|

市场调查报告书

商品编码

1630251

德国包装产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Germany Packaging Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

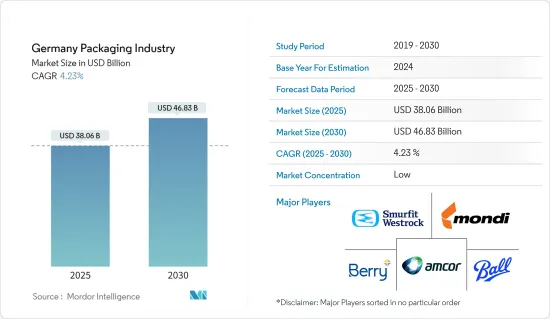

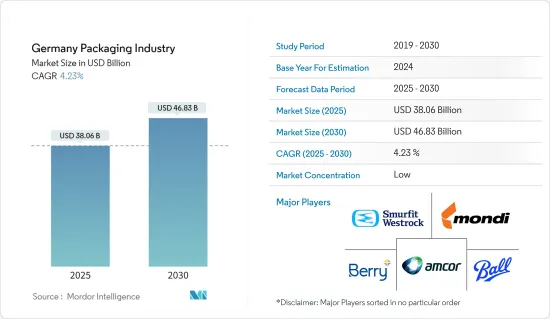

德国包装产业预计将从2025年的380.6亿美元成长到2030年的468.3亿美元,预测期内(2025-2030年)复合年增长率为4.23%。

主要亮点

- 由于电子商务的快速成长,德国对包装材料的需求不断增加。为此,当地包装公司正在转向提供专为线上零售设计的经济高效、安全且轻巧的解决方案。

- 这些产品采用创新设计,可在运输过程中保护产品,同时优化材料使用。为了跟上线上订单的成长,这些公司正在投资尖端的自动化包装技术,包括机器人系统和人工智慧驱动的分类工具。这种自动化不仅简化了操作,还确保了统一的包装品质。

- 德国的包装食品和个人保健部门对较小包装尺寸的需求不断增长,这一趋势可能在未来几年获得成长势头。这种转变是由于单人家庭的增加、对可重新密封和便携式包装的偏好以及对保质期的关注等因素造成的。

- 这些趋势增加了从酱汁和调味料到糖果零食和加工水果等各种包装材料的需求。为此,製造商正在设计创新的包装解决方案,优先考虑产品新鲜度、最大限度地减少浪费并加强份量控制。

- 由于其重量轻且适应性强,对软质塑胶包装的需求正在增加。这种趋势是由对紧凑、易于使用的包装和先进设计的偏好所推动的。软质塑胶不仅可以延长保质期、降低运输成本,还可以增加产品保护。出于环境考虑,製造商正在优先开发可回收和生物分解的软质塑胶。

- 消费者转向环保包装材料的趋势意义重大。铝和玻璃因其环境效益和可回收性而在该地区越来越受欢迎。这一趋势支持了更广泛的远离传统塑胶的运动。

- 此外,欧洲理事会还针对一次性塑胶推出了新的欧盟范围内的法规,并制定了雄心勃勃的回收目标。这些法规可能会对市场状况产生影响。

德国包装市场趋势

德国塑胶包装产业在监管收紧的情况下持续成长

- 在德国,由于解决方案供应商和最终用户的积极努力,塑胶包装解决方案的采用正在取得进展。 「德国製造」的声誉为该地区的塑胶包装公司创造了有利的环境。然而,德国政府对塑胶包装产业实行严格的监管。德国包装方法要求包装设计应可回收、可回收,并使用可回收和可再生的材料。

- 由于各领域的需求不断增加,製造商发现塑胶瓶的使用量不断增加。例如,2023 年 6 月,可口可乐欧洲太平洋合作伙伴德国公司在其巴特诺伊纳尔工厂运作了一条未使用的可回收 PET 生产线。这条生产线将装瓶流行的碳酸饮料,包括可口可乐、芬达和雪碧,并重新推出不加糖的饮料。

