|

市场调查报告书

商品编码

1630252

硅外延片:市场占有率分析、产业趋势、成长预测(2025-2030)Silicon Epitaxial Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

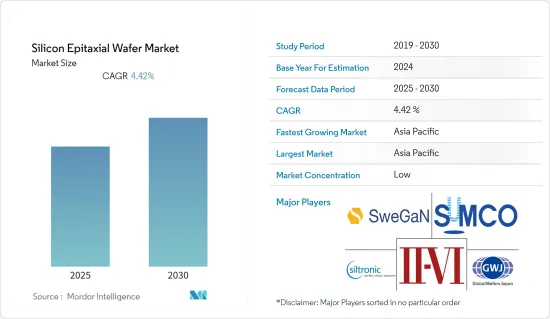

硅外延片市场预计在预测期间内复合年增长率为4.42%

主要亮点

- 半导体硅片仍然是许多微电子元件的核心元件,并构成电子工业的基石。由于数位化和电子移动是当前的技术趋势,这些产品应用于许多设备。

- 目前,市场对硅片的需求超过了工业供应。公司正在利用这一趋势来增加产量并增加市场占有率。

- 此外,对更小设备的需求意味着单一设备需要更多功能。这意味着IC晶片必须有更多的电晶体才能支援更多的功能。智慧型手机和平板电脑等无线计算设备的进步正在活性化半导体设计人员的设计活动。此外,对电子产品小型化日益增长的需求(由于对实现更低功耗的更薄晶圆的需求)预计将在预测期内推动硅外延晶圆市场的多项进步。

- 行业平均价格不断上涨。例如,日本信越化学公司占了硅外延片市场占有率。例如,占大部分市场占有率的日本信越化学公司宣布,从2021年4月开始,将所有硅片产品的价格从10%提高到20%。公司正在利用需求增加的机会,进一步影响收益。第二大晶圆供应商环球晶圆表示,其硅晶圆产线已满员,加上价格上涨,3月收益成长,年增12.99%。

- 消费电子等以消费者为中心的终端用户产业对硅晶圆的需求强劲,迫使产业厂商扩大产能并投资创新研究。

- COVID-19 已导致中国国内供应链和生产中断。随着中国在过去20-30年成为世界製造中心,主要的半导体製造业受到了显着的影响。

硅外延片市场趋势

电力电子可望占较大份额

- 节能产品不断增长的需求是推动所有最终用户产业电力电子产品外延片需求的关键因素之一。因此,市场供应商瞄准了广泛的行业,以降低风险并扩大基本客群。

- 儘管 IGBT 和 MOSFET 市场可能会继续成长,但部分市场预计将转向 SiC,特别是在讨论 EV/HEV 模组时。此外,不断增长的替代绝缘栅、双极电晶体和闸流体的应用也支援了对功率 MOSFET 的需求。此外,使用功率MOSFET在低电压下提高元件功率效率的显着优势进一步推动了全球功率MOSFET市场的需求。

- 电力电子在消费性设备中的使用不断增加也推动了需求。智慧型手机和智慧型设备的日益普及、物联网设备的日益普及以及工业应用的增加也为电力电子打开了新兴市场。电力电子装置的高需求也导致2018年和2019年200mm晶圆短缺。主要客户仍有大量设备库存,减少了客户需求。电力电子市场的长期成长也推动了 300mm 晶圆生产。超过七家全球电力电子供应商已宣布投资新的製造产能,预计 2021 年开始生产。

- Imec 和 Qromis 一直合作在 Aixtron 的 G5+C 200 mm MOVCD 平台上生长外延层,并在 200 mm QST基板上开发增强模式、p-GaN 分立元件和 IC 功率元件。两家公司均从事元件製造,拥有先进的 CMOS 硅试验线,开发 GaN 功率元件、分立和单晶片整合 IC 形式以及 200mm QST基板。 Imec 和 Qromis 正在与德国 GaN MOCVD 设备製造商 Aixtron 合作开发 GaN-on-QST 外延技术。许多产业专家预测,全球加工300毫米晶圆的积体电路(IC)半导体製造厂数量将从2002年的15家增加到2023年的138家。

