|

市场调查报告书

商品编码

1630244

欧洲金属加工设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Metal Fabrication Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

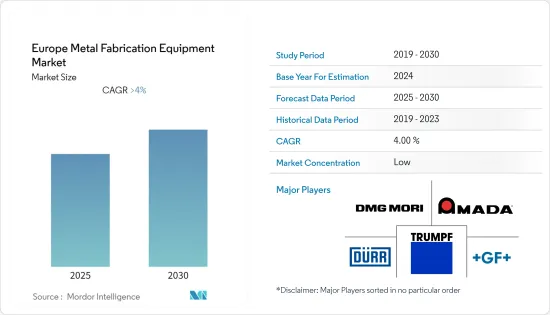

欧洲金属加工设备市场预计在预测期内复合年增长率将超过 4%。

主要亮点

- 金属工业和製造业的扩张、汽车和航太工业的扩张以及研发费用的增加等因素预计将在整个预测期内推动欧洲金属加工设备市场的发展。欧洲的工业金属加工产业也在不断成长,因为该地区政府制定了支持该产业的政策。

- 欧洲金属加工设备领域最重要的技术进步是工业4.0,其中包括资料分析、物联网、积层製造和扩增实境。 AR 可用于培训、品质保证、设计/原型、维护、操作、安全管理等。例如,扩增实境可以透过视觉化和简化组装、工具机转换和逐步安装过程来改进製造程序。

COVID-19 的营运挑战和需求疲软对欧洲金属加工设备产业造成了相当大的打击。预计在预测期内恢復到大流行前生产水准的时间会有所延迟。研究预测国内金属需求将大幅下降,这种情况至少要到疫情结束后的 2023 年至 2024 年才会发生。

欧洲金属加工设备市场趋势

金属加工产业不断涌现的技术创新

- 自动化、积层製造和工业 4.0 正在受到欧洲金属加工设备生产商的关注,因为该技术为金属加工服务供应商提供了多种好处,包括提高业务效率。例如,最大的金属零件製造设备製造商之一的通快公司正在将尖端雷射产品推向市场,其中包括被认为支持「绿色製造」理念的新型二极管雷射技术。

- 工业4.0的主要目标是自动化。随着新技术进入市场,ICT技术正在更快地融入生产过程。组织、设备和其他製造资源变得更加数位化,从而导致「智慧工厂」的发展,其机器和流程持续连接,可提供高品质的成果。

- 工业4.0技术正在引领金属加工设备製造领域的新生产方式、经营模式和产业的兴起。这使得不断改进生产过程成为可能。

- 机器人技术现已应用于金属加工设备製造企业,并且已经发展到这些机器可以与团队成员安全地一起业务的程度。协作机器人非常适合劳动密集或危险任务。此外,该领域29万人的劳动力短缺问题也有望得到解决。儘管新型冠状病毒肺炎 (COVID-19) 疫情导致更多人失业并引发了人们的关注,但协作机器人在金属製造领域仍处于起步阶段,并且正在迅速填补需要支援的空白。

此外,CNC工具机现已成为金属製造业务的重要组成部分。金属製造 CNC 部分的自动化可以减少过程中的一些重复,并随着时间的推移提高生产力和效率。 2021-2021年及以后,随着该领域的发展,数控自动化将继续受到欢迎。

製造业和汽车业的需求不断增长

- 在欧洲,金属加工设备的主要最终用户市场之一是汽车产业。世界汽车工业总产量的20%以上是在欧洲生产的。 2022年前三季度,欧盟生产了近800万辆汽车,比2021年同期成长5.8%。

- 未来几年,由于亚洲国家需求的增加,欧洲汽车产量预计将增加。生产更多车辆的需求可能会推动该地区的金属加工设备市场。

- 汽车行业的公司正致力于简化流程以节省成本和时间。我们也专注于在製造过程中使用最新技术,这增加了对六轴加工中心等最先进金属加工工具的需求。

- 儘管该地区的四轮车产量因国内外市场需求的成长而大幅增加,但两轮车和三轮车的产量几乎没有成长。冷压和热压与汽车的品质息息相关,除此之外没有太大的需求。

- 汽车价格和生产水准的上涨正在推动汽车金属衝压产业的成长。汽车金属衝压製造商也预计铝等轻质金属市场在未来几年将会成长。这是由于缩小动力传动系统尺寸以使汽车更轻、更省油的趋势日益增长。