- 软性饮料,尤其是碳酸饮料,主要采用塑胶瓶包装,尤其是聚对苯二甲酸乙二醇酯(PET)瓶。随着消费量的增加,对这些宝特瓶的需求也在增加,推动了塑胶包装产业的成长。根据非酒精饮料经济协会 (WAFG) 的资料,到 2023 年,德国人均软性饮料消费量约 124.5 公升,高于 2020 年的 114.7 公升。

- 这些消费趋势可能会将焦点转向永续塑胶包装解决方案,例如回收材料和生物分解性塑胶。公司可能会投资这些创新,以满足消费者和监管机构对环境责任的要求。

- 塑胶瓶和容器是洗髮精、护髮素和乳液等个人保健产品的首选,因为它们具有成本效益、易于处理且不易破损。此外,环保塑胶材料的进步,例如回收和生物分解性的选择,正在减轻永续性问题,并使它们对具有环保意识的消费者更具吸引力。例如,2024年8月,Alpla Werke Alwin Lehner GmbH &Co KG和zerooo发起者SEA ME GmbH推出了可重复使用且完全可回收的化妆品和个人保健产品宝特瓶。

德国包装产业受到食品趋势和环境问题的推动

- 在在家工作的持续趋势的推动下,食品领域主要推动了德国包装产业的发展。轻质、经济高效且设计灵活的塑胶在食品包装中占据主导地位,使其成为方便产品储存和使用的理想选择。

- 儘管硬质塑胶包装在大规模生产方面具有成本优势,但纸质和纸板包装因其便携性和便利性也越来越受欢迎。这些成分不仅无需冷藏即可延长保质期,而且被证明是环保的。

- 随着经济的繁荣,从超级市场到便利商店的现代零售商正在扩大他们的视野,特别是在冷冻食品产品方面。这种零售业的发展正在加速新兴市场采用各种包装技术,包括收缩膜、软袋、封盖膜、高阻隔材料、热成型膜和贴体膜。

- 为了应对日益增长的环境问题,德国领先的快速消费品公司正在雄心勃勃地减少食品包装中塑胶的使用,并转向环保材料,其中纸质包装的数量显着增加。

- 食品包装在确保安全交付给消费者方面发挥着至关重要的作用。随着对功能性和美观包装的需求不断增加,食品包装领域的公司正在努力满足这些期望。

- 已调理食品具有从托盘到袋子再到盒子的多样化包装需求,正在推动包装市场的创新。製造商正在积极开发各种解决方案来满足这项需求。

- 德国联邦统计局的资料显示,德国调理食品销售额大幅成长,从2021年的439万美元跃升至2023年的635万美元。销量的激增代表着销量的增加,直接转化为对包装材料的需求增加,因为每道家常小菜都需要自己的包装。

德国包装产业概况

德国包装市场分散,包括多家在市场上占有重要地位的跨国公司。主要参与企业包括 Amcor plc、Berry Global Inc.、Mondi plc、OI germany GmbH &Co.KG(Owens-Illinois Inc. 的子公司)、Smurfit WestRock plc 和 Ball Corporation。德国包装产业始终认为公司及其部门之间的产品发布、收购和联盟旨在实现策略成长。

- 2024 年 11 月,Mondi plc 将在德国开设创新中心,旨在共同创造软包装解决方案的未来。这些体验式工作室旨在让 Mondi 客户直接参与创新过程。这种亲身参与将使客户能够利用 Mondi 深厚的专业知识、最尖端科技以及推动软包装领域可持续转型的承诺。透过整合试验线、测试能力和协作空间,Mondi 准备加速新包装和纸张解决方案的市场推出。

- 2024 年 10 月,Ardagh Group SA 旗下子公司 Ardagh Glass Packaging-Europe (AGP-Europe) 推出了全新的轻量标准酒瓶系列。这些瓶子在德国製造,专门迎合欧洲市场。值得注意的是,瓶子的重量从410克减轻到了360克。透过使用高达 80% 的回收玻璃屑玻璃,可以减轻重量,从而使每瓶二氧化碳排放减少 12%。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 各国先进技术驱动的创新和客製化包装解决方案的需求

- 对环保、便利的包装解决方案的需求不断增长

- 市场限制因素

- 政府法规和环境问题

第六章 市场细分

- 按材质

- 纸和纸板

- 玻璃

- 塑胶

- 金属

- 其他的

- 按包装类型

- 难的

- 柔软的

- 按行业分类

- 食物

- 饮料

- 药品

- 家居用品/个人护理

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Amcor plc

- Berry Global Inc.