预计亚太地区将占据主要份额

- 在半导体晶圆市场,2021年至2022年200mm晶圆产量预计将活性化。到 2025 年,对 300mm 晶圆的需求预计将增长,所研究的市场也可能证实进步和创新。亚太地区也因其在半导体製造方面的优势而在市场上占据主导地位。 SiC基板的高市场价格和 LED 需求的不断增长迫使许多亚洲製造商转向 GaN 晶圆。然而,2019-2020年,许多中国LED製造商的GaN晶圆产量过剩。金属有机化学气相沉积(MOCVD)市场的GaN LED产量与产量相比也有显着过剩。

- 近十年来,中国半导体产业呈现成长趋势。根据中国工业与资讯化部统计,2018年中国製造商的半导体销售额达973亿美元,约占当年全球半导体销售额的20%。该国的目标是到 2020 年生产所用半导体的 40%,到 2025 年生产 70%。

- 中国政府的国家战略规划「中国製造2025」也是该刊物崛起的一大因素。该计划的核心目标是半导体产业的成长。此外,中国国家智慧财产权局 (CNIP) 的 2021 年预算预计,到 2023 年每年会有 200 万件申请,预计这将推动研究市场的成长。

- 此外,台积电已表示有兴趣并敲定在亚利桑那州建造一座先进的 5 奈米晶圆厂的计划。该公司董事会还核准了对亚利桑那州一家全资铸造厂投资 35 亿美元。该公司也将在2021年至2029年间总共投资120亿美元建造一座12吋晶圆厂,采用先进的5奈米製程生产晶片。

硅外延片行业概况

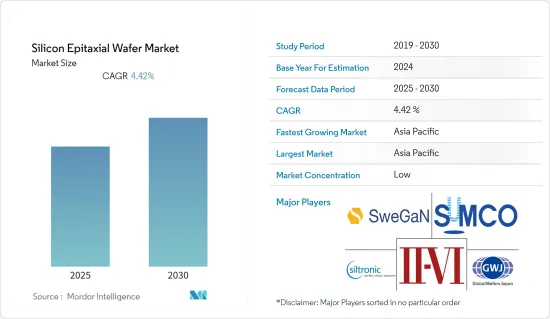

硅外延片市场竞争温和,许多主要企业进入市场,如 SweGaN、GlobalWafers Japan、Siltronic AG、II-VI Incorporated 和 Sumco Corporation。目前,就市场占有率而言,还没有主要企业在市场上占据主导地位。公司专注于产品创新,并透过併购来保持竞争力。

- 2022年8月-贰陆公司投资1亿美元向天宇供应电力电子用碳化硅基板合同,以满足天宇长期客户的供货需求。

- 2022 年 6 月 - SK Siltron Corporation.Ltd. 宣布计划在 2024 年上半年之前斥资 8.1 亿美元扩大国内产能,併计划在此基础上提高产量。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 技术小型化

- 高性能照明的需求增加

- 市场限制因素

- 设计复杂性

第六章 市场细分

- 按用途

- 电力电子

- MEMS

- 射频电子产品

- 光电

- 按地区

- 中国

- 台湾

- 韩国

- 北美洲

- 欧洲

- 其他的

第 7 章 外延片类型与优先应用的详细映射

第8章外延生长的应用与机会

第9章 外延片的主要属性

第10章其他类型详细分析

晶圆详细分析(GaAS、GaN/基板、InP等)

第十一章竞争格局

- 公司简介

- SweGaN AB

- Sumco Corporation

- GlobalWafers Japan CO. Ltd

- Siltronic AG

- MOSPEC Semiconductor Corporation

- IQE PLC

- II-VI Incorporated

- SHOWA DENKO KK

第十二章供应商市场占有率分析晶圆市场

第十三章投资分析

第十四章投资分析市场的未来

The Silicon Epitaxial Wafer Market is expected to register a CAGR of 4.42% during the forecast period.