- 汽车产业的进一步发展和投资预计欧洲汽车金属衝压产业的经济影响将是巨大的。汽车引擎持续严重依赖铸铝、钛、锻钢和铸铁等合金,支撑着欧洲金属加工设备的成长。

欧洲金属加工设备产业概况

据观察,欧洲金属加工设备市场的竞争格局已巩固,目前由几家大公司主导市场。然而,他们面临来自调查行业的区域竞争对手、中小企业和专业设备製造公司的激烈竞争。

汽车工业及其附属行业是加工设备的最大买家,紧随其后的是製造业。航太和国防等金属製造市场关键产业的供需预计将在预测期内恢復。由于该地区工业部门的需求不断增长以及某些行业的巨大市场,欧洲的金属加工设备行业正在透过转移製造设施来扩大规模。

TRUMPF GmbH+Co.KGm、Durr AG、Amada Europe、GF Machining Solutions 和 DMG MORI 是欧洲金属加工设备市场上的领先公司。

其他领先公司包括 Schuler AG、GROB-WERKE GmbH、Bystronic Maschinen AG、Feintool International Holding AG、Mazak UK Limited、Okuma Europe、Reishauer AG、Starrag Group Holding AG、Gebr. Heller Maschinenfabrik GmbH、Bleighleigh Industrial 有 Meaileigh。 。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- COVID-19 对市场的影响

第五章市场区隔

- 按服务类型

- 加工

- 切割加工

- 焊接

- 成型

- 其他服务类型

- 按最终用户产业

- 车

- 建造

- 航太

- 电力/电子

- 其他最终用户产业

- 按地区

- 德国

- 英国

- 法国

- 其他欧洲国家

第六章 竞争状况

- 市场集中度概览

- 公司简介

- TRUMPF GmbH+Co. KG

- Durr AG

- Amada Europe

- GF Machining Solutions

- DMG MORI

- Schuler AG

- GROB-WERKE GmbH

- Bystronic Maschinen AG

- Feintool International Holding AG

- Mazak UK Limited*

- 其他公司(Reishauer AG、Okuma Europe、Gebr. Heller Maschinenfabrik GmbH、Starrag Group Holding AG、Meusburger Georg Gmbh、Baileigh Industrial)

第七章 市场的未来

第8章附录

The Europe Metal Fabrication Equipment Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- Throughout the forecast period, it is anticipated that factors such as the expanding metal and manufacturing industries, expanding automotive and aerospace sectors, and rising R&D expenditures would drive the European market for metal fabrication equipment. Europe's industrial metal fabrication industry is also growing because governments all over the region are putting in place policies that help the industry.

- The most important technological advancements in the metal fabrication equipment sector in Europe are Industry 4.0, including data analytics, the internet of things, additive manufacturing, and AR (augmented reality). AR can be used in training, quality assurance, design and prototyping, maintenance, operations, and safety management. For instance, by visualizing and streamlining assembly, machine tool change, and step-by-step installation processes, augmented reality (AR) can improve manufacturing operation procedures.

Due to COVID-19's operational challenges and poor demand, Europe's metal fabrication equipment sector took a considerable hit. A delayed return to pre-pandemic production levels was anticipated during the projected period. The study predicted a significant decline in domestic metal demand, which would not happen until at least 2023-2024 after the pandemic.

Europe Metal Fabrication Equipment Market Trends

Rising Technological Innovations in Metal Fabrication Industry

- As technologies offer several advantages, including increased operational efficiencies for the service providers of metal fabrication, automation, additive manufacturing, and industry 4.0 are gaining prominence among European producers of metal fabrication equipment. For example, Trumpf, one of the largest manufacturers of equipment for making metal parts, has put on the market cutting-edge laser products, such as new diode laser technology, which is thought to support the idea of "green production."

- The main aim of Industry 4.0 is automation. As new technologies hit the market, ICT technologies are being incorporated into production processes more quickly. Organizations, equipment, and other manufacturing resources are becoming more digitized, resulting in the development of "smart factories'' with continually connected machines and processes that provide high-quality outcomes.

- Industry 4.0 technology is leading to the rise of new production methods, business models, and industries in the metal fabrication equipment manufacturing sector. This makes it possible to continue to improve the production process.