- Mondi plc

- Ball Corporation

- Ardagh Group SA

- Crown Holdings, Inc.

- OI Germany GmbH & Co. KG(Owens-Illinois Inc.)

- Smurfit WestRock plc

- Stora Enso Oyj

- Constantia Flexibles GmbH

第八章投资分析

第九章 市场机会及未来趋势

The Germany Packaging Industry is expected to grow from USD 38.06 billion in 2025 to USD 46.83 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

Key Highlights

- In Germany, the surge of e-commerce has led to a heightened demand for packaging materials. In response, regional packaging companies are pivoting, providing cost-effective, secure, and lightweight solutions specifically designed for online retail.

- These offerings feature innovative designs that safeguard products during transit while optimizing material usage. To handle the uptick in online orders, these firms are channeling investments into cutting-edge automated packing technologies, including robotic systems and AI-driven sorting tools. Such automation not only streamlines operations but also guarantees uniformity in packaging quality.

- Germany's packaged food and personal care sectors are witnessing an escalating demand for smaller pack sizes, a trend poised to gain momentum in the coming years. This shift is attributed to factors like the rise of single-person households, a preference for resealable, on-the-go packaging, and best-before-date considerations.

- These dynamics amplify the need for packaging materials in items ranging from sauces and dressings to confectionery and processed fruits. In response, manufacturers are crafting innovative packaging solutions that prioritize product freshness, minimize waste, and enhance portion control.

- The need for flexible plastic packaging is on the rise, driven by its lightweight nature and adaptability. This trend is bolstered by the preference for compact, user-friendly packaging and design advancements. Flexible plastics not only extend shelf life and cut transportation costs but also bolster product protection. In light of environmental concerns, manufacturers are prioritizing the development of recyclable and biodegradable flexible plastic variants.

- There's a noticeable consumer shift towards eco-friendly packaging materials. Aluminum and glass are gaining traction in the region, celebrated for their environmental benefits and recyclability. This trend underscores a broader movement away from traditional plastics.

- Additionally, the European Council has rolled out new EU-wide regulations targeting single-use plastics and setting ambitious recycling goals. These regulations are poised to influence the market landscape.

German Packaging Market Trends

Germany's Plastic Packaging Sector Navigates Growth Amidst Stricter Regulations

- Germany is increasingly adopting plastic packaging solutions, driven by advancements from solution suppliers and end users. The "Made in Germany" reputation has fostered a conducive environment for the region's plastic packaging companies. However, the German government has imposed stringent regulations on the plastic packaging industry. The German Packaging Law mandates that packaging be designed for recycling, emphasizing recyclability and using recyclable and renewable materials.

- Manufacturers are witnessing an expansion in the use of plastic bottles, with rising demand across various sectors. For instance, in June 2023, Coca-Cola Europacific Partners Germany activated an unused returnable PET line at its Bad Neuenahr facility. This line will bottle popular carbonated soft drinks, including Coca-Cola, Fanta, and Sprite, and reintroduce sugar-free variants.

- Soft drinks, especially carbonated ones, are primarily packaged in plastic bottles, especially polyethylene terephthalate (PET) bottles. As consumption rises, so does the demand for these plastic bottles, fueling growth in the plastic packaging sector. Data from the Economic Association of Non-Alcoholic Beverages (wafg) indicates that in 2023, the average German consumed approximately 124.5 litres of soft drinks, up from 114.7 litres in 2020.

- This growing consumption trend may lead to a pivot towards sustainable plastic packaging solutions, such as recycled materials or biodegradable plastics. Companies will likely invest in these innovations to align with consumer and regulatory demands for environmental responsibility.

- Plastic bottles and containers are favoured for personal care products like shampoos, conditioners, and lotions due to their cost-effectiveness, ease of handling, and resistance to breakage. Moreover, advancements in eco-friendly plastic materials, including recycled and biodegradable options, have alleviated sustainability concerns, making them more appealing to environmentally conscious consumers. For instance, in August 2024, Alpla Werke Alwin Lehner GmbH & Co KG and zerooo initiator SEA ME GmbH unveiled a reusable and fully recyclable PET bottle tailored for cosmetics and personal care products.