Key Highlights

- Semiconductor silicon wafer remains the core component of many microelectronic devices and forms the cornerstone of the electronics industry. With digitization and electronic mobility being the current trends in technology, these products are finding applications in many devices.

- Currently, the demand for silicon wafers in the market exceeds the supply in the industry. This factor creates considerable scope for expansion, as the companies utilize this trend to expand their market shares by ramping up production.

- In addition, the demand for small-sized gadgets has increased the requirement for more functionalities from a single device. This means that an IC chip should now house more transistors to support more functionalities. Thus, the advancements in wireless computing devices, such as smartphones and tablets, have helped increase semiconductor designers' design activities. Further, the growing need for miniaturization in electronics (due to the demand for thinner wafers that consume low power) is expected to drive some advancements in the silicon epitaxial wafer market over the forecast period.

- The average prices in the industry are increasing. For instance, the Japanese company, Shin -Etsu Chemical Co . , which holds most of the market share, announced a price hike on all silicon wafer products to rise from 10 % -20 % from April 2021 onwards. The companies are taking advantage of the growing demand, further impacting the revenue accrued. GlobalWafer Co . , the second largest silicon wafer supplier, said that their silicon wafer production lines are fully loaded, coupled with the price hike, which led to an increase in revenue in March, which reached a 12 .99 % yearly increase.

- Consumer-centric end-user industries, such as consumer electronics, have robust demand for silicon wafers, forcing vendors in the industry to expand production facilities while investing in research to innovate.

- Due to COVID-19, China disrupted the country's supply chain and production. Major semiconductor manufacturing industries have been significantly affected due to China becoming a world production center over the past two to three decades.

Silicon Epitaxial Wafer Market Trends

Power Electronics is Expected to Significant Share

- The growing need for power-efficient products is one of the major factors driving the demand for the epitaxial wafer for power electronics products across all the end-user industries. Therefore, the market vendors are targeting a wide range of industries to mitigate risk and expand their customer base.

- The IGBT and MOSFET markets may continue to increase, but a part of the market is expected to go to SiC, especially when discussing modules for EV/ HEV. Moreover, the demand for power MOSFET is supported by its growing use in replacing insulated-gate, bipolar transistors, and thyristors. Additionally, the significant advantage of using power MOSFET in reinforcing the power efficiency of devices at low voltages further drives the demand for the global power MOSFET market.

- The increasing usage of power electronics in consumer devices also fuels the demand. The growing penetration of smartphones and smart devices, increasing the adoption of IoT devices, and increasing industrial usage are also developing markets for power electronics. The high demand for power electronics devices has also resulted in a shortage of 200 mm wafers in 2018 and 2019. The customer demand is falling because major customers still have vast equipment inventory. The long-term growth in the power electronics market is also driving 300 mm wafer-based production. More than seven global power electronics vendors have announced an investment in new fabrication capabilities to be in production from 2021.

- Imec and Qromis have collaborated for the developed enhancement-mode, p-GaN discrete, and IC power devices on 200 mm QST substrates, with epitaxy layers grown in Aixtron's G5+ C 200 mm MOVCD platform. Both companies have been working on device fabrication, developing GaN power devices, indiscreet and monolithically-integrated ICs forms, and 200 mm QST substrates in an advanced CMOS silicon pilot line. Imec and Qromis have collaborated with Germany-based GaN MOCVD equipment manufacturer, Aixtron on GaN-on-QST epitaxy development. Many industrial experts claim that the number of integrated circuits (IC) semiconductor fabrication plants processing 300 mm wafers worldwide are expected to grow from 15 in 2002 to 138 by 2023.

