|

市场调查报告书

商品编码

1630246

远端临场机器人:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Telepresence Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

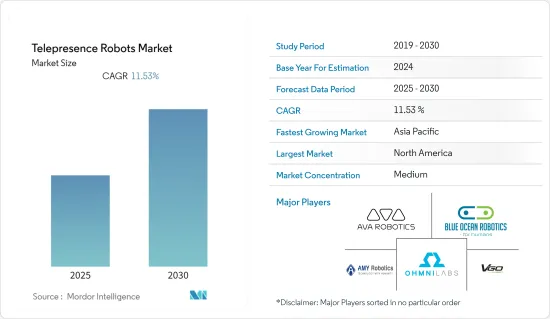

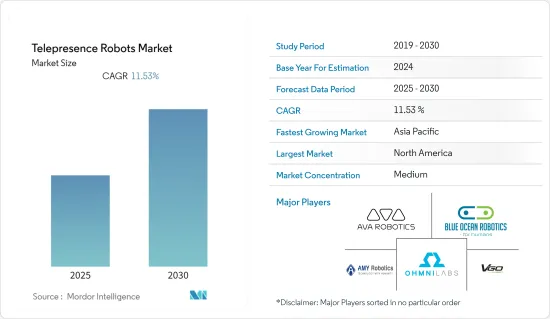

远端临场机器人市场预计在预测期内复合年增长率为11.53%。

主要亮点

- 远端临场机器人预计将用于世界各地的医疗保健、商业和教育机构。在医疗保健行业,远端临场机器人可以创建虚拟外观,使临床医生能够帮助不同地点的患者。同样,在专业领域,企业领导者可以使用安装在职场的远端临场机器人来存取各种活动、监控他们的团队、参加会议等。

- 与移动机器人相比,固定式远端临场机器人的主要优势在于不间断且一致的网路连线(例如 WiFi),为特定的利基应用提供了机会。此类技术平台正在为远端健康监测等应用的实现铺平道路。随着世界各地 65 岁及以上老年人数量的增加,尤其是在印度和日本等国家,这项技术预计将获得巨大的吸引力。

- 机器人技术在医疗保健环境中的使用越来越多,以及通讯能力(包括 4G 和 5G)的进步,正在吸引额外的支出进入该业务。技术的快速进步以及产品和服务需求的波动正在促使市场相关人员增加研究和创新项目的支出,以创造新颖的解决方案。此外,越来越多的公司提供具有升级功能的尖端产品和服务,正在推动医疗保健远端临场机器人产业向前发展。

- COVID-19病毒的爆发也增加了对远端临场机器人的需求,特别是在医疗机构中。领先企业正在加大研发投入,以满足不断增长的需求,并确保引入具有先进医疗功能的远端临场机器人。此外,科技公司的不断发展预计将有助于市场成长。例如,2021 年 5 月,马拉加大学综合技术工程小组开发了远端临场机器人,让 COVID-19 患者与亲人联繫。

远端临场机器人市场趋势

医疗保健产业推动市场成长

- 远端医疗是医疗保健行业快速发展的技术进步,它促进患者和医疗保健提供者之间的远端交互,同时使用视讯会议工具等数位技术提供远端患者监护。远距远端临场机器人在医疗保健产业的日益普及和普及进一步推动了远端医疗的发展。

- 远端呈现机器人可以帮助在专家不在场的乡村医院环境中远端监控患者,并且可以部署机器人来连接患者和医疗保健提供者。护理师还可以在家中远端监控患者的復原情况。此类技术的引进使得即使在偏远地区也能获得高品质的医疗支援。通讯技术的快速发展和进步使这变得更加可能,从而形成了一个完整的生态系统来帮助成长。

- 根据Robohub介绍,远距临场系统医疗机器人是一款可自订的机器人,可以监控患者床边的医疗资料和行为变化,并立即向护理师发送警报,表明患者病情发生重大变化,延误时我会毫不犹豫地采取行动。例如,Pepper 在疫情期间部署了机器人,帮助加护治疗室的患者与无法探视的家人进行沟通。机器人可以站在病人的床边,使用胸前的平板电脑进行视讯会议。

- 该行业的主要成长动力包括医疗领域对机器人执行关键任务的需求增加,例如线上患者监测和医生咨询,以及对床边护理、患者资料收集和实验室自动化的支援。 。此外,远端医疗的上升趋势预计也将为市场成长创造机会。

- 促进人工智慧和自动化研究与创新的政府计划和资助正在推动许多经济体的创新并吸引新的竞争对手。除了越来越多的参与企业该行业引入尖端技术之外,为了应对不断变化的需求而更加註重研发,导致了新型替代技术的发展,进一步影响了市场的扩张。

预计北美将占据较大市场占有率

- 鑑于北美强大的网路基础设施和对新技术的接受度,预计北美对此类机器人的需求很大。该地区还拥有许多知名的远端临场机器人供应商,预计它们将成为该技术的主要贡献者。

- 明确的法规、高购买力以及终端用户产业升级体验的意愿是该地区的驱动因素。此外,该地区的学校和其他教育机构迅速利用科技产品来增强和改善学生的学习体验。这也是该地区拥有压倒性市场份额的原因之一。