- Robotics technology is now being used in the metal fabrication equipment production business, and it has advanced to the point where these machines can safely do duties alongside team members. Cobots, or collaborative robots, are perfect for laborious or hazardous activities. They might also lessen the 290,000-person labor shortfall in the sector. The COVID-19 pandemic, which forced even more people out of work and brought the situation into focus, showed that although cobots are still in their infancy in the metal manufacturing sector, they are rapidly filling a gap that needs to be supported.

Additionally, CNC machines are now a crucial component of the metal fabrication business. Automation in the CNC part of metal manufacturing can reduce some of the repetitiveness in this process, improving productivity and efficiency over time. After 2021-2021, CNC automation will continue to grow in popularity as the sector develops.

Growing Demand from the Manufacturing and Automotive Sectors

- In Europe, one of the key end-user markets for metal fabrication equipment is the automotive industry. More than 20% of all production in the automotive industry worldwide is produced in Europe. Nearly 8 million cars were produced in the European Union during the first three quarters of 2022, 5.8% higher than during the same time in 2021.

- In the coming years, the production volume of automobiles from Europe is anticipated to rise due to the growing demand from Asian nations. The need to make more cars is likely to drive the market for metal fabrication equipment in the region.

- Businesses in the automotive industry are focusing more on streamlining their processes to save money and time. They are also paying more attention to using the latest technologies in their manufacturing processes, which increases the demand for cutting-edge metal fabrication tools like a 6-axis machining center.

- The region's production of four-wheelers has significantly increased in response to rising demand from domestic and international markets, whereas manufacturing of two- and three-wheelers has grown very little. Cold pressing and hot pressing have a lot to do with how well cars are made, and there isn't much other demand for them.

- Rising automobile pricing and production levels are driving growth in the automotive metal stamping sector. Also, manufacturers of automotive metal stamping expect the market for lightweight metals like aluminum to grow in the coming years. This is because of the growing trend of downsizing powertrains to make cars lighter and get better gas mileage.

- Additional development and investment in the automobile sector The economic impact of the European automobile metal stamping sector is anticipated to be significant. Vehicle engines continue to employ a lot of alloys like cast aluminum, titanium, forged steel, and cast iron, which has helped the growth of metal fabrication equipment in Europe.

Europe Metal Fabrication Equipment Industry Overview

The competitive landscape of the European metal fabrication equipment market is observed to be somewhat consolidated, with a few of the major players currently dominating the market. However, they are up against fierce competition from regional competitors, small and medium-sized businesses, and firms that specialize in making specialized equipment in the industry under investigation.

The automotive industry and its auxiliary sectors are the biggest buyers of fabrication equipment, closely followed by manufacturing companies. Throughout the forecast period, demand and supply for key industries in the metal fabrication market, such as aerospace and defense, are anticipated to pick up. Companies were driven to relocate their manufacturing facilities to expand the European metal fabrication equipment industry due to growing demand in the region's industrial sectors and sizable marketplaces for several industry verticals.

TRUMPF GmbH + Co. KGm, Durr AG, Amada Europe, GF Machining Solutions, and DMG MORI are some of the leading players operating in the European metal fabrication equipment market.

Some other major players in the market are Schuler AG, GROB-WERKE GmbH, Bystronic Maschinen AG, Feintool International Holding AG, Mazak U.K. Limited, Okuma Europe, Reishauer AG, Starrag Group Holding AG, Gebr. Heller Maschinenfabrik GmbH, Baileigh Industrial, Meusburger Georg Gmbh, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Snapshot

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Service type

- 5.1.1 Machining

- 5.1.2 Cutting

- 5.1.3 Welding

- 5.1.4 Forming

- 5.1.5 Other Service Types

- 5.2 End-user Industries

- 5.2.1 Automotive

- 5.2.2 Construction

- 5.2.3 Aerospace

- 5.2.4 Electrical and Electronics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 UK

- 5.3.3 France

- 5.3.4 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 TRUMPF GmbH + Co. KG

- 6.2.2 Durr AG

- 6.2.3 Amada Europe

- 6.2.4 GF Machining Solutions

- 6.2.5 DMG MORI

- 6.2.6 Schuler AG

- 6.2.7 GROB-WERKE GmbH

- 6.2.8 Bystronic Maschinen AG

- 6.2.9 Feintool International Holding AG

- 6.2.10 Mazak U.K. Limited*

- 6.3 Other Companies (Reishauer AG, Okuma Europe, Gebr. Heller Maschinenfabrik GmbH, Starrag Group Holding AG, Meusburger Georg Gmbh, Baileigh Industrial)