|

市场调查报告书

商品编码

1630243

北美仪表板摄影机:市场占有率分析、行业趋势和成长预测(2025-2030)North America Dashboard Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

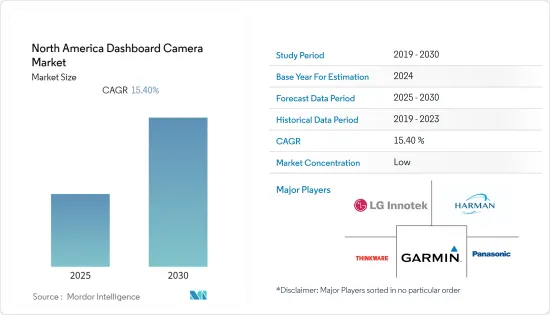

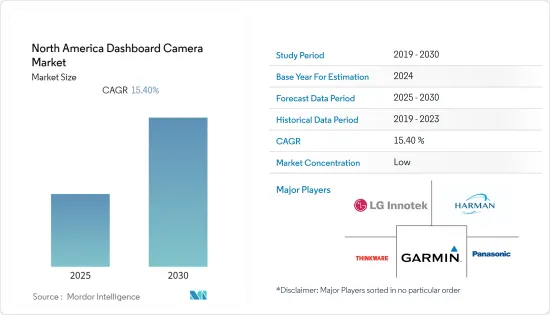

北美行车记录器市场预计在预测期内复合年增长率为 15.4%

主要亮点

- 由于过去十年报告的事故死亡人数急剧增加,驾驶辅助系统最近越来越受欢迎。汽车产业对更好的辅助系统的需求正在成为一种可行的产品,能够果断地确定迫在眉睫的危险并指导驾驶员。

- 行车记录器仅安装在特斯拉、宝马、宾士、沃尔沃、凯迪拉克等豪华车上,但消费者已经习惯了它们。随着最近社交和主流媒体上的个人影像涌入,消费者清楚地意识到行车记录器、随身摄影机、行动电话、门铃摄影机等的摄影机影像可用于安全目的。

- 配备仪表板摄影机的自动驾驶汽车预计将提高资料透明度,减少公众焦虑,并导致采用更安全的无人驾驶技术。自动驾驶汽车已在美国各地投入使用。 2021 年,超过 80 家公司正在 36 个州和华盛顿特区积极测试 1,400 多辆自动驾驶汽车、卡车和其他车辆。

- 例如,2021年4月,一辆载有两人的特斯拉在德克萨斯州坠毁并起火,据调查人员称,两人均因不在驾驶座而死亡。同时,美国国家公路交通安全管理局宣布正在调查近 20 起涉及特斯拉汽车的事故,这些汽车曾经或可能已经使用了 Autopilot。在这种情况下,行车记录器可以为法医调查提供很大帮助。

- 因此,仪表板摄影机和捕获的资料可用于升级感测器和其他为自动驾驶汽车提供动力的技术。目前,大多数全自动驾驶汽车正处于测试阶段。汽车行业的几家主要公司正在测试自动驾驶汽车,包括宝马、戴姆勒、大众集团和沃尔沃。

- COVID-19 的爆发以及由此导致的世界各地运营关闭正在影响世界各地的工业活动。停工的影响包括供应链中断、製造过程中使用的原材料短缺、劳动力短缺、价格波动和运输问题。

北美行车记录器市场趋势

双声道仪表板摄影机推动市场成长

- 对于行车记录器製造商来说,多镜头行车记录器主要是一个利润丰厚的投资领域,因此人们越来越偏好双通道行车记录器而不是单通道行车记录器。过去,由于处理复杂性,多通道仪表板摄影机的需求受到限制,因为它们同时捕获和记录两个视图的视讯串流。

- 仪表板摄影机市场预计将因 Uber、Lyft 和 Bookmycab 等私人计程车服务而受到高度关注。该设备节能且具有记录车辆内部和外部环境的功能。

- 此外,该设备的内建 GPS 和 Wi-Fi 支援即时位置追踪功能,允许用户使用智慧型手机上的应用程式存取该装置。提供震动和运动侦测功能,有助于速度侦测和车辆事故侦测,为驾驶提供额外的警告。

- 此外,目前保险公司对安装行车记录器缺乏直接折扣被认为是导緻美国消费者缺乏兴趣的原因之一。然而,由于美国事故数量不断增加,政府实施了严格的监管,预计这将推动成长。

预计美国将占据主要份额

- 各种公司和新兴企业正在大力投资,以提高其在该地区的影响力和渗透率。现有公司创新新产品以扩大产品系列、获得市场吸引力并增加市场占有率。

- 同样,一群美国新兴企业开发了一种创新的经营模式,为在车辆中安装仪表板摄影机的驾驶者提供经济奖励。因此,北美越来越多的乘车服务供应商(包括 Lyft 和 Uber)正在引入车载 DVR 来记录他们的乘车情况。