- 远端临场机器人越来越多地应用于医疗保健领域,用于对患者进行远端医疗监控和线上医疗咨询。此外,不断增长的老年人口可能会支援对医疗保健远端临场机器人的需求,从而导致北美的行业扩张。根据人口研究所的数据,65 岁及以上的美国人数量预计将增加一倍以上,从 2018 年的 5,200 万人增加到 2060 年的 9,500 万人。

- 该地区的成长是由通讯和电力等关键基础设施推动的。此外,远端临场机器人在各种商业应用中的日益普及预计将增加全球对远端临场机器人的需求。

- 在该地区运营的公司增加对产品开发的投资预计将推动该地区的市场成长。例如,2022 年 4 月,位于洛杉矶附近的 Shortcut Robotics 公司开始对其首款远端临场机器人进行 Beta 测试。 Beta 测试将分两部分进行,以便在每个阶段进行更新。

远端临场机器人产业概况

远端临场机器人市场适度分散,由多个参与者组成。一些公司正在透过推出新产品和策略併购来扩大其在市场上的影响力。参与市场的公司包括 Ava Robotics Inc.、Blue Ocean Robotics、AMY Robotics、VGo Communications Inc. 和 OhmniLabs, Inc.。

2022 年 4 月,OhmniLabs 宣布与 SDVOSB 的 Lovell Government Services 合作,将 OhmniClean 和 Ohmni Telepresence 机器人整合到主要的政府合约机群中。这项进步意义重大,因为它简化了政府客户的采购体验,同时帮助政府组织实现 SDVOSB 采购目标。

2022 年 3 月 - 达拉斯牛仔队推出了革命性的远端临场机器人Cowboys Starbot。该机器人将允许达拉斯牛仔队的球员、啦啦队员、校友、管理人员等以创造性和安全的方式虚拟地探访患者。该机器人透过将视讯会议技术整合到远端操作平台中,为虚拟互动提供了具体的框架。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 使用者控制的远程感知功能推动市场成长

- 市场限制因素

- 远端临场机器人的维护成本上升

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业生态系统分析

- COVID-19 对远距临场系统产业的影响

第五章市场区隔

- 依产品类型

- 固定式

- 移动的

- 按最终用户使用情况

- 教育

- 卫生保健

- 商业

- 安全

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争状况

- 公司简介

- Ava Robotics Inc.

- Blue Ocean Robotics

- AMY Robotics

- VGo Communications Inc.

- OhmniLabs Inc.

- Inbot Technology Ltd

- Double Robotics Inc.

- Mantaro Product Development Services Inc.

- InTouch Technologies Inc.(Teladoc Health)

- Beam Telepresence(Blue Ocean Robotics)

- Wicron Company

- Endurance Robots

第七章 投资分析

第八章市场的未来

The Telepresence Robots Market is expected to register a CAGR of 11.53% during the forecast period.

Key Highlights

- Telepresence robots are anticipated to find a home in healthcare, business, and educational institutions throughout the world. The capacity of telepresence robots to create a virtual appearance in the healthcare industry allows clinicians to assist patients located in various areas. Similarly, in the professional sector, business leaders may access different activities, monitor their teams, and attend meetings and conferences using a telepresence robot installed in their workplace.

- Stationary telepresence robots provide opportunities for specific niche applications that benefit from the advantage they offer over mobile robots, with the significant advantage being the consistency in network connectivity (WiFi, etc.) without interruption. Such technology platforms are paving the way for applications, such as remote health monitoring, to be possible. The technology is expected to gain significant traction as the number of people aged more than 65 grows across the world, particularly in countries, such as India and Japan.

- The increasing use of robotics in healthcare settings and the advancement of communication capabilities, including 4G and 5G, are drawing additional expenditures in the business. The swiftly evolving technology and variable demand for products and services are prompting market players to spend more on study and innovation operations in order to create novel solutions. Furthermore, the growing number of companies offering cutting-edge goods and services with upgraded capabilities is moving the industry for healthcare telepresence robotics forward.

- The outbreak of the COVID-19 virus also raised the demand for telepresence robots, notably in healthcare facilities. Major corporations are raising their R&D investment in order to meet rising demand and ensure the introduction of telepresence robots with advanced medical capabilities. Furthermore, increasing developments by technology companies are expected to contribute to market growth. For instance, in May 2021, the Integrated Technologies Engineering Group at the University of Malaga created a telepresence robot enabling COVID-19 patients to connect with their dear ones.

Telepresence Robot Market Trends

Healthcare Industry to Drive the Market Growth

- Telemedicine is a rapidly growing technological advancement in the healthcare industry, which involves remote patient monitoring by using digital technologies, such as video conferencing tools while fostering remote interaction between patients and healthcare providers. The increasing adoption and popularity of telepresence robots in the healthcare industry are further aiding in the growth of telemedicine.