Germany's Packaging Industry is Driven by Food Trends and Environmental Concerns

- The food sector, bolstered by the persistent work-from-home trend, primarily drives Germany's packaging industry. Lightweight, cost-effective, and design-flexible, plastics dominate food packaging, making them ideal for easy product storage and use.

- While rigid plastic packaging boasts cost advantages for large-scale production, paper and cardboard packaging are rising in popularity, mentioned for their portability and convenience. These materials not only extend shelf life without refrigeration but also back environmental friendliness.

- As economies flourish, modern retail outlets, from supermarkets to convenience stores, are broadening their horizons, especially in frozen food offerings. This retail evolution accelerates the adoption of diverse packaging technologies in emerging markets, including shrink films, flexible bags, lidding films, high-barrier materials, thermoforming films, and skin films.

- In response to growing environmental concerns, major FMCG companies in Germany are ambitiously cutting down on plastic use in food packaging, pivoting towards eco-friendly materials, with paper-based packaging witnessing a notable surge.

- Ensuring safe delivery to consumers, food packaging plays a pivotal role. As demand rises for both functional and visually appealing packaging, companies in the food packaging sector are gearing up to meet these expectations.

- Ready meals, with their diverse packaging needs ranging from trays to pouches and boxes, are driving innovation in the packaging market. Manufacturers are actively developing varied solutions to cater to these demands.

- Data from Statistisches Bundesamt reveals a notable uptick in Germany's ready meals revenue, soaring from USD 4.39 million in 2021 to USD 6.35 million in 2023. This revenue surge, indicative of heightened sales volumes, directly correlates to an increased demand for packaging materials, as each ready meal necessitates its own packaging.

German Packaging Industry Overview

The fragmented German packaging market includes various global players with significant market presence. Key players encompass Amcor plc, Berry Global Inc., Mondi plc, O-I Germany GmbH & Co. KG (a subsidiary of Owens-Illinois Inc.), Smurfit WestRock plc, and Ball Corporation, among others. The German packaging industry has consistently witnessed trends such as product launches, acquisitions, and collaborations among businesses and their units, all aimed at strategic growth.

- November 2024: Mondi plc has inaugurated an innovative hub in Germany, aimed at co-creating the future of flexible packaging solutions. These experiential studios are designed for Mondi's customers to engage directly in the innovation process. This hands-on involvement allows them to leverage the company's vast expertise, cutting-edge technology, and commitment to driving sustainable change in the flexible packaging sector. By consolidating pilot lines, testing capabilities, and collaborative spaces, Mondi is poised to accelerate the market introduction of its new packaging and paper solutions.

- October 2024: Ardagh Glass Packaging-Europe (AGP-Europe), a division of Ardagh Group S.A., has unveiled a new lightweight range of standard wine bottles. Manufactured in Germany, these bottles cater specifically to the European market. Notably, the bottles have undergone a weight reduction from 410g to 360g. This achievement was made possible by incorporating a high recycled glass cullet level of up to 80%, resulting in a commendable 12% decrease in carbon emissions for each bottle produced.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Innovative and Customized Packaging Solution Aided with Country-s Adoption of Advanced Technology

- 5.1.2 Increasing Demand for Eco-friendly and Convenient Packaging Solution

- 5.2 Market Restraints

- 5.2.1 Government Regulations and Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Paper and Paperboard

- 6.1.2 Glass

- 6.1.3 Plastic

- 6.1.4 Metal

- 6.1.5 Other Materials

- 6.2 By Packaging Type

- 6.2.1 Rigid

- 6.2.2 Flexible

- 6.3 By End-user Vertical

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor plc

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi plc

- 7.1.4 Ball Corporation

- 7.1.5 Ardagh Group S.A.

- 7.1.6 Crown Holdings, Inc.

- 7.1.7 O-I Germany GmbH & Co. KG (Owens-Illinois Inc.)

- 7.1.8 Smurfit WestRock plc

- 7.1.9 Stora Enso Oyj

- 7.1.10 Constantia Flexibles GmbH