- 由于技术进步,行车记录器现在配备了 3 轴 G 感知器。这使得行车记录器的功能不仅仅是录影。现在可以侦测突然煞车或碰撞等意外运动。在此类紧急情况下,我们会采取特定步骤来确保影片已储存并传输到云端,并锁定以防止被窜改或删除。

- 2021 年 9 月,美国汽车行驶了约 2,670 亿英里。今年8月的交通量比去年8月减少了近70亿英里。今年1月至7月车辆行驶总公里数约3.3兆。随着都市区交通量的增加,交通事故和路怒症也呈现上升趋势。良好的影像可以减少所有者面临不利法律诉讼的机会。

北美行车记录器产业概况

北美行车记录器市场竞争非常激烈。市场高度集中,参与企业规模各异。所有主要公司都占有重要的市场份额,并致力于扩大其在全球的消费群。市场主要企业包括Garmin Ltd、LG Innotek、Panasonic Corporation、Harman International Industries Inc.(三星电子)、Transcend Information Inc.、BlackVue(Pittasoft)、YI Technology、Papago Inc.、Thinkware Corporation等。公司正在透过建立多个伙伴关係关係和投资新产品推出来增加市场占有率,以在预测期内获得竞争优势。

- 2022 年 5 月 - THINKWARE 与 BMW 签订合同,供应两台专用行车记录器。 THINKWARE 的行车记录器型号 ACE 3.0 和 ACE 3.0 PRO 将安装在BMW集团的车辆上。透过这些产品,THINKWARE 将在全球供应和安装两种型号的宝马集团独家行车记录器。该计划将于 2022 年在中国、美国、英国和日本等 7 个国家开始推出,然后扩展到其他国家。

- 2021 年 11 月 - Cobra Electronics 宣布在现有 Cobra SC 系列产品阵容中推出新型 Cobra SC 400 和 SC 400D 智慧仪表板摄影机。这款新型行车记录器使驾驶者更清楚地了解驾驶时发生的情况。该产品支援超高清4K视讯分辨率,内建Alexa,可同时录製3个相机(前、后、舱内视图)。支援 4K 的 SC 400 和 SC 400D 可撷取车辆内部和外部的清晰视图,并具有增强的车辆和驾驶员安全性、警报管理平台和视讯事件通知。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对仪表板摄影机市场的影响

第五章市场动态

- 市场驱动因素

- 越来越重视驾驶员安全,越来越多地接受仪表板影像作为法医证据

- 智慧仪表板摄影机的技术进步促进了美国的采用

- 同地区单价下降

- 市场问题

- 隐私问题和法规

- 与欧洲主要国家相比,由于保险公司的回扣而广泛使用行车记录仪,普及率相对较低

第六章 市场细分

- 依技术

- 基本的

- 聪明的

- 按分销管道

- 离线

- 在线的

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Garmin Ltd

- LG Innotek

- Panasonic Corporation

- Harman International Industries Inc.(Samsung Electronics Co. Ltd)

- Transcend Information Inc.

- BlackVue(Pittasoft Co. Ltd)

- YI Technology

- Papago Inc.

- Thinkware Corporation

- Waylens Inc

- Rand McNally

- Nextbase

- Cobra Electronics Corporation(Cedar Electronics Holdings Corp.)

- HP Inc.

第八章投资分析

第9章市场的未来

The North America Dashboard Camera Market is expected to register a CAGR of 15.4% during the forecast period.

Key Highlights

- The driving assistance systems have recently gained popularity due to the drastic increase in the number of accidental fatalities reported in the last decade. The demand for better assistance systems to categorically judge imminent dangers and guide drivers has emerged as a viable product in the automotive sector.

- Although dash cams are available only in high-end automobiles from companies like Tesla, BMW, Mercedes-Benz, Volvo, and Cadillac, consumers are already familiar with them. Consumers are well aware of the potential security benefits of camera footage from dash cameras, body cameras, mobile phones, and doorbell cameras, thanks to an inflow of personal video in social and mainstream media in recent years.

- Autonomous cars with dashboard cameras offer increased data transparency, which is expected to relieve public fears and lead to safer deployments of driverless technology. Autonomous vehicles are already in use across the United States. In 2021, over 80 firms were actively testing more than 1,400 self-driving cars, trucks, and other vehicles in 36 states and Washington, DC.

- For example, in April 2021, two men were killed in Texas after a Tesla they were riding in crashed and caught fire, with neither of the guys in the driver's seat, according to investigators. At the same time, the National Highway Traffic Safety Administration announced that it was looking into nearly two dozen crashes involving Teslas that were either using or may have been using Autopilot. In such circumstances, dashcams become quite helpful for forensic purposes.

- Hence, dashboard cameras and the data captured can be used to upgrade the sensor and other technologies that power autonomous vehicles. Currently, most fully autonomous vehicles are in their testing phase. Several automobile industry giants, like BMW, Daimler, Volkswagen Group, and Volvo, are testing their self-driving cars.

- The COVID-19 outbreak and the associated lockdowns across the globe have affected industrial activities worldwide. Some effects of the lockdown include supply chain disruptions, the lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices, and shipping problems.