- Telepresence robotics aids in the remote monitoring of patients in rural hospital settings where a medical specialist is physically unavailable, and the robot can be deployed to connect the patient with the healthcare provider. Also, a nurse can remotely connect and monitor the patient's recovery in the home. Such technology adoption has made quality health support available to remote locations. The rapid growth and advancement in communications technology have enabled this further, resulting in a complete ecosystem aiding the growth.

- According to Robohub, a telepresence medical robot is a customizable robot to monitor changes in a patient's medical bedside data and behavior and immediately sends alerts to nurses indicating the critical changes in the patient's condition and acts without delay. Pepper, for instance, deployed robotics during the pandemic to allow patients in the intensive care ward to communicate with their families, who were not allowed to visit. The robot could stand next to the patient's bed and use the tablet on its chest to deliver a video conference.

- Major key drivers of this segment's growth include the rise in demand for robots in the medical sector for critical tasks, such as online patient surveillance and physician consultation, as well as their expanding use in health facilities for tasks like bedside nursing, patient data collection, and lab automated support. Furthermore, increasing trends for telemedicine are also expected to create opportunities for market growth.

- Stimulation of government programs and funding for study and innovation in artificial learning and automation is fueling innovations and drawing new competitors in numerous economies. The increased number of industry participants implementing cutting-edge technologies, in addition to a higher concentration on R&D in reaction to shifting demands, resulted in the development of novel alternatives, which has influenced market expansion further.

North America is Expected to Hold a Major Market Share

- North America is estimated to have a significant demand for such robots, considering the strong network infrastructure and acceptance of new technologies. The region is also expected to be a key contributor to the technology, as it houses prominent telepresence robot vendors.

- The presence of the defined regulations, higher purchasing power, and the readiness of the end-user industry to upgrade the experience have been driving factors in the region. Furthermore, educational institutions, such as schools in the region, are promptly using technological products to enhance and improve students' learning experience. This has also helped in making the regional market enjoy the dominant share in this market.

- Telepresence robots are increasingly used in healthcare for remote patient medical monitoring and online medical consultations. Furthermore, the growing senior population will likely support the demand for healthcare telepresence robots, leading to the industry's expansion in North America. As per the Population Reference Bureau, the number of Americans aged 65 and older is anticipated to more than double from 52 million in 2018 to 95 million in 2060.

- The region's vital supporting infrastructures, including telecommunication and power, will likely drive growth. Besides that, the rising penetration of telepresence robotics in various business applications is expected to boost the worldwide demand for telepresence robots.

- Increasing investments in product development by players operating in the region are expected to drive market growth in the region. For instance, in April 2022, Shortcut Robotics, located near Los Angeles, launched beta testing of its first telepresence robots. The beta testing would be performed in two rounds to allow for updates in each phase.

Telepresence Robot Industry Overview

The telepresence robots market is moderately fragmented and consists of several players. Several companies are increasing their market presence by introducing new products or by entering into strategic mergers and acquisitions. Some of the players operating in the market include Ava Robotics Inc., Blue Ocean Robotics, AMY Robotics, VGo Communications Inc., and OhmniLabs, Inc.

April 2022, OhmniLabs announced a collaboration with Lovell Government Services, an SDVOSB, to integrate OhmniClean and Ohmni Telepresence Robots into key government contracting vehicles. This advancement is significant because it streamlines the purchase experience for government clients while also assisting government organizations in meeting their SDVOSB procurement targets.

March 2022 - Dallas Cowboys introduced Cowboys Starbot, a revolutionary telepresence robot. Dallas Cowboys players, cheerleaders, alumni, administrators, and others will be able to visit patients virtually in an inventive and secure method, owing to the robot. The robot offers a concrete framework for virtual interactions by integrating video conferencing technologies into a remote-controlled platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 User Controlled Remote Presence Capabilities Aids Market Growth

- 4.4 Market Restraints

- 4.4.1 Higher Costs of Maintenance of Telepresence Robots

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Ecosystem analysis

- 4.7 Impact of COVID-19 on the Telepresence industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Stationary

- 5.1.2 Mobile

- 5.2 By End User Application

- 5.2.1 Education

- 5.2.2 Healthcare

- 5.2.3 Business

- 5.2.4 Security

- 5.2.5 Other End user Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ava Robotics Inc.

- 6.1.2 Blue Ocean Robotics

- 6.1.3 AMY Robotics

- 6.1.4 VGo Communications Inc.

- 6.1.5 OhmniLabs Inc.

- 6.1.6 Inbot Technology Ltd

- 6.1.7 Double Robotics Inc.

- 6.1.8 Mantaro Product Development Services Inc.

- 6.1.9 InTouch Technologies Inc. (Teladoc Health)

- 6.1.10 Beam Telepresence ( Blue Ocean Robotics)

- 6.1.11 Wicron Company

- 6.1.12 Endurance Robots