telecom back offices into an expert customer care team. Further, the telecommunications sector can improve its essential business operations by automating customer care bots' interpretation of natural language and text translation. Intelligent network operations, often called a cognitive network operations center, use artificial intelligence (AI), machine learning (ML), and advanced analytics to support self-healing, self-optimized, and autonomous transport networks.

- The IT and telecom vertical leverages cognitive operations solutions to extract valuable insights from the massive amounts of data user networks create. It thereby improves customer experience. Cognitive services enable the telecoms sector to perform its essential business functions better by automating assisting robots by understanding natural language and translating text.

- One of the top conversational AI firms, Jio Haptik, is enhancing the accuracy and efficiency of its existing Hindi conversational AI models by leveraging Microsoft Azure Cognitive Services. This industry-leading AI translation technology enables end-to-end dialogues in Hindi, English, and even Hinglish and is a crucial component allowing users to chat with the Intelligent Virtual Assistants at Jio Mobility.

- Due to the rise in cyberattacks, and the shortage of knowledgeable cybersecurity personnel, companies need contemporary techniques like cognitive computing to battle these cyber risks due to the growth in data volume. Cognitive algorithms will help prevent cyberattacks by offering a technical means of spotting false information and deceptive data. Hence customers will be less vulnerable to manipulation.

- Forbes claims that annual data production is increasing more quickly than ever. Every person will generate 3.2 GB of information every second by 2025. The total data worldwide will reach 64 trillion GB in just one year. The organization will include proper knowledge to make business decisions more quickly and accurately after adopting cognitive operations.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is projected to be the fastest-growing data governance region because of the rising spending on technology in countries like Singapore, Australia, China, and India. Small and medium-sized organizations (SMEs) need affordable data management and governance solutions and services. It drives the region's cognitive operations market need.

- The region is further investing in smart manufacturing and digitization, driving the need for cognitive operations. With the help of cognitive manufacturing, businesses can maintain a laser-like focus on quality across all stages of a product's development, from design to production and warranty service.

- According to research from the IBM Institute for Business Value, Fortune 500 businesses can lose between 2% and 5% of revenue due to misplacing inventory or manufacturing the wrong SKU and channel mix. Companies can increase supply chain productivity by 10% to 15%, decrease non-value-added work by 50% to 60%, and reduce their response time to disruptions from days to hours or minutes as they develop their digital twin, prescriptive and cognitive capabilities.

Cognitive Operations Industry Overview

Since only some players leverage their offerings in Cognitive Operations Market, there is moderate competition. However, there is vast potential for growth during the studied period. These Cognitive Operation providers release improved products with AI technology integrated, resulting in cost savings, more client satisfaction, and improved accuracy in complex business processes using unstructured data. As businesses shift to digital technologies, they include a wider scope of expansion. Some significant companies offering their services in this sector include Micro Focus International Plc, Broadcom Corporation, IBM Corporation, and VMware, Inc., among others.

- March 2023- i3systems, an insurtech startup, partnered with Microsoft Azure to provide industry-leading document and data intelligence accuracy for critical BFSI processes. i3systems' domain-specific AI models backed by Microsoft Azure Cognitive Vision are helping health and life insurance companies. Users of i3systems noticed a considerable improvement in customer NPS and a 70% reduction in processing time and cost.

- October 2022- Tata Consultancy Services launched TCS Cognix, the cognitive business operation solution. It is an AI-driven, pre-built human-machine collaboration suite that combines business process management, IT applications or software, data centers, and servers into a single offering. COGNIZ cash flow command center for CFO will provide data on how much money their firm will receive and a forecast of which customers they include payment troubles with.

- August 2022- Operaize joins the SAP PartnerEdge program in the manufacturing industry to accelerate innovation for AI-based production planning and scheduling in the cloud. Operaize integrates its AI-based production planning and scheduling solution Cognitive Operations with the production planning component within SAP ERP Central Component (SAP ECC) and SAP S/4HANA. The solution drives customer value using artificial intelligence to achieve speed and accuracy while managing complexity at the same time. It helps customers to take their operational excellence to new heights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Focus Toward Selection of Cloud-Based Cognitive IT Operations Solutions

- 4.2.2 Rising Demand for Monitoring the Complex IT Environment

- 4.3 Market Restraints

- 4.3.1 Integration of Cognitive Operations Capabilities With the Present Systems

- 4.3.2 Dearth of Skills and Expertise

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premises

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-Sized Enterprises

- 5.4 By Application

- 5.4.1 IT Operations Analytics

- 5.4.2 Application Performance Management

- 5.4.3 Network Analytics

- 5.4.4 Security Analytics

- 5.4.5 Infrastructure Management

- 5.4.6 Other Applications

- 5.5 By Industry Vertical

- 5.5.1 BFSI

- 5.5.2 Healthcare & Life Sciences

- 5.5.3 IT & Telecom

- 5.5.4 Retail & E-commerce

- 5.5.5 Other Industry Verticals

- 5.6 Geography

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia-Pacific

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Broadcom Inc.

- 6.1.2 IBM Corporation

- 6.1.3 VMware, Inc.

- 6.1.4 Micro Focus International Plc

- 6.1.5 Splunk Inc.

- 6.1.6 HCL Technologies Limited

- 6.1.7 BMC Software, Inc.

- 6.1.8 New Relic, Inc.

- 6.1.9 CloudFabrix Software Inc.

- 6.1.10 Servicenow Inc.

- 6.1.11 Loom Systems Inc.

- 6.1.12 Dynatrace LLC

- 6.1.13 Interlink Software Services Ltd

- 6.1.14 DEVO Technology Inc.

- 6.1.15 Correlata Solutions Inc

- 6.1.16 ScienceLogic Inc.