North America Dashboard Cameras Market Trends

Dual-channel Dashboard Camera to Drive the Market Growth

- Multi-lens dashboard cameras serve a lucrative segment to invest in, majorly for dashboard camera manufacturers, thereby driving an increasing preference for dual-channel dashboard cameras over single-channel dashboard cameras. Demand for multi-channel dashboard cameras was restricted in the past due to the complication of processing, as video streaming of the two views was captured and recorded simultaneously.

- The Dashboard Camera market is expected to gain high traction due to private taxi services like Uber, Lyft, and Bookmycab. The devices are energy efficient and provide recording features of vehicles' internal and external environments.

- Furthermore, the Devices' built-in GPS and Wi-Fi support the live location tracking feature, allowing the owner to access the device using smartphone applications. The availability of impact and motion detection features aids in speed detection and vehicle accidents, further providing alerts to drivers.

- In addition, the current lack of direct discounts from insurance companies for the installation of dashcams is estimated to have an impact on the low interest of US consumers. However, stringent regulations mandated by the government, due to the growing number of accidents in the United States, are expected to propel the growth.

United States is Expected to Hold Major Share

- Various companies and startups made significant investments to increase the regional presence and the adoption rate. The existing companies are innovating new products to expand the product portfolio, gain market traction and increase their market share.

- Similarly, a group of startups in the United States have developed an innovative business model wherein the drivers are offered monetary rewards for installing dashboard cameras in their vehicles. As a result, more ride service providers across North America, such as Lyft and Uber, have started deploying in-car DVRs to record their rides.

- Dash cams are now equipped with a 3-axis G-sensor due to technology improvements. It has expanded the capabilities of dash cams beyond only recording video. It's also capable of detecting unexpected movements like emergency braking or crashes. It takes specific procedures in such emergencies to ensure that the film is kept and transferred to the cloud or to lock it to prevent tampering or erasure.

- In September 2021, the American motor vehicle fleet traveled around 267 billion vehicle miles. Traffic declined by almost seven billion vehicle miles in August of that year compared to August of the previous year. Between January and July of this year, the total number of vehicle kilometers traveled was roughly 3.3 trillion. Because of the increased traffic in cities and rural regions, there are increasing incidents of accidents and road rage. Having a good video can lessen the chance of an owner being involved in an unfavorable legal action.

North America Dashboard Cameras Industry Overview

The North America Dashboard Camera Market is very competitive in nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Garmin Ltd, LG Innotek, Panasonic Corporation, Harman International Industries Inc.(Samsung Electronics Co. Ltd), Transcend Information Inc., BlackVue (Pittasoft Co. Ltd), YI Technology, Papago Inc., Thinkware Corporation, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

- May 2022 - THINKWARE signed a supply contract with BMW for two exclusive dash cams. THINKWARE's exclusive dash cam models, the ACE 3.0 and ACE 3.0 PRO will be installed in BMW Group vehicles. These products result in THINKWARE supplying and equipping two new dash cam models exclusively for BMW Group vehicles worldwide. The rollout will begin in 2022 in 7 countries, including China, the United States, the United Kingdom, and Japan, and later expand to other countries.

- November 2021 - Cobra Electronics unveiled the newest addition to its existing Cobra SC Series lineup, the Cobra SC 400 and SC 400D Smart Dashboard Cameras. The new dash cams empower drivers to be more aware of what's happening on their drive. Products are equipped with Ultra HD 4K video resolution, Alexa built-in, and capable of simultaneously recording three cameras (front, rear, and cabin views). The 4K-capable SC 400 and SC 400D capture crystal-clear views outside and inside the vehicle, offering enhanced car and driver security, an alerts management platform and video-powered incident notification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Dashboard Camera Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Driver Safety Coupled With Growing Acceptance of Dashboard Footage as Evidence in Court of Law

- 5.1.2 Technological Advancements in Smart Dashboard Camera Segment Driving Adoption in the United States

- 5.1.3 Declining Unit Prices in the Region

- 5.2 Market Challenges

- 5.2.1 Privacy Concerns and Regulations

- 5.2.2 Relatively Low Level of Adoption as Compared to Major European Countries Wherein Dashboard Cameras are Widely Deployed by Motorists Due to Rebate Policies Provided by Insurance Companies

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Basic

- 6.1.2 Smart

- 6.2 By Distribution Channel

- 6.2.1 Offline

- 6.2.2 Online

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd

- 7.1.2 LG Innotek

- 7.1.3 Panasonic Corporation

- 7.1.4 Harman International Industries Inc. (Samsung Electronics Co. Ltd)

- 7.1.5 Transcend Information Inc.

- 7.1.6 BlackVue (Pittasoft Co. Ltd)

- 7.1.7 YI Technology

- 7.1.8 Papago Inc.

- 7.1.9 Thinkware Corporation

- 7.1.10 Waylens Inc

- 7.1.11 Rand McNally

- 7.1.12 Nextbase

- 7.1.13 Cobra Electronics Corporation (Cedar Electronics Holdings Corp.)

- 7.1.14 HP Inc.