Asia Pacific is Expected to Hold Major Share

- The semiconductor wafer market is expected to ramp up 200 mm manufacturing between 2021-2022. The demand for 300 mm wafers is expected to grow by 2025; the market studied may also witness advancement and innovation. Due to their dominance in semiconductor manufacturing, Asia-Pacific is also dominating the market looked. The high market price of the SiC substrate and the growing LED demand forced many Asian manufacturers to GaN wafers. However, in 2019-2020, many Chinese LED manufacturers overproduced GaN wafers. The Metalorganic Chemical Vapour Deposition (MOCVD) market is also witnessing a significant overcapacity for GaN LED production compared to what is produced.

- The semiconductor industry of China has been showing an upward trend for the past ten years. According to China's Ministry of Industry and Information Technology, semiconductor sales by Chinese manufacturers reached USD 97.3 billion in 2018, which is around 20% of the global semiconductor revenue for the year. The country aims to produce 40% of the semiconductors it uses by 2020 and 70% by 2025.

- The Chinese government's Made in China 2025 national strategic plan has also been a significant factor in the publications' rise. The central aim of the plan is the growth of the semiconductor industry. Further, China's National Intellectual Property Administration (CNIP) 2021 budget anticipates 2 million filings per year till 2023, which is expected to drive the growth of the studied market.

- Moreover, TSMC cited its interest and finalized its plan to build an advanced 5-nanometer wafer plant in Arizona. The company's board of directors had also approved investing USD 3.5 billion in a wholly-owned foundry in Arizona. It also stated to spend a total of USD 12 billion from 2021 to 2029 to build a 12-inch wafer plant to produce chips using the advanced 5nm process.

Silicon Epitaxial Wafer Industry Overview

The Silicon Epitaxial Wafer Market is moderately competitive and consists of many significant players SweGaN, GlobalWafers Japan CO. Ltd, Siltronic AG, II-VI Incorporated, and Sumco Corporation. None of the major players currently dominate the market in terms of market share. Along with an increased focus on product innovation, the companies also engage in mergers and acquisitions to stay competitive.

- August 2022 - II-VI Incorporated has invested in a USD 100 Million Contract to Supply Tianyu with Silicon Carbide Substrates for Power Electronics to meet the requirements of Tianyu's supply with long-term customers.

- June 2022 - SK Siltron Corporation. Ltd. announced a plan to spend USD 810 million on expanding its domestic capacity by the first half of 2024, from which it plans to ramp up output.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Miniaturization of Technology

- 5.1.2 Rise in Demand of High Performance Lighting

- 5.2 Market Restraints

- 5.2.1 Complexities Associated with the Design

6 MARKET SEGMENTATION

- 6.1 By Applications

- 6.1.1 Power Electronics

- 6.1.2 MEMS

- 6.1.3 RF Electronics

- 6.1.4 Photonics

- 6.2 By Geography

- 6.2.1 China

- 6.2.2 Taiwan

- 6.2.3 Korea

- 6.2.4 North America

- 6.2.5 Europe

- 6.2.6 Rest of the World

7 DETAILED MAPPING OF EPITAXIAL WAFER TYPE WITH PREFERRED APPLICATION

8 EPITAXIAL GROWTH APPLICATIONS AND OPPORTUNITIES

9 KEY ATTRIBUTES OF AN EPITAXIAL WAFER

10 DETAILED ANALYSIS ON OTHER TYPES

OF WAFERS (GaAS ,GaN/Substrate, InP, etc.)

11 COMPETITIVE LANDSCAPE

- 11.1 Company Profiles

- 11.1.1 SweGaN AB

- 11.1.2 Sumco Corporation

- 11.1.3 GlobalWafers Japan CO. Ltd

- 11.1.4 Siltronic AG

- 11.1.5 MOSPEC Semiconductor Corporation

- 11.1.6 IQE PLC

- 11.1.7 II-VI Incorporated

- 11.1.8 SHOWA DENKO K